Cancer biomarkers are specific molecules or substances that can be found in the body and provide valuable information about the presence, progression, or characteristics of cancer. These biomarkers play a crucial role in the field of oncology by aiding in the early detection, diagnosis, treatment monitoring, and prognosis of various types of cancer. They are typically present in blood, urine, tissues, or other bodily fluids. The identification and analysis of cancer biomarkers involve advanced techniques such as genomics, proteomics, and metabolomics.

These techniques enable researchers and healthcare professionals to detect subtle changes at the molecular level, which can provide insights into the development of cancer and its response to treatments. By measuring the levels of specific biomarkers, clinicians can tailor treatment plans to individual patients, leading to more targeted therapies and improved outcomes.

The increasing prevalence of various types of cancers across the globe is a significant driver. As the number of cancer cases grows, the demand for accurate and early diagnostic tools, like biomarkers, intensifies. Additionally, biomarkers offer non-invasive methods of cancer detection and monitoring, reducing patient discomfort and enabling frequent assessments. This convenience is driving both patient acceptance and clinical adoption. Other than this, early detection is crucial for improving survival rates. Cancer biomarkers allow for the detection of cancers at their earliest stages, enabling timely intervention and potentially curative treatments.

Besides this, the demand for companion diagnostics, which help determine the most effective treatment for a patient, is fostering the cancer biomarkers market growth. In line with this, the global aging population is more susceptible to cancer. This demographic trend is driving the need for improved diagnostic and therapeutic approaches, in which biomarkers play a pivotal role. Furthermore, rapid advancements in technologies such as genomics, proteomics, and bioinformatics have revolutionized cancer biomarker discovery and analysis.

These technologies enable the identification of novel biomarkers with higher sensitivity and specificity. Moreover, the shift toward personalized medicine has escalated the demand for biomarkers as they enable the identification of specific genetic, molecular, and proteomic signatures unique to each patient's cancer, facilitating targeted therapies and improving treatment outcomes.

Cancer Biomarkers Market Trends/Drivers:

The increasing prevalence of cancer across the globe is creating a positive outlook for the market. Biomarkers are widely used for early cancer detection and during treatment and management to accurately and reliably predict outcomes. In line with this, the increasing incidences of lung cancer due to the upsurge in pollution levels, smoking trends and poor ingestion habits is augmenting the market growth. Moreover, various technological advancements in genetic biomarker discovery, such as next-generation sequencing (NGS), polymerase chain reaction (PCR), gene expression profiling (microarray), and the artificial inelegance (AI) that assist in predicting the recurrence of cancer after treatment, are providing an impetus to the market growth.Additionally, the increasing awareness amongst healthcare professionals and patients about the importance of early diagnosis and the significant shift toward personalized medicine for cancer treatment due to the lack of standard diagnosis is favoring the market growth. Other factors, including the significant growth in the healthcare industry, extensive research and development (R&D) activities and the implementation of various government initiatives for enhancing the drug development processes, are anticipated to drive the global cancer biomarkers market toward growth.

Rising Cancer Incidence

The World Health Organization (WHO) reports a growing burden of cancer cases, attributed to factors such as lifestyle changes, environmental exposures, and an aging population. This surge necessitates improved diagnostic tools that can detect cancer at its earliest stages, when treatment is most effective. Cancer biomarkers, with their ability to identify subtle molecular changes, enable early detection and risk assessment. This empowers healthcare professionals to devise tailored treatment plans, optimizing patient outcomes. As cancer prevalence continues to escalate, the demand for accurate and efficient diagnostic solutions like biomarkers is expected to remain on an upward trajectory.Advancements in Personalized Medicine

Each cancer is unique, driven by distinct genetic and molecular characteristics. This complexity demands tailored treatment approaches that address the specific attributes of an individual's cancer. Biomarkers offer a window into these intricacies, allowing clinicians to select therapies that target the precise molecular alterations driving the disease.By minimizing trial and error in treatment selection, personalized medicine enhances treatment efficacy while reducing adverse effects. This approach has gained traction due to the availability of advanced technologies that can rapidly analyze a patient's genetic and molecular profile. As personalized medicine gains prominence, the demand for biomarkers that guide treatment decisions will continue to grow. This is projected to expand the cancer biomarkers market scope.

Significant Technological Innovations

The advent of high-throughput techniques such as next-generation sequencing, mass spectrometry, and microarray analysis has exponentially increased our ability to identify and analyze potential biomarkers. These methods enable the identification of specific genetic mutations, epigenetic changes, and protein expression patterns that are indicative of different cancer types.Moreover, bioinformatics tools facilitate the interpretation of vast datasets, aiding in the discovery of novel biomarker candidates. These technological advancements not only expedite biomarker discovery but also enhance their sensitivity and specificity, making them more reliable for clinical use. As technology continues to evolve, it is anticipated that the pool of cancer diagnosis solutions will expand, further transforming the cancer biomarkers market outlook.

Cancer Biomarkers Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global cancer biomarkers market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on profiling technology, biomolecule, cancer type, application, and end user.Breakup by Profiling Technology:

- Omic Technologies

- Imaging Technologies

- Immunoassays

- Cytogenetics

Omic technologies, encompassing genomics, proteomics, and metabolomics, play a pivotal role in cancer biomarker discovery and profiling. Genomic analysis reveals alterations in DNA sequences, identifying mutations and genetic variations associated with cancer development. Proteomics delves into the intricate world of proteins, identifying biomarkers by studying their expression levels, modifications, and interactions. Metabolomics focuses on small molecule metabolites, shedding light on metabolic pathways disrupted in cancer.

These omic approaches provide a comprehensive understanding of the molecular intricacies underlying cancer, enabling the identification of potential biomarkers with high precision. Their ability to uncover subtle changes in genes, proteins, and metabolites makes omic technologies indispensable in the quest for reliable cancer biomarkers, enhancing diagnostic accuracy and paving the way for targeted therapies.

Techniques like positron emission tomography (PET), magnetic resonance imaging (MRI), and computed tomography (CT) provide detailed anatomical and functional information. These technologies enable the visualization of tumors, their growth patterns, and interactions with surrounding tissues. Molecular imaging techniques, a subset of imaging technologies, utilize specific tracers to visualize molecular changes within tumors.

This aids in identifying unique biomarkers expressed on cancer cells. Imaging-based biomarker profiling not only aids in accurate diagnosis but also assists in treatment planning and monitoring. As imaging technologies continue to advance, their role in non-invasive biomarker identification and real-time monitoring of treatment responses becomes increasingly integral.

Enzyme-linked immunosorbent assays (ELISA) and multiplex immunoassays measure the concentration of specific proteins, including biomarkers indicative of various cancers. Their high sensitivity and ability to analyze multiple analytes simultaneously make immunoassays invaluable in cancer diagnosis, prognosis, and therapeutic monitoring. Immunoassays are particularly well-suited for measuring soluble proteins and antigens present in blood or other bodily fluids. The advent of novel immunoassay platforms, such as bead-based and microfluidic systems, further enhances their capabilities. Immunoassay-based biomarker profiling not only aids in clinical decision-making but also expedites the development of targeted therapies by identifying patients likely to respond favorably to specific treatments.

Breakup by Biomolecule:

- Genetic Biomarkers

- Protein Biomarkers

- Glyco-Biomarker.

Genetic biomarkers hold the largest share in the market

A detailed breakup and analysis of the market based on the biomolecule has also been provided in the report. This includes genetic biomarkers, protein biomarkers, and glycol-biomarkers. According to the report, genetic biomarkers accounted for the largest cancer biomarkers market share.Genetic biomarkers offer insights into an individual's genetic predisposition, mutations, and variations that contribute to disease development. The advent of advanced genomic sequencing technologies has revolutionized our ability to decode the genetic code, identifying specific gene alterations associated with various cancers. Genetic biomarkers not only facilitate early cancer detection but also guide personalized treatment strategies.

By pinpointing genetic mutations driving a particular cancer, clinicians can tailor therapies to target these specific genetic anomalies, thereby enhancing treatment efficacy while minimizing adverse effects. Moreover, genetic biomarkers play a crucial role in the development of precision medicine, where treatments are tailored to a patient's genetic profile.

Breakup by Cancer Type:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Stomach Cancer

- Other.

Lung cancer dominates the market

The report has provided a detailed breakup and analysis of the market based on the cancer type. This includes breast cancer, lung cancer, colorectal cancer, prostate cancer, stomach cancer, and others. According to the report, lung cancer represented the largest segment.Lung cancer holds a significant global prevalence, ranking among the leading causes of cancer-related deaths. The strong association between lung cancer and smoking, along with environmental factors, contributes to its widespread occurrence. Furthermore, advancements in diagnostic technologies, including imaging and molecular profiling, have improved lung cancer detection and classification. This has led to a higher number of diagnosed cases, contributing to the segment's prominence.

Additionally, the complex nature of lung cancer, characterized by diverse subtypes like non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC), necessitates targeted therapies based on biomarker profiles. This drives research and innovation, fostering the development of precision medicine approaches tailored to specific lung cancer subtypes.

Breakup by Application:

- Diagnostics

- Prognostics

- Risk Assessment

- Drug Discovery and Development

- Others

Cancer biomarkers play a critical role in enabling early and accurate cancer detection. By identifying specific molecular signatures associated with various cancer types, biomarkers assist in pinpointing the presence of cancer at its initial stages. This facilitates timely intervention, ultimately leading to improved patient outcomes. Biomarker-based diagnostics encompass a range of techniques, including blood tests, imaging, and molecular assays, which collectively contribute to effective and non-invasive cancer detection.

By analyzing specific biomarkers, clinicians can gauge the aggressiveness of the cancer, assess the risk of recurrence, and estimate patient survival rates. These insights guide treatment planning, allowing for tailored therapies that match the anticipated disease trajectory. Prognostic biomarkers contribute to informed decision-making, enabling patients and healthcare providers to make choices aligned with individual prognosis.

These biomarkers enable early screening of individuals at elevated risk due to genetic, environmental, or lifestyle factors. By identifying those at risk, healthcare professionals can implement targeted surveillance, preventive measures, and lifestyle interventions to reduce the likelihood of cancer development. Risk management based on biomarkers empowers proactive healthcare strategies that emphasize prevention and early intervention.

Breakup by End User:

- Hospitals

- Academic and Research Institutions

- Ambulatory Surgical Centers

- Diagnostic Laboratories

- Others

With their comprehensive range of medical services and infrastructure, hospitals serve as essential hubs for cancer diagnosis, treatment, and management. Biomarker-based tests are seamlessly integrated into hospital workflows, facilitating timely and accurate cancer diagnosis. Hospitals also offer the necessary facilities for patient monitoring and follow-up, making them central to cancer care. The demand for biomarkers in hospitals is driven by the need for efficient diagnostic tools that aid in early detection, prognosis, and treatment decision-making.

These institutions conduct in-depth research to identify and validate novel biomarkers, contributing to the expansion of our understanding of cancer biology. They also develop cutting-edge technologies and methodologies for biomarker discovery and analysis. Academic institutions serve as platforms for training the next generation of researchers, clinicians, and professionals who will drive biomarker-related research and applications. Additionally, academic collaborations often lead to the development of innovative diagnostic and therapeutic approaches, further enriching the biomarkers market.

These centers provide outpatient surgical and medical procedures, including cancer diagnostics and treatment. ASCs offer efficient and convenient options for patients who require biomarker-based tests, minimizing the need for hospitalization. They cater to patients seeking specialized care in a more streamlined and patient-centered environment. As the trend towards outpatient care continues to grow, ambulatory surgical centers are increasingly adopting biomarker-based diagnostic and treatment methods, contributing to their significance within the market ecosystem.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for cancer biomarkers.North America possesses a well-established healthcare infrastructure with advanced medical facilities, research centers, and academic institutions. This provides a conducive environment for the integration of biomarker-based diagnostics and treatments into clinical practice. Additionally, substantial investments in cancer research and healthcare technology contribute to the continuous advancement of biomarker discovery and validation. This, coupled with a strong emphasis on personalized medicine, drives the demand for biomarker-driven approaches in patient care. Moreover, North America's proactive regulatory landscape, with agencies like the FDA, fosters the validation and approval of new biomarkers, ensuring their safety and efficacy.

This regulatory support instills confidence among healthcare professionals and encourages the adoption of biomarker-based tests. Besides this, a higher awareness of cancer prevention, early detection, and treatment options within the population further fuels the demand for biomarker-based solutions. The presence of a substantial patient pool and a robust pharmaceutical industry also play a pivotal role in the region's dominance in the cancer biomarkers market.

Competitive Landscape:

Major players invest heavily in R&D to identify and validate new biomarkers. This involves extensive laboratory research, clinical trials, and collaborations with academic institutions to discover biomarkers that offer higher accuracy and specificity in cancer detection and monitoring. Additionally, collaboration between biotechnology firms, pharmaceutical companies, research institutions, and healthcare providers accelerates the translation of biomarker discoveries into practical applications. Partnerships facilitate the development of novel diagnostics and therapies that incorporate biomarker information.Other than this, key players continually innovate by adopting and developing cutting-edge technologies, such as next-generation sequencing, liquid biopsies, and advanced imaging techniques. These innovations enhance biomarker detection sensitivity, allowing for earlier and more accurate cancer diagnoses. Besides this, leading firms are focusing on developing companion diagnostics that identify patients most likely to respond to specific treatments. This approach optimizes treatment selection, leading to better patient outcomes and reduced healthcare costs.

In line with this, key market players are driving the shift toward personalized medicine by utilizing biomarker information to tailor treatments to individual patients. This approach improves treatment efficacy and minimizes adverse effects. Furthermore, collaboration with regulatory authorities, such as the FDA, ensures that biomarker-based tests meet rigorous standards for accuracy and safety. Regulatory approvals enhance trust in these tests among healthcare professionals and patients.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abbott Laboratories

- Agilent Technologies Inc.

- Becton Dickinson and Company

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- General Electric Company

- Illumina Inc.

- Qiagen N.V.

- Sino Biological Inc.

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

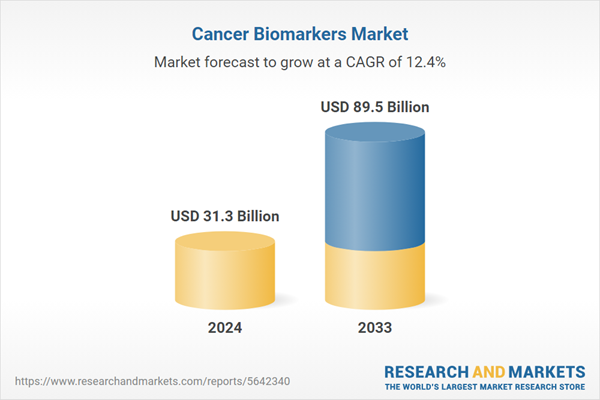

- What was the size of the global cancer biomarkers market in 2024?

- What is the expected growth rate of the global cancer biomarkers market during 2025-2033?

- What are the key factors driving the global cancer biomarkers market?

- What has been the impact of COVID-19 on the global cancer biomarkers market?

- What is the breakup of the global cancer biomarkers market based on the biomolecule?

- What is the breakup of the global cancer biomarkers market based on the cancer type?

- What are the key regions in the global cancer biomarkers market?

- Who are the key players/companies in the global cancer biomarkers market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Agilent Technologies Inc.

- Becton Dickinson and Company

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- General Electric Company

- Illumina Inc.

- Qiagen N.V.

- Sino Biological Inc.

- Thermo Fisher Scientific Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 31.3 Billion |

| Forecasted Market Value ( USD | $ 89.5 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |