A tankless water heater is a type of heater that heats water using either gas or electricity as an energy source. It differs from conventional or tanked water heaters in that it heats water as it goes through the heating units quickly rather than storing it. The main factors boosting the growth of the tankless water heater market are an increase in infrastructure improvements, the replacement of conventional and tank-based water heaters along with modern tankless water heaters, as well as the deployment of smart water heaters. In addition, a greater emphasis on producing tankless electric water heaters with improved quality, safety awareness, and energy efficiency is anticipated to open up significant growth opportunities for major players in this market.

Tankless water heater use is anticipated to rise in the coming years as businesses introduce more advanced tankless water heaters. For instance, one of the top producers of commercial tankless water heaters and a leader in clean technology IoT, Intellihot Inc., introduced the Neuron Series of water heaters. These models have cellular Wi-Fi connectivity enabling remote flow and water temperature monitoring. These models also fit in existing water connections and are made for use in schools, restaurants, and hotels, which eliminates the need for re-piping and reduces installation time by half. The majority of the businesses that produce these kinds of heaters also offer extra features in some of their models.

Due to their ability to save space and energy, these heaters are likely to be adopted by residential as well as commercial sectors at a rapid rate throughout the coming years. Additionally, many tankless water heaters have energy star ratings, which make them cost-effective and environmentally good for consumers. Additionally, these devices typically cost more than a normal 40-gallon water heater, but they typically have longer warranty periods and last longer than the latter. Additionally, a tankless water heater can reduce the annual electric expenditure significantly. The storage tank is the most often used type of water heating technology in the residential market.

COVID-19 Impact Analysis

The COVID-19 pandemic had a detrimental impact on a number of businesses and nations. Due to the worldwide lockdown, a decline in the growth rate of the construction and building, transportation, automotive, oil and gas, and energy sectors has been observed. As a result, there is now less demand for tankless water heaters, which hindered the market's expansion in 2020. In order to stop the spread of the coronavirus, countries with developed economies imposed robust measures, such as achieving social seclusion and limiting mobility and transportation.Market Growth Factors

Replacement Of Traditional Water Heaters With Tankless Water Heaters

In the era of modern and advanced technologies, people are continuously adopting the latest innovations across their homes as well as workplaces. The tankless water heater is a novel technology that is far better than traditional water heating equipment, due to which, it is widely being employed in commercial as well as residential applications. Tankless water heaters are being used to replace conventional water heaters as a result of various government rebates and subsidies as well as consumers' changing attitudes regarding advanced heatersRising Number Of Construction Activities All Over The World

One of the main factors driving the market expansion for tankless water heaters is the increase in construction activities all over the world along with the rising government expenditure in the construction sector. With the rapid diffusion of urbanization across people all over the world, the demand for more residencies is booming. In addition, a significant number of people are now shifting to urban areas. To fulfill their requirement, various governments are increasing their efforts in the construction sector. Due to all these aspects, the construction sector across the world is rapidly expanding. With the increasing growth of the construction industry, the demand for tankless water heaters is also expediting.Market Restraining Factors

Requirement For Frequent Maintenance

Maintenance is necessary for tankless water heaters at least once each year. Minerals accumulate inside the water heater over time, necessitating a system flush to avoid damage or a reduction in performance. Moreover, the user needs to flush the heater at least two times a year if it is deployed in an area with a hard water supply. Since the majority of warranties do not cover the damage from mineral build-up, this maintenance schedule is crucial to keep the device in a good condition. leaning the air filter as well as the water filter are examples of routine maintenance and care. Since they differ by model, it should also be considered that how frequently these heaters are needed to be cleaned.Type Outlook

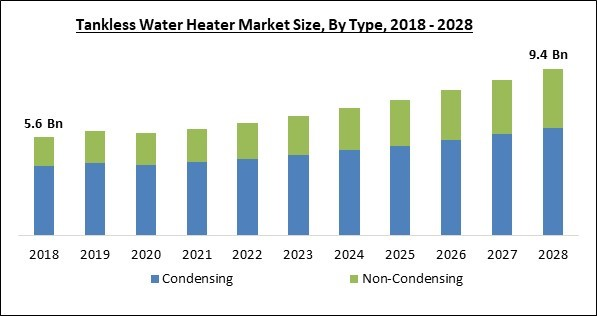

Based on type, the tankless water heater market is segmented into Condensing and Non-Condensing. In 2021, the condensing segment acquired the largest revenue share of the tankless water heater market. This growth is attributed to the increase in the demand for condensing heaters across a variety of applications, including hotels, buildings, and other infrastructures. Condensing tankless water heaters use a variety of techniques to extract more heat from the exhaust gases, resulting in cooler exhaust gases that are typically around 100° F.Energy Source Outlook

On the basis of energy source, the tankless water heater market is divided into Electric and Gas. In 2021, the gas segment recorded a substantial revenue share of the tankless water heater market. The constantly rising growth of the segment is attributed to the low investment cost for deploying this type of water heaters. Gas-operated water heaters are less expensive in contrast to electric water coolers. In addition, the maintenance cost of these water heaters is also lower. Gas tankless water heaters are very popular among small organizations.Energy Factor Outlook

By energy factor, the tankless water heater market is classified into 0.80 to 0.90 EF and 0.91 to 0.99 EF. The 0.91 to 0.99 EF segment witnessed the biggest revenue share of the tankless water heater market. This is due to an increase in research and development efforts for the creation of extremely efficient tankless water heaters. In addition, rising prices of electricity all over the world are also playing a major role in accelerating the growth of this segment.End-User Outlook

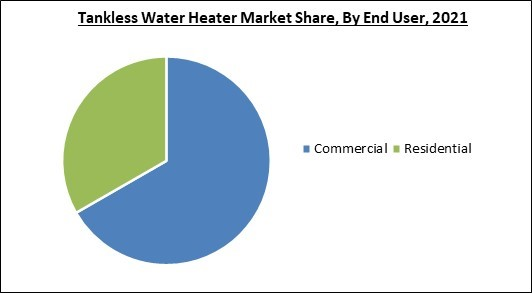

Based on end-user, the tankless water heater market is fragmented into Residential and Commercial. In 2018, the residential segment held a substantial revenue share of the tankless water heater market. The key driver boosting demand for these items in the residential market is the rising use of environmentally friendly and energy-efficient products, such as tankless water heaters. The growth of the disposable income of people all over the world, especially in developed economies, is also anticipated to increase the number of residential units, which is estimated to encourage the use of these solutions throughout the forecast period.Regional Outlook

Region-wise, the tankless water heater market is analyzed across North America, Europe, Asia Pacific and LAMEA. Europe accounted for the largest revenue share of the tankless water heater market in 2021. The expansion of tankless water heaters in this region is related to an increase in investments in low-carbon energy generation and a surge in the demand for replacing old conventional water heaters. Moreover, there is a significant prevalence of major market players operating in the field of tankless water heaters in the region. This factor is expected to bolster the growth of the regional tankless water heater market.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include A. O. Smith Corporation, Robert Bosch GmbH, Stiebel Eltron GmbH & Co. KG, Takagi Seiko Co., Ltd., Kyungdong Navien Co., Ltd., Noritz Corporation, Bradford White Corporation, EcoSmart Green Energy Products, Inc., Rinnai Corporation, and Rheem Manufacturing Company.

Strategies deployed in Tankless Water Heater Market

» Partnerships, Collaborations and Agreements:

- Apr-2022: A.O Smith launched X3 Scale Prevention Technology. a new addition to its residential condensing gas tankless water heaters range. The new solution aimed to prevent scale buildup in a tankless unit to eliminate the demand for routine descaling maintenance. In addition, it is expected to significantly boost the lifetime of a unit and enable it to operate with more efficiency.

- Jan-2022: Bradford launched KwickShot, an electric tankless water heater. The new heaters are available in thermostatic and non-thermostatic models and aimed to fulfill the demand for a range of water temperatures across a variety of daily applications.

- Oct-2021: Bradford unveiled the RE255T, an addition to its residential electric water heater range. The new residential electric water heater aimed to offer a best-in-class water heating experience to its residential customers. Moreover, the new RE255T comprises a capacity of 55-gallon.

- Mar-2021: Navien rolled out the Navien NPE-2 series. The new product series is a new breakthrough in the condensing tankless water heaters across North America and is available in four Standard models up to 199,900 BTU/H as well as three Advanced models up to 199,900 BTU/H.

- Feb-2021: Navien launched the NFC-H range in collaboration with wall-hung boilers across North America. The new product range leverages durable dual stainless steel heat exchangers to heat along with a separate flat plate stainless steel heat exchanger for DHW.

- Sep-2020: Bradford introduced BMS and modulation technology in its existing eF120 product line. With this product expansion, the company aimed to enable customers to incorporate a water heater and an automated system that monitors and controls communications, electrical, security, as well as other systems.

- May-2020: Rheem rolled out ProTerra, the most efficient hybrid electric water heater in the industry. Through this launch, the company aimed to offer an NEEA Tier 4-certified water heater, which is equipped with a CTA 2045 adaptor along with full Demand Response capability out of the box.

» Acquisitions and Mergers:

- Oct-2021: A.O Smith acquired Giant Factories, a residential and commercial water heaters manufacturer. This acquisition aimed to strengthen A.O Smith's position as a global supplier of commercial and residential water heaters. Moreover, this acquisition is expected to also complement the company's strategy to penetrate the North American market.

- Sep-2021: Rinnai acquired Industrias MASS, a leader in the Mexican commercial water heater market. Through this acquisition, the company aimed to leverage the capacities of Industrias MASS as well as its complementary set of products.

- Jul-2021: A.O Smith completed its acquisition of Master Water Conditioning, a Pennsylvania-based water treatment company. This acquisition aimed to complement the company's vision to offer innovative and distinct solutions that treat and heat water to fulfill the increasing consumer demands in North America.

- Jan-2021: Bradford completed its acquisition of Keltech, a subsidiary of Bradley Corporation. This acquisition aimed to expand the commercial and industrial electric products portfolio of Bradford in order to meet the demands of a wider customer base.

» Geographical Expansions:

- May-2022: Rinnai expanded its geographical footprint in North America with the launch of its production unit in Georgia. Following this geographical expansion, the company aimed to expand the manufacturing and distribution of its latest tankless water heater.

- Nov-2021: A.O Smith launched the Zip Digital Tankless Water Heater in Mumbai. The new product is developed to meet consumer demands with a blend of advanced technology with high-end aesthetics and HAS. Moreover, the new water heater is expected to also offer the best-in-class and highly-efficient user experience.

- Mar-2020: Navien, Inc., the leader in condensing technology, will establish its first U.S. manufacturing and assembly operation in James City County, VA. The 300,000-square-foot facility will be used as a distribution center for the first two years and begin the transition process & preparation into manufacturing operation in 2022 with the first stage of manufacturing expected to begin in 2023.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Condensing

- Non-Condensing

By Energy Source

- Electric

- Gas

By Energy Factor

- 91 to 0.99 EF

- 80 to 0.90 EF

By End User

- Commercial

- Residential

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- A.O. Smith Corporation

- Robert Bosch GmbH

- Stiebel Eltron GmbH & Co. KG

- Takagi Seiko Co., Ltd.

- Kyungdong Navien Co., Ltd.

- Noritz Corporation

- Bradford White Corporation

- EcoSmart Green Energy Products, Inc.

- Rinnai Corporation

- Rheem Manufacturing Company

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- A. O. Smith Corporation

- Robert Bosch GmbH

- Stiebel Eltron GmbH & Co. KG

- Takagi Seiko Co., Ltd.

- Kyungdong Navien Co., Ltd.

- Noritz Corporation

- Bradford White Corporation

- EcoSmart Green Energy Products, Inc.

- Rinnai Corporation

- Rheem Manufacturing Company