Mobile TV Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth owing to the extensive use of smartphones, improvements in 4G and 5G networks, and the rising demand for mobile entertainment. Furthermore, the increasing levels of disposable income and the availability of cost-effective data packages are contributing to the growth of the market.

- Key Market Trends: The shift towards streaming services, higher production of localized content, and the integration of advanced technologies like artificial intelligence (AI) for personalized viewing experiences are some of the key trends.

- Geographical Trends: Asia Pacific leads the market because of rapid urbanization, improved internet accessibility, increasing affordability of smart devices, and notable investment in network infrastructure development.

- Competitive Landscape: Some of the major market players in the industry include Asianet Satellite, AT&T Inc., Bell Canada (BCE Inc.), Bharti Airtel Limited, Charter Communications Inc., Comcast Corporation, Consolidated Communications, Cox Communications Inc., MobiTV Inc., SPB TV AG, Tata Sky Ltd. (TOF), United States Cellular (Telephone and Data Systems), and Verizon Communications Inc.

- Challenges and Opportunities: Network congestion, concerns about data privacy, and the necessity for regular technological advancements are influencing the market. Nevertheless, there are opportunities to expand rural market reach, improve user experience with AI, and capitalize on the growing demand for personalized and localized content.

Mobile TV Market Trends:

Rising Smartphone Penetration and Internet Access

With the increasing affordability and feature enhancements of smartphones, more people are able to enjoy mobile entertainment. Improved mobile network systems, such as the implementation of 4G and 5G technologies, offer quicker and more trustworthy internet connections, making high-quality video streaming easier. According to the 5G-Market Snapshot November 2023 by Global Mobile Suppliers Association (GSA), 578 operators across 173 nations had made investments in 5G technology, while 300 operators in 114 countries had already rolled out 3GPP-compliant 5G services. GSA found 2,148 5G devices, with 1,756 being available for purchase, showing a notable increase compared to last year. The easy access to powerful devices and strong internet connections allows users to watch media wherever they are, driving the demand for mobile television (TV) services. The ease of accessing entertainment anytime and anywhere aligns well with the modern lifestyles of individuals, making mobile TV an attractive option.Growing Popularity of Over-The-Top (OTT) Platforms

Over-the-top (OTT) services provide a wide range of content, such as movies, TV shows, documentaries, and exclusive original programming, which can be easily accessed on mobile devices without requiring traditional cable or satellite subscriptions. This direct-to-consumer (DTC) approach offers unmatched convenience, allowing subscribers to access and watch content on their smartphones and tablets via apps. Competitive pricing models like subscription levels and ad-supported free versions make these services affordable to a wider audience by decreasing entry barriers. Moreover, OTT platforms are consistently evolving by recommending interactive and immersive content such as live streaming and personalized suggestions, which elevate user involvement. The flexibility, diverse content offerings, and user-centric features of OTT platforms make them highly attractive, driving their popularity as more people shift towards mobile and on-demand viewing preferences. In 2024, Dish TV launched 'Dish TV Smart+', which combines OTT services with traditional TV subscriptions, giving Dish TV and direct-to-home (D2H) users access to TV and OTT content on all screens without any additional fees.Increasing Affordability of Mobile Data Plans

Telecommunication companies are competing to provide cheaper and high-volume data plans, making it more economical for people to watch videos on their smartphones. This increased affordability makes it easier for new users to join, especially in developing markets where price awareness is more crucial. Combined packages that include mobile data plans along with subscriptions to mobile TV services encourage individuals to use mobile streaming. The trend of data plans that are both more generous and economically feasible is leading to higher accessibility to mobile TV services, allowing a broader range of viewers to enjoy smooth streaming experiences. The democratization of mobile data helps create a digital ecosystem that is more inclusive, support the growth of the market. In July 2024, Vodafone Idea (Vi) introduced 'Vi One,' a package deal that includes fiber internet, prepaid mobile, and OTT subscriptions like Disney+ Hotstar and ZEE5 in one all-inclusive plan.Mobile TV Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on content type, technology, service type, and application.Breakup by Content Type:

- Video-on-Demand

- Online Video

- Live Streaming

Video-on-demand (VoD) enables users to choose and view video content whenever they prefer instead of being limited to a set broadcast schedule. This segment is gaining attention because of its versatility and wide range of content, such as films, series, and documentaries. The demand for VoD is driven by the desire for customized viewing experiences and the opportunity to binge-watch shows. In 2023, 1&1 introduced "1&1 Cinema," a VOD service, in collaboration with Zattoo and Rakuten TV, providing more than 6,000 titles to its broadband subscribers. This offering merged no-cost and paid material by incorporating Rakuten TV's transactional video-on-demand (TVOD) into Zattoo's platform.

Online video includes content produced by influencers, independent creators, and user-generated short videos. This segment is renowned for its wide range and fast usage rate, typically accessed through platforms that encourage user interaction and participation. The rise of online video is driven by the increase of social media platforms and video-sharing websites, where short and engaging content can quickly gain popularity. This segment is very appealing, especially to younger audiences who enjoy diverse and dynamic content due to lower production costs and easy accessibility.

Live streaming involves broadcasting real-time events, including sports, concerts, news, and other live performances. This segment is becoming popular because of the progress in mobile technology and the rising access to high-speed internet. Viewers are drawn to live streaming because of its immediacy and the chance to interact with the content in real-time. The segment benefits from the integration of interactive features such as live chats and polls enhancing viewer engagement and participation.

Breakup by Technology:

- IPTV

- OTT

- Satellite

- Others

OTT holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes IPTV, OTT, satellite, and others. According to the report, OTT accounted for the largest market share.OTT, which is known for providing video content over the internet without using traditional methods like cable or satellite television, leads the market. The dominance of this segment is driven by the increasing availability of high-speed internet and the growing use of smart devices, enabling easy and flexible access to OTT content. Viewers are attracted to OTT services because of their ability to provide content on demand, offer a wide range of content, and allow for streaming on various devices. The rise of subscription-based streaming services and the creation of exclusive, high-quality content are further driving the demand for OTT platforms. In March 2024, Africell Angola collaborated with Perception Group to introduce AfriTV, an OTT mobile TV service providing 44 live TV channels and catch-up TV for mobile data users. This project aims to improve the variety of entertainment choices available to users in Angola.

Breakup by Service Type:

- Free-to-Air Services

- Pay TV Services

Pay TV services represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the service type. This includes free-to-air services and pay TV services. According to the report, pay TV services represented the largest segment.Pay TV services hold the biggest market share, including subscription-based models in which viewers pay a fee to watch a variety of television programs. This segment consists of conventional cable/satellite subscriptions along with contemporary streaming services, providing exclusive channels, premium content, and on-demand viewing choices. The appeal of pay TV services is found in their vast content collections, top-notch programming, and the option to enjoy ad-free viewing. Additionally, the increasing demand for high-definition and 4K content, bundled service packages, and the inclusion of value-added features such as digital video recorder (DVR) capabilities and multi-device access are supporting the market growth. As people seek more tailored and high-quality viewing experiences, pay TV services continues to attract a notable user base. In 2024, Verizon introduced the "myHome" plan for home internet users, which offers discounted streaming services bundled with the option to choose YouTube TV for their pay-TV, providing integrated mobile and TV streaming choices.

Breakup by Application:

- Commercial

- Personal

Personal exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial and personal. According to the report, personal accounted for the largest market share.Personal dominates the market due to the extensive use of mobile devices for individual entertainment purposes. This segment includes a diverse range of applications where users stream video content for personal usage, such as watching TV shows, movies, live sports, and user-generated content. The dominance of the personal segment is driven by the rising accessibility and availability of smartphones and tablets, along with the improvement of mobile network infrastructure that enables fast streaming. Furthermore, customization options provided by streaming services, such as tailored suggestions and individualized content collections, increase the attractiveness of mobile TV for personal usage. The convenience of accessing entertainment anytime and anywhere continues to attract a large number of users to this segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest mobile TV market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for mobile tv.Asia Pacific dominates the market due to its large and tech-savvy population, rapid urbanization, and high smartphone usage. The growing middle class and rising disposable income in the region are driving the need for mobile entertainment services. It is predicted that the middle-class population in India will increase from 432 million people in 2020-21 to 715 million (or 47% of the population) in 2030-31 and then reach 1.02 billion out of India's estimated population of 1.66 billion in 2047, as per the data provided by the India Brand Equity Foundation (IBEF). Furthermore, the region is also witnessing increasing investments in 4G and 5G network infrastructures, which are improving the availability and excellence of mobile TV content. Moreover, the rise of cost-effective data packages and the increasing demand for local and regional content are contributing to the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Asianet Satellite, AT&T Inc., Bell Canada (BCE Inc.), Bharti Airtel Limited, Charter Communications Inc., Comcast Corporation, Consolidated Communications, Cox Communications Inc., MobiTV Inc., SPB TV AG, Tata Sky Ltd. (TOF), United States Cellular (Telephone and Data Systems), Verizon Communications Inc etc.

- Major players in the industry are concentrating on increasing their content offerings and improving user satisfaction with personalized suggestions and top-notch streaming services. They are making investments in unique and original content to attract and retain subscribers. To take advantage of technological progress, these firms are incorporating AI and ML to enhance content delivery and user interaction. In addition, they are establishing strategic collaborations with telecommunication companies to provide packaged services and broadening their presence in developing markets. Mobile TV providers are also embracing adaptive streaming technologies to guarantee smooth viewing experiences on various network conditions and devices. In May 2024, Vi revealed a collaboration with Netflix to introduce two unlimited prepaid packs featuring a Netflix basic subscription, allowing users to enjoy a range of content on mobile and TV screens. Vi also emphasized extra perks, including data delight and weekend data roll-over for users who recharge with the 84-day validity plan.

Key Questions Answered in This Report:

- How has the global mobile TV market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global market?

- What is the impact of each driver, restraint, and opportunity on the global market?

- What are the key regional markets?

- Which countries represent the most attractive market?

- What is the breakup of the market based on the content type?

- Which is the most attractive content type in the market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the market?

- What is the breakup of the market based on the service type?

- Which is the most attractive service type in the market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global mobile TV market?

Table of Contents

Companies Mentioned

- Asianet Satellite

- AT&T Inc.

- Bell Canada (BCE Inc.)

- Bharti Airtel Limited

- Charter Communications Inc.

- Comcast Corporation

- Consolidated Communications

- Cox Communications Inc.

- MobiTV Inc.

- SPB TV AG

- Tata Sky Ltd. (TOF)

- United States Cellular (Telephone and Data Systems)

- Verizon Communications Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | August 2025 |

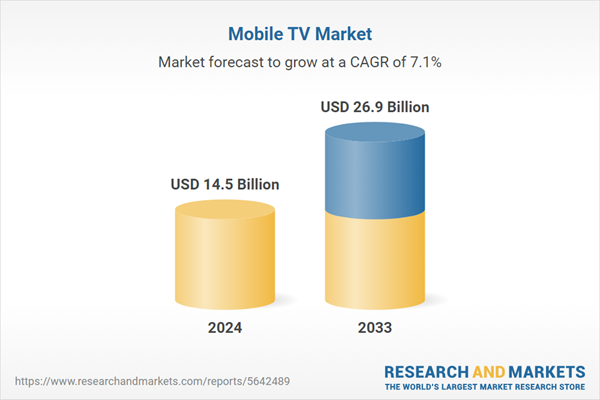

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 14.5 Billion |

| Forecasted Market Value ( USD | $ 26.9 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |