Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The expanding automotive industry is driving increased demand for elastomers used in tires, seals, and gaskets. Additionally, the shift towards electric vehicles (EVs) is expected to further enhance the need for advanced elastomer materials. The healthcare sector, particularly considering the COVID-19 pandemic, has also seen a surge in demand for medical-grade elastomers in various devices and equipment. However, fluctuations in raw material prices, including natural rubber and petrochemical derivatives, may affect production costs and profitability. Manufacturers face challenges related to compliance with stringent environmental regulations and product safety standards.

Regional growth is notable in states with robust industrial bases, such as Maharashtra, Gujarat, and Tamil Nadu, which offer established manufacturing infrastructures and proximity to major automotive and construction centers. There is also an increasing emphasis on sustainable elastomers and recycling initiatives, reflecting global trends toward sustainability. Advances in material science are paving the way for high-performance elastomers with improved temperature resistance and chemical stability.

The India elastomers market is well-positioned for strong growth, driven by technological innovations and expanding applications across various sectors. The rise of sustainable and eco-friendly elastomer solutions is likely to influence market dynamics as consumers and industries pursue more environmentally responsible options.

Key Market Drivers

Growth of the Automotive Sector

The expansion of the automotive industry is a significant driver for the elastomers market in India, shaped by multiple factors. As the Indian economy grows, demand for both personal and commercial vehicles is increasing. Greater affordability and urbanization are prompting more consumers to purchase cars, trucks, and two-wheelers. According to IBEF, total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 2,358,041 units in April 2024. In response, major automotive manufacturers are ramping up production capacities, which in turn heightens the demand for elastomer components.The automotive sector is also innovating with new materials to enhance vehicle performance. Elastomers are essential for producing lightweight and durable parts that improve fuel efficiency. Modern vehicles require components that can endure high temperatures, extreme weather, and mechanical stress, driving elastomer manufacturers to develop advanced materials with superior properties.

The shift towards electric mobility is accelerating. Electric vehicles (EVs) demand specialized elastomer applications, such as battery seals, electrical insulation, and lightweight materials. Government initiatives like FAME II, with a budget of USD 1.43 billion, aim to incentivize EV adoption and bolster manufacturing. Similarly, the Electric Mobility Promotion Scheme, with a budget of USD 60.18 million, supports green mobility and stimulates EV production.

As the vehicle population grows, the need for replacement parts increases, expanding the automotive aftermarket for components like elastomer seals and gaskets. Rising disposable incomes enable more individuals to purchase personal vehicles, contributing to overall market growth. This trend also encourages the acquisition of higher-end vehicles, which often feature advanced elastomer technologies.

Urbanization fosters infrastructure development such as roads, highways, and public transport systems creating further demand for vehicles. The need for efficient logistics in urban areas drives up the demand for commercial vehicles, which also rely heavily on elastomer products. This environment presents significant opportunities for manufacturers and suppliers in the elastomers market to innovate and expand their product lines in line with trends in the automotive sector.

Rising Use in Healthcare and Medical Applications

As India's population continues to grow and age, there is an increasing demand for medical devices and equipment, resulting in higher consumption of elastomers used in components like tubing, seals, and gaskets. Elastomers play a vital role in various medical applications, including surgical instruments, diagnostic equipment, and drug delivery systems, enhancing their market relevance.Technological advancements are facilitating the development of new elastomer formulations that provide improved biocompatibility, chemical resistance, and durability, making them ideal for sensitive medical uses. The ability to customize elastomers for specific applications further boosts their effectiveness and demand. For example, in January 2023, Prayasta, a Bengaluru-based startup focused on intellectual property, is transforming the Indian breast implant market through 3D printing technology. Specifically, they utilize Implant-grade Elastomer Additive Manufacturing (iEAM) to create breast implants and prostheses that are rupture-resistant and fully customizable in shape, size, weight, touch, and feel. Prayasta employs the Silimac P250, a 3D printer designed for implant-grade elastomers, which excels in printing silicone and is compatible with various elastomeric materials.

Increased investment from both government and private sectors in healthcare infrastructure, such as hospitals and clinics, is driving the demand for medical devices and, consequently, elastomers. For instance, foreign direct investment (FDI) in the medical and surgical appliances sector reached USD 3.28 billion from April 2000 to March 2024. A growing health consciousness among consumers is fueling demand for preventive care and medical services, which in turn leads to greater consumption of medical devices. The trend toward disposable medical products, such as syringes, catheters, and gloves, has also increased the need for cost-effective elastomers suitable for single-use applications.

Additionally, the rise of telemedicine and home healthcare solutions has amplified demand for portable medical devices that often rely on elastomer components for functionality and durability. The expansion of wearable health-monitoring devices further necessitates specialized elastomers that are flexible, durable, and comfortable for extended wear. As healthcare needs evolve and technology progresses, elastomer manufacturers have significant opportunities to innovate and diversify their product offerings to meet the demands of this critical sector, aligning with broader health and wellness trends.

Key Market Challenges

Raw Material Volatility

Raw material volatility poses a significant challenge for the India elastomers market, affecting production costs and overall market stability. Many elastomers are sourced from petroleum-based products, making them vulnerable to fluctuations in crude oil prices. When oil prices increase, raw material costs rise, resulting in higher production expenses for manufacturers. Additionally, speculation in commodity markets can cause unpredictable price variations, complicating budgeting and financial forecasting for elastomer producers.The elastomers market heavily relies on a global supply chain for raw materials. Disruptions stemming from geopolitical issues, natural disasters, or pandemics can result in shortages or delays in material availability. Transportation challenges, such as port congestion or freight delays, can further worsen this supply chain issues and impact production timelines.

While manufacturers attempt to pass increased costs on to customers, competitive pressures often limit their ability to raise prices, which can squeeze profit margins. Fluctuating raw material prices can complicate inventory management, as companies may be reluctant to purchase large quantities at high prices, risking potential stock shortages later.

To mitigate these risks, companies can consider diversifying their supplier base to lessen dependence on any single source, though this requires investments in new partnerships and logistics. The volatility in raw material prices can also prompt manufacturers to increase their investments in research and development to create alternative materials or more cost-efficient production processes. To effectively navigate these challenges, companies should implement strategic planning, diversify their sourcing strategies, and focus on innovation to sustain competitiveness in the market.

Environmental Concerns

Environmental concerns pose a significant challenge for the India elastomers market, impacting production methods, regulatory compliance, and overall market dynamics. Governments are introducing increasingly strict environmental regulations to curb pollution and encourage sustainable practices. Adhering to these regulations can lead to additional costs for elastomer manufacturers. Moreover, regulations surrounding waste disposal and management necessitate that manufacturers implement effective strategies for handling waste produced during manufacturing and from end-of-life products.There is also a rising demand from consumers for sustainable and eco-friendly materials, prompting manufacturers to develop elastomers that are either biodegradable or derived from renewable resources. The production process for elastomers typically involves toxic chemicals and energy-intensive methods, raising concerns about resource depletion and environmental consequences. Shifting to more sustainable production practices requires substantial investment in new technologies, which can impose a financial strain on manufacturers.

The emergence of alternative materials such as biopolymers and sustainable composites creates competition for traditional elastomers. To remain competitive in a market increasingly centered on sustainability, manufacturers must innovate. The recycling of elastomers is particularly challenging due to their chemical composition, making it difficult to reclaim and reuse these materials. This presents obstacles for manufacturers aiming to engage in the circular economy. Investing in technologies for effective recycling can be costly and demands ongoing research and development. By adopting sustainable practices, investing in green technologies, and aligning their product offerings with consumer expectations, companies can address these challenges and enhance their position in an evolving market landscape.

Key Market Trends

Technological Advancements

Technological advancements are a major trend in the Indian elastomers market, influencing production, performance, and applications. Innovations in polymerization techniques, including high-throughput and continuous processing, enhance efficiency and lower production costs, allowing manufacturers to provide a broader range of elastomer products. New formulations and additives are being introduced to boost the mechanical, thermal, and chemical resistance of elastomers, incorporating nano-fillers and specialized compounding methods.The adoption of smart technologies, such as self-healing and shape-memory elastomers, is on the rise. These materials can adapt to environmental changes and self-repair, introducing new functionalities. For example, in December 2023, RenewSys launched India’s first POE (Polyolefin Elastomer) Encapsulant designed for N-type TOPCon PV cells, known as CONSERV E-NT. This encapsulant features a free radical scavenger that protects TOPCon cells from irreversible damage caused by free radicals during normal PV module operation. It provides several advantages to module manufacturers, including a wider lamination processing window, which allows for greater flexibility in operating conditions. This ultimately increases throughput and productivity by reducing rejection rates related to lamination issues.

Additionally, progress is being made in the development of bio-based elastomers and recycling technologies, focusing on creating elastomers from renewable resources and enhancing recycling methods, thereby supporting a circular economy. For instance, in September 2024, a study published in the journal ACS Applied Engineering Materials by a group of researchers in India reported on a self-healing and recyclable elastomer made from styrene-butadiene rubber (SBR) using polysulfide metathesis reactions. Low molecular weight polysulfide rubber (PSR) was blended into the SBR matrix using an internal mixer to create polysulfide linkages.

These linkages undergo dynamic crossover reactions within the cross-linked networks of vulcanized rubber, facilitated by metal chloride catalysts. The SBR-PSR blend with polysulfide bridges presents a promising approach for developing self-healing and recyclable elastomers. Improved testing methodologies, such as advanced analytical techniques and automated quality control, are helping manufacturers meet rigorous performance standards. These technological innovations not only improve elastomer capabilities but also broaden their applications across various industries, fostering growth and innovation in the market.

Segmental Insights

Type Insights

Based on Type, the Styrene Butadiene Rubber (SBR) emerged as the dominating segment in the Indian market for Elastomers during the forecast period. SBR is widely utilized across multiple applications, especially in the automotive sector for tire production. Its properties make it ideal for high-performance tires, where durability and wear resistance are crucial. Additionally, SBR is more cost-effective than other elastomers, making it an appealing option for manufacturers, particularly in large-scale production settings.SBR strikes a favorable balance of mechanical properties, such as high tensile strength, abrasion resistance, and aging stability, which are vital for products that must endure significant stress and wear. Furthermore, it can be easily blended with other polymers to enhance its characteristics, allowing manufacturers to tailor SBR for specific applications.

