There are several factors contributing to Saudi Arabia PE pipes market is witnessing several notable trends. There is a growing adoption of high-density polyethylene (HDPE) pipes due to their strength, flexibility, and resistance to corrosion and chemicals, making them suitable for harsh environments. The push toward sustainable water management is driving demand in irrigation and water distribution. Smart city development and large-scale infrastructure projects under Vision 2030 are expanding applications in telecom, sewage, and gas distribution. Manufacturers are also focusing on product innovation, such as multilayered and UV-resistant pipes. The market is shifting toward automated pipe production for better efficiency and quality. Additionally, partnerships with construction and oil companies are increasing, enabling customized solutions. Local manufacturing is being strengthened to reduce import dependence, aligning with government initiatives for industrial growth and self-sufficiency.

Ongoing investments in water distribution infrastructure are boosting Saudi Arabia PE pipes market demand for high-density polyethylene (HDPE) pipes. Projects involving long-distance pipeline installations are increasing the need for PE pipes in various diameter categories, especially for underground and municipal applications. This shift supports higher production volumes and encourages domestic sourcing. As development initiatives progress, PE pipe usage is expected to remain strong in the utility and construction sectors nationwide. For instance, in June 2023, Saudi Arabia’s National Water Company awarded a USD 130 Million EPC contract for the Bisha Drinking Water Networks project. The scope includes 95 kilometers of HDPE pipes (110-200mm diameter). This project marked a significant demand surge for PE pipes in the Kingdom, reinforcing HDPE pipe usage in large-scale water infrastructure and supporting the domestic polyethylene pipe manufacturing sector.

Saudi Arabia PE Pipes Market Trends:

Oil and Gas Exploration Driving PE Pipe Demand

Saudi Arabia’s robust oil and gas sector continues to be a major catalyst for PE pipe consumption. These pipes are essential for upstream and midstream activities, offering chemical resistance, long service life, and minimal maintenance. Their ease of fusion welding and adaptability in remote installations further enhance operational efficiency in energy projects. Additionally, the harsh desert environment makes corrosion-resistant PE pipes a practical choice for long-term use in hydrocarbon transport. The growing investment in exploration and production, along with infrastructure expansion in remote oilfields, is further driving demand for durable, lightweight, and cost-effective PE piping systems. According to OPEC data, Saudi Arabia held an estimated 17% of the world’s proven oil reserves and 22% of OPEC’s proven reserves in 2023.Real Estate Expansion Boosting Infrastructure Pipe Applications

The rapid pace of urbanization and residential development in Saudi Arabia is amplifying the need for efficient water and utility networks. PE pipes are increasingly favored in building infrastructure due to their durability, flexibility, and cost-efficiency. Their ability to withstand surge events and temperature fluctuations makes them ideal for water distribution in newly built communities and high-density developments. The ongoing infrastructure upgrades in line with Vision 2030 further reinforce their relevance across real estate and utility projects. For instance, the residential sector dominates Saudi Arabia’s real estate landscape. In the first half of 2024 (H1), the number of real estate transactions surged by 38%, with total transaction values rising to USD 34 Billion.Rising Investments in Insulated Piping Solutions

A rising uptake of insulated polyethylene piping systems, driven by expanding infrastructure development across urban and industrial zones, is leading to Saudi Arabia PE pipes market growth. These systems are favored for their thermal efficiency, corrosion resistance, and suitability for extreme desert environments. Their use is expanding in applications such as district cooling, water transmission, and industrial utilities, where long service life and minimal maintenance are essential. Increasing focus on sustainable and energy-efficient construction practices is also supporting the wider deployment of advanced insulation technologies within the country’s pipeline networks. For example, in July 2024, Perma-Pipe International Holdings, Inc. secured USD 10 Million in contracts for infrastructure projects in Riyadh, Madinah, and Mekkah, Saudi Arabia. These projects would utilize the XTRU-THERM insulation system.Saudi Arabia PE Pipes Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the Saudi Arabia PE pipes market, along with forecasts at the regional level from 2025-2033. The market has been categorized based on type and application.Analysis by Type:

- HDPE

- MDPE

- LDPE

- LLDPE

Analysis by Application:

- Water Supply

- Irrigation

- Sewerage and Drainage

- Gas Supply

- Mining and Slurry Lines

- Others

Competitive Landscape:

The Saudi Arabia PE pipes market is experiencing significant growth, driven by government initiatives like Vision 2030, which focus on infrastructure development and water management. This has led to increased demand for PE pipes in water supply, sewage systems, and irrigation. The emphasis on infrastructure projects and sustainability initiatives is a common practice in the current market scenario. The report provides a comprehensive analysis of the competitive landscape in the Saudi Arabia PE pipes market with detailed profiles of all major companies, including:- Saudi Plastic Products Company Ltd. (SAPPCO)

- Alwasail Industrial Company

- Arabian Gulf Manufacturers Ltd.

- Saudi Arabian Amiantit Company

- Al Jubail Sanitary Pipe Factory

- IKK Group

Key Questions Answered in This Report

1. How big is the PE pipes market in Saudi Arabia?2. What factors are driving the growth of the Saudi Arabia PE pipes market?

3. What is the forecast for the PE pipes market in Saudi Arabia?

4. Which segment accounted for the largest Saudi Arabia PE pipes segment market share?

5. Who are the major players in the Saudi Arabia PE pipes market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Saudi Arabia Polyethylene Market

5.1 Market Overview

5.2 Market Performance

5.3 Price Trends

5.4 Market Breakup by Type

5.4.1 HDPE

5.4.1.1 Market Trends

5.4.1.2 Market Forecast

5.4.2 LDPE

5.4.2.1 Market Trends

5.4.2.2 Market Forecast

5.4.3 LLDPE

5.4.3.1 Market Trends

5.4.3.2 Market Forecast

5.5 Market Breakup by Application

5.5.1 Packaging

5.5.1.1 Market Trends

5.5.1.2 Market Forecast

5.5.2 Construction

5.5.2.1 Market Trends

5.5.2.2 Market Forecast

5.5.3 Electronics and Electrical

5.5.3.1 Market Trends

5.5.3.2 Market Forecast

5.5.4 Household Applications

5.5.4.1 Market Trends

5.5.4.2 Market Forecast

5.5.5 Automotive

5.5.5.1 Market Trends

5.5.5.2 Market Forecast

5.5.6 Others

5.5.6.1 Market Trends

5.5.6.2 Market Forecast

5.6 Market Forecast

6 Saudi Arabia PE Pipes Market

6.1 Market Overview

6.2 Market Performance

6.3 Impact of COVID-19

6.4 Market Breakup by Type

6.4.1 HDPE

6.4.1.1 Market Trends

6.4.1.2 Market Forecast

6.4.2 MDPE

6.4.2.1 Market Trends

6.4.2.2 Market Forecast

6.4.3 LDPE

6.4.3.1 Market Trends

6.4.3.2 Market Forecast

6.4.4 LLDPE

6.4.4.1 Market Trends

6.4.4.2 Market Forecast

6.5 Market Breakup by Application

6.5.1 Water Supply

6.5.1.1 Market Trends

6.5.1.2 Market Forecast

6.5.2 Irrigation

6.5.2.1 Market Trends

6.5.2.2 Market Forecast

6.5.3 Sewerage and Drainage

6.5.3.1 Market Trends

6.5.3.2 Market Forecast

6.5.4 Gas Supply

6.5.4.1 Market Trends

6.5.4.2 Market Forecast

6.5.5 Mining and Slurry Lines

6.5.5.1 Market Trends

6.5.5.2 Market Forecast

6.5.6 Others

6.5.6.1 Market Trends

6.5.6.2 Market Forecast

6.6 Price Analysis

6.6.1 Price Trends

6.6.2 Key Price Indicators

6.6.3 Price Forecast

6.6.4 Industry Best Practices

6.7 Market Forecast

6.8 SWOT Analysis

6.9 Value Chain Analysis

6.10 Porters Five Forces Analysis

6.10.1 Overview

6.10.2 Bargaining Power of Buyers

6.10.3 Bargaining Power of Suppliers

6.10.4 Degree of Rivalry

6.10.5 Threat of New Entrants

6.10.6 Threat of Substitutes

6.11 Key Market Drivers and Success Factors

7 Competitive Landscape

7.1 Market Structure

7.2 Key Players

8 PE Pipes Manufacturing Process

8.1 Product Overview

8.2 Detailed Process Flow

8.3 Various Types of Unit Operations Involved

8.4 Mass Balance and Raw Material Requirements

9 Project Details, Requirements and Costs Involved

9.1 Land, Location and Site Development

9.2 Construction Requirements and Expenditures

9.3 Plant Machinery

9.4 Machinery Pictures

9.5 Raw Materials Requirements and Expenditures

9.6 Raw Material and Final Product Pictures

9.7 Packaging Requirements and Expenditures

9.8 Transportation Requirements and Expenditures

9.9 Utilities Requirements and Expenditures

9.10 Manpower Requirements and Expenditures

9.11 Other Capital Investments

10 Loans and Financial Assistance

11 Project Economics

11.1 Capital Cost of the Project

11.2 Techno-Economic Parameters

11.3 Product Pricing and Margins Across Various Levels of the Supply Chain

11.4 Income Projections

11.5 Expenditure Projections

11.6 Taxation and Depreciation

11.7 Financial Analysis

11.8 Profit Analysis

12 Key Players Profiles

12.1 Saudi Plastic Products Company Ltd. (SAPPCO)

12.1.1 Company Overview

12.1.2 Company Description

12.2 Alwasail Industrial Company

12.2.1 Company Overview

12.2.2 Company Description

12.3 Arabian Gulf Manufacturers Ltd.

12.3.1 Company Overview

12.3.2 Company Description

12.4 Saudi Arabian Amiantit Company

12.4.1 Company Overview

12.4.2 Company Description

12.5 Al Jubail Sanitary Pipe Factory

12.5.1 Company Overview

12.5.2 Company Description

12.6 IKK Group

12.6.1 Company Overview

12.6.2 Company Description

List of Figures

Figure 1: Saudi Arabia: PE Pipes Market: Major Drivers and Challenges

Figure 2: Saudi Arabia: PE Production Capacity: Volume Trends (in Million Tons), 2019-2024

Figure 3: Saudi Arabia: PE Market: Consumption Volume (in Million Tons), 2019-2024

Figure 4: Saudi Arabia: PE Market: Consumption Value (in Million USD), 2019-2024

Figure 5: Saudi Arabia: PE Market: Average Prices (in USD/Ton), 2019-2024

Figure 6: Saudi Arabia: PE Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 7: Saudi Arabia: PE Market: Production Capacity Breakup by Type (in %), 2024

Figure 8: Saudi Arabia: HDPE Production Capacity: Volume Trends (in Million Tons), 2019 & 2024

Figure 9: Saudi Arabia: HDPE Production Capacity Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 10: Saudi Arabia: LDPE Production Capacity: Volume Trends (in Million Tons), 2019 & 2024

Figure 11: Saudi Arabia: LDPE Production Capacity Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 12: Saudi Arabia: LLDPE Production Capacity: Volume Trends (in Million Tons), 2019 & 2024

Figure 13: Saudi Arabia: LLDPE Production Capacity Forecast: Volume Trends (in Million Tons), 2025-2033

Figure 14: Saudi Arabia: PE Market: Consumption Volume Breakup by Application (in %), 2024

Figure 15: Saudi Arabia: PE Market (Applications in Packaging): Consumption Volume (in ‘000 Tons), 2019 & 2024

Figure 16: Saudi Arabia: PE Market Forecast (Applications in Packaging): Consumption Volume (in ‘000 Tons), 2025-2033

Figure 17: Saudi Arabia: PE Market (Applications in Construction): Consumption Volume (in ‘000 Tons), 2019 & 2024

Figure 18: Saudi Arabia: PE Market Forecast (Applications in Construction): Consumption Volume (in ‘000 Tons), 2025-2033

Figure 19: Saudi Arabia: PE Market (Applications in Electronics and Electrical Industry): Consumption Volume (in ‘000 Tons), 2019 & 2024

Figure 20: Saudi Arabia: PE Market Forecast (Applications in Electronics and Electrical Industry): Consumption Volume (in ‘000 Tons), 2025-2033

Figure 21: Saudi Arabia: PE Market (Household Applications): Consumption Volume (in ‘000 Tons), 2019 & 2024

Figure 22: Saudi Arabia: PE Market Forecast (Household Applications): Consumption Volume (in ‘000 Tons), 2025-2033

Figure 23: Saudi Arabia: PE Market (Automotive Applications): Consumption Volume (in ‘000 Tons), 2019 & 2024

Figure 24: Saudi Arabia: PE Market Forecast (Automotive Applications): Consumption Volume (in ‘000 Tons), 2025-2033

Figure 25: Saudi Arabia: PE Market (Other Applications): Consumption Volume (in ‘000 Tons), 2019 & 2024

Figure 26: Saudi Arabia: PE Market Forecast (Other Applications): Consumption Volume (in ‘000 Tons), 2025-2033

Figure 27: Saudi Arabia: PE Market Forecast: Production Capacity (in Million Tons), 2025-2033

Figure 28: Saudi Arabia: PE Market Forecast: Consumption Volume (in Million Tons), 2025-2033

Figure 29: Saudi Arabia: PE Market Forecast: Consumption Value (in Million USD), 2025-2033

Figure 30: Saudi Arabia: PE Pipes Market: Consumption Volume (in Tons), 2019-2024

Figure 31: Saudi Arabia: PE Pipes Market: Consumption Value (in Million USD), 2019-2024

Figure 32: Saudi Arabia: PE Pipes Market: Consumption Volume Breakup by Type (in %), 2024

Figure 33: Saudi Arabia: HDPE Pipes Market: Consumption Volume (in Tons), 2019 & 2024

Figure 34: Saudi Arabia: HDPE Pipes Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 35: Saudi Arabia: MDPE Pipes Market: Consumption Volume (in Tons), 2019 & 2024

Figure 36: Saudi Arabia: MDPE Pipes Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 37: Saudi Arabia: LDPE Pipes Market: Consumption Volume (in Tons), 2019 & 2024

Figure 38: Saudi Arabia: LDPE Pipes Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 39: Saudi Arabia: LLDPE Pipes Market: Consumption Volume (in Tons), 2019 & 2024

Figure 40: Saudi Arabia: LLDPE Pipes Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 41: Saudi Arabia: PE Pipes Market: Consumption Volume Breakup by Application (in %), 2024

Figure 42: Saudi Arabia: PE Pipes Market (Applications in Water Supply): Consumption Volume (in Tons), 2019 & 2024

Figure 43: Saudi Arabia: PE Pipes Market Forecast (Applications in Water Supply): Consumption Volume (in Tons), 2025-2033

Figure 44: Saudi Arabia: PE Pipes Market (Applications in Irrigation): Consumption Volume (in Tons), 2019 & 2024

Figure 45: Saudi Arabia: PE Pipes Market Forecast (Applications in Irrigation): Consumption Volume (in Tons), 2025-2033

Figure 46: Saudi Arabia: PE Pipes Market (Applications in Sewerage and Drainage): Consumption Volume (in Tons), 2019 & 2024

Figure 47: Saudi Arabia: PE Pipes Market Forecast (Applications in Sewerage and Drainage): Consumption Volume (in Tons), 2025-2033

Figure 48: Saudi Arabia: PE Pipes Market (Applications in Gas Supply): Consumption Volume (in Tons), 2019 & 2024

Figure 49: Saudi Arabia: PE Pipes Market Forecast (Applications in Gas Supply): Consumption Volume (in Tons), 2025-2033

Figure 50: Saudi Arabia: PE Pipes Market (Applications in Mining and Slurry Lines): Consumption Volume (in Tons), 2019 & 2024

Figure 51: Saudi Arabia: PE Pipes Market Forecast (Applications in Mining and Slurry Lines): Consumption Volume (in Tons), 2025-2033

Figure 52: Saudi Arabia: PE Pipes Market (Other Applications): Consumption Volume (in Tons), 2019 & 2024

Figure 53: Saudi Arabia: PE Pipes Market Forecast (Other Applications): Consumption Volume (in Tons), 2025-2033

Figure 54: Saudi Arabia: PE Pipes Market: Average Prices (in USD/Ton), 2019-2024

Figure 55: HDPE Pipes Manufacturing: Price Structure

Figure 56: Saudi Arabia: PE Pipes Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 57: Saudi Arabia: PE Pipes Market Forecast: Consumption Volume (in Tons), 2025-2033

Figure 58: Saudi Arabia: PE Pipes Market Forecast: Consumption Value (in Million USD), 2025-2033

Figure 59: Saudi Arabia: PE Pipes Industry: SWOT Analysis

Figure 60: Saudi Arabia: PE Pipes Industry: Value Chain Analysis

Figure 61: Saudi Arabia: PE Pipes Industry: Porter’s Five Forces Analysis

Figure 62: HDPE Pipes Manufacturing Plant: Detailed Process Flow

Figure 63: HDPE Pipes Manufacturing Process: Conversion Rate of Feedstocks

Figure 64: PE (HDPE) Pipes Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 65: PE (HDPE) Pipes Industry: Profit Margins at Various Stages of Supply Chain

Figure 66: PE (HDPE) Pipes Manufacturing Plant: Breakup of Operational Costs

List of Tables

Table 1: Saudi Arabia: PE Market: Key Industry Highlights, 2024 and 2033

Table 2: Saudi Arabia: PE Pipes Market: Key Industry Highlights, 2024 and 2033

Table 3: Saudi Arabia: PE Pipes Market Forecast: Consumption Volume Breakup by Type (in Tons), 2025-2033

Table 4: Saudi Arabia: PE Pipes Market Forecast: Consumption Volume Breakup by Application (in Tons), 2025-2033

Table 5: Saudi Arabia: PE Pipes Market: Competitive Structure

Table 6: Saudi Arabia: PE Pipes Market: Key Players

Table 7: HDPE Pipes: General Properties

Table 8: HDPE Pipes Manufacturing Plant: Raw Material Requirements (in Tons/Day)

Table 9: PE (HDPE) Pipes Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 10: PE (HDPE) Pipes Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 11: PE (HDPE) Pipes Manufacturing Plant: Costs Related to Plant and Machinery (in USD)

Table 12: PE (HDPE) Pipes Manufacturing Plant: Raw Material Requirements (in Tons/Day) and Expenditures (USD/Ton)

Table 13: PE (HDPE) Pipes Manufacturing Plant: Utility Requirements and Expenditures

Table 14: PE (HDPE) Pipes Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 15: PE (HDPE) Pipes Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 16: Details of Financial Assistance Offered by Financial Institutions

Table 17: PE (HDPE) Pipe Manufacturing Plant: Capital Costs (in USD)

Table 18: PE (HDPE) Pipes Manufacturing Plant: Techno-Economic Parameters

Table 19: PE (HDPE) Pipes Manufacturing Plant: Income Projections (in USD)

Table 20: PE (HDPE) Pipes Manufacturing Plant: Expenditure Projections (in USD)

Table 21: PE (HDPE) Pipes Manufacturing Plant: Taxation (in USD/Year)

Table 22: PE (HDPE) Pipes Manufacturing Plant: Depreciation (in USD/Year)

Table 23: PE (HDPE) Pipes Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability

Table 24: PE (HDPE) Pipes Manufacturing Plant: Profit and Loss Account (in USD)

Companies Mentioned

- Saudi Plastic Products Company Ltd. (SAPPCO)

- Alwasail Industrial Company

- Arabian Gulf Manufacturers Ltd.

- Saudi Arabian Amiantit Company

- Al Jubail Sanitary Pipe Factory

- IKK Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 116 |

| Published | August 2025 |

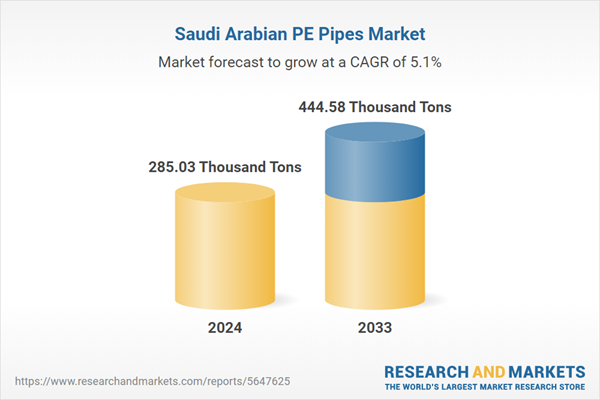

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 285.03 Thousand Tons |

| Forecasted Market Value by 2033 | 444.58 Thousand Tons |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 6 |