Software Defined Radio Market Trends:

Increasing Demand for Advanced Communications

The software defined radio (SDR) market is significantly driven by the escalating demand for more sophisticated communication systems. Modern military, emergency, and civilian communication infrastructures require flexible, versatile, and efficient radio systems that can support various functions. SDRs cater to this need by offering adaptable platforms that can be updated with software, eliminating the necessity for hardware changes to support new frequencies or protocols. Their capability to handle a wide range of frequency bands and waveforms enhances interoperability and enables seamless communication in diverse environments, making them indispensable in contemporary communication networks.Technological Advancements

The rapid advancements in wireless technology, including the proliferation of IoT devices, the expansion of 5G networks, and the increasing reliance on mobile communications, have fueled the demand for SDRs. These radios support a wide spectrum of frequencies and can be easily upgraded to accommodate new standards and technologies, making them future-proof solutions. Their versatility allows for the integration with existing networks and the capacity to adapt to evolving technological landscapes, thereby ensuring longevity and relevance in a fast-paced industry. This adaptability is crucial for maintaining the effectiveness and efficiency of communication systems in various sectors, including defense, public safety, and commercial industries.Cost Efficiency and Reduced Time to Market

SDRs offer significant cost benefits and reduced time-to-market for new communication products and services. By shifting much of the radio's functionality from hardware to software, manufacturers can develop and deploy new features, protocols, or standards without needing to redesign or replace the physical hardware. This software-centric approach allows for quicker updates and adaptations to emerging technologies, enabling companies to stay competitive and respond rapidly to market demands. Additionally, the ability to update the radio systems via software downloads eliminates the need for physical modifications, reducing maintenance costs and extending the lifecycle of the radio equipment.Growth of Commercial Telecommunication

The commercial telecom sector is witnessing a shift toward more flexible and scalable networks to support the increasing data traffic and evolving service demands. SDRs play a crucial role in this transformation by providing the backbone for next-generation networks that can dynamically adjust to changing bandwidth requirements, protocols, and services. This adaptability allows telecom operators to optimize network performance and capacity, reduce operational costs, and accelerate the deployment of new services. Furthermore, the integration of SDRs facilitates the seamless introduction of innovative technologies such as cognitive radio, which can intelligently manage spectrum usage to alleviate congestion and improve service quality, thereby driving market growth.Software Defined Radio Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, component, platform and frequency band.Breakup by Type:

- Joint Tactical Radio System (JTRS)

- Cognitive Radio

- General Purpose Radio

- Terrestrial Trunked Radio (TETRA)

- Others

Joint tactical radio system (JTRS) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes joint tactical radio system (JTRS), cognitive radio, general purpose radio, terrestrial trunked radio (TETRA), and others. According to the report, joint tactical radio system (JTRS) represented the largest segment.As the largest segment, joint tactical radio system (JTRS) finds extensive application in military communications, offering interoperable and secure communication solutions for defense forces. JTRS encompasses a wide range of radio platforms and waveforms tailored to meet the diverse needs of military operations, including voice, data, and video transmission in challenging battlefield environments. Its advanced features such as software-defined architecture, encryption capabilities, and spectrum agility make it indispensable for modern warfare scenarios.

Cognitive radio technology enables intelligent and adaptive utilization of radio frequencies, optimizing spectrum utilization and enhancing communication efficiency. It dynamically adjusts transmission parameters based on environmental conditions, traffic load, and user requirements, maximizing spectrum availability and mitigating interference. Cognitive radio finds applications in wireless networks, IoT, and cognitive radar systems, offering enhanced spectral efficiency, flexibility, and resilience to changing operational conditions.

General purpose radio serves a broad range of civilian and commercial applications, providing reliable and versatile communication solutions for various industries. These radios offer standard communication protocols, modulation schemes, and frequency bands suitable for everyday use in public safety, transportation, utilities, and enterprise environments. General Purpose Radios are characterized by their ease of use, affordability, and compatibility with existing infrastructure, making them ideal for applications requiring dependable wireless connectivity.