The rapid expansion of India's automotive industry, fueled by rising vehicle production and demand, further bolsters the use of SBR. As the automotive sector grows, so does the need for SBR in tires, seals, and various components. Additionally, ongoing infrastructure initiatives in India, including road construction and urban development, increase the demand for tires and other rubber products, solidifying SBR's market position. These factors contribute to SBR's dominance in the Indian elastomers market, facilitating its broad adoption across different industries.

End User Insights

Based on End User, Automotive emerged as the fastest growing segment in the Indian market for Elastomers in 2024. As urbanization and disposable incomes rise, more consumers are opting to purchase vehicles. This increased demand directly leads to a greater need for elastomers in various automotive components. The automotive industry heavily depends on elastomers for essential parts such as tires, seals, gaskets, and vibration dampers, positioning it as a major consumer of these materials.The transition to electric vehicles is also creating new opportunities for elastomers. Components like battery seals, insulation, and lightweight parts are vital for EVs, contributing to growth in this segment. Additionally, advancements in elastomer formulations and processing methods are enhancing their performance, making them suitable for a broader range of automotive applications, particularly in terms of fuel efficiency and safety.

The industry is increasingly focusing on lightweight solutions to improve fuel efficiency and reduce emissions, with elastomers providing the necessary properties to achieve these objectives. As manufacturers seek improved durability, weather resistance, and overall vehicle performance, elastomers deliver critical functionalities that meet these requirements. These factors are driving the rapid expansion of the automotive sector within the Indian elastomers market, solidifying its role as a key growth driver.

Regional Insights

Based on Region, South India emerged as the dominant region in the Indian market for Elastomers in 2024. South India, particularly in states like Tamil Nadu and Karnataka, is home to significant automotive manufacturers and suppliers. This concentration leads to a strong demand for elastomers used in tires, seals, and other automotive components. The region boasts a well-established industrial ecosystem, featuring numerous manufacturing facilities, research centers, and a skilled workforce, which facilitates efficient production and innovation in elastomer applications. Being close to suppliers of essential raw materials for elastomer production, such as butadiene and styrene, helps minimize transportation costs and ensures a consistent supply for manufacturers.Ongoing infrastructure projects, including road construction and urban development, further drive the demand for elastomer products in construction applications, contributing to market growth. Additionally, the presence of research and development facilities fosters advancements in elastomer formulations and applications, allowing manufacturers to remain competitive and adapt to changing market needs. State governments in the south have also enacted policies and incentives to support industrial growth, attracting investments in manufacturing sectors, including elastomers. These factors solidify the south region's dominance in the Indian elastomers market, positioning it as a central hub for production and consumption.

Key Market Players

- Reliance Industries Ltd.

- Flexishine Polyblends LLP

- Viscon Rubber Pvt. Ltd.

- Sujan Industries

- Kuraray India Private Limited

- ExxonMobil Company India Pvt. Ltd.

- LANXESS India Private Limited

- Peeco Polytech Pvt Ltd.

- Synotech Polymers Pvt. Ltd.

- Apcotex Industries Limited

Report Scope:

In this report, the India Elastomers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Elastomers Market, By Type:

- Styrene Butadiene Rubber

- Polybutadiene Rubber

- Butyl Rubber

- Nitrile Butadiene Rubber

- Ethylene Propylene Diene Monomer Rubber {EPDM}

India Elastomers Market, By End User:

- Automotive

- Medical

- Industrial

- Construction

- Consumer Electronics

- Consumer Goods

- Others

India Elastomers Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Elastomers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Reliance Industries Ltd.

- Flexishine Polyblends LLP

- Viscon Rubber Pvt. Ltd.

- Sujan Industries

- Kuraray India Private Limited

- ExxonMobil Company India Pvt. Ltd.

- LANXESS India Private Limited

- Peeco Polytech Pvt Ltd.

- Synotech Polymers Pvt. Ltd.

- Apcotex Industries Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | November 2024 |

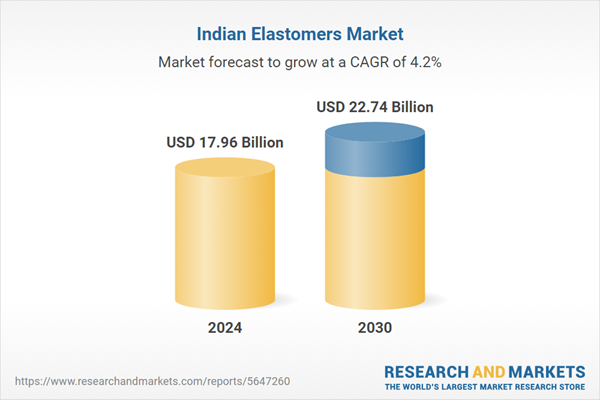

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.96 Billion |

| Forecasted Market Value ( USD | $ 22.74 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |