Blood pressure monitoring devices, also known as sphygmomanometers, are essential medical instruments used to measure and monitor blood pressure levels. They play a crucial role in healthcare, helping individuals and healthcare professionals assess cardiovascular health. These devices are available in various forms, including manual and digital models. Manual sphygmomanometers consist of an inflatable cuff, a pressure gauge, and a stethoscope. Digital devices, on the other hand, use advanced technology to provide quick and accurate readings without the need for a stethoscope. They typically display blood pressure values on a digital screen.

The increasing prevalence of hypertension and related cardiovascular diseases worldwide is a significant driver. As more individuals are diagnosed with high blood pressure, the demand for monitoring devices rises. Additionally, the global aging population is another crucial factor. Elderly individuals are more prone to hypertension, making blood pressure monitoring a routine necessity. This demographic trend fuels market growth. Other than this, growing awareness about the importance of regular health check-ups and self-monitoring drives demand for blood pressure devices. Health-conscious consumers seek accurate and convenient options. Besides this, the trend toward home healthcare and remote patient monitoring has boosted the market. Patients and healthcare providers increasingly use these devices for convenient and cost-effective health management. In line with this, rising healthcare expenditure, particularly in emerging economies, enables more people to access and afford blood pressure monitoring devices, driving market expansion. Besides this, the growth of telemedicine and e-health platforms has created a demand for blood pressure monitoring devices that can transmit data remotely, enhancing patient care and diagnosis. Moreover, ongoing advancements in technology have led to the development of innovative and user-friendly blood pressure monitoring devices with wireless connectivity and smartphone integration, which make them more appealing to consumers.

Blood Pressure Monitoring Devices Market Trends/Drivers:

Prevalence of Hypertension (High Blood Pressure)The primary driver of the blood pressure monitoring devices market is the increasing prevalence of hypertension. Lifestyle factors such as poor diet, lack of exercise, and stress have contributed to a surge in high blood pressure cases. As a result, healthcare providers and individuals are emphasizing regular monitoring to detect and manage this condition early. This has led to a growing demand for blood pressure monitors both in clinical settings and for home use. The importance of hypertension management in preventing heart disease, stroke, and other serious health complications underscores the significance of blood pressure monitoring devices in healthcare.

Rising Aging Population

With advancing age, the risk of hypertension tends to increase. Elderly individuals are more susceptible to high blood pressure due to changes in blood vessel elasticity and hormonal shifts. As a result, the demographic shift toward an older population worldwide is driving the demand for blood pressure monitoring devices. Healthcare providers are more frequently prescribing these devices to monitor and manage the blood pressure of elderly patients. Additionally, many older adults prefer the convenience of home blood pressure monitoring, further contributing to market growth.Growing Awareness and Health Consciousness Associated with Hypertension

As people become more informed about the risks associated with hypertension and its impact on overall health, they are more inclined to monitor their blood pressure regularly. The emphasis on preventive healthcare and early detection encourages consumers to invest in blood pressure monitoring devices for personal use. Moreover, healthcare providers are actively educating patients about the benefits of monitoring, leading to higher prescription rates. This heightened awareness and health-consciousness drive device sales and also contribute to better health outcomes by facilitating early intervention and lifestyle modifications in response to elevated blood pressure readings.Blood Pressure Monitoring Devices Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global blood pressure monitoring devices market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on product type, technology and end-user.Breakup by Product Type:

- Monitor

- Sphygmomanometers

- Automated BP Monitors

- Ambulatory BP Monitors

- BP Transducers

- Home-Based BP Monitors

- Others

- Accessories

- Blood Pressure Cuffs

- Manometers

- Valves and Bladders

- Others

Monitor dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes monitor (sphygmomanometers, automated BP monitors, ambulatory BP monitors, BP transducers, home-based BP monitors, and others), accessories (blood pressure cuffs, manometers, valves and bladders, and others). According to the report, monitor represented the largest segment.Monitoring devices are fundamental in managing hypertension, a condition that affects a substantial portion of the global population. These devices allow for continuous tracking of blood pressure levels, which is critical for diagnosing hypertension and monitoring its progression. As hypertension is a leading cause of heart disease, stroke, and other cardiovascular complications, healthcare providers worldwide rely on these devices for early detection and ongoing management. Additionally, the shift toward preventive healthcare and the promotion of self-monitoring has significantly boosted the demand for blood pressure monitors. Many individuals are now taking proactive steps to monitor their own health, and home blood pressure monitoring has become a routine practice. This consumer-driven trend has led to a surge in sales of monitoring devices for home use. Other than this, advancements in technology have made monitoring devices more user-friendly and accurate. Features such as digital displays, memory storage of readings, and the ability to connect to smartphones have made these devices more appealing and convenient for consumers.

Breakup by Technology:

- Digital

- Aneroid

- Wearable

Digital monitors are user-friendly, making them popular for both clinical and home use. Many digital monitors also offer memory storage for multiple readings, facilitating tracking and trend analysis over time. Their convenience and reliability have made them a dominant choice for blood pressure monitoring.

Aneroid monitors use a manually operated cuff and a gauge to measure blood pressure. They are often found in clinical settings due to their precision and durability. Healthcare professionals frequently use aneroid monitors for their accuracy. However, they require more skill to operate compared to digital monitors, making them less common for personal home use.

Wearable blood pressure monitors are designed to be worn on the wrist or upper arm and continuously monitor blood pressure throughout the day. They offer real-time data and are often integrated with smartphone apps for easy tracking. Wearable monitors cater to the growing demand for remote patient monitoring and are gaining popularity among individuals who want continuous blood pressure insights without the need for traditional cuff-based measurements. Their portability and convenience align with the trend toward personalized and proactive healthcare.

Breakup by End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Homecare Settings

- Others

Hospitals and clinics dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, ambulatory surgical centers, diagnostic centers, homecare settings, and others. According to the report, hospitals and clinics represented the largest segment.Healthcare professionals in these settings rely heavily on accurate blood pressure measurements to diagnose and manage a wide range of cardiovascular conditions. Blood pressure monitoring is an integral part of routine patient care, making these devices indispensable within hospital and clinic environments. Additionally, the prevalence of hypertension and related cardiovascular diseases necessitates frequent blood pressure monitoring, and hospitals and clinics are primary locations for diagnosing and treating such conditions. The high patient volume in these healthcare facilities contributes significantly to the demand for blood pressure monitors. Furthermore, the expertise of healthcare professionals ensures the correct usage and interpretation of blood pressure readings, making hospitals and clinics ideal settings for accurate monitoring. These facilities often invest in a variety of blood pressure monitoring devices to cater to different patient needs and conditions. Moreover, the importance of monitoring vital signs, including blood pressure, in critical care units and emergency departments further drives the adoption of blood pressure monitoring devices within hospital settings.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

North America exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share.The growing awareness about cardiovascular health and the risks associated with hypertension has led to a higher demand for blood pressure monitoring devices among the population. Public health initiatives, healthcare campaigns, and proactive health-consciousness have all contributed to this awareness. Additionally, North America possesses a substantial elderly population, and with advancing age comes an increased risk of hypertension. This demographic trend has driven the consistent need for accurate blood pressure monitoring devices, both in clinical settings and for personal home use. Besides this, the well-established healthcare infrastructure of the region, including hospitals, clinics, and pharmacies, provides easy access to these devices, further fueling the market. The availability of technologically advanced and user-friendly blood pressure monitors has also attracted consumers, encouraging them to invest in these devices for regular monitoring.

Competitive Landscape:

Leading companies continuously invest in research and development to introduce innovative blood pressure monitoring devices. This includes the development of wearable and wireless technologies, making monitoring more convenient and user-friendly. These innovations align with the trend toward personalized and remote healthcare. Additionally, numerous key players have formed strategic partnerships and collaborations with healthcare providers, research institutions, and technology companies. These collaborations foster knowledge sharing, access to data, and the development of integrated healthcare solutions. Other than this, global expansion strategies, including entering emerging markets with high growth potential, have been undertaken by major players. These efforts involve adapting products to local needs and regulatory requirements. Besides this, key players have integrated their blood pressure monitoring devices with digital health platforms and mobile applications. This integration allows for real-time data sharing, remote patient monitoring, and more comprehensive healthcare management. In line with this, companies invest in marketing campaigns to raise awareness about the importance of blood pressure monitoring and the benefits of their products. These efforts not only drive sales but also contribute to public health awareness.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- A&D Medical Inc.

- GE Healthcare

- Koninklijke Philips N.V

- Omron Healthcare

- Welch Allyn

- Rossmaax International Limited

- Spacelab’s Healthcare Inc.

- Contec Medical System Co. Ltd

- Microlife AG

- Halma plc.

- Hill-Rom Holdings

- American Diagnostic

- Smith’s Group Plc.

- Schiller AG

- SunTech Medical

Key Questions Answered in This Report:

- How has the global blood pressure monitoring devices market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global blood pressure monitoring devices market?

- What is the impact of each driver, restraint, and opportunity on the global blood pressure monitoring devices market?

- What are the key regional markets?

- Which countries represent the most attractive blood pressure monitoring devices market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the blood pressure monitoring devices market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the blood pressure monitoring devices market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the blood pressure monitoring devices market?

- What is the competitive structure of the global blood pressure monitoring devices market?

- Who are the key players/companies in the global blood pressure monitoring devices market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Blood Pressure Monitoring Devices Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Product Type

5.5 Market Breakup by Technology

5.6 Market Breakup by Accessories

5.7 Market Breakup by End-User

5.8 Market Breakup by Region

5.9 Market Forecast

6 Market Breakup by Product Type

6.1 Monitor

6.1.1 Market Trends

6.1.2 Market Breakup by Monitor Type

6.1.2.1 Sphygmomanometers

6.1.2.1.1 Market Trends

6.1.2.1.2 Market Forecast

6.1.2.2 Automated BP Monitors

6.1.2.2.1 Market Trends

6.1.2.2.2 Market Forecast

6.1.2.3 Ambulatory BP Monitors

6.1.2.3.1 Market Trends

6.1.2.3.2 Market Forecast

6.1.2.4 BP Transducers

6.1.2.4.1 Market Trends

6.1.2.4.2 Market Forecast

6.1.2.5 Home-Based BP Monitors

6.1.2.5.1 Market Trends

6.1.2.5.2 Market Forecast

6.1.2.6 Others

6.1.2.6.1 Market Trends

6.1.2.6.2 Market Forecast

6.1.3 Market Forecast

6.2 Accessories

6.2.1 Market Trends

6.2.2 Market Breakup by Accessories Type

6.2.2.1 Blood Pressure Cuffs

6.2.2.1.1 Market Trends

6.2.2.1.2 Market Forecast

6.2.2.2 Manometers

6.2.2.2.1 Market Trends

6.2.2.2.2 Market Forecast

6.2.2.3 Valves and Bladders

6.2.2.3.1 Market Trends

6.2.2.3.2 Market Forecast

6.2.2.4 Others

6.2.2.4.1 Market Trends

6.2.2.4.2 Market Forecast

6.2.3 Market Forecast

7 Market Breakup by Technology

7.1 Digital

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Aneroid

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Wearable

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by End-User

8.1 Hospitals and Clinics

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Ambulatory Surgical Centers

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Diagnostic Centers

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Homecare Settings

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Region

9.1 Asia Pacific

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Europe

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 North America

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Middle East and Africa

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Latin America

9.5.1 Market Trends

9.5.2 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porter’s Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 A&D Medical Inc.

14.3.2 GE Healthcare

14.3.3 Koninklijke Philips N.V

14.3.4 Omron Healthcare

14.3.5 Welch Allyn

14.3.6 Rossmaax International Limited

14.3.7 Spacelab’s Healthcare Inc.

14.3.8 Contec Medical System Co.Ltd

14.3.9 Microlife AG

14.3.10 Halma plc.

14.3.11 Hill-Rom Holdings

14.3.12 American Diagnostic

14.3.13 Smith’s Group Plc.

14.3.14 Schiller AG

14.3.15 SunTech Medical

List of Figures

Figure 1: Global: Blood Pressure Monitoring Devices Market: Major Drivers and Challenges

Figure 2: Global: Blood Pressure Monitoring Devices Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Blood Pressure Monitoring Devices Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Blood Pressure Monitoring Devices (Monitor) Market: Breakup by Type (in %), 2024

Figure 5: Global: Blood Pressure Monitoring Devices (Accessories) Market: Breakup by Type (in %), 2024

Figure 6: Global: Blood Pressure Monitoring Devices Market: Breakup by Technology (in %), 2024

Figure 7: Global: Blood Pressure Monitoring Devices Market: Breakup by End-User (in %), 2024

Figure 8: Global: Blood Pressure Monitoring Devices Market: Breakup by Region (in %), 2024

Figure 9: Global: Blood Pressure Monitoring Devices Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Blood Pressure Monitoring Devices Industry: SWOT Analysis

Figure 11: Global: Blood Pressure Monitoring Devices Industry: Value Chain Analysis

Figure 12: Global: Blood Pressure Monitoring Devices Industry: Porter’s Five Forces Analysis

Figure 13: Global: Blood Pressure Monitoring Devices (Monitor) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Blood Pressure Monitoring Devices (Sphygmomanometers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Blood Pressure Monitoring Devices (Sphygmomanometers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Blood Pressure Monitoring Devices (Automated BP Monitors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Blood Pressure Monitoring Devices (Automated BP Monitors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Blood Pressure Monitoring Devices (Ambulatory BP Monitors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Blood Pressure Monitoring Devices (Ambulatory BP Monitors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Blood Pressure Monitoring Devices (BP Transducers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Blood Pressure Monitoring Devices (BP Transducers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Blood Pressure Monitoring Devices (Home-Based BP Monitors) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Blood Pressure Monitoring Devices (Home-Based BP Monitors) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Blood Pressure Monitoring Devices (Other Monitor Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Blood Pressure Monitoring Devices (Other Monitor Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Blood Pressure Monitoring Devices (Monitor) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Blood Pressure Monitoring Devices (Accessories) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Blood Pressure Monitoring Devices (Blood Pressure Cuffs) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Blood Pressure Monitoring Devices (Blood Pressure Cuffs) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Blood Pressure Monitoring Devices (Manometers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Blood Pressure Monitoring Devices (Manometers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Blood Pressure Monitoring Devices (Valves and Bladders) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Blood Pressure Monitoring Devices (Valves and Bladders) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Blood Pressure Monitoring Devices (Other Accessories) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Blood Pressure Monitoring Devices (Other Accessories) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Blood Pressure Monitoring Devices (Accessories) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Blood Pressure Monitoring Devices (Digital) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Blood Pressure Monitoring Devices (Digital) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Global: Blood Pressure Monitoring Devices (Aneroid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Global: Blood Pressure Monitoring Devices (Aneroid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Global: Blood Pressure Monitoring Devices (Wearable) Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Global: Blood Pressure Monitoring Devices (Wearable) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Global: Blood Pressure Monitoring Devices (Hospitals and Clinics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Global: Blood Pressure Monitoring Devices (Hospitals and Clinics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Global: Blood Pressure Monitoring Devices (Ambulatory Surgical Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Global: Blood Pressure Monitoring Devices (Ambulatory Surgical Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Global: Blood Pressure Monitoring Devices (Diagnostic Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Global: Blood Pressure Monitoring Devices (Diagnostic Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: Global: Blood Pressure Monitoring Devices (Homecare Settings) Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: Global: Blood Pressure Monitoring Devices (Homecare Settings) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: Global: Blood Pressure Monitoring Devices (Other End-Users) Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: Global: Blood Pressure Monitoring Devices (Other End-Users) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Asia Pacific: Blood Pressure Monitoring Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Asia Pacific: Blood Pressure Monitoring Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Europe: Blood Pressure Monitoring Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Europe: Blood Pressure Monitoring Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: North America: Blood Pressure Monitoring Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: North America: Blood Pressure Monitoring Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Middle East and Africa: Blood Pressure Monitoring Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Middle East and Africa: Blood Pressure Monitoring Devices Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: Latin America: Blood Pressure Monitoring Devices Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: Latin America: Blood Pressure Monitoring Devices Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

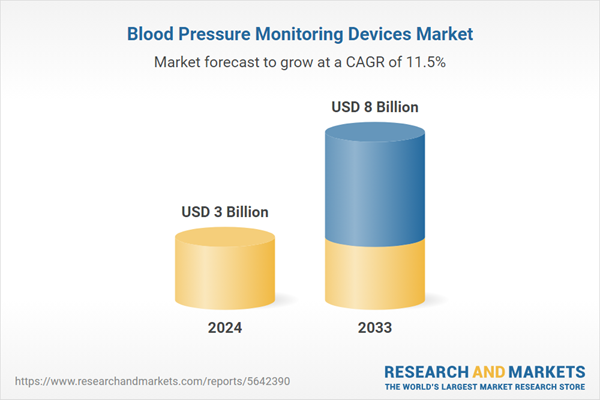

Table 1: Global: Blood Pressure Monitoring Devices Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Blood Pressure Monitoring Devices Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Blood Pressure Monitoring Devices Market Forecast: Breakup by Technology (in Million USD), 2025-2033

Table 4: Global: Blood Pressure Monitoring Devices Market Forecast: Breakup by Accessories (in Million USD), 2025-2033

Table 5: Global: Blood Pressure Monitoring Devices Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 6: Global: Blood Pressure Monitoring Devices Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Blood Pressure Monitoring Devices Market Structure

Table 8: Global: Blood Pressure Monitoring Devices Market: Key Players

Companies Mentioned

- A&D Medical Inc.

- GE Healthcare

- Koninklijke Philips N.V

- Omron Healthcare

- Welch Allyn

- Rossmaax International Limited

- Spacelab’s Healthcare Inc.

- Contec Medical System Co.Ltd

- Microlife AG

- Halma plc.

- Hill-Rom Holdings

- American Diagnostic

- Smith’s Group Plc.

- Schiller AG

- SunTech Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 8 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |