The abbreviation for "Financial Technology" is fintech. In essence, it's a piece of software that tries to automate, enhance, and facilitate both the management of financial operations for business owners and the experience of clients utilizing financial services. Even though the phrase is only about ten years old, its popularity trend has long been established. Although it may seem like something that only bankers and techies deal with and comprehend, customers interact with it more frequently than they know.

Tokenization, one-click purchases, cryptocurrencies, and any form of online purchasing, for example, are all members of the large "Fintech services" family. Offering financial technology as a service is referred to as "fintech as a service." The Cashier platform serves as an illustration of this, enabling merchants from various business categories to access a variety of payment options with just a single integration. They provide this platform's access as a service.

The provider of the technology is solely accountable for the platform's creation, upkeep, upgrades, adherence to security requirements, etc. Fintech-as-a-Service is the term for providing financial technology as a service. Offering other participants in the financial industry APIs as software that may be incorporated into their systems may fall under this category. A typical financial platform provides access to different payment options with just one integration for merchants from various business categories.

To take advantage of cutting-edge business activities and financial processes, many traditional lending institutions are turning to fintech technologies. The demand for technology-backed banking has increased as a result of the surge in popularity of digital payments, digital lending, insurance, wealth management, and Robo-advisory.

Financial institutions can streamline all of their procedures by using a Fintech-as-a-Service platform, ensuring the timely and proper delivery of a commercial service over the Internet. FaaS solutions provide total deployment and management of the delivery environment. Additionally, they guarantee the use of relevant security measures, such as strong authentication, and legal compliance with banking regulations.

COVID-19 Impact Analysis

To provide clients with a safe and secure method of payment, some retail establishments also implemented contactless payments at the same time. The increased use of digital fintech services during the pandemic, such as digital wallets, is positive for the fintech platform as a service. Several nations had negative economic effects as a result of the COVID-19 pandemic because of the shutdown to stop the virus' spread. People used FinTech apps and services to help people negotiate a wide range of financial demands, including banking, pay analyzers, and making payments, among others, as a result of the COVID-19 pandemic's increased financial issues. Due to the lockdown implementation and reluctance to trade currency, payment wallets saw a large increase in P2P transfers, bill payments, and P2M payments for important services.Market Growth Factors

The Utilization Of Mobile Banking Is Expanding

The demands the Fintech-as-a-Service platform market are driven by the growing use of mobile payment technologies and increased attention to big tech financial services. The current generation has adopted mobile payment technology as a trend. Using a smartphone application, a user can access account information, manage payments, and pay for services using a mobile wallet that is a digital wallet. The widespread use of digital wallets is attributed to the recent increase in smartphone users. As a result, the market for the Fintech-as-a-Service platform ultimately benefits from the development of mobile payment technologies.Predictive Analysis Is Increasingly Being Used In The Financial Sector

Predictive analysis is being used more often in financials. Predictive analytics in the financial services sector can directly affect overall business strategy, revenue generation, sales nurturing, and optimization. It has the potential to change the game by improving internal procedures, business operations, and performance against the competition. Analytics works cooperatively with companies from a variety of industries to gather and organize data, analyze it using state-of-the-art technology and algorithms, and quickly deploy customized, prescriptive solutions to meet the needs of every client. The determination of credit scores and the prevention of troublesome loans can both benefit from predictive analysis.Market Restraining Factors

Worries Regarding Data Security And Privacy

The biggest barrier to AI adoption in the Fintech-as-a-Service is the delicate subject of data protection and security, which is addressed by the majority of fintech organizations. The fintech industry is closely regulated by strict adherence to standards and governance since any data breach or security failure might be fatal. Businesses are feeding increasingly more user and provider data into sophisticated, AI-powered algorithms, creating novel personal data without being aware of how that is expected to influence customers and staff, which ultimately fuels the escalating privacy concerns.Type Outlook

On the basis of Type, the Fintech-as-a-Service Market is segmented into Payment, Fund Transfer, Loan, and others. The payment segment acquired the highest revenue share in the Fintech-as-a-Service market in 2021. Due to the growing integration of AI technology and API into mobile-based payment services for traditional banking. The creative initiatives being used by numerous tech-based businesses to improve their products are also encouraging for the segment's growth.Technology Outlook

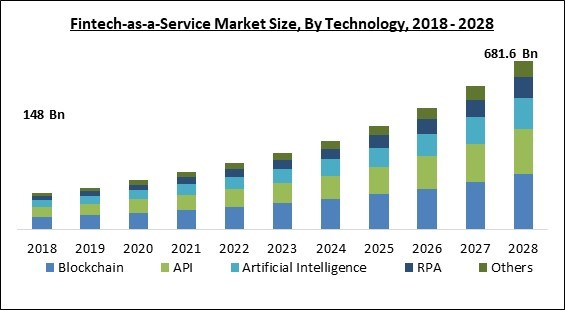

Based on the Technology, the Fintech-as-a-Service Market is divided into API, Artificial Intelligence, RPA, Blockchain, and Others. The blockchain segment procured the largest revenue share in the Fintech-as-a-Service market in 2021. Due to its increased transparency and advantages for automation, several significant businesses are attempting to adopt blockchain. Blockchain technology is being embraced by financial organizations due to the improved security and efficiency it provides.Application Outlook

By Application, the Fintech-as-a-Service Market is bifurcated into KYC Verification, Fraud Monitoring, Compliance & Regulatory Support, and Others. The KYC Verification segment witnessed a significant revenue share in the Fintech-as-a-Service market in 2021. Among the key elements anticipated to propel the segment's growth are the rise in criminal activity and the number of scams. KYC is a crucial regulatory component that verifies the veracity of users by validating the personal information they have submitted.End-Use Outlook

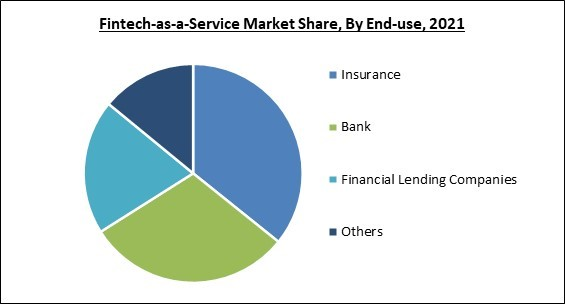

On the basis of End-use, the Fintech-as-a-Service Market is divided into Banks, Financial Lending Companies, Insurance, and Others. The financial lending companies segment recorded a substantial revenue share in the Fintech-as-a-Service market in 2021. It is because consumers increasingly desire to use financial instruments at their convenience from home. Additionally, technologically advanced platforms assist financial organizations in providing services like borrowing, lending, fixed deposits, and others. Additionally, the increasing use of digital lending platforms is positive for the market's expansion.Regional Outlook

Region-wise, the Fintech-as-a-Service Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region procured the highest revenue share in the Fintech-as-a-Service in 2021. It is because of North America's increasing preference for digital financial services. For instance, 51% of customers in the United States use a contactless payment method, according to MasterCard Contactless Consumer Polling. The industry is expanding due to the shifting customer preferences toward fintech services and digital payment methods. Factors that can be attributed to the region's increasing adoption of smartphones.Cardinal Matrix - Fintech-as-a-Service Market Competition Analysis

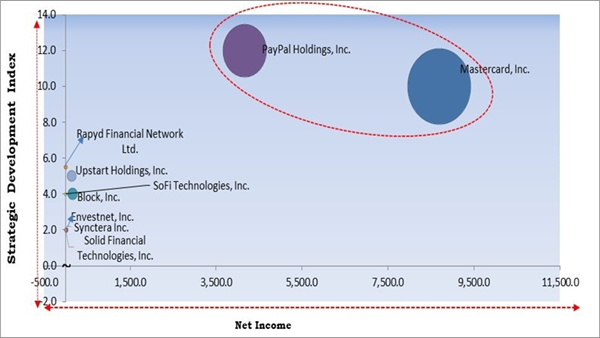

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; PayPal Holdings, Inc. and Mastercard, Inc. are the forerunners in the Fintech-as-a-Service Market. Companies such as Rapyd Financial Network Ltd., Upstart Holdings, Inc., Block, Inc. are some of the key innovators in Fintech-as-a-Service Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include PayPal Holdings, Inc., Mastercard, Inc., Upstart Network, Inc., Block, Inc., Envestnet, Inc., SoFi Technologies, Inc., Rapyd Financial Network Ltd., Solid Financial Technologies, Inc., Synctera Inc., and Railsbank Technology Ltd. (Railsr).

Strategies deployed in Fintech-as-a-Service Market

» Partnerships, Collaborations and Agreements:

- May-2022: Mastercard came into a partnership with Synctera, a leading FinTech banking provider. Together, the companies aimed to combine Mastercard’s open banking platform to deliver account validation solutions for Synctera-powered FinTechs. Additionally, This modern collaboration utilizes Mastercard’s open banking platform to expand the possibilities open to Synctera-powered FinTechs as they develop their tech stacks and permits for enhanced KYC abilities.

- Sep-2021: Solid came into a partnership with i2c, a leading provider of digital payment and banking technology. Together, the organization's integrated platform and software abilites of the two industries is expected to permit third parties to launch and build deposit products, including consumer and business checking accounts, quickly credit, issue debit, and prepaid cards both virtually and physically, and process trades in real-time.

- Aug-2021: Synctera formed a partnership with Marqeta, an IT service management business. Together the companies is expected to expand Synctera’s portfolio to retain card processing and issuing, powered by Marqeta. Additionally, Synctera is expected to integrate its Fintech-as-a-Service abilities with Marqeta’s modern card issuing and processing solutions to allow fintech to smoothly and fast launch and handle customer and enterprise debit card programs.

- Jun-2021: Upstart formed a partnership with NXTsoft, the market leader in secure, complete, and entire API connectivity. Together, the companies is expected to allow Upstart to effectively execute its all-digital AI lending forum to any U.S.-based financial institution. Moreover, Upstart provides an all-digital lending experience to lender enable them to involve from any device at any time with over 70% of funded loans being completely automated with no human relations.

- Mar-2021: Envestnet formed a partnership with Productfy, a developer-based on a business-to-business FinTech platform. With this partnership, FinTech creators utilizing Productfy's platform is expected to have direct entry through a single interface to Envestnet - Yodlee's leading data collection and account validation services, along with know-your-customer" (KYC), Automated Clearing House (ACH), credit data, card issuance, and other abilities provided via Productfy.

- Dec-2020: PayPal came into a partnership with Razorpay, a Financial technology unicorn. Together the companies aimed to allow hassle-free international payments for freelancers and MSMEs. Additionally, The business’s partner can now combine with PayPal and obtain payments from international consumers from across 200 markets securely and easily, decreasing wait time from days down to minutes.

- Feb-2020: Rapyd signed an agreement with Visa, an American multinational financial services corporation. Through this agreement, Rapyd is expected to collaborate with Visa to deliver fintech and payment services where both companies see possibilities to help companies expand their core portfolio with more expansive local and cross-border market solutions.

» Product Launches and Product Expansions:

- Sep-2021: PayPal launched a super app. The new app delivers consumers an individual slot to operate their bill payments, get paid up to two days earlier with the new Direct Deposit feature offered through bank partners, gain awards and handle gift cards, receive and money from family, friends, and enterprise, pay with QR codes for buy and redeem rewards in-store, pass and handle credit, hold and sell crypto, Pay Later services, Buy Now, buy, as well as support causes and organizations they care about.

- Sep-2021: Upstart holding extended its platform upstart is now unrestricted in Spanish. With this launch, the foremost online lending platform for private loans with full support for Spanish orators across the U.S.

- Oct-2020: PayPal Holdings unveiled a new service allowing consumers to hold, buy, and sell cryptocurrency directly from their PayPal accounts. The launch expands cryptocurrency's potential by making it open as a funding source for acquisitions at its 26 million merchants across the world.

- Jun-2020: Rapyd introduced a full-stack, payment solution allowing companies globally and locally. The new payment solution delivers more than 900+ payment techniques in over 100 countries and the system obtains every fragmented and disparate local payment technique in a typical country into a single, combined connection. Additionally, Rapyd’s “full-stack” permit to every major local payment procedure such as cash, e-wallets, bank transfers, and cards, via one easy-to-combine link

» Acquisitions and Mergers:

- Nov-2021: PayPal completed the acquisition of Paidy, a Japan-based buy now, pay later supplier. This acquisition is expected to expand PayPal’s abilities, allotment, and applicability in the domestic payments market in Japan.

- Nov-2021: Mastercard acquired Aiia, a supreme European open banking technology provider. With this acquisition, Mastercard further expands its current open banking technology and established data techniques and strengthens the organization’s progress in creating a more powerful global open data network.

- Aug-2021: Square now known as Block Inc. took over Afterpay, the leading global 'buy now, pay later platform. This acquisition is expected to boost Square's strategic importance for its Dealer and Cash App environment. Additionally, Square intends to combine Afterpay into its current Seller and Cash App industry branches, allowing even the shortest of merchants to deliver BNPL at checkout.

- Nov-2020: Mastercard took over Finicity, a foremost North American supplier of real-time access to financial data and insights. With this acquisition, the addition of Finicity’s additional technology and teams reinforces the current Mastercard open banking platform to promote and protect a greater selection of financial services, helping the business’s long-standing partnerships with and dedication to financial organizations and fintech around the world.

- Apr-2020: SoFi completed the acquisition of Galileo, payments and bank account infrastructure business. Additionally, SoFi’s purpose is that Galileo is expected to help power its expanding offering of finance outcomes and deliver it another income source beyond of consumer services.

» Geographical Expansions:

- Dec-2020: Rapyd expanded its geographical footprint by establishing an all-in-one offering of payment abilities in Thailand. The new expansion is a complete set of international and local payment methods that contains local e-wallets, cash, bank transfers, and debit and credit cards. Additionally, Multinational companies provide localized checkout experiences with access to an expansive list of local payment methods favored by Thai customers.

Scope of the Study

Market Segments Covered in the Report:

By Technology

- Blockchain

- API

- Artificial Intelligence

- RPA

- Others

By End Use

- Insurance

- Bank

- Financial Lending Companies

- Others

By Type

- Payment

- Fund Transfer

- Loan

- Others

By Application

- Compliance & Regulatory Support

- KYC Verification

- Fraud Monitoring

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- PayPal Holdings, Inc.

- Mastercard, Inc.

- Upstart Network, Inc.

- Block, Inc.

- Envestnet, Inc.

- SoFi Technologies, Inc.

- Rapyd Financial Network Ltd.

- Solid Financial Technologies, Inc.

- Synctera Inc.

- Railsbank Technology Ltd. (Railsr)

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- PayPal Holdings, Inc.

- Mastercard, Inc.

- Upstart Network, Inc.

- Block, Inc.

- Envestnet, Inc.

- SoFi Technologies, Inc.

- Rapyd Financial Network Ltd.

- Solid Financial Technologies, Inc.

- Synctera Inc.

- Railsbank Technology Ltd. (Railsr)