Immunosuppressive drugs find their clinical utility in managing autoimmune diseases such as skin disorders, multiple sclerosis, and rheumatoid arthritis. These medications, which are also known as anti-rejection medications, prevent our body from rejecting transplanted organs. The need to support populations with chronic ailments, particularly those requiring organ transplants and technological advancements that enhance the transplant process, would significantly increase market growth.

According to the World Health Organization report in September 2023, about 41 million die per year from noncommunicable diseases (NCDs), which equals about 74% of all deaths in the world. It would cover respiratory, cancer, kidney, cardiovascular diseases, etc. Improving immunosuppressive medications and the development of organ transplantation would hence reduce some of the mortalities caused by these diseases and boost market expansion.

Global Immunosuppressant Drugs Market Drivers

Rising chronic health diseases are contributing to the global Immunosuppressant Drugs market growth

Stem cell transplant requirements are rising for acute leukemia, refractory anemia, and osteopetrosis, while there is an increase in chronic renal diseases that cause kidney transplants. The organ transplant burden has thus led to a colossal rise in the demand for immunosuppressants and has further contributed to the global market. Increasing clinical trials, growing mergers and acquisitions, and the fast-growing CDMOs and CROs supporting drug discovery and development are additional factors fostering market expansion.Global Immunosuppressant Drugs Market Geographical Outlook

North America is witnessing exponential growth during the forecast period.Technological advancements and the presence of significant market participants aid the development of this regional market. In nations like the US and Canada, rising demand for organ transplants and related procedures increases demand for immunosuppressive medications, propelling market expansion. Growing public awareness of organ donation is also opening the door for more transplant procedures, which will accelerate the immunosuppressive medication market's growth over the next five years. In the United States, 90% of adults favor organ donation. The market for immunosuppressive medications is expanding due to the region's increasing prevalence of autoimmune disease and R&D spending.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The global Immunosuppressant Drugs market is segmented and analyzed as follows:

By Drug Class

- Calcineurin Inhibitors

- mTOR inhibitor

- Antibodies

- Others

By Application

- Organ Transplantation

- Autoimmune Disorder

ByDistribution Channel

- Online

- Offline

By Geography

- North America

- South America

- Europe

- Middle East and Africa

- Asia-Pacific

Table of Contents

Companies Mentioned

- Astellas Pharma Inc.

- Sanofi

- AbbVie Inc.

- Veloxis Pharmaceuticals Inc.

- GlaxoSmithKline plc

- Dr. Reddy’s Laboratories Ltd.

- Lupin

- Neovii

- F. Hoffmann-La Roche Ltd

- Biocon

- Novartis

- Pfizer

- Veloxis

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | December 2024 |

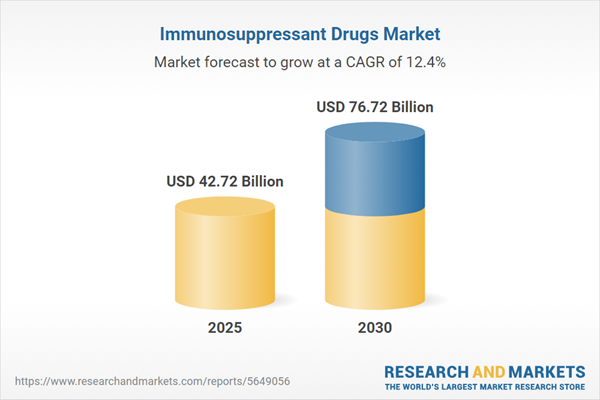

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 42.72 Billion |

| Forecasted Market Value ( USD | $ 76.72 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |