Superalloys refer to specialized materials that are designed to withstand extreme mechanical stress, elevated temperatures, and corrosive environments. Comprising a complex blend of elements such as nickel, cobalt, and iron, superalloys are engineered for superior strength, thermal stability, and resistance to wear and tear. The alloy's crystalline structure is meticulously formulated to optimize performance under stressful conditions, often making them an essential component in aerospace engines, gas turbines, and various industrial applications. Superalloys are typically used in components that must bear high loads and resist oxidation or corrosion at elevated temperatures.

The global market is primarily driven by the increasing product utilization in aerospace applications, particularly jet engines that require materials capable of withstanding high temperatures and pressures. In line with this, the expansion of the global aviation industry is providing an impetus to the market. Moreover, the rising demand for energy-efficient gas turbines in power plants is acting as a significant growth-inducing factor. In addition to this, ongoing advancements in material science are paving the way for more durable and efficient superalloys, thereby creating new investment opportunities. Also, government regulations aimed at ensuring equipment durability and safety are stimulating the adoption of high-quality superalloys.

The market is further driven by increased military spending, which demands robust materials for various applications. Apart from this, the growing healthcare sector requiring advanced medical devices and equipment, rising need for materials that can withstand extreme industrial conditions, and extensive research and development (R&D) activities are some of the factors that are elevating market demand.

Superalloys Market Trends/Drivers:

Growth in the number of high-temperature industrial applications

The burgeoning necessity for materials that can endure high-temperature environments is a paramount factor steering the global superalloys market. Particularly in sectors like aviation and power generation, where jet engines and gas turbines operate under extreme heat and stress conditions, superalloys have become virtually irreplaceable. These materials boast superior mechanical strength, excellent thermal stability, and the ability to withstand corrosive atmospheres.The ongoing quest for greater fuel efficiency and reduced carbon emissions in aerospace and energy sectors further necessitates materials that can perform under taxing conditions without failure. As technology advances, higher combustion temperatures are sought for better efficiency, thereby putting more challenging demands on materials. As a result, investments in research and development for creating even more resilient superalloys have accelerated, ensuring that the market for these materials remains robust over the long term.

Increasing research-related activities on material science

Material science has witnessed groundbreaking advancements in recent years that have had a transformative impact on the global market. Previously regarded primarily as subjects of academic investigation, superalloys have transcended this role to become indispensable materials integral to an array of industries, from aerospace and automotive to healthcare and the oil and gas sectors. Through meticulous research and state-of-the-art manufacturing processes, scientists and engineers have pushed the boundaries of metallurgy, facilitating the creation of superalloys that can withstand extremes of stress, heat, and corrosive environments.These properties translate to material advantages in real-world applications such as jet engines, surgical implants, and high-pressure drilling equipment. Each advancement in material science not only refines existing applications for superalloys but also opens up new avenues for the market. This cyclical relationship between innovation and market growth further incentivizes ongoing research and development (R&D) activities, which in turn creates a positive market outlook.

Considerable rise in military expenditure

The strategic importance of superalloys gains particular emphasis against the backdrop of increased military spending in several countries across the globe. The heightened geopolitical tensions are resulting in nations continually looking to enhance their defense capabilities. Superalloys are pivotal in this context, given their application in military aerospace engines, armaments, and other environments that demand materials to perform under high-stress and extreme conditions.These specialized materials offer a combination of mechanical strength and resistance to thermal and environmental degradation, making them indispensable in the production of cutting-edge military equipment. As countries globally allocate more resources to fortify their military capabilities, the market for superalloys correspondingly experiences amplified demand, with a specific focus on alloys that meet the rigorous performance and resilience criteria essential for defense applications.

Superalloys Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global superalloys market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on base material and application.Breakup by Base Material:

- Nickel-Based

- Iron-Based

- Cobalt-Base.

Nickel-based represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the base material. This includes nickel-based, iron-based, and cobalt-based. According to the report, nickel-based represented the largest segment.The nickel-based segment is majorly driven by its widespread application in aerospace and energy sectors due to its superior mechanical properties and resistance to corrosion. These alloys are critical for high-temperature applications such as in jet engines and gas turbines, making them invaluable in those industries. Additionally, the ongoing trend towards fuel efficiency and emissions reduction places nickel-based superalloys as a preferred material. Technological advancements in metallurgy have also enabled the creation of nickel-based superalloys with improved performance attributes. The growing demand for these specific characteristics establishes a robust market for nickel-based alloys.

On the other hand, the iron-based and cobalt-based superalloys segments are commonly used in automotive and industrial applications where high tensile strength is required but not necessarily the high-temperature resistance that nickel-based superalloys provide. Their lower cost compared to nickel-based alloys also makes them attractive for certain applications. Advancements in the production methods for these materials have led to increased efficiency and thus a broader range of applications.

Breakup by Application:

- Aerospace

- Commercial and Cargo

- Business

- Military

- Rotary

- Industrial Gas Turbine

- Electrical

- Mechanical

- Automotive

- Oil and Gas

- Industrial

- Other.

Aerospace accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes aerospace (commercial and cargo, business, military and rotary), industrial gas turbine (electrical and mechanical), automotive, oil and gas, industrial, and others. According to the report, aerospace represented the largest segment.The aerospace sector is a major consumer of superalloys, largely due to the material's ability to withstand extreme temperatures and pressures. The drive for higher fuel efficiency and performance in modern aircraft has placed increased importance on lightweight yet durable materials, making superalloys a popular choice. Moreover, the trend towards more efficient, quieter, and eco-friendly aircraft engines further emphasizes the critical role superalloys play. Government investment in aerospace research and development, as well as a strong push for defense modernization, are also contributing factors.

On the other hand, for industrial gas turbine (electrical and mechanical), automotive, oil and gas, industrial, and others - superalloys find specific yet important applications. They are essential for certain parts of gas turbines, particularly in high-temperature zones. In the automotive industry, superalloys are used for specialized components that require exceptional strength. While their application in oil and gas is relatively limited, it is growing, particularly in drilling and extraction activities that require corrosion-resistant materials.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America exhibits a clear dominance, accounting for the largest superalloys market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North America region plays a significant role in the global market. Factors contributing to this prominence include robust aerospace and defense sectors, especially in developed nations such as the United States, which is a world leader in aircraft manufacturing.

Moreover, the availability of advanced manufacturing facilities, skilled labor, and sophisticated technologies enhance production capabilities. In addition to this, favorable trade policies and economic stability contribute to a favorable business environment, thereby making North America a substantial market for superalloys.

Furthermore, North America has extensive natural resources, enabling easier access to raw materials necessary for superalloys production. Innovation and research in material science are also strong in this region, further propelling the market for superalloys. The stringent regulatory landscape, particularly in relation to environmental sustainability and emissions, pushes industries to adopt more efficient materials, thus providing a boost to superalloys.

Competitive Landscape:

The key players are diligently working on refining the alloy compositions to enhance performance characteristics such as corrosion resistance and mechanical strength. They are continuously investing in research and development activities to create superior products that can withstand extreme conditions. These firms are also engaging in strategic collaborations to expand their expertise and market reach.Market leaders are increasingly targeting specific industries like aerospace and energy to provide customized solutions. Quality control and sustainability are other critical areas where these key market players are dedicating resources. Furthermore, they are regularly seeking certifications and complying with international standards to gain a competitive edge.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Allegheny Technologies Inc

- AMG Superalloys

- Aperam S.A.

- Cannon-Muskegon Corporation

- Carpenter Technology Corporation

- Doncasters Group

- Haynes International Inc

- IHI Corporation

- IMET Alloys

- Mishra Dhatu Nigam Limited

- Special Metals Corporation

- Western Australian Specialty Alloys (Precision Castparts Corp..

Key Questions Answered in This Report

- How big is the global superalloys market?

- What is the expected growth rate of the global superalloys market during 2025-2033?

- What are the key factors driving the global superalloys market?

- What has been the impact of COVID-19 on the global superalloys market?

- What is the breakup of the global superalloys market based on the base material?

- What is the breakup of the global superalloys market based on the application?

- What are the key regions in the global superalloys market?

- Who are the key players/companies in the global superalloys market?

Table of Contents

Companies Mentioned

- Allegheny Technologies Inc

- AMG Superalloys

- Aperam S.A.

- Cannon-Muskegon Corporation

- Carpenter Technology Corporation

- Doncasters Group

- Haynes International Inc

- IHI Corporation

- IMET Alloys

- Mishra Dhatu Nigam Limited

- Special Metals Corporation

- Western Australian Specialty Alloys (Precision Castparts Corp.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | June 2025 |

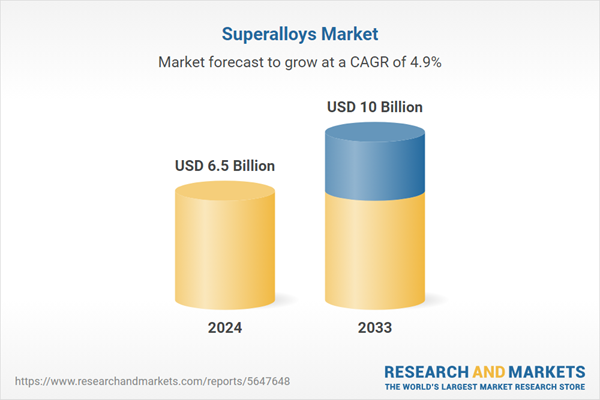

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |