Network function virtualization (NFV) is a technology trend in the telecommunications and networking industry. It involves the virtualization of network services traditionally performed by dedicated hardware appliances. In NFV, network functions such as firewalls, routers, and load balancers are decoupled from specialized hardware and instead run as software on virtual machines or containers. This enables greater flexibility, scalability, and cost efficiency in managing and deploying network services. NFV aims to streamline network infrastructure, reduce operational costs, and accelerate the rollout of new services by leveraging the advantage of virtualization and cloud computing in the networking domain.

The increasing demand for agile and scalable network infrastructure solutions, coupled with the rise of 5G technology, is compelling enterprises and telecommunication providers to adopt NFV to efficiently manage their networks, primarily driving its market growth. Moreover, NFV offers the flexibility to virtualize and manage diverse network functions, resulting in reduced hardware dependency and streamlined network operations, creating a positive outlook for market expansion. In addition to this, the cost-effectiveness and resource optimization achieved through NFV implementation are appealing to organizations aiming to allocate resources more efficiently, thereby contributing to the market's growth. Furthermore, the ability of NFV to accelerate the deployment of new services and applications while minimizing downtime is impelling the product adoption. Apart from this, as the digital landscape evolves, the expansion of IoT devices and edge computing also necessitates adaptable and dynamic network architectures, further fueling the NFV market's growth.

Network Function Virtualization (NFV) Market Trends/Drivers:

Demand for agile network infrastructure

As businesses increasingly rely on digital operations and services, the need for agile and adaptable network infrastructure becomes paramount. NFV addresses this demand by enabling the virtualization of network functions that were traditionally tied to specialized hardware appliances. This decoupling of functions from hardware allows for more dynamic network management, enabling rapid adjustments to meet changing requirements. In confluence with this, the ability to scale services up or down swiftly, allocate resources dynamically, and introduce new services efficiently positions NFV as a strategic solution for organizations seeking flexibility in their network operations.5G technology and network enhancement

The advent of 5G technology is a significant driver for NFV adoption. The deployment of 5G networks requires a highly flexible and scalable infrastructure due to the increased data traffic, diverse use cases, and stringent latency requirements. NFV's virtualized approach aligns well with these demands. By virtualizing network functions, telecom operators can rapidly deploy and manage services specific to 5G, such as network slicing, edge computing, and virtual radio access networks. Apart from this, NFV enhances the implementation of 5G by providing the necessary infrastructure agility to effectively support a wide array of applications and services while optimizing resource utilization.Cost efficiency and resource optimization

NFV introduces cost-effective solutions by eliminating the need for dedicated hardware for each network function. Virtualizing these functions and running them on standardized hardware reduces capital expenditure while also improving resource utilization. NFV allows organizations to consolidate their hardware resources and allocate them dynamically based on the current demand. Concurrent with this, the ability to optimize hardware resources leads to operational cost savings, efficient energy usage, and a streamlined network maintenance process, which is strengthening the market growth. Moreover, the deployment of virtualized network functions can occur remotely, reducing the need for on-site maintenance and minimizing operational disruptions.Network Function Virtualization (NFV) Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global network function virtualization (NFV) market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on offering, deployment mode, enterprise size, application, and end-user.Breakup by Offering:

- Software

- Orchestration and Automation

- Services

Software dominates the market

The report has provided a detailed breakup and analysis of the market based on the offering. This includes software, orchestration and automation, and services. According to the report, software represented the largest segment.The expanding demand for NFV software is strongly driven by its ability to boost network scalability while minimizing the time-to-market for novel services. With businesses placing greater emphasis on swift service deployment to address changing customer needs, NFV's software-centric methodology provides the necessary agility and rapid provisioning. This demand is further underscored by the necessity for resource efficiency, as virtualized functions allow for optimized hardware utilization, resulting in significant cost savings and heightened operational efficiency. As industries continue to navigate dynamic market demands, the adoption of NFV software stands out as a strategic choice for staying competitive and responsive, presenting lucrative opportunities for market expansion.

Breakup by Deployment Mode:

- Cloud-Based

- On-Premises

On-premises holds the largest share of the market

A detailed breakup and analysis of the market based on the deployment mode has also been provided in the report. This includes cloud-based and on-premises. According to the report, on-premises accounted for the largest market share.The surge in demand for on-premises NFV solutions among organizations seeking to retain authority over their network infrastructure while harnessing virtualization advantages is acting as another significant growth-inducing factor. This approach empowers enterprises to fine-tune network functions according to precise needs, guaranteeing data security and adherence to compliance standards. Besides this, on-premises NFV tackles latency issues associated with real-time processing requirements, rendering it especially attractive in sectors such as manufacturing and healthcare, where localized processing holds paramount importance, thus aiding in market expansion. As the landscape of digital operations evolves, the adoption of on-premises NFV ensures customization and establishes a foundation for optimized performance and tailored functionality.

Breakup by Enterprise Size:

- Small and Medium Enterprises

- Large Enterprises

Large enterprises dominate the market

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium enterprises, and large enterprises. According to the report, large enterprises represented the largest segment.The growing need for scalable and agile network solutions in large enterprises to cater to their multifaceted operations is fueling the demand for NFV. Concurrent with this, NFV offers these enterprises a means to effectively oversee their networks by virtualizing functions and dynamically allotting resources, which, in turn, presents remunerative opportunities for market expansion. In addition to this, virtualization also bolsters scalability and facilitates the rollout of diverse applications and services across the organization, all while reducing reliance on hardware. The cost-efficiency of NFV, coupled with its resource optimization capabilities, harmonizes with the operational and budgetary requisites of large enterprises, thereby accelerating its adoption as a strategic solution.

Breakup by Application:

- Virtual Appliance

- Core Network

Core network holds the largest share of the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes virtual appliance and core network. According to the report, core network accounted for the largest market share.The expanding need to enhance network flexibility and streamline operations is propelling the use of NFV in the core network. Furthermore, NFV's virtualization of core network functions allow efficient scaling and dynamic allocation of resources, enabling telecom operators to swiftly adapt to changing traffic patterns and service demands, fostering a favorable outlook for market growth. This agility is particularly crucial as operators transition to 5G networks and face the challenges of handling diverse applications with varying performance requirements. Apart from this, NFV's ability to optimize core network resources while reducing reliance on proprietary hardware aligns with the evolving needs of the telecommunications industry, driving its adoption in this critical network segment.

Breakup by End-User:

- BFSI

- Healthcare

- Retail

- Manufacturing

- Government and Defense

- Education

- IT and Telecom

- Others

IT and telecom dominates the market

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes BFSI, healthcare, retail, manufacturing, government and defense, education, IT and telecom, and others. According to the report, IT and telecom represented the largest segment.The rapid uptake of NFV in the thriving IT and telecommunications sector, driven by the industry's commitment to improving operational efficiency and promoting service innovation, is bolstering market expansion. NFV's software-centric approach facilitates the swift deployment of novel network services, empowering telecom providers to promptly address changing customer needs and market trends. This agility is further enhanced by the potential for consolidating resources and optimizing hardware utilization, yielding cost efficiencies, which is bolstering product adoption. Moreover, the growing use of NFV across the IT sector for crafting adaptable and scalable network architectures, crucial for managing the expanding realm of digital operations and data-intensive applications, is propelling the market forward. As both sectors persistently pursue improved services and streamlined infrastructure, NFV's capabilities harmonize seamlessly with their objectives, fostering its widespread adoption within this dynamic landscape.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest network function virtualization (NFV) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America's advanced technological landscape and robust telecommunication industry are impelling the growth of the NFV market. Concurrent with this, the increasing adoption of 5G technology across the region is a significant driver, necessitating flexible and scalable network solutions. Moreover, NFV's ability to support 5G-specific requirements such as network slicing and edge computing positions it as a pivotal solution, creating a favorable outlook for market expansion. In addition to this, the high concentration of large enterprises in North America seeking agile and cost-effective network management strategies aligning with NFV's core benefits is strengthening the market growth. Furthermore, the region's emphasis on data security and compliance is heightening the demand for on-premises NFV solutions, allowing businesses to maintain control over their networks. Apart from this, the presence of well-established technology companies and a fertile startup ecosystem fosters innovation, further fueling the market.

Key Regional Takeaways:

United States Network Function Virtualization (NFV) Market Analysis

The United States NFV market is growing strongly, driven by the rising demand for software-defined, agile network solutions and cloud-native architecture adoption. Industry leaders, such as Cisco, VMware, and Juniper Networks, are leading the way to address the requirements of telecom operators, enterprises, and data centers. Expanding 5G deployments, along with edge computing and IoT use cases, are fueling NFV implementation across verticals like telecom, finance, and healthcare. In addition, businesses are adopting NFV for cost-effective scaling, network automation, and enhanced service delivery. High government support for digital infrastructure and private investment in cutting-edge network technology is reinforcing the market. The U.S. also enjoys a mature technology ecosystem and extensive collaboration among vendors and service providers, creating instant innovation. Challenges like cybersecurity threats and integration issues continue to exist, but ongoing innovations in AI network orchestration and cloud security are likely to reduce the issues, supporting market growth.Europe Network Function Virtualization (NFV) Market Analysis

In Europe, the market is witnessing the increasing demand consistently with the increasing investments in 5G infrastructure, IoT deployment, and the move toward virtualized network environments. Major telecom operators such as Vodafone, Deutsche Telekom, and Orange are employing NFV to improve operational efficiency, minimize CAPEX, and provide innovative services. The emphasis of the European Union on digital transformation and robust regulatory initiatives are facilitating market progress. Germany, the UK, and France are at the forefront of NFV adoption owing to massive data consumption and enterprise digitalization efforts. Integration challenges and fears regarding data privacy laws, like GDPR, are creating obstacles. In spite of these, greater interoperability between telecom operators, cloud providers, and technology vendors and the creation of open-source NFV solutions are leading to innovation. Moreover, the increasing interest in Europe for edge computing and private 5G networks will further fuel NFV adoption in major industries such as manufacturing, automotive, and smart cities over the next few years.Asia Pacific Network Function Virtualization (NFV) Market Analysis

The Asia Pacific market is witnessing healthy growth with increasing 5G networks, aggressive digitalization, and massive mobile penetration. China, Japan, South Korea, and India are at the forefront of NFV deployments, with telecom operators driving growth through the demand for scalable, cost-effective solutions. Increased investments in cloud infrastructure and the growth of IoT applications are also contributing to the uptake. In addition, government programs encouraging smart city initiatives and industrial digitalization are fueling demand. Besides legacy infrastructure integration issues, the region's rich ecosystem of technology suppliers and growing cooperation among telecom operators and vendors are making Asia Pacific a key NFV growth center.Latin America Network Function Virtualization (NFV) Market Analysis

The Latin American NFV market is slowly growing as telecom operators upgrade networks to handle increasing data requirements. Brazil, Mexico, and Argentina are pacing the region's uptake, fueled by 4G/5G evolution and increasing adoption of cloud services. Limited budgets and infrastructural issues limit quick deployment, but rising partnerships with international vendors and government support for digital inclusion are opening up growth prospects.Middle East and Africa Network Function Virtualization (NFV) Market Analysis

The Middle East and Africa NFV market is also experiencing steady momentum, driven by investments in telecommunications modernization and increased 5G deployments. Nations such as the UAE, Saudi Arabia, and South Africa are leading the charge, using NFV to optimize network efficiency and facilitate digital transformation objectives. Budget limitations and skills gaps remain challenges, but government-sponsored digital programs and strategic partnerships with international technology companies are driving adoption.Competitive Landscape:

The competitive landscape of the global NFV market is characterized by a dynamic interplay of established technology giants, emerging startups, and telecom solution providers. Key players in this market are continuously engaged in innovation and strategic partnerships to gain a competitive edge. Established companies dominate with their comprehensive NFV solutions and extensive industry expertise. Simultaneously, there is a notable presence of innovative startups focusing on disrupting the market by offering specialized NFV solutions and addressing niche requirements. Furthermore, telecom operators are playing a significant role in shaping the NFV landscape, seeking partnerships and collaborations with technology providers to deploy NFVs for network enhancement, service diversification, and operational efficiency.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Affirmed Networks Inc. (Microsoft Corporation)

- Allot Ltd.

- Amdocs

- Ciena Corporation (Tellabs Inc.)

- Cisco Systems Inc.

- Dell EMC (Dell Technologies Inc.)

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Juniper Networks Inc.

- NEC Corporation

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Key Questions Answered in This Report

1. How big is the global Network Function Virtualization (NFV) market?2. What is the expected growth rate of the global Network Function Virtualization (NFV) market during 2025-2033?

3. What are the key factors driving the global Network Function Virtualization (NFV) market?

4. What has been the impact of COVID-19 on the global Network Function Virtualization (NFV) market?

5. What is the breakup of the global Network Function Virtualization (NFV) market based on the offering?

6. What is the breakup of the global Network Function Virtualization (NFV) market based on the deployment mode?

7. What is the breakup of the global Network Function Virtualization (NFV) market based on the enterprise size?

8. What is the breakup of the global Network Function Virtualization (NFV) market based on the application?

9. What is the breakup of the global Network Function Virtualization (NFV) market based on the end-user?

10. What are the key regions in the global Network Function Virtualization (NFV) market?

11. Who are the key players/companies in the global Network Function Virtualization (NFV) market?

Table of Contents

Companies Mentioned

- Affirmed Networks Inc. (Microsoft Corporation)

- Allot Ltd.

- Amdocs

- Ciena Corporation (Tellabs Inc.)

- Cisco Systems Inc.

- Dell EMC (Dell Technologies Inc.)

- Huawei Technologies Co. Ltd.

- Intel Corporation

- Juniper Networks Inc.

- NEC Corporation

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Table Information

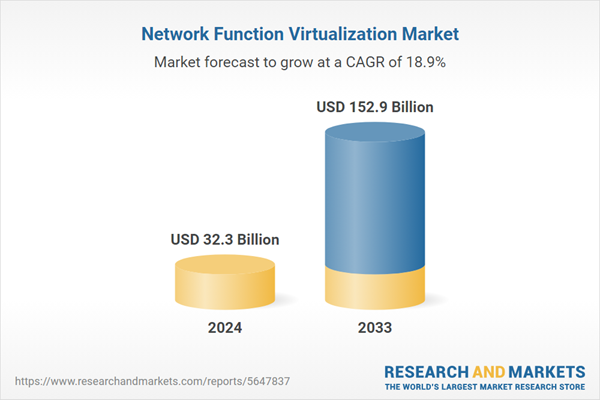

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 32.3 Billion |

| Forecasted Market Value ( USD | $ 152.9 Billion |

| Compound Annual Growth Rate | 18.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |