Orthokeratology is a method of refractive error correction that uses bespoke gas permeable contact lenses to temporarily alter the corneal curvature. Orthokeratology, also known as ortho-k, corneal refractive therapy (CRT), and nighttime vision correction therapy, is a non-surgical procedure that corrects refractive problems by altering the cornea's curvature to enhance object visibility. To enable quicker as well as more effective corneal reshaping, modern ortho-K technology reverses geometry designs and uses breathable stiff lens material. This technique, which involves temporary medication, is used to treat myopia, hypermetropia, and other vision-related issues. Myopia, hypermetropia, astigmatism, & presbyopia occurrences are predicted to rise, which will help the industry.

Wearing lenses that reduce eye sight issue progression and correct eye sight may sound like a fantasy, but it's actually a reality. Orthokeratology lenses are not exactly a novel concept. However, these lenses have just recently begun to make significant strides. Due to development of advanced and precise technology, the field of technology is currently really advancing. These tools facilitate and expedite the production of 3D models of the eye's surface. The enhanced polymer substance that makes hard contact lenses more oxygen permeable is another driving force behind the new technology.

But since the pandemic began, there has been a significant change, and many more people are now more likely to have refractive defects. It is anticipated that the move toward online education and the widespread adoption of work-from-home policies by businesses is expected to lead to an increase in peoples' overall screen time and an increase in refractive errors. Consequently, it is possible to predict that during the upcoming years, the market. The main driver fueling the market expansion is key manufacturers' increased efforts to introduce new products and obtain regulatory approvals. Additionally, the market is growing significantly because of the increasing burden of patients with refractive defects.

COVID-19 Impact Analysis

The decrease in patient visits to hospitals & clinics brought about by the COVID-19 pandemic had a marginally negative effect. The outbreak of pandemics that swept the world significantly altered how the health care industry is managed. Nobody has been in a decent physical, mental, or emotional state during the pandemic. The government had declared rigorous internment as the coronavirus was about to break out, and individuals were confined to their houses, which increased screen time. People's eyesight was impacted by excessive exposure to laptops & personal computers. Despite the difficulties that several industries faced during the pandemic, the worldwide orthokeratology market expanded significantly.Market Growth Factors

Increase In Cases Of Myopia & High Myopia

Myopia & high myopia are becoming more and more commonplace on a massive level. Myopia is a significant public health issue, and excessive myopia is the second-leading factor in the visual impairment globe. In East Asia, the prevalence of myopia is among a large number of students and affected around half of the urban population. Additionally, because myopia's visual difficulties begin earlier than other causes of blindness like cataracts, its effects on quality of life are also seen earlier. The cost of eye illnesses in various developed regions is estimated to be in the millions. Myopia prevention, as well as control techniques, are therefore highly sought after on a worldwide scale.Increasing Use Of Laptops & Extended Exposure

Digital gadgets such as laptops, tablets, smartphones, and e-readers have become an essential part of everyday life. Most occupations necessitate working on computers for extended periods of time. In addition, the need of staying connected has increased with the rise of social networking sites. A worrying trend has been seen where people turn on their cell phones as soon as they get up and continue their trust with digital screens until they go to bed. In addition, the rising use of digital screens has given rise to a disorder called Computer Vision Syndrome (CVS), which harms the eyes and causes issues with vision.Market Restraining Factors

Availability Of Various Alternatives In The Market

There are various alternatives available in the market like multifocal contact lenses and atropine eye drops. MiSight lenses are the first type of FDA-approved contact lenses for preventing childhood myopia progression. Children as young as 8 years old may be prescribed these soft, disposable lenses. At night, the lenses are removed after being worn during the day. These lenses include concentric rings that refocus light so that it strikes the retina in a different way, deceiving the eye into not enlarging too much. Although the lenses can correct astigmatism.Product Type Outlook

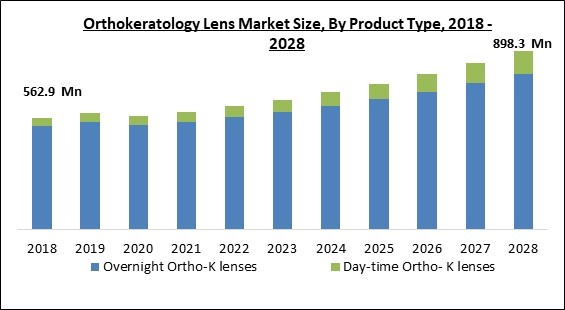

Based on product type, the orthokeratology lens market is segmented into overnight ortho-K lenses and day-time ortho- K lenses. In 2021, overnight ortho-K lenses dominated the orthokeratology lens market with the highest revenue share. This is attributed to the easy availability of overnight ortho-K lenses. In addition, ortho-k lenses are customized contact lenses. The user can wake up with clear vision without the need for glasses or contacts the next day. Ortho K lens softly reshapes the eye overnight. All these factors are supporting market growth in this segment. The main advantage of these lenses is that they are needed to be worn only at night.Indication Outlook

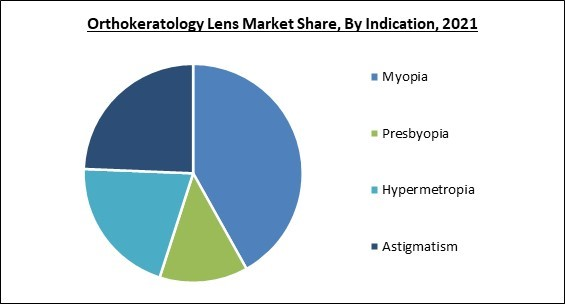

On the basis of indication, the orthokeratology lens market is fragmented into myopia, presbyopia, hypermetropia and astigmatism. In 2021, the astigmatism segment covered a significant revenue share in the orthokeratology market. The vision may become distorted or fuzzy if someone has astigmatism, a common condition of the eyes. It occurs when the cornea the transparent outer layer of the eye or lens the inner portion of the eye that aids in eye focus have an abnormal shape. The demand for ortho-k lenses is rising in this segment as spherical ortho-k lenses are available which have the ability to reshape the anterior surface of the cornea.Distribution Channel Outlook

By distribution channel, the orthokeratology lens market is classified into hospitals, optometry clinics, ophthalmology clinics and others. In 2021, the North America region witnessed the largest revenue share in the orthokeratology lens market. The increase in the prevalence and incidence of vision errors, as well as the number of qualified specialists, are indicators of the market expansion in this region. Additionally, the market in this region is being driven by the rising awareness of the use of ortho-k lenses, successful compensation policies, and market penetration by key competitors in the region.Regional Outlook

Region-wise, the orthokeratology lens market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region witnessed the largest revenue share in the orthokeratology lens market. The increase in the prevalence and incidence of vision errors, as well as the number of qualified specialists, are indicators of the market expansion in this region. Additionally, the market in this region is being driven by the rising awareness of the use of ortho-k lenses, successful compensation policies, and market penetration by key competitors in the region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Johnson & Johnson (Johnson & Johnson Vision Care, Inc.), Bausch Health Companies, Inc., The Cooper Companies, Inc., Euclid Systems Corporation, Alpha Corporation, Inc. (Menicon Co., Ltd.), Brighten Optix Corporation, TruForm Optics, Inc., Art Optical Contact Lens, Inc., and MiracLens, LLC.

Strategies deployed in Orthokeratology Lens Market

- Jun-2022: CooperVision took over EnsEyes, a leader in specialty contact lenses. Under the acquisition, EnsEyes is expected to operate within CooperVision’s Specialty EyeCare group. The acquisition focused on accelerating the growth of specialty lens adoption across these markets. In addition, the acquisition is expected to give its highly respected team more resources for growth, further build the expertise of CooperVision as well as support eye care professionals’ soaring enthusiasm for specialty fitting.

- Apr-2022: Euclid Vision acquired Visionary Optics, a specialty scleral contact lens design, and distribution pioneer. The acquisition aimed to enhance the abilities of both companies to provide comprehensive specialty contact lens care to more patients worldwide.

- Jan-2022: Johnson & Johnson introduced ACUVUE Ability, a powerful new comprehensive approach for myopia management. The launch is expected to address the spread and progression of myopia in children.

- May-2021: CooperVision received European approval for Procornea DreamLite night lenses. The lenses are a new CooperVision myopia control product to gain the CE Mark, joining EyeDream & Paragon CRT ortho-k designs, MiSight 1-day soft contact lenses, and SightGlass Vision Diffusion Optics Technology spectacle lenses.

- May-2021: Euclid Systems released Euclid MAX, the overnight orthokeratology lens. These lenses is expected to gently reshape the cornea to manage myopia while the patient sleeps. The latest contact lenses provide incredible lens stability, oxygen permeability, and wettability, which adds a layer of comfort, safety, and satisfaction to my Ortho-K practice.

- Feb-2021: CooperCompanies formed a joint venture with EssilorLuxottica, a leader in the design, manufacture, and distribution of ophthalmic lenses. The companies are focused on accelerating the commercialization of innovative spectacle lenses from SightGlass Vision, which is developed to reduce the progression of myopia in children. With the SightGlass Vision technology by this collaboration, MiSight 1 day and orthokeratology contact lenses from CooperVision, and Stellest lenses from Essilor, ECPs can create a comprehensive optical intervention portfolio to address the rising number of children impacted by myopia.

- Sep-2020: TruForm Optics took over DreamLens. The acquisition is expected to enable licensed eye care professionals to expand the options of managing myopia using DreamLens, manufactured in Boston Equalens II material, after achieving online certification.

- May-2020: Bausch + Lomb unveiled LuxSmart, an Extended Depth of Focus intraocular lens (IOL), and LuxGood, a new monofocal IOL. These products feature the latest premium optic design and PRO technology that decreases dysphotopsia, a common phenomenon that can occur in some premium IOLs and compromise a patient's vision.

Scope of the Study

Market Segments Covered in the Report:

By Product Type

- Overnight Ortho-K lenses

- Day-time Ortho- K lenses

By Indication

- Myopia

- Presbyopia

- Hypermetropia

- Astigmatism

By Distribution Channel

- Ophthalmology Clinics

- Optometry Clinics

- Hospitals

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Johnson & Johnson (Johnson & Johnson Vision Care, Inc.)

- Bausch Health Companies, Inc.

- The Cooper Companies, Inc.

- Euclid Systems Corporation

- Alpha Corporation, Inc. (Menicon Co., Ltd.)

- Brighten Optix Corporation

- TruForm Optics, Inc.

- Art Optical Contact Lens, Inc.

- MiracLens, LLC

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Johnson & Johnson (Johnson & Johnson Vision Care, Inc.)

- Bausch Health Companies, Inc.

- The Cooper Companies, Inc.

- Euclid Systems Corporation

- Alpha Corporation, Inc. (Menicon Co., Ltd.)

- Brighten Optix Corporation

- TruForm Optics, Inc.

- Art Optical Contact Lens, Inc.

- MiracLens, LLC