Robotic sensors are tools that assess the surroundings wherein the robot is functioning and enable the robot to modify its actions in response to data gathered. Because of Industry 4.0 and digitization, the utilization of robots has considerably grown over the forecast period. As robotics innovations result in versatile production models, it is projected that the use of industrial robot sensors in robotics is expected to increase quickly in the coming years.

The implementation of autonomous and collaborative robots throughout end-user industries is also anticipated to raise the demand for robotic sensors. The robotic sensors market is expanding due to the rising requirement for automation and security in organizations as well as the development of reasonably priced, energy-efficient robots. The robotic sensors are developed as a result of rising labor and energy expenses as well as increased utilization of robotic sensors in various industry verticals.

One of the helpful technologies which are essential to the realm of robotics is the usage of sensors. These devices are crucial for safety assessment, quality control in work component inspection, interlocking in work cell control, and data collecting on the items in the robot work cell. In industrial robotics, sensors are employed to detect hazardous and safe situations in the robot cell architecture. By doing so, they serve to prevent bodily harm and other harm to human workers.

The robot work cell uses switches to govern a variety of equipment's actions, and sensors are utilized to confirm that the current work cycle has ended before moving on to the next one. Traditionally, quality control was carried out using a human inspection method. Presently, however, sensors are employed during the inspection procedure to identify specific quality characteristics of the work item. The sensors can only evaluate a small number of work part features and flaws, but they nonetheless produce very precise results.

COVID-19 Impact Analysis

Due to its severe effects on key supply chain stakeholders, the COVID-19 outbreak will have a significant effect on the improvement of consumer product safety testing solutions in 2020. On the other hand, the COVID-19 pandemic had a significant negative impact on the market because of several challenges, including a shortage of competent labor and delays or cancellations of projects owing to partial or total lockdowns around the world. Additionally, the market opportunity for robotic sensors beyond COVID-19 is anticipated to be strengthened by the rapid deployment of industrial and medical robots.Market Growth Factors

Rising Use Of Robots In The Military And Defense Sector For Intelligence, Surveillance, And Reconnaissance (Isr)

Numerous military & defense organizations have decided to introduce robots into their environments as a result of ongoing automation breakthroughs and accelerating robotics advancements. These robots have built-in sensors that let them carry out a wider range of warfare operations, from choosing snipers to engaging targets more successfully. For propulsion, weaponry controls, site monitoring, flight controls, and communications, military and defense organizations are installing sensors in a variety of security systems, crime detection systems, intrusion detection systems, explosives detection systems, and civil establishments.Growing Demand For Robots In The Healthcare Sector

Digital gadgets such as laptops, tablets, smartphones, and e-readers have become an essential part of everyday life. Most occupations necessitate working on computers for extended periods of time. In addition, the need of staying connected has increased with the rise of social networking sites. A worrying trend has been seen where people turn on their cell phones as soon as they get up and continue their trust with digital screens until they go to bed. In addition, the rising use of digital screens has given rise to a disorder called Computer Vision Syndrome (CVS), which harms the eyes and causes issues with vision.Market Restraining Factors

Restricted Range And Shelf Life Of Sensors

While sensors are employed in a variety of applications, their restricted bandwidth and range prevent them from collecting data from far-off or remote places. Given that robotic sensor installations depend on electrical resources, it is essential to make sure that sensors can continue to function even when there is little power. Furthermore, depending on the sort of application they are used for, such sensors typically get a shelf life of six months to a year. This short shelf life creates the need for changing these sensors within a fixed interval of time, which is restricting many companies to use them in their products.Type Outlook

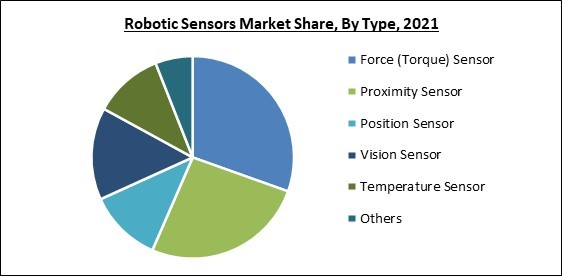

Based on type, the robotic sensors market is segmented into Proximity Sensor, Vision Sensor, Position Sensor, Temperature Sensor, Force (Torque) Sensor and Others. The proximity sensor segment procured a significant revenue share in the robotic sensors market in 2021. It is owing to the low cost attached to these sensors. This widespread application in the detection of items working in the area of the sensor is also expected to support growth. Multiple sensors are required for various proximity sensor targets.Indication Outlook

On the basis of indication, the Robotic Sensors Market is fragmented into myopia, presbyopia, hypermetropia and astigmatism. In 2021, the astigmatism segment covered a significant revenue share in the orthokeratology market. The vision may become distorted or fuzzy if someone has astigmatism, a common condition of the eyes. It occurs when the cornea the transparent outer layer of the eye or lens the inner portion of the eye that aids in eye focus have an abnormal shape. The demand for ortho-k lenses is rising in this segment as spherical ortho-k lenses are available which have the ability to reshape the anterior surface of the cornea.Vertical Outlook

