Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The landscaping market encompasses the industry involved in designing, planning, installing, and maintaining outdoor spaces for residential, commercial, and public properties. It revolves around enhancing the aesthetic appeal, functionality, and ecological balance of outdoor environments through various horticultural and architectural elements. Landscaping professionals may include landscape architects, designers, contractors, and maintenance crews who collaborate to transform outdoor spaces into attractive and functional areas.

Key aspects of the landscaping market include landscape design, which involves creating blueprints and plans tailored to client preferences and site conditions. Installation services encompass activities like planting trees, shrubs, and flowers, laying sod, constructing pathways, and installing water features or outdoor structures. Maintenance services range from regular lawn care and pruning to irrigation system management and seasonal cleanups, ensuring that landscapes remain healthy and visually appealing over time.

The landscaping market is influenced by trends in sustainable practices, such as xeriscaping (water-efficient landscaping) and the use of native plants to reduce water consumption and support local ecosystems. Additionally, technological advancements like computer-aided design (CAD) software and automated irrigation systems are increasingly integrated into landscaping practices, enhancing efficiency and precision. Overall, the landscaping market plays a pivotal role in enhancing the livability and environmental quality of outdoor spaces across residential, commercial, and public sectors.

Key Market Drivers

Urban Development and Infrastructure Projects

Saudi Arabia's landscaping market is significantly driven by urban development and infrastructure projects across the kingdom. With rapid urbanization and population growth, there is a burgeoning demand for aesthetically pleasing and functional outdoor spaces in residential, commercial, and public sectors.The Saudi government has embarked on ambitious urban expansion initiatives as part of its Vision 2030 strategy, aiming to diversify the economy and improve quality of life. Major cities like Riyadh, Jeddah, and Dammam are witnessing extensive urban development projects that include the construction of new residential areas, commercial districts, and public parks. These developments require comprehensive landscaping solutions to enhance the appeal and functionality of urban spaces.

Infrastructure development, including the construction of roads, bridges, airports, and public transportation systems, also drives the landscaping market in Saudi Arabia. Landscaping plays a crucial role in integrating these infrastructural elements harmoniously into the environment. For instance, green spaces along highways, parks near residential complexes, and landscaped areas around government buildings are integral parts of these projects.

The Saudi government's commitment to enhancing urban landscapes is evident through substantial investments in landscaping projects. Public parks, botanical gardens, and recreational areas are being developed to promote leisure activities and improve the overall well-being of residents. Initiatives like the Green Riyadh project, which aims to increase green cover and enhance urban biodiversity, exemplify the government's proactive approach to sustainable landscaping practices.

The landscaping sector contributes to economic growth by generating employment opportunities and stimulating related industries such as horticulture, irrigation systems, and landscaping materials. Local and international companies involved in landscape architecture, design, construction, and maintenance benefit from these developments, thereby contributing to the diversification of the Saudi economy.

Urban development and infrastructure projects are pivotal drivers of the landscaping market in Saudi Arabia. The integration of sustainable landscaping practices not only enhances the aesthetic appeal of urban spaces but also supports the kingdom's goals of economic diversification and improved quality of life for its residents.

Approximately 83% of Saudi Arabia’s population lives in urban areas, with cities like Riyadh, Jeddah, and Dammam being the major urban centers.

The population is expected to grow to around 45 million by 2030, driving further urban development needs.

The Saudi government aims to deliver 1.5 million homes by 2030 under the Saudi Housing Program, investing around USD 25 billion.

Key Market Challenges

Water Scarcity and Irrigation Challenges

One of the primary challenges facing the landscaping market in Saudi Arabia is water scarcity and the associated irrigation challenges. As a desert country with limited freshwater resources, Saudi Arabia faces significant constraints in meeting the water demands of landscaping projects, particularly in urban areas where green spaces are crucial for enhancing quality of life and environmental sustainability.Saudi Arabia has implemented strict regulations and guidelines to promote water conservation in landscaping practices. These regulations dictate the use of efficient irrigation technologies, such as drip irrigation and soil moisture sensors, to minimize water wastage. However, the implementation of these technologies can be challenging due to the initial investment costs and the need for ongoing maintenance and technical expertise.

To mitigate water scarcity, desalinated water is often used for irrigation purposes in landscaping projects. While desalination provides a reliable source of freshwater, it is energy-intensive and costly, posing economic and environmental challenges. Balancing the demand for green spaces with sustainable water management practices remains a critical challenge for stakeholders in the landscaping market.

Addressing water scarcity in landscaping requires not only technological solutions but also changes in behavior and attitudes towards water use. Educating stakeholders, including landscape designers, contractors, and the public, about the importance of water conservation and sustainable landscaping practices is essential. Encouraging the adoption of water-efficient landscaping designs and promoting native plants adapted to arid conditions can help reduce water consumption without compromising aesthetic and functional goals.

Investing in research and innovation is crucial for overcoming irrigation challenges in the Saudi Arabian landscaping market. Developing drought-tolerant plant varieties, improving water-efficient irrigation systems, and exploring alternative water sources are areas where innovation can play a transformative role. Collaboration between government agencies, academic institutions, and private sector stakeholders is essential to drive technological advancements and best practices in sustainable water management for landscaping.

Water scarcity and irrigation challenges pose significant hurdles for the landscaping market in Saudi Arabia. By leveraging technological innovation, promoting water conservation practices, and fostering stakeholder collaboration, the industry can work towards sustainable solutions that balance the demand for green spaces with the need to preserve precious water resources.

Key Market Trends

Integration of Smart Technologies

A prominent trend shaping the landscaping market in Saudi Arabia is the integration of smart technologies to enhance efficiency, sustainability, and user experience in outdoor environments. As part of the kingdom's Vision 2030 initiative, which emphasizes technological innovation across various sectors, the landscaping industry is embracing smart solutions to meet evolving demands and environmental challenges.Smart irrigation systems are revolutionizing water management in landscaping by using sensors and weather data to optimize watering schedules based on real-time conditions. These systems reduce water consumption, minimize runoff, and ensure that plants receive the right amount of water at the right time. In Saudi Arabia, where water scarcity is a critical concern, the adoption of smart irrigation technologies is crucial for promoting sustainable landscaping practices.

Internet of Things (IoT) technology is increasingly utilized to monitor and manage landscape maintenance activities efficiently. IoT sensors installed in green spaces can track soil moisture levels, detect plant health indicators, and remotely control irrigation and lighting systems. This real-time data enables landscape managers to respond promptly to maintenance needs, optimize resource use, and ensure the longevity of landscaping investments.

Advancements in digital technology, such as computer-aided design (CAD) software and virtual reality (VR) tools, are transforming landscape design processes in Saudi Arabia. Landscape architects can create detailed 3D models and simulations of proposed designs, allowing clients to visualize the final outcome before construction begins. This interactive approach improves design accuracy, enhances client satisfaction, and facilitates better communication throughout the project lifecycle.

Incorporating energy-efficient lighting solutions, such as LED fixtures and solar-powered lights, is gaining traction in Saudi Arabian landscaping projects. Smart lighting systems can be programmed to adjust brightness levels and schedules based on natural light conditions and user preferences, enhancing safety and ambiance in outdoor spaces while reducing energy consumption and operational costs.

The integration of smart technologies is a transformative trend in the Saudi Arabian landscaping market, offering opportunities to optimize resource use, improve operational efficiency, and deliver innovative outdoor environments that meet the needs of modern urban communities.

Key Market Players

- BrightView Landscapes, LLC

- The Davey Tree Expert Company

- TruGreen Limited

- Yellowstone Landscape, Inc

- The Landscape Company

- BEC Arabia

- Ruppert Landscape

- Marina Landscape, Inc.

- Landscape Development, Inc.

Report Scope:

In this report, the Saudi Arabia Landscaping Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Landscaping Market, By Type:

- Installation

- Maintenance

Saudi Arabia Landscaping Market, By Service Type:

- Hardscape

- Decks, Patios & Driveways

- Cycling Tracks & Walkways

- Fountains & Aesthetic Sculptures

- Others

- Softscape

- Plantation & Gardening

- Architectural Services

- Watering & Fertilizing

- Others

Saudi Arabia Landscaping Market, By Customer Segment:

- Commercial

- Residential

- Public Sector

- Industrial

Saudi Arabia Landscaping Market, By Sector:

- Housing

- Hospitality

- Office

- Healthcare

- Institutional

- Retail

- Others

Saudi Arabia Landscaping Market, By Region:

- Riyadh

- Makkah

- Madinah

- Eastern Province

- Dammam

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Landscaping Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BrightView Landscapes, LLC

- The Davey Tree Expert Company

- TruGreen Limited

- Yellowstone Landscape, Inc

- The Landscape Company

- BEC Arabia

- Ruppert Landscape

- Marina Landscape, Inc.

- Landscape Development, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | July 2025 |

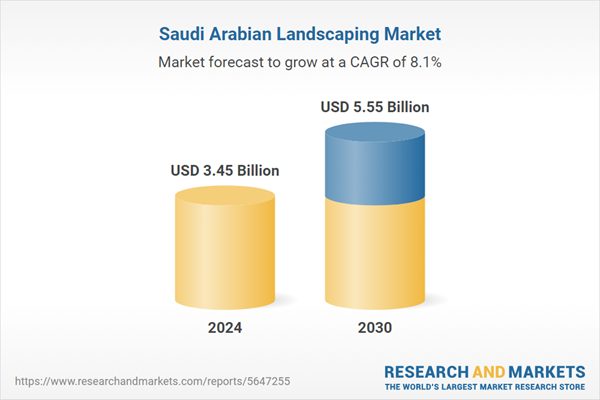

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.45 Billion |

| Forecasted Market Value ( USD | $ 5.55 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 9 |