Speak directly to the analyst to clarify any post sales queries you may have.

The advancements in needle manufacturing technology have resulted in shorter and thinner needles. This has helped the vendors to reduce needle stick injuries. This even made vendors focus on thinner and thinner needles. These thinner needles are more user-friendly, progressively improving patient self-rating of injection comfort. BD (Becton, Dickinson) is one of the key innovative players and launched many revolutionary products in the pen needles segment.

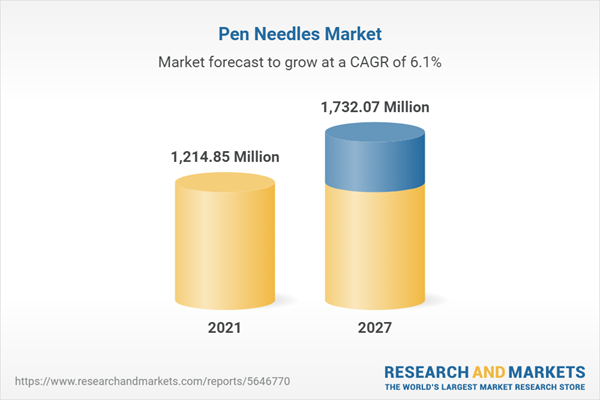

Growth in the market is largely driven by the growing prevalence of the diabetic population and the favorable demand for self-injection devices. On the other hand, the preference for alternative modes of drug delivery, poor reimbursement in developing countries, and needle anxiety are expected to restrain the overall market growth. The growing preference for biosimilar drugs and emerging markets are areas of opportunity in the market.

All injector pens require single-use replaceable pen needles for each injection. The companies offer pen needles in various lengths to accommodate varying depths of subcutaneous tissue under the top of the skin. Pen needles are designed for single-use subcutaneous injection of medication and are not intended to be reused for more than one administration. The pen needles are generally manufactured with an outer protective plastic shell, which a person uses to attach the needle to the pen, and an inner plastic shell protecting the needle itself. The doctor or nurse's responsibility instructs how to attach and use needles to ensure proper use properly.

MARKET TRENDS & DRIVERS

The Rising Prevalence of Diabetic Population

Diabetes prevalence in all regions is predicted to rise in the coming years due to unhealthy diets and bad lifestyle choices. The countries are increasingly putting in demand for medication in recent years, majorly the low-income countries, as the patients are more convenient with injector pens. The rising incidences of needle-stick injuries due to the high usage of 8mm syringes and lack of awareness & education in low-middle income countries are also one of the main reasons for the higher adoption of insulin pen needles.When compared with developed countries, developing countries are more prone to diabetes. In these regions, young children are also affected by diabetes due to childhood obesity, which is a significant risk factor. In the case of developed countries, only older people get affected by diabetes. In contrast, in developing countries, individuals of the adult age and elderly persons above 65 are also prone to diabetes. One in 11 adults in the age group 0-79 is affected with diabetes, especially type-II, which is attributable to lifestyle changes.

Growing Demand for Self-Injection Devices

Devices for self-injection, chiefly pens used for the subcutaneous delivery of biopharmaceuticals, constitute a growing segment of the world of drug delivery devices. With the trend toward biological drugs that cannot be administered orally and the worldwide increase in diabetes, their importance is set to grow further in the future. With the large number of new injectables expected to enter the market in the coming years, the trend to shift treatment from the clinic to the home environment to save costs and provide more patient convenience is increasing the demand for self-injection devices. Self-injection solutions can also significantly improve the quality of care from the patient's perspective. Self-administration by the patient (e.g., using an injection pen) has several advantages. For drugs requiring a subcutaneous application, self-injection pens offer an ideal opportunity to control the time factor and reduce risk.Technological Advancements in Pen Needles

New pen needles, which are better than the conventional ones, are being introduced to the market. These next-generation pen needles will significantly add an advantage to healthcare providers, nurses, and at-home settings. This trend states that the manufacturers are focusing on improving the traditional portfolios for pen needles. The needle-stick injuries and non-adherence to the therapies are the significant phenomenon in which the manufacturers try to minimize and deliver the medication safely to the patients. There are few manufacturers whose products are top-selling in the market. To reduce risk, those companies have improved their traditional portfolio of pen needles with technology.Growing Demand for Safety Pen Needles

Accidental blood exposures are caused by contaminated needle sticks, sharps, or splashes and expose HCPs and non-healthcare users to the risk of serious infections. Pen needles with automatic protective safety features allow patients who are temporarily incompetent to continue self-administering drugs with assistance but without compromising healthcare provider (HCP) safety. Moreover, safety pen needles (SPNs) have been found to minimize the risk of exposure to bloodborne infections associated with needle-stick injury without any related adverse events. Safety devices are one of the most effective risk-control measures to prevent healthcare workers' exposure to injuries and infectious agents. Over 80% of NSIs can be prevented with the use of sharps with engineered sharps injury protection system.SEGMENTATION ANALYSIS

Product Type Analysis

Based on product type, the market is segmented into standard pen needles and safety pen needles. In 2021, standard pen needles held the largest of 71.72% in the global market due to their daily usage of larger doses by diabetic patients. However, these needles are less preferred as they have a higher risk of needle-stick injury and interfere with the safe use of pen needles. Therefore, they are expected to be in low demand soon. Increasing diabetes and awareness of insulin pen use are some factors that support this segment's growth. Safety pen needles are expected to witness favorable growth during the forecast period due to technological advances in this segment and increased launches of next-generation products. These devices make it possible to minimize needle-stick injuries to patients.Segmentation by Product Type

- Standard Pen Needles

- Safety Pen Needles

Needle Length Analysis

Based on needle length, it is segmented into short needles and long needles. The short needle segment accounted for the largest share of 78.30% in the global market in 2021. Amongst the short needle lengths, 4 mm-sized pen needles are most prescribed to all patients, including obese people suffering from the target disease. Patients are increasingly using the shortest and thinnest needles due to a greater comfort level offered by them as compared to injections. Moreover, their short layer helps reach the subcutaneous tissue of the patients easily.Segmentation by Length

- Short Length

- Long Length

Therapy Analysis

The market is segmented on therapy into insulin and non-insulin. The insulin pen needles market accounted for the largest share of 81.20% in the global market in 2021 and is also expected to showcase lucrative growth over the forecast period. This is due to the increasing awareness about the self-administration of insulin therapy amongst type 1 and types 2 diabetes patients. In non-insulin therapy, GLP-1 and growth hormone therapy is expected to exhibit significant growth soon. This is due to its capability to minimize the blood glucose level amongst patients who have type 2 diabetes.Segmentation by Therapy

- Insulin

- Non-Insulin

Distribution Channel

The global pen needles market is segmented into retail and online based on distribution channels. The retail segment accounted for the largest share of 76.96% in the global pen needles market in 2021. In the retail segment, hospitals and clinics play a major role in distributing pen needles. The retailer pharmacies prefer to collaborate with hospitals and clinics to get a huge profit as the hospitals and clinics are the first points of contact. Online distribution channels are expected to grow drastically in the coming era. The COVID-19 pandemic has opened the doors for online platforms to surge the demand for pen needles in the market.Segmentation by Distribution Channel

- Retail

- Online

GEOGRAPHICAL OVERVIEW

The Europe region is dominating the market and accounts for the share of 33.85%, followed by North America with the share of 29.65%, APAC with a share of 24.90%, Latin America with a share of 7.48%, and the Middle East & Africa region accounted for the share of 6.12% in the global market.Segmentation by Geography

- Europe

- Germany

- France

- UK

- Italy

- Spain

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- APAC

- China

- Japan

- India

- South Korea

- Australia

- Middle East & Africa

- Turkey

- South Africa

- Saudi Arabia

VENDOR ANALYSIS

The key companies profiled in the global pen needles market are:- BD

- Braun Melsungen

- Novo Nordisk

- Owen Mumford

- Ypsomed

Other Prominent Vendors

- AdvaCare Pharma

- Allison Medical

- ARKRAY

- GlucoRx

- Hindustan Syringes & Medical Devices

- HTL-STREFA

- IGAKU NEEDLES

- Iyon Medical

- Links Medical Products

- MedExel

- Medivena

- Montméd

- Narang Medical

- Nipro Europe Group Companies

- Promisemed Medical Devices

- SHANGHAI BERPU MEDICAL

- Simple Diagnostics

- Terumo Europe

- Trividia Health

- UltiMed

- Van Heek Medical

- VOGT MEDICAL

Strategies adopted by the market vendors

One of the key vendors, B.Braun Melsungen, is launching the second-generation needles, and other vendors are also coming up with safety needles in the market. These are largely adopted among the developed countries in the market. The increasing target population and adoption of advanced technologies like pen needles in Europe make them dominate the market. This is making the vendors focus the product launches across Europe. The major vendors continuously compete for the leading position in the market, with occasional spurts of competition coming from other local vendors.KEY QUESTIONS ANSWERED:

1. How big is the global pen needle market?2. What is the growth rate of the global pen needle market?

3. Who are the key players in the global pen needle market?

4. What are the growth enablers in the global pen needle market?

5. Which region is expected to hold the largest share by 2027?

Table of Contents

Companies Mentioned

- BD

- Braun Melsungen

- Novo Nordisk

- Owen Mumford

- Ypsomed

- AdvaCare Pharma

- Allison Medical

- ARKRAY

- GlucoRx

- Hindustan Syringes & Medical Devices

- HTL-STREFA

- IGAKU NEEDLES

- Iyon Medical

- Links Medical Products

- MedExel

- Medivena

- Montméd

- Narang Medical

- Nipro Europe Group Companies

- Promisemed Medical Devices

- SHANGHAI BERPU MEDICAL

- Simple Diagnostics

- Terumo Europe

- Trividia Health

- UltiMed

- Van Heek Medical

- VOGT MEDICAL

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 325 |

| Published | August 2022 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value in 2021 | 1214.85 Million |

| Forecasted Market Value by 2027 | 1732.07 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |