Steam Autoclaves Market Trends:

Surging Emphasis on Infection Control and Patient Safety

One of the primary drivers of the industry is the increasing focus on infection control and patient safety within healthcare settings. HAIs pose a significant threat to patient safety and can lead to increased morbidity, mortality, and healthcare costs. For instance, according to an article published by the U.S. Food and Drug Administration, healthcare-associated infections (HCAIs) caused by medical devices not only risk patients' health and lives but also place an additional financial burden on patients and the healthcare system. Infections can arise as a result of a variety of factors, including poor cleaning, disinfection, and sterilization of reusable medical devices, bacterial adhesion to devices after implantation, and skin breaches caused by external communication devices. Steam autoclaves play a critical role in sterilizing medical instruments, equipment, and supplies to prevent the transmission of pathogens and reduce the risk of HAIs, thereby contributing to the steam autoclaves market share. In confluence with this, as healthcare providers strive to reduce the risk of infections and improve the quality of patient care, there is a growing demand for reliable and efficient sterilization solutions. For instance, according to an article published by the U.S. Food and Drug Administration in January 2023, regulatory science research is carried out by the FDA's Sterility and Infection Control Program at the Center for Devices and Radiological Health (CDRH) to help guarantee that patients have access to safe and functional medical devices that are devoid of microbiological and biochemical contamination. These factors are positively influencing the steam autoclaves market forecast.Expanding Research and Development Activities

The pharmaceutical, biotechnology, and life sciences industries are experiencing robust growth, driven by the increasing research and development (R&D) efforts. These industries heavily rely on the sterility of laboratory equipment and materials to maintain the integrity of experiments and ensure the safety and efficacy of products. For instance, in March 2024, LTE Scientific launched its newest line, the Touchclave-V series of laboratory autoclaves. The Touchclave-V series provides a low-cost solution that can handle the majority of laboratory applications. The Touchclave-V series is a top-loading cylindrical chambered autoclave with capacities of 50 and 80 liters, designed for simplicity. This is further positively impacting the steam autoclaves market’s recent price. Apart from this, growing investments in research and development (R&D) are propelling the demand for autoclaves that can reliably and efficiently sterilize these items. This trend is likely to persist as scientific advancements and innovative discoveries drive further growth in these sectors. For instance, in May 2024, Nucleome Therapeutics, a biotech company that specializes in decoding the dark genome's non-coding DNA regions to produce precision treatments for autoimmune disorders such as multiple sclerosis, lupus, and rheumatoid arthritis, purchased an LTE research-grade autoclave to aid in research. These factors are further bolstering the steam autoclaves market revenue.Technological Advancements

Technological advancements in steam autoclaves have led to increased efficiency in sterilization processes. Enhanced cycle controls, automation features, and optimized heating and cooling mechanisms contribute to shorter cycle times and higher throughput, allowing healthcare facilities to sterilize instruments and equipment more quickly and effectively. For instance, in March 2024, Schoeller-Bleckmann Medizintechnik (SBM), a Syntegon subsidiary, launched the SBM Essential Line, a new range of sterilizers. The SBM Essential Line's sterilizers disinfect porous and solid equipment, as well as liquids in containers such as vials, cartridges, or pens, using either a vacuum-steam (ADV), steam-air mixture (SDR), or combined (SDT) procedure. Fans, jacket cooling, and internal heat exchangers are offered for quick cooling following sterilization. Apart from this, manufacturers are continually innovating to develop steam autoclaves with shorter cycle times without compromising sterilization efficacy. Advanced heating and cooling mechanisms, optimized cycle algorithms, and rapid exhaust systems enable high-performance autoclaves to sterilize instruments more quickly, improving workflow efficiency and throughput in healthcare facilities. For instance, in May 2024, CAI, a global provider of technical, operational consulting, and project management services, collaborated with Fedegari Group, a producer and service provider of high-performance sterilization systems. This agreement will improve steam sterilization capabilities for firms in the life sciences and biotech industries. The partnership's purpose is to improve the application of steam sterilization science while reducing sterilization process installation time in order to reduce lifetime costs, slash product costs, and streamline manufacturing processes. These factors are contributing to the steam autoclaves market share.Steam Autoclaves Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on configuration, technology, and application.Breakup by Configuration:

- Table Top Steam Autoclaves

- Vertical Steam Autoclaves

- Horizontal Steam Autoclaves

- Others

Table top steam autoclaves dominate the market

The report has provided a detailed breakup and analysis of the market based on the configuration. This includes table top steam autoclaves, vertical steam autoclaves, horizontal steam autoclaves, and others. According to the report, table top steam autoclaves represented the largest segment.According to the steam autoclaves outlook, the increasing prevalence of smaller healthcare facilities, including dental clinics, veterinary practices, and smaller outpatient centers, is fueling the demand for compact and space-efficient sterilization solutions such as tabletop steam autoclaves. Tabletop autoclaves are ideal for such settings as they are compact, easy to install, and do not occupy valuable floor space. In addition to this, the rise of mobile healthcare units and field-based medical services, especially in remote or underserved areas, necessitates portable sterilization equipment. Tabletop autoclaves offer the mobility and flexibility required to ensure sterile conditions in these dynamic environments. Furthermore, their user-friendly interfaces and automated features make them accessible to a range of healthcare professionals, including those without extensive technical expertise. This accessibility factor further contributes to the growing demand for tabletop steam autoclaves across diverse healthcare and field-service applications.

Breakup by Technology:

- Gravity Displacement

- Pre-Vacuum

- Steam Flush Pressure Pulse

Gravity displacement holds the largest share in the market

A detailed breakup and analysis of the market based on the technology has also been provided in the report. This includes gravity displacement, pre-vacuum, and steam flush pressure pulse. According to the report, gravity displacement accounted for the largest market share.According to the steam autoclaves market overview, gravity displacement autoclaves are particularly well-suited for sterilizing delicate instruments, porous materials, and liquids that might be adversely affected by the vigorous air removal processes of pre-vacuum autoclaves. This gentler approach to air removal minimizes the risk of damaging sensitive items while still ensuring effective sterilization. In line with this, gravity displacement autoclaves are often more cost-effective than their pre-vacuum counterparts, making them a preferred choice for facilities with budget constraints, thereby aiding in market expansion. Moreover, their simplicity and ease of operation also appeal to a variety of industries, including dental clinics, small laboratories, and educational institutions, where specialized technical expertise may be limited. The demand for gravity displacement autoclaves continues to grow among users who prioritize efficient, yet gentle sterilization methods without compromising on effectiveness or affordability.

Breakup by Application:

- Medical

- Laboratory

- Others

Medical represents the leading application segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes medical, laboratory, and others. According to the steam autoclaves market report, medical represented the largest segment.The demand for steam autoclaves in medical applications is primarily driven by the critical need for sterility and infection control within healthcare settings. In the medical field, maintaining aseptic conditions is paramount to prevent infections, safeguard patient well-being, and ensure successful surgical procedures. Steam autoclaves play a pivotal role in achieving these objectives by providing reliable and efficient sterilization of surgical instruments, medical devices, and equipment. With the global population aging and the healthcare industry continuously evolving, there is a growing number of medical facilities, including hospitals, clinics, and ambulatory surgery centers, all of which require sterilization solutions. Additionally, the increasing prevalence of outpatient care and the demand for rapid sterilization turnaround times, especially in emergency departments, drive the adoption of autoclaves tailored to the specific needs of these medical settings. Consequently, the demand for steam autoclaves in medical applications remains robust as healthcare providers prioritize patient safety and infection prevention. For instance, in December 2022, the Government of Mauritius, with the help of the Government of Japan, and the United Nations Development Program (UNDP) launched a new 500L autoclave at Victoria Hospital to commemorate the Ministry of Health and Wellness's cooperation with UNDP.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest steam autoclaves market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.According to the steam autoclaves market overview, North America's well-established healthcare infrastructure and the constant need for infection control measures in hospitals and medical facilities fuel the demand for sterilization equipment, including steam autoclaves. Besides this, the stringent regulatory standards and guidelines set by organizations such as the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC) further emphasize the importance of maintaining sterile conditions, encouraging healthcare providers to invest in advanced autoclave technologies. Moreover, the rise in the prevalence of chronic illness and a rapidly aging population in North America result in higher demand for surgical procedures and medical interventions, boosting the need for reliable autoclaves in healthcare settings. In addition to this, the region's robust pharmaceutical and biotechnology industries, including vaccine production and research activities, drive the requirement for autoclaves for the sterilization of laboratory equipment and materials, thereby bolstering the market growth. Furthermore, the ongoing emphasis on research and development (R&D), coupled with technological advancements in steam autoclave design and functionality, is supporting the market growth. For instance, in February 2024, Dothan City Commissioners approved the group Daniels Sharpsmart to install autoclave in order to sterilize medical gauze, bandages, gowns, sharps, etc.

Competitive Landscape:

The market is characterized by intense competition among key players and a diverse range of manufacturers. Prominent companies dominate the market, leveraging their extensive product portfolios, established brand recognition, and global distribution networks. These industry leaders continuously invest in research and development to introduce innovative features like advanced sterilization cycles, user-friendly interfaces, and energy-efficient technologies, maintaining their competitive edge. Additionally, strategic mergers, acquisitions, and collaborations are common in the market, allowing companies to expand their product offerings and market reach. Price competitiveness and customization options have become vital for survival in this competitive landscape as customers seek cost-effective solutions tailored to their specific needs, creating a dynamic and evolving global steam autoclaves market.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Accumax India

- Astell Scientific Ltd.

- Belimed GmbH (Metall Zug AG)

- BMM Weston Ltd.

- Consolidated Machine Corporation

- Getinge Infection Control AB

- LTE Scientific Ltd.

- Matachana

- Priorclave Ltd.

- Steris Corporation

- Tuttnauer

- Zirbus technology GmbH

Key Questions Answered in This Report:

- How has the global steam autoclaves market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global steam autoclaves market?

- What is the impact of each driver, restraint, and opportunity on the global steam autoclaves market?

- What are the key regional markets?

- Which countries represent the most attractive steam autoclaves market?

- What is the breakup of the market based on the configuration?

- Which is the most attractive configuration in the steam autoclaves market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the steam autoclaves market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the steam autoclaves market?

- What is the competitive structure of the global steam autoclaves market?

- Who are the key players/companies in the global steam autoclaves market?

Table of Contents

Companies Mentioned

- Accumax India

- Astell Scientific Ltd.

- Belimed GmbH (Metall Zug AG)

- BMM Weston Ltd.

- Consolidated Machine Corporation

- Getinge Infection Control AB

- LTE Scientific Ltd.

- Matachana

- Priorclave Ltd.

- Steris Corporation

- Tuttnauer

- Zirbus technology GmbH

Table Information

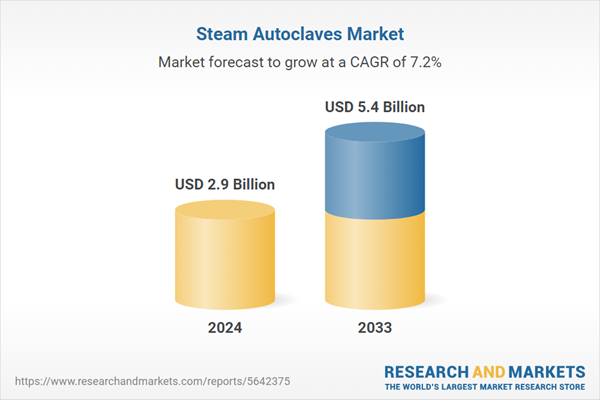

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |