Rising adoption of personal mobility, increased penetration of alternative-engine powertrain vehicles, increased connectivity in vehicles, digitization in dealership models, telematics, digitalization of the workforce, and growth in the used car market, are likely to result in strong demand for electric vehicles in the automotive sector, thus augmenting the product demand. The rapid growth of the end-user industries, such as e-commerce, fast-moving consumer goods (FMCG), and pharmaceutical have increased the demand for packaging products. In addition, the rising demand for industrial buildings and commercial infrastructure in India is creating several growth opportunities for market players, which expands the industry growth.

According to the Ministry of Chemicals and Fertilizers, For the promotion of the plastic industry in the country, the government has implemented several industry-friendly policy initiatives such as deregulating the petrochemical sector and authorizing 100% FDI under the automatic route to facilitate fresh investments, thus augmenting the demand for this product. The companies are focusing on optimum business growth by introducing numerous growth strategies. Some of the major India injection molding machine manufacturers are exploring new markets and expanding their presence in emerging economies. Many companies are investing heavily in research and development and continue to bring new products to the global market.

India Injection Molding Machine Market Report Highlights

- The plastics material segment led the market and accounted for a revenue share of 74.8% in 2024 owing to their wide applications in e-commerce, fast-moving consumer goods (FMCG), and pharmaceutical, which drives the industry for injection molding machines

- The hydraulic segment dominated the industry as it accounted for 80.34% of the global revenue share in 2024 owing to its widespread application in the marine, automotive, and aerospace industries

- The automotive end-use segment led the industry on account of the factors such as material compatibility, and high precision. Rising automotive production and growing demand for lightweight automotive components are expected to propel industry growth

- The advent of electric vehicles can be seen as an opportunity for injection molding machine manufacturers. The rising trend of replacing metal with plastic in automobiles is expected to drive the industry during the forecast period

- India is an attractive destination for manufacturers to set up plants considering the cost advantages. Furthermore, positive economic development is anticipated to boost the growth of the process manufacturing sector, which, in turn, is conducive to industry growth

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Arburg GmbH + Co KG

- HAITIAN INTERNATIONAL

- KraussMaffei

- Milacron

- NISSEI PLASTIC INDUSTRIAL CO., LTD.

- ENGEL AUSTRIA GmbH

- Chen Hsong Holdings Limited

- UBE MACHINERY CORPORATION, Ltd.

- Husky Injection Molding Systems Ltd.

- WITTMANN Kunststoffgeräte GmbH

- FANUC CORPORATION

- Shibaura Machine CO., LTD (Formerly Toshiba Machine)

- TOYO MACHINERY & METAL CO., LTD.

- The Japan Steel Works, LTD.

- Sumitomo Heavy Industries, Ltd.

Table Information

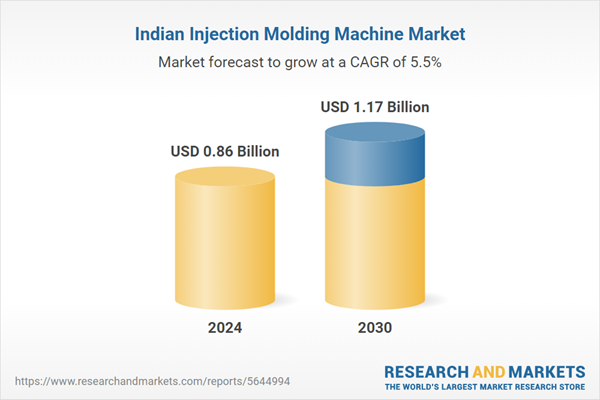

| Report Attribute | Details |

|---|---|

| No. of Pages | 152 |

| Published | November 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.86 Billion |

| Forecasted Market Value ( USD | $ 1.17 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 15 |