Terrestrial trunked radio (TETRA) is a digital mobile radio standard widely adopted for professional mobile communications, particularly in public safety, transportation, and utilities sectors. TETRA networks provide secure, mission-critical voice and data communication services, supporting features such as group calling, encryption, and emergency signaling. TETRA systems offer high reliability, coverage, and interoperability, making them essential for ensuring seamless communication and coordination among public safety agencies and critical infrastructure operators.

Breakup by Application:

- Aerospace and Defense

- Commercial

- Telecommunication

- Others

Aerospace and defense dominates the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace and defense, commercial, telecommunication, and others. According to the report, aerospace and defense represents the largest segment.Aerospace and defense segment represents the largest market share in the software defined radio (SDR) market, driven by the critical communication requirements of defense and aerospace applications. SDR systems are extensively used in military communications, tactical radios, surveillance, and electronic warfare applications due to their flexibility, interoperability, and adaptability to dynamic operational environments. Additionally, advancements in SDR technology enable defense agencies to enhance situational awareness, spectrum efficiency, and communication security, thereby supporting mission-critical operations and modernization initiatives.

The commercial segment of the SDR market is experiencing significant growth, fueled by the increasing adoption of SDR solutions in various commercial applications such as wireless infrastructure, IoT connectivity, and automotive systems. SDR technology offers scalability, cost-effectiveness, and compatibility with evolving communication standards, making it an attractive choice for commercial organizations seeking flexible and efficient communication solutions. Applications include base stations, repeaters, wireless routers, and smart devices, driving demand for SDR solutions in the commercial sector.

The telecommunication segment is another key market for SDR, characterized by the deployment of SDR systems in cellular networks, satellite communications, and broadband access networks. SDR technology enables telecom operators to optimize spectrum utilization, improve network performance, and support the rollout of advanced services such as 5G and beyond. By leveraging SDR, telecom providers can enhance coverage, capacity, and quality of service while minimizing operational costs and maintaining compatibility with legacy infrastructure.

Breakup by Component:

- Transmitter

- Receiver

- Auxiliary System

- Software

Transmitter represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the component. This includes transmitter, receiver, auxiliary system, and software. According to the report, transmitter represented the largest segment.As the largest segment in the market, transmitters play a pivotal role in the Software Defined Radio (SDR) ecosystem by converting digital signals into analog signals for transmission over the airwaves. These transmitters are highly adaptable and configurable, allowing for efficient utilization of spectrum resources and supporting various modulation schemes and communication protocols. They find extensive applications in military communications, commercial wireless networks, satellite communications, and broadcasting systems, where reliable and high-performance transmission capabilities are essential for seamless connectivity.

Receivers in the SDR market are responsible for capturing and processing incoming radio signals, converting them from analog to digital format, and extracting relevant information for further processing or analysis. These receivers offer flexibility in signal processing and demodulation techniques, enabling efficient reception of diverse communication signals across different frequency bands and standards. They are integral components in communication systems for tasks such as signal intelligence, spectrum monitoring, radio astronomy, and software-defined radio experimentation.

The auxiliary systems segment encompasses various supporting components and peripherals that complement the core functionalities of SDR systems. This includes amplifiers, filters, antennas, power supplies, and cooling systems, which are essential for optimizing the performance, reliability, and operability of SDR platforms. Auxiliary systems play a critical role in enhancing signal quality, minimizing interference, extending operational range, and ensuring robustness in challenging environmental conditions. They are tailored to meet specific application requirements and are often integrated seamlessly with transmitter and receiver modules to form complete SDR solutions.

The software segment of the SDR market comprises the software-defined architecture, algorithms, protocols, and user interfaces that enable programmable and reconfigurable radio functionalities. This software-driven approach allows for dynamic adjustment of radio parameters, waveform generation, modulation/demodulation, and signal processing tasks, empowering users to adapt SDR systems to evolving requirements and scenarios. Software-defined radio platforms offer flexibility, scalability, and interoperability across diverse communication standards and frequency bands, making them ideal for applications such as public safety, emergency response, amateur radio, and academic research.

Breakup by Platform:

- Land

- Airborne

- Naval

- Space

Land represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the platform. This includes land, airborne, naval, and space. According to the report, land represented the largest segment.The land segment represents the largest market share in the software-defined radio (SDR) market, driven by the extensive deployment of SDR systems in military and commercial land-based applications. SDRs are widely utilized in land-based communication systems, including tactical radios for military forces, public safety networks, and critical infrastructure such as utilities and transportation. The flexibility, interoperability, and adaptability of SDR technology make it well-suited for addressing the diverse communication needs of land-based operations, ranging from urban environments to remote areas.

In the airborne segment, SDRs play a crucial role in aviation and aerospace applications, where reliable and efficient communication systems are essential for flight safety, navigation, and mission success. SDRs are integrated into aircraft communication systems, avionics, and unmanned aerial vehicles (UAVs), providing pilots, crew members, and ground operators with secure and real-time communication capabilities. The airborne segment benefits from advancements in SDR technology, enabling increased bandwidth, improved spectrum efficiency, and enhanced situational awareness in airborne platforms.

The naval segment of the SDR market encompasses maritime communication systems deployed on naval vessels, submarines, and maritime patrol aircraft. SDRs are vital for maritime operations, facilitating ship-to-ship, ship-to-shore, and ship-to-aircraft communication, as well as navigation, surveillance, and electronic warfare applications. The naval segment relies on SDR technology to ensure seamless connectivity, interoperability with allied forces, and resilience to electromagnetic interference in maritime environments characterized by challenging conditions and long-range communications requirements.

In the space segment, SDRs are utilized in satellite communication systems, space exploration missions, and satellite-based navigation and positioning systems. SDR technology enables flexible and adaptive communication links between satellites, ground stations, and other spacecraft, supporting a wide range of applications including broadband internet access, Earth observation, scientific research, and satellite navigation services such as GPS and Galileo. The space segment benefits from advancements in SDR miniaturization, power efficiency, and radiation-hardened designs to meet the stringent requirements of space missions and satellite constellations.

Breakup by Frequency Band:

- High Frequency

- Very High Frequency

- Ultra-High Frequency

- Others

High frequency represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the frequency band. This includes high frequency, very high frequency, ultra-high frequency, and others. According to the report, high frequency represented the largest segment.The High frequency (HF) segment is the largest in the market, encompassing communication systems operating within the frequency range of 3 MHz to 30 MHz. HF SDR systems are widely used in military and defense applications for long-range communication, including tactical communications, surveillance, and command and control. These systems offer reliable communication over vast distances, often in challenging environments such as remote areas, maritime operations, and battlefield scenarios. Advancements in HF SDR technology, such as adaptive modulation schemes, wideband capabilities, and interference mitigation techniques, further enhance their effectiveness in delivering secure and resilient communication solutions.

The very high frequency (VHF) segment of the SDR market covers frequencies ranging from 30 MHz to 300 MHz. VHF SDR systems find applications in a diverse range of sectors, including public safety, aviation, maritime, and amateur radio. These systems provide reliable line-of-sight communication, making them suitable for applications such as air traffic control, emergency services, navigation, and broadcast. VHF SDRs offer advantages such as high data rates, improved signal quality, and reduced latency, contributing to their widespread adoption across various industries.

The ultra-high frequency (UHF) segment of the SDR market comprises frequencies between 300 MHz and 3 GHz. UHF SDR systems are extensively utilized in telecommunications, satellite communication, broadcasting, and scientific research. These systems offer increased bandwidth, enhanced data transmission rates, and improved signal penetration compared to lower frequency bands. UHF SDR technology enables applications such as cellular networks, satellite communication links, remote sensing, and scientific instrumentation, facilitating high-speed data transfer and reliable communication over extended ranges.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest software defined radio market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.With its robust technological infrastructure and significant investments in defense and aerospace sectors, North America emerges as the largest segment in the global Software Defined Radio (SDR) market. The region is home to major market players and research institutions driving innovation in SDR technology. The defense sector accounts for a substantial share of SDR adoption, supported by defense modernization initiatives and the need for advanced communication systems. Additionally, commercial applications such as telecommunications, public safety, and automotive contribute to market growth, fueled by the region's strong emphasis on technological advancement and digital transformation.

Asia Pacific represents a rapidly growing segment in the global SDR market, fueled by increasing defense spending, infrastructure development, and the proliferation of advanced communication technologies. Countries like China, India, Japan, and South Korea are key contributors to market expansion, driven by their focus on military modernization and indigenous defense capabilities. Moreover, the region's burgeoning telecommunications sector, coupled with the adoption of 5G technology and IoT applications, presents significant opportunities for SDR deployment across diverse industries.

Europe is a prominent segment in the global SDR market, characterized by a strong presence of defense contractors, technology firms, and research institutions driving innovation in wireless communication systems. The region's defense modernization efforts, particularly in NATO member countries, drive demand for advanced SDR solutions for military applications. Additionally, Europe's leadership in telecommunications infrastructure and standards development fosters the adoption of SDR in commercial applications such as wireless networks, satellite communications, and IoT deployments.

Latin America represents a growing segment in the global SDR market, driven by increasing investments in defense modernization, public safety initiatives, and telecommunications infrastructure. Countries like Brazil, Mexico, and Colombia are key markets for SDR adoption, supported by their efforts to enhance military capabilities, address security challenges, and expand access to digital communication services. Moreover, the region's growing emphasis on disaster response, emergency management, and critical infrastructure protection further drives demand for SDR solutions.

The Middle East and Africa emerge as a significant segment in the global SDR market, driven by defense modernization programs, infrastructure development, and the need for reliable communication solutions in challenging environments. Countries in the Middle East, such as Saudi Arabia, the UAE, and Israel, invest heavily in defense and security, driving demand for advanced SDR systems for military applications. Additionally, Africa's expanding telecommunications market and initiatives to bridge the digital divide contribute to the adoption of SDR for wireless connectivity, rural broadband, and disaster relief operations.

Leading Key Players in the Software Defined Radio Industry:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Aselsan A.S.

- BAE Systems

- Elbit Systems Ltd.

- General Dynamics Corporation

- Huawei Technologies Co. Ltd. (Huawei Investment & Holding Co. Ltd.)

- L3harris Technologies Inc.

- Leonardo S.p.A.

- Northrop Grumman Corporation

- Rohde & Schwarz GmbH & Co. KG

- Thales Group

- ZTE Corporation

Key Questions Answered in This Report

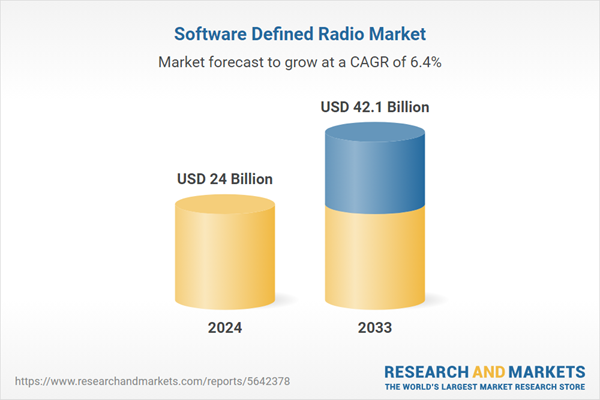

1. What was the size of the global software defined radio market in 2024?2. What is the expected growth rate of the global software defined radio market during 2025-2033?

3. What are the key factors driving the global software defined radio market?

4. What has been the impact of COVID-19 on the global software defined radio market?

5. What is the breakup of the global software defined radio market based on the type?

6. What is the breakup of the global software defined radio market based on the application?

7. What is the breakup of the global software defined radio market based on the component?

8. What is the breakup of the global software defined radio market based on the platform?

9. What is the breakup of the global software defined radio market based on the frequency band?

10. What are the key regions in the global software defined radio market?

11. Who are the key companies/players in the global software defined radio market?

Table of Contents

Companies Mentioned

- Aselsan A.S.

- BAE Systems

- Elbit Systems Ltd.

- General Dynamics Corporation

- Huawei Technologies Co. Ltd. (Huawei Investment & Holding Co. Ltd.)

- L3harris Technologies Inc.

- Leonardo S.p.A.

- Northrop Grumman Corporation

- Rohde & Schwarz GmbH & Co. KG

- Thales Group

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 24 Billion |

| Forecasted Market Value ( USD | $ 42.1 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |