Speak directly to the analyst to clarify any post sales queries you may have.

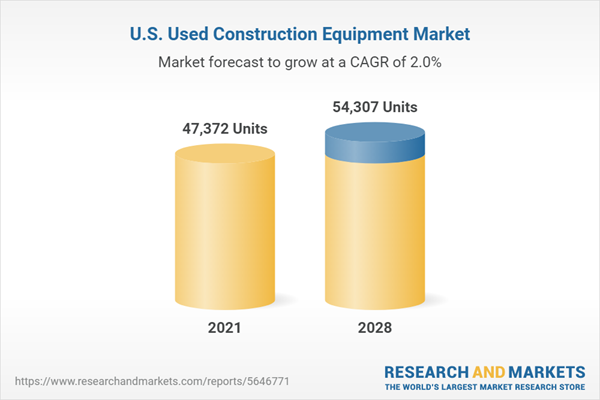

The used construction equipment market in the US is expected to reach 45,766 units by 2028. The US government investment in the up-gradation of infrastructure & renewable energy projects is expected to support the demand for used equipment in the US during the forecast period (2022-2028).

U.S. USED CONSTRUCTION EQUIPMENT MARKET: KEY HIGHLIGHTS

1. The Earthmoving segment has the largest U.S. used construction equipment market share. Other segments, including motor graders, skid loaders, bulldozers & trenchers, held the largest share in the earthmoving segment in 2021.2. Infrastructure up-gradation projects such as the renovation of commercial buildings, railway stations, airports, repair of runways, and extension of roadways & bridges in rural parts drive high demand for used construction equipment in the US market.

3. The government aims to produce 95GW of power through renewable energy resources by 2025. For achieving this goal, the government is setting up windfarm & solar plants across the country, which is expected to support the demand for used equipment as the new equipment supply chain is still in the recovery phase, so used equipment caters to the need of the industry.

4. Less costly equipment having high operational requirements & low life expectancies, such as excavators, backhoe loaders, and forklifts, are expected to grow faster during the forecast period than costly equipment such as motor graders and cranes with low operational requirements and long-life expectancy.

5. Recovery in the supply chain of new construction equipment post-pandemic and rising rental markets are a major threat to the demand for used construction equipment in the US market. However, used equipment is expected to remain popular among small contractors for a short interval of projects due to diverse portfolios & low acquisition cost & good resell value.

Supply Chain Disruption of New Equipment During Pandemic Continues to Drive the Demand for Used Construction Equipment Market in the U.S.

a) COVID-19 positively impacted the demand for used construction equipment in the US market. The supply of new equipment was disrupted due to supply chain interruption caused by lockdown measures taken by the US Government. Businesses were not in favor of making large investments. These factors triggered the demand for used equipment in various sectors such as construction, agriculture, mining & forestry.

b) In 2021, the US government investment in the transport industry, including redevelopment projects for economic recovery, was expected to support the demand for used construction equipment. However, the volume sales for used equipment reduced in 2021, and a sharp decline in used equipment sales were witnessed in the age group of 0-10 years. Companies reduced buying used equipment to avoid more aging machinery in their fleet as the supply of new equipment was low even in 2021. This resulted in a surge in prices & reduction in the volume of used equipment in the US market.

c) Used equipment is an excellent choice by contractors for short-term projects. Various short-term projects of repair & redevelopment are allocated to contractors who prefer to use used construction equipment due to its quick availability, diverse portfolio & low cost of acquisition to complete the project and resell the equipment then after.

d) Motor graders are one of the costliest equipment ranging from $200,000 to $500,00, with an average life expectancy of around 30 years. There was a surge in demand for used motor graders in the US market in 2020 & 2021. The equipment operates for a short time at construction sites compared to other earthmoving equipment such as excavators & backhoe loaders. So, it is a popular choice for used equipment buyers due to factors such as the high price of new motor graders, low operating hours at the job site, & long-life expectancy. Due to its long-life expectancy, the equipment can be resold can happen multiple times.

Surge In Government Investment for Infrastructure Upgradation

a) US Department of Transportation invested $906 million for redevelopment projects across the country under the Infrastructure for Rebuilding America program in 2021. Used heavy construction equipment is an extremely popular choice for redevelopment, repair & small-budget projects due to its lower cost than new equipment. The US government planned twenty projects in different states to improve major highways, bridges, ports & railroads across the country.b) In 2021, the country’s Aviation administration planned to invest $1.2 billion to upgrade 405 national airports, which includes repairing runways & taxiways.

c) The government approved $55 million in road repair projects in Arizona, aiming to fix nearly 127 miles of a local road in 2021. In addition, small development projects are planned for building libraries & renovation of the historic courthouse in Arizona state.

d) The road construction project in Howard County, Maryland, is under progress in 2022 and aims to improve pedestrian access & safety. The project also improves the roadways along Oakland Mills Roads in Columbia. The project is planned in two phases and is expected to complete by September 2022.

Rise in demand for Used Equipment across Agriculture & Forestry sectors Due to the low Buying Capacity of Farmers in the aftermath of the pandemic.

Construction equipment such as mini excavators and loaders are used in agriculture and forestry industries. Equipment used for ground leveling, loading crops, fence building, & land clearing activities in agriculture & forestry. The demand for used equipment in forestry & agriculture sectors had increased in 2021. The COVID-19 pandemic has adversely impacted the US economy. The country’s agriculture sector underperforms due to a reduction in demand & labor shortage. Farmer’s net income declined by 9% in 2020. The reduction in buying capacity of farmers triggers the demand for used equipment in the US market.

The shift in Focus Towards Renewable Energy Resources Triggers The demand for Used Mini Excavators & Crane in The US market

a) The US government focuses on renewable energy sources and aims to produce 25GW of clean energy by 2025. In Jan 2022, the government approved 18 onshore projects of 4.17 GW and 54 priority projects, adding 27.5 GW of clean energy. According to Energy Information Administration, US solar energy capacity is expected to grow by 21 GW in 2022 & 25GW in 2023. Various solar & windfarm energy projects are progressing in different locations across the country in 2022.b) The demand for used construction equipment for these projects is expected to grow sharply due to its quick availability as compared to new equipment. The new equipment supply was disrupted due to COVID-19 in 2020. The second wave of infection in 2021 across the US worsened the situation for manufacturing new construction equipment. So, the used construction equipment demand is expected to grow for these short-term renewable energy projects. The demand for used cranes & mini excavators is expected to grow sharply for solar & wind farm projects.

Rise in Used Construction Equipment Prices to Devalue the Demand for Used Equipment

a) There is a constant increase in used construction equipment prices in the US market. According to Ritchie Bros, there was a 16% rise in prices of large earthmoving equipment such as excavators, dozers, & motor graders. A similar price surge was witnessed in aerial equipment such as cranes, forklifts & aerial platforms & medium earthmoving equipment such as backhoe loader, mini-excavator & trenchers.b) A similar trend is witnessed in Q1 2022; large earthmoving, medium earthmoving, & aerial equipment prices increased by 20%, 37% & 35%, respectively. There was a surge in demand for construction equipment due to increased investment in infrastructure projects across the country. However, the supply of new equipment was not recovered in 2021, and volume sales of used equipment declined. This mismatch of demand & supply of used equipment pushes up the prices of used equipment in the US market in 2021.

New Emission Standard & Rising Accident Cases in Construction Sites Can Hamper the Demand for Used Construction Equipment

a) The US government’s concern for air pollution drives it towards taking necessary steps to control it. The country is now following Tier 4 emission standard in 2022. The US is expected to launch Tier 5 emission standard by 2024, which focuses on reducing the emission of nitrogen oxides and particulate matter. Therefore, the up-gradation of emission standards in the US is expected to adversely impact the demand for larger used equipment, which is older used equipment construction in the market.b) There is a surge in work accident cases in the US Construction industry. According to the Bureau of Labour Statistics (BLS), nearly 10 million workers were employed in the US construction industry in 2020. Bureau of Labour Statistics revealed that 1,061 construction workers were killed in 2020, accounting for 20% of all work-related deaths in the US. The report also revealed that 60% of all construction site death was related to the crane.

COVID-19 triggers Online Bidding Process for Used Equipment Sales

a) COVID-19 has accelerated a new trend of online bidding in the used heavy-duty construction equipment market. In 2020, there was a 35% increase in website traffic & 71% increase in bidder registrations. This shift to an online process widens the reach for the used equipment market and creates new data insight opportunities for selling companies. The equipment sales increased sharply in 2020 due to online bidding provided by major auction companies such as Ritchie Bros & Sandhill.b) The equipment owners could have good insights and help them understand the best time to sell or buy equipment according to machine type, hour usage, & machine age.

SEGMENTATION BY EARTHMOVING EQUIPMENT

- Excavator

- Backhoe Loaders

- Motor Graders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

SEGMENTATION BY ROAD CONSTRUCTION EQUIPMENT

- Road Rollers

- Asphalt Pavers

SEGMENTATION BY MATERIAL HANDLING EQUIPMENT

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

SEGMENTATION BY END USERS

- Construction

- Manufacturing

- Mining

- Others

VENDOR LANDSCAPE

- Caterpillar is the market leader in the US used equipment market. The company excels in the sale of used earthmoving types of equipment in 2021.

- John Deere was the second-largest player in the US used equipment market in 2021. The company’s backhoe loader was sold maximum in 2021. Excavators & mini excavators were among the prominently used equipment sold by the company in 2021.

- Prominent vendors are Caterpillar, Volvo Construction Equipment, Liebherr, Komatsu, Hitachi Construction Machinery, Hyundai Construction Equipment, John & Deere, and Kobelco.

- Other prominent vendors are Terex Corporation, Case Construction, LiuGong, & Tadano.

Key Vendors

- Caterpillar

- Volvo Construction Equipment

- Liebherr

- Komatsu

- Hitachi Construction Machinery

- Hyundai Construction Equipment

- John & Deere

Other Prominent Vendors

- Terex corporation

- Tadano

- Liu Gong

- CASE Construction

KEY QUESTIONS ANSWERED

1. What is the growth rate of the used construction equipment market in the US?2. Who are the key players in the US used construction machinery market?

3. How many units of used construction equipment are expected to be sold by 2028 in the U.S.?

4. What is the latest U.S. used construction equipment market trends?

Table of Contents

Companies Mentioned

- Caterpillar

- Volvo Construction Equipment

- Liebherr

- Komatsu

- Hitachi Construction Machinery

- Hyundai Construction Equipment

- John & Deere

- Terex corporation

- Tadano

- Liu Gong

- CASE Construction

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value in 2021 | 47372 Units |

| Forecasted Market Value by 2028 | 54307 Units |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |