Architectural lighting refers to the synthesis of science and art that is lighting and architecture. Building designs and functions are illuminated by architectural lighting. Architectural lighting has more appealing qualities for consumers, including affordability, dependability, longevity, cost savings, and adjustable illumination power.

Architectural LED lighting is the most energy-efficient recycling technology and converts 80% of the energy it consumes into visible light with just 20% being lost as heat, it has a wide range of applications in the commercial and residential sectors. With a projected operational time of 50000 hours, LED lighting technology is also 25 times more durable than incandescent and halogen, lowering maintenance costs and raising product quality standards. There are no temperature-sensitive filaments or glass components in this lighting technology.

Additionally, because it doesn't include harmful substances like mercury, it is environmentally benign and contributes to lowering carbon emissions. It is lauded for its endlessly adaptable function and design. Additionally, it can emit a range of hues, which affects mood, texture, and spatial awareness in conjunction with architecture. With the use of sensors that detect humans and regulate lighting intensity automatically, technological advancements offer intelligent architectural lighting solutions. In the upcoming years, it is anticipated that widespread usage of this technology is expected to significantly increase the market share of architectural LED lighting.

Architectural lighting is the fusion of lighting technology and visual arts (architecture). Both residential and commercial buildings can be lit or illuminated. Architectural lighting primarily serves to illuminate the inside and exterior of buildings. Architectural lighting designs arrange, include, develop, integrate, and envision lighting as a coordinated system. This system makes use of natural light, electric light, or both to progress and supports human tasks. Architectural lighting influences spatial awareness, texture, and mood while working to promote a sense of place.

COVID-19 Impact Analysis

The Covid-19 pandemic hindered total market expansion. Major companies like Acuity Brands Lighting and Signify Holdings have seen revenue losses as a result of a decline in demand, interruptions in supply and distribution, and delays in the completion of the projects that help create the demand for lighting. Additionally, the commercial and industrial sectors, such as retail, manufacturing, and hospitality, contributed less to the market as a result of the temporary lockdown and partial restrictions on mobility. China is the largest producer and exporter of goods in the world, and it has become increasingly well-known in terms of adoption.Market Growth Factors

Demand For The Use Of Green Technology Is Expected To Increase

The increased propensity of consumers to utilize lighting for decorative purposes is thought to have an impact on the growth of the worldwide architectural lighting industry. A well-lit atmosphere also contributes to improving the surroundings' security and safety. It is further anticipated that the introduction of LED lighting systems is expected to strengthen the method of designing lighting fixtures and lights. Because of this, interior designers may provide a variety of lighting options for both home and commercial environments. In the years to come, it is predicted that rising interest in interior design will fuel growth in the market for architectural lighting worldwide.Increasing Customer Preference For An Luxury Lifestyle

The demands for LED lighting goods have increased dramatically worldwide due to the rising consumer tendency toward affluent lifestyles. Both the business and residential sectors have seen this demand. Additionally, as part of smart city projects, government buildings and monuments are increasingly utilizing architectural LED luminaires and lamps. Luxury homes offer a wealth of thoughtful luxuries and the perfect setting for raising a family. The majority of these houses have cutting-edge amenities and gorgeous interiors while being constructed using the most recent technologies.Market Restraining Factors

The high initial installation cost of architectural led products market.

The adoption of LED lighting products in the residential sector is quite modest when compared to the commercial sector. This is due to the expensive initial installation cost. Particularly in emerging nations, residential users continue to favor low-cost lighting technology goods like fluorescent lighting fixtures. As a result, it is anticipated that the market expansion over the projection period is expected to be constrained and the demand for LED lighting products will be hampered. Currently, a 60W equivalent LED bulb costs nine times as much as a 60W fluorescent light. The capital investment and operational costs associated with the installation of effective emergency lighting systems are relatively significant.Light Type Outlook

On the basis of Light Type, the Architectural Lighting Market is divided into Light-Emitting Diode (LED), High-Intensity Discharge (HID), and Others. The Light-Emitting Diode (LED) segment acquired the highest revenue share in the architectural lighting market in 2021. It is due to the decreased cost of energy usage and accessibility of attractive LED lighting fixtures that are credited with the segment's rise. Furthermore, as LED usage grows in architectural lighting, it can now be incorporated into recessed floor lighting, façade lighting, decorative pendant lighting, chandelier lighting, and strip lighting in both indoor and outdoor regions of buildings.Application Area Outlook

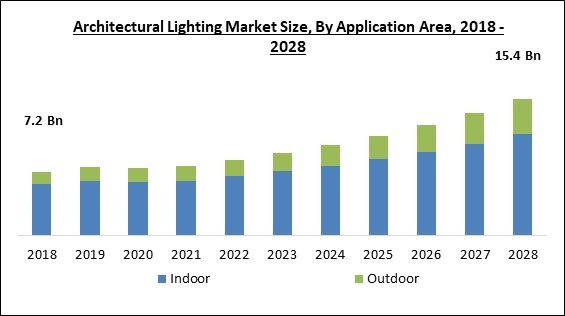

Based on the Application Area, the Architectural Lighting Market is segmented into Indoor and outdoor. The indoor segment procured the largest revenue share in the architectural lighting market in 2021. Due to the increased use of lights in the building's interior, the indoor segment has become the largest income provider. The need for different types of lighting in inside spaces, such as up lighting, retrofits, wall wash lights, pendants, and chandeliers, has also contributed to the expansion of the indoor market.End-User Outlook

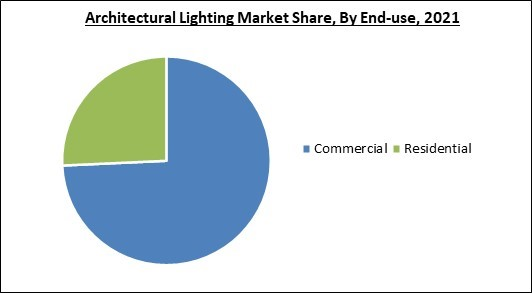

By end use, the Architectural Lighting Market is classified into Residential and Commercial. The residential segment recorded a significant revenue share in the architectural lighting market in 2021. High-end luxury villas and apartments were where architectural lighting was first used in residential buildings. However, the improvement in living standards brought about by the rise in purchasing power parity (PPP) had a positive effect on the growth of the residential segment. Additionally, the residential sector has seen a startling trend due to the falling cost of LED fixtures, which is predicted to continue growing during the projected period.Regional Outlook

Region wise, the Architectural Lighting Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region acquired the largest revenue share in the architectural lighting market in 2021. Innovative lighting solutions are required due to the infrastructure expansion in commercial buildings, public areas, and high-end residential complexes in Asia's growing countries. The installation of attractive interiors and outdoor architectural lighting is consequently becoming more and more in demand.Cardinal Matrix - Architectural Lighting Market Competition Analysis

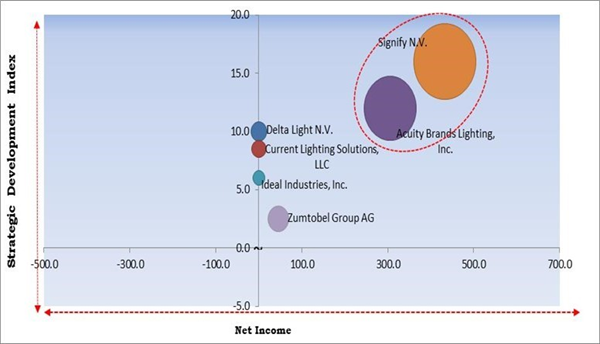

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Signify N.V. and Acuity Brands Lighting, Inc. are the forerunners in the Architectural Lighting Market. Companies such as Zumtobel Group AG, Delta Light N.V., Current Lighting Solutions, LLC are some of the key innovators in Architectural Lighting Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Acuity Brands Lighting, Inc., Ideal Industries, Inc., Delta Light N.V., Current Lighting Solutions, LLC, Siteco GmbH, Signify N.V., Zumtobel Group AG, and Technical Consumer Products, Inc.

Strategies Deployed in Architectural Lighting Market Market

» Partnerships, Collaborations and Agreements:

- Jun-2022: IDEAL INDUSTRIES came into a partnership with RIVET Work, the foremost provider of workforce management software. Together, the companies aimed to supply electrical contractors transformative clarity, permit labor and supplies planning tools, and real-time leverage of business assets that helps in enhanced profit margins.

- Jun-2022: Signify formed a partnership with EDZCOM, a group of Cellnex, and a European market head in Edge Connectivity solutions. Together, the companies aimed to create a creative and long-term personal network project with the image to make the city a better site for its residents to live and work.

- Feb-2021: Delta Light formed a partnership with UNStudio, international network expertise in architecture. Through this partnership, the companies aimed to develop Soliscape, an adaptable light and soundscape system developed to form optimum conditions for wellbeing. Additionally, Soilscape is an adaptable system that permits the customization and personalization of light and acoustic requirements in particular workplaces.

- Dec-2020: Zumtobel joined hands with Quuppa, a powerful technology platform for location-based services and applications. Together the companies aimed to precisely discover objects or devices utilizing sensors combined straight into luminaires. Additionally, Zumtobel employs Quuppa’s software and hardware and blends highly accurate positioning technology straight into Zumtobel’s lighting system.

» Product Launches and Product Expansions:

- Apr-2022: Acuity Brands unveiled Verjure, a professional-grade horticultural LED fixture series, for indoor applications. The new Verjure is designed to sustain all phases of plant growth from veg to flower. Additionally, e Series is public in three various sizes and results to support flexibility in growing, such as a greenhouse, indoor warehouse, and vertical frames.

- Mar-2021: Signify introduced tailored 3D printed light fixtures in the Indian market. The new 3D printer lights is expected to be 3D printed using a 100 percent biodegradable polycarbonate material at the producing plant in Vadodara. Additionally, Customers can develop and order their 3D printed luminaires online on the organization's website or visit their nearest Philips Smart Light Hub.

- Apr-2020: Acuity Brands Lighting launched Peerless Olessence, a redeveloped slim profile linear luminaire for indoor architectural areas. The new Olessence forms an agile indirect/direct, high-lumen performance luminaire, which combines and maximizes the stability of organic LED (OLED) and LED origins. Additionally, Using panels from OLEDWorks in luminaires delivers bright, uniform light that forms a soft and inviting atmosphere.

» Acquisition, Joint Venture and Merger:

- May-2022: Delta Light Group took over Lambent Lighting Group, a leading manufacturer of LED downlights and complicated architectural lighting systems. Through this acquisition, the company aimed to bolster its position in the North American lighting market and evolve into a prevailing world participant in architectural lighting.

- Mar-2022: Signify took over Fluence, a leading global supplier of energy-efficient LED lighting system solutions. This acquisition bolsters Signify's global Agriculture lighting growth medium and extends its role in the North American horticultural lighting market. Additionally, firms is expected to be capable to produce the world’s most advanced horticulture technology for cultivators on an international scale.

- Feb-2022: GE Current, also known as Current Lighting Solutions, LLC, took over Hubbell Incorporated’s commercial and industrial lighting enterprise. Through this acquisition, the company delivers an unmatched range and depth of solutions, products, and expertise that is expected to deliver greater service and innovation for various consumer bases.

- Apr-2021: GE Current, also known as Current Lighting Solutions, LLC, completed the acquisition of Forum, a Pittsburgh-based architectural linear luminaire business. With this acquisition, the company develops Current’s architectural offering and customization abilities. Additionally, Forum is expected to be able to utilize Current’s innovation, abilities and trademarks to support future growth for the brand.

- Mar-2020: Signify acquired Cooper Lighting Solutions from Eaton, a diversified power management company. This acquisition bolsters Signify’s market standing and better ranks the business to capture growth in the North American lighting market.

» Geographical Expansions:

- Jun-2020: GE Current, also known as Current Lighting Solutions, LLC, expanded its geographical footprints by establishing new agents in the Province of Ontario, Canada. Through this expansion, Omnilumen and GS Lighting Group can now include Current products in lighting layout and designs for new building tasks and LED retrofits. Additionally, This includes Current lamps and fixtures transiting outdoor, indoor, and industrial applications, along with wired and wireless controls.

Scope of the Study

Market Segments Covered in the Report:

By Application Area

- Indoor

- Outdoor

By End User

- Commercial

- Residential

By Light Type

- Light-Emitting Diode (LED)

- High-Intensity Discharge (HID)

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Acuity Brands Lighting, Inc.

- Ideal Industries, Inc.

- Delta Light N.V.

- Current Lighting Solutions, LLC

- Siteco GmbH

- Signify N.V.

- Zumtobel Group AG

- Technical Consumer Products, Inc

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Acuity Brands Lighting, Inc.

- Ideal Industries, Inc.

- Delta Light N.V.

- Current Lighting Solutions, LLC

- Siteco GmbH

- Signify N.V.

- Zumtobel Group AG

- Technical Consumer Products, Inc