A cloud identity and access management (IAM) solution delivers a clear and uniform access control interface for all cloud platform services. It enhances the IT infrastructure and in-house capabilities while being maintained via cloud platforms in partnership with third-party managed providers.

As a result, the top impediments to businesses embracing cloud-managed services remain security and privacy concerns. IAM technology can initiate, capture, record, and manage user identities and access rights.

Cloud Identity And Access Management Market Drivers:

Growing cloud computing and the requirement for identity security solutions enhance the market expansion.

A lack of adequate security measures may harm cloud computing's advantages. Owing to this, the requirement for security solutions to safeguard confidential data to prevent identity-related crimes is expected to positively impact cloud identity and access management demand. Additionally, due to cloud computing’s rising use across several sectors and industrial digitization, the prevalence of cloud identity and access management platforms to handle identity access management issues will also increase.As the cloud market’s growth proceeds, so does the need to encrypt and manage different accounts that employees can access via the cloud, resulting in increased usage of IAM solutions. This is seen as a capital expense and needs to be integrated and procured on-premises. The successful deployment of IAM projects used to come at a high cost, requiring months of arduous labor. However, this trend is changing with the rise of cloud computing, making cloud-based IAM services easier to accomplish and access.

Adaptation of heterogeneous deployment bolsters market growth.

Due to technological shifts and booming digitization, the preference for heterogeneous cloud platforms that mix different deployments and technologies has been on the rise over the years. Moreover, pricing choices such as pay-as-you-go usage and subscriptions provided to vendors are expected to drive the demand for cloud-based IAM solutions among users. This aspect, together with the rise of SMEs, is projected to boost the use of user IAM solutions worldwide.Cloud Identity And Access Management Market Segmentation Analysis

Provisioning accounts for a considerable share.

The market is divided by solution type into Provisioning, Single Sign-On, Advanced Authentication, Compliance and Regulation, Password Management, and Others. The provinces sector dominated the market over the forecast period owing to its broad capabilities and user provisioning automation that boost productivity.Large enterprise is set to show significant growth.

The cloud identity and access management market is analyzed by enterprise size into small, medium, and large enterprises, where the latter is set to constitute a considerable market share and will also show significant growth. With high employee strength, organizations require software or digital platforms to offer identity access and management. Cloud IAS helps in providing maximum investment to ensure advanced identity and protect the customer’s privacy.The BFSI sector constitutes a major market share.

By end-user industry, the cloud identity and access management market is segmented into BFSI, healthcare, energy and power, manufacturing, education, government, communication and technology, and Others. The BFSI sector is anticipated to hold a considerable market share fuelled by favorable investments and strategic collaboration between financial institutions and cloud service providers. Moreover, efforts to prevent the prevalence of unauthorized data access are also expected to bolster overall segment growth.North America constitutes a significant market share.

North America is expected to account for a considerable market share over a forecast period. This is attributable to adopting remote work, growing cloud technology, and favorable investments by major regional economies, namely the USA and Canada, to digitize the sectors and expand their operations.In addition, key companies such as Amazon Web Services Inc., Akamai Technologies, HP Development Company L.P., Microsoft Corporation, IBM Corporation, and others are present in the region. These companies are implementing investments in modern technological options such as Artificial Learning, which has provided new growth prospects for the regional market.

Cloud Identity And Access Management Market Restraints:

High maintenance restrains the market expansion.

The high installation and maintenance expenses of consumer IAM systems are offset by a lack of identification standards and insufficient budgetary resources. The initial installation and maintenance expenses are substantial. Budgetary restraints have been noticed in large economies, such as areas of Latin America, APAC, and MEA, where businesses are either leveraged or run on a limited budget.Lack of technical expertise & knowledge hinders the market expansion.

Due to a lack of awareness of modern cyber threats, organizations do not spend that much on their system security and suffer enormous losses. Furthermore, businesses with critical cybersecurity needs have reported a severe shortage of competent personnel, making them even more vulnerable to cyberattacks. According to the Center for Strategies and International Studies, the global cybersecurity workforce shortage by 2022 reached 1.8 million.Cloud Identity And Access Management Market Key Developments

- January 2024: Omada A/S launched its next generation of “Omada Identity Cloud”, which offers unprecedented speed, decision, support, and operational efficiency. The solution will enhance data import frequency to reflect real-time organizational changes.

- November 2023: Saviynt partnered with Amazon Web Service (AWS), which will integrate the former’s identity governance technology with the latter’s identity and access management access analyzer. The advanced solution offers cloud security innovation inclusive of adaptive access control and security verification.

- October 2023: ManageEngine announced the launch of its cloud-native identity management platform, “identity369”. This will address the identity and access management issues of enterprises looking to enhance their workforce mobility without compromising security.

The Cloud Identity And Access Management market is segmented and analyzed as follows:

By Solution Type

- Provisioning

- Single Sign-On

- Advanced Authentication

- Compliance and Regulation

- Password Management

- Others

By Enterprise Size

- Small

- Medium

- Large

By End-User Industry

- BFSI

- Healthcare

- Energy and Power

- Manufacturing

- Education

- Government

- Communication and Technology

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- IBM

- Microsoft

- Dell

- Oracle Corporation

- Broadcom Inc. (CA Technologies)

- Hewlett Packard Enterprise Development LP

- Intel Corporation

- SecureWorks Inc.

Table Information

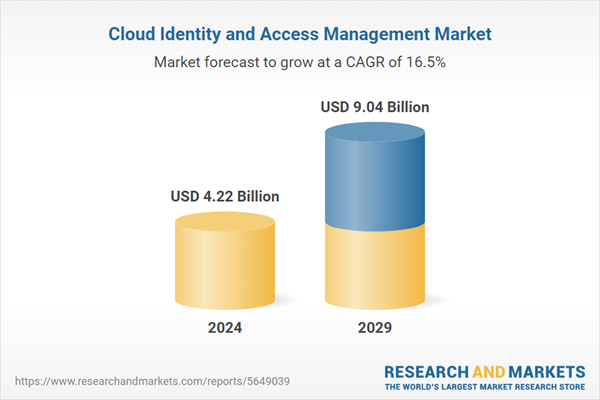

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | July 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 4.22 Billion |

| Forecasted Market Value ( USD | $ 9.04 Billion |

| Compound Annual Growth Rate | 16.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |