Spinal compression fractures are widened and stabilized via a surgical procedure called kyphoplasty. It entails using a balloon-like device to make room for the surgery as well as injecting a specific cement into the spine. A type of vertebroplasty called kyphoplasty lessens discomfort while restoring the height of a destroyed spine. Vertebral body compression fractures, which are minor breaks in the substantial bone mass that forms the spinal cord's front segment, are one of the conditions that can be treated with this procedure.

Patients who are not getting better with their current treatment & are in danger of a serious decline may want to think about kyphoplasty. It's a somewhat specialized procedure that is only applied to patients who have experienced a vertebral fracture, not for conditions like disc rupture or arthritis. Untreated spinal compression fractures can have significant clinical repercussions and significantly affect both the patient's and the caregiver's quality of life. The ineffectiveness of non-surgical treatment for these fractures has led to an increase in the use of kyphoplasty surgeries to stabilize fractures and manage pain.

Increase in the older population, osteoporosis & arthritis incidence, the prevalence of spine disorders, and patient awareness of advancements in spine treatments are all factors that are fueling the expansion of the kyphoplasty market. Untreated vertebral compression fractures can have substantial clinical repercussions and also have a considerable negative influence on the quality of life of patients as well as careers. Kyphoplasty treatments are becoming more widely used in medical practice for fracture stabilization and pain management because non-surgical care for these fractures is ineffective in treating them.

COVID-19 Impact Analysis

In the market for kyphoplasty, the COVID-19 outbreak is expected to have a negative effect. To expand hospital capacity for patients diagnosed with COVID-19, a significant number of clinics and hospitals all around the world underwent restructuring. A potential backlog in non-essential procedures developed as a result of the sharp increase in COVID-19 cases. The lockdown caused delays in the production and delivery of critical medical supplies. Limited access to medical treatment, a staffing deficit in the healthcare industry, and an increase in COVID-19-related hospitalization are a few more variables that have an impact on the market.Market Growth Factors

Increase In R&D Efforts

The rising investment in the research and development activities by various medical organizations is expected to present favorable chances for the kyphoplasty market. Additionally, the rise in new product launches, collaborations, are also increasing in this industry. The increasing emphasis on adopting cutting-edge technologies by manufacturers will result in larger adoption of kyphoplasty. The market is expanding as a result of innovations and the creation of new technologies built on the manufacturers' research efforts.Increased use of technologically advanced products

To draw in more users, a large number of international manufacturers with technical know-how and core competencies are always working to develop and produce revolutionary vertebroplasty and kyphoplasty products. Demand for enhanced biomaterial-based implants that give great strength and no cement leaks during the repairing of spine fractures is skyrocketing in both developed and developing nations. The main concerns of product developers in this industry are affordability, usability, and originality in order to meet the growing demand for inexpensive care among the people affected by spine fractures, which is expanding quickly.Market Restraining Factors

The High Price Of Minimally Invasive Ablation Techniques

The market for kyphoplasty will rise, but there are some factors that may result in hampering the market growth. One of the major factors negatively affecting the market growth is the high price to be spent on minimally invasive ablation techniques. The price of spinal surgery is very high, and in some circumstances, it may not be covered by insurance. This makes it costly for those in the low-income group and increases the strain on the patient as well as the family.Product Type Outlook

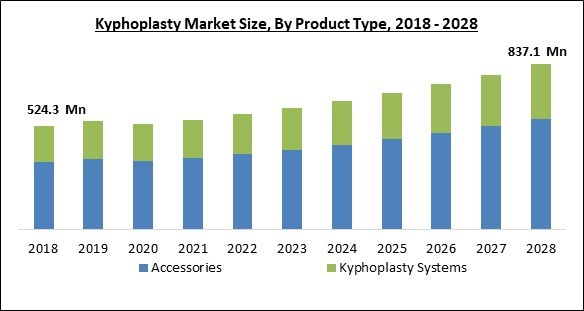

On the basis of product type, the Kyphoplasty market is segmented into kyphoplasty systems and accessories. In 2021, the accessories segment dominated the kyphoplasty market by generating the maximum revenue share. This is due to an increase in demand for bone cement as well as biopsy kits as a result of a rise in cancer cases related to the vertebrae. With the increasing traffic, the cases of road accidents are increasing which may lead to serious injuries requiring the surgical procedure which need bone cement and other accessories.Indication Outlook

Based on indication, the kyphoplasty market is fragmented into osteoporosis and others. In 2021, the others segment witnessed a substantial revenue share in the kyphoplasty market. The palliative treatment of metastatic spinal malignancies frequently involves kyphoplasty. When compared to nonsurgical treatment, kyphoplasty is more affordable from the perspective of elderly individuals in the U.S. Also, kyphoplasty significantly and quickly decreases the amount of pain experienced by cancer patients with VCFs which supported the market growth.End-User Outlook

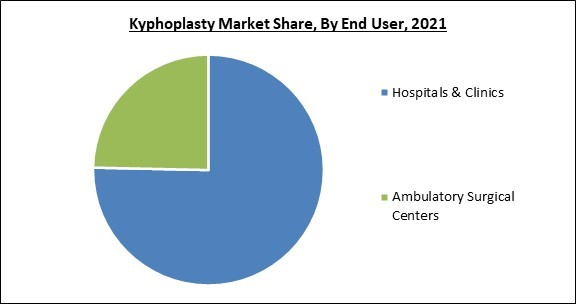

By end-user, the kyphoplasty market is divided into hospitals & clinics, and ambulatory surgical centers. In 2021, the hospital & clinics segment held the maximum revenue share in the kyphoplasty market. This can be attributed to the increase in hospital admissions for vertebral compression fractures and unintentional spinal cord injuries. As hospitals are the principal setting for treating all types of health issues, the segment is predicted to have the largest market share. Hospitals are a crucial component of the healthcare sector and the primary source of money for the overall industry, which stimulates research & innovation.Regional Outlook

Region-wise, the hair removal wax market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the North America segment led the kyphoplasty market with the highest revenue share. Due to its high awareness levels and developed healthcare infrastructure the region is expecting market growth. Back pain, spine fractures, and osteoporosis are all becoming more common, which may be responsible for regional market growth. In the region, women have been more frequently affected by this disease than men. The market is expanding as a result of the rapid uptake of kyphoplasty and the rising incidence of spinal compression fractures.Cardinal Matrix - Kyphoplasty Market Competition Analysis

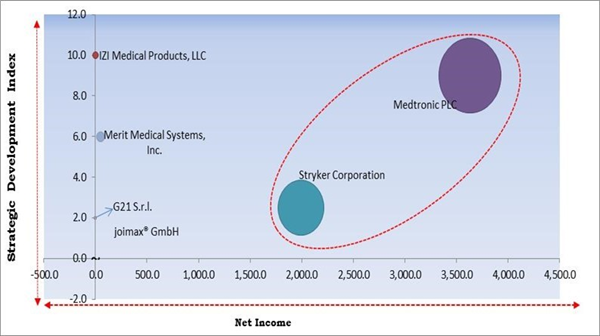

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Medtronic PLC and Stryker Corporation are the forerunners in the Kyphoplasty Market. Companies such as Merit Medical Systems, Inc., G21 S.r.l., joimax GmbH are some of the key innovators in Kyphoplasty Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Medtronic PLC, Stryker Corporation, MicroPort Scientific Corporation, IZI Medical Products, LLC (Landauer, Inc.), Merit Medical Systems, Inc., Jiangsu Changmei Medtech Co. Ltd., G21 S.r.l., Seawon Meditech Co., Ltd., joimax® GmbH and Taeyeon medical Co., Ltd.

Strategies Deployed in Kyphoplasty Market Market

» Partnerships, Collaborations and Agreements:

- 2022-Apr: Medtronic joined hands with GE Healthcare, a subsidiary of American multinational conglomerate General Electric. The collaboration aimed at fulfilling the unique requirements and demand for care at Ambulatory Surgery Centers (ASCs) and Office Based Labs (OBLs). This collaboration is expected to enable consumers to access extensive product portfolios, financial solutions, and exceptional service.

- 2021-Jul: joimax partnered with NAMSA, the only full continuum Contract Research Organization (CRO) in the world. Under this partnership, NAMSA is expected to assist joimax consumers with reimbursement support services, including prior authorization and appeals support, across the US.

» Product Launches and Product Expansions:

- 2021-Aug: IZI Medical Products released Vertefix HV Cement, a unique solution addressing the need for real-time flow visualization during cement injection for vertebroplasty and kyphoplasty procedures. Through this launch, the company aimed to provide physicians with a better way to track and control where cement is flowing during their procedures.

- 2020-Aug: IZI Medical Products unveiled Osteo-Site Vertebral Balloon. The Osteo-Site Balloon fulfills IZI's offering of Vertebral Compression Fracture treatment options, which include Osteo-Site Balloon Kyphoplasty, Osteo-Site Vertebroplasty, Blazer Curved Needle Augmentation, and Kiva PEEK Implant-based augmentation.

- 2020-May: Medtronic introduced Kyphon Assist Directional Cannula. The product is launched for use with its balloon kyphoplasty (BKP) products to treat vertebral compression fractures because of osteoporosis, cancer, or benign lesions. The latest device enables physicians greater control when inflating the bone tamp while also rising height restoration capability compared to a traditional balloon kyphoplasty cannula.

- 2020-Jan: Merit Medical launched Arcadia steerable and straight balloons. The newly introduced balloons are developed to help physicians achieve controlled, precise cavity creation during unipedicular or bipedicular vertebral augmentation procedures.

» Acquisition, Joint Venture and Merger:

- 2020-Nov: Medtronic took over Medicrea International, one of the leading spinal implant and instrument suppliers bringing advanced digital tools to the surgery suite. The acquisition is expected to help the company become the leader in personalized implants and AI-driven planning and prediction capabilities, setting a foundation for the coming years of individualized patient care

» Geographical Expansions:

- 2021-Oct: Stryker expanded its geographical footprints in Queensland, Australia by establishing the R&D Lab. The company focused on strengthening existing partnerships with hospitals, researchers, universities, and local governments to drive the transformation of research into viable, commercially available precision medical device technology.

» Approvals and Trials:

- 2021-Feb: G21 S.r.l. received the FDA approval for SpaceFlex Shoulder, as a completion of its existing Spaceflex line: Hip and Knee. SpaceFlex Shoulder is expected to represent a user-friendly solution for a complex issue.

Scope of the Study

Market Segments Covered in the Report:

By Product Type

- Accessories

- Kyphoplasty Systems

By Indication

- Osteoporosis

- Others

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Medtronic PLC

- Stryker Corporation

- MicroPort Scientific Corporation

- IZI Medical Products, LLC (Landauer, Inc.)

- Merit Medical Systems, Inc.

- Jiangsu Changmei Medtech Co. Ltd.

- G21 S.r.l.

- Seawon Meditech Co., Ltd.

- joimax® GmbH

- Taeyeon medical Co., Ltd.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Medtronic PLC

- Stryker Corporation

- MicroPort Scientific Corporation

- IZI Medical Products, LLC (Landauer, Inc.)

- Merit Medical Systems, Inc.

- Jiangsu Changmei Medtech Co. Ltd.

- G21 S.r.l.

- Seawon Meditech Co., Ltd.

- joimax® GmbH

- Taeyeon medical Co., Ltd.