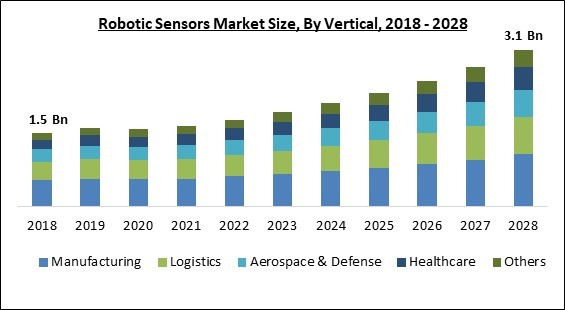

On the basis of vertical, the robotic sensors market is classified into Logistics, Aerospace and Defense, Manufacturing, Healthcare and Others. The manufacturing segment recorded the maximum revenue share in the robotic sensors market in 2021. It is due to the high acceptance of automation in manufacturing units. Throughout this industry, sensor-based collaborative & humanoid robots are employed for a variety of tasks like packaging, picking, rolling, and others.Regional Outlook

On the basis of vertical, the robotic sensors market is classified into Logistics, Aerospace and Defense, Manufacturing, Healthcare and Others. The manufacturing segment recorded the maximum revenue share in the robotic sensors market in 2021. It is due to the high acceptance of automation in manufacturing units. Throughout this industry, sensor-based collaborative & humanoid robots are employed for a variety of tasks like packaging, picking, rolling, and others.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include TE Connectivity Ltd., Infineon Technologies AG, Omron Corporation, Honeywell International, Inc., ATI Industrial Automation, Inc., FANUC Corporation, Sensata Technologies Holdings PLC, Baumer Holding AG, Tekscan, Inc., and FUTEK Advanced Sensor Technology, Inc.

Strategies deployed in Signals Intelligence (SIGINT) Market

» Partnerships, Collaborations and Agreements:

- Feb-2022: Infineon Technologies teamed up with SensiML, a leading developer of AI tools for building intelligent Internet of Things (IoT) endpoints. The companies aimed to provide developers with an easy and effortless procedure to gather data from Infineon XENSIV sensors, train Machine Learning (ML) models, and implement real-time inferencing models on ultra-low-power PSoC 6 microcontrollers (MCUs). In addition, this collaboration is expected to also provide designers with the right tools to make smart applications for IoT devices ranging from the smart home, industrial, and fitness sectors.

- Nov-2021: Infineon Technologies came into a partnership with Toposens, a developer of a 3D ultrasound sensor technology. This partnership aimed to recognize 3D obstacle detection & collision avoidance in autonomous systems utilizing Toposens' proprietary 3D ultrasound technology. The easy-to-integrate 3D ultrasonic sensor is expected to allow safe collision avoidance via precise 3D obstacle detection, which is based on Infineon's XENSIV MEMS microphone IM73A135V01.

- May-2021: Omron Industrial Automation Europe entered into a new distribution agreement with OnRobot, the Danish manufacturer of tools for collaborative robot (cobot) applications. This agreement aimed to allow Omron to provide OnRobot’s products that could be fully combined with the Omron TM cobot to its users in Europe, the Middle East, and Africa (EMEA). The agreement is expected to provide their customers with more agility when deploying collaborative solutions.

» Product Launches and Product Expansions:

- Oct-2021: ATI Industrial Automation launched its “ultra-thin” Mini43LP Force/Torque Sensor. This sensor body is expected to enable customers to improve their work envelope and preserve the robot’s lifting power for end-of-arm tools.

- Oct-2021: Infineon Technologies unveiled the new XENSIV TLE4972, the first automotive current sensor. This coreless current sensor is expected to utilize Infineon’s well-proven Hall technology for accurate and stable measurements. Through its compact design and diagnosis modes, the TLE4972 is expected to be a perfect fit for xEV applications such as traction inverters utilized in hybrid and battery-driven vehicles, along with battery main switches.

- Jan-2020: TE Connectivity (TE) introduced a safety torque sensor with integrated and enhanced functional safety, involving better precision and speed. This sensor could be integrated at each cobot joint, which is expected to fulfill the new level of safety needs up to ISO13849 Category 4 PL e due to two electrically-segregated channels with no common cause of failure.

» Acquisitions and Mergers:

- Mar-2020: TE Connectivity acquired First Sensor, a sensor technology company. This acquisition aimed to offer a market expansion opportunity with optical sensing applications for industrial, heavy truck, and auto applications.

Scope of the Study

Market Segments Covered in the Report:

By Vertical

- Manufacturing

- Logistics

- Aerospace & Defense

- Healthcare

- Others

By Type

- Force (Torque) Sensor

- Proximity Sensor

- Position Sensor

- Vision Sensor

- Temperature Sensor

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- TE Connectivity Ltd.

- Infineon Technologies AG

- Omron Corporation

- Honeywell International, Inc.

- ATI Industrial Automation, Inc.

- FANUC Corporation

- Sensata Technologies Holdings PLC

- Baumer Holding AG

- Tekscan, Inc.

- FUTEK Advanced Sensor Technology, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- TE Connectivity Ltd.

- Infineon Technologies AG

- Omron Corporation

- Honeywell International, Inc.

- ATI Industrial Automation, Inc.

- FANUC Corporation

- Sensata Technologies Holdings PLC

- Baumer Holding AG

- Tekscan, Inc.

- FUTEK Advanced Sensor Technology, Inc.