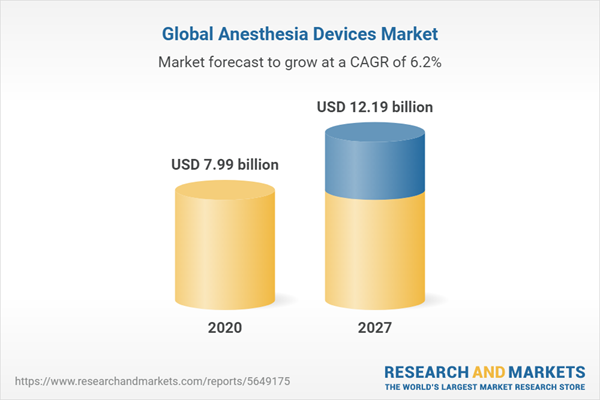

The global anesthesia devices market is projected to witness a CAGR of 6.22% during the forecast period to reach a total market size of US$12.186 billion by 2027, increasing from US$ 7.987 billion in 2020. Anaesthesia is a temporary loss of sensation, which includes loss of pain or unconsciousness. As it suppresses the nervous system activity, which results in unconsciousness. An anaesthesia device is used to give anaesthesia to patients which helps them to feel no pain during medical procedures, by making their bodies numb. The most commonly used anaesthesia device is the continuous-flow anaesthetic device, as it provides a steady flow of air containing a regulated supply of gas. The anesthesia devices are mounted on anti-static wheels for convenient transportation. Lately, advanced anaesthesia devices include monitors and touch-screen displays to provide data on heart rate and oxygen saturation level.

The rising geriatric population across the globe will increase the demand for anaesthesia devices as they will require more surgeries and medical treatment for which the devices will be required. According to the United Nations, in 2019, the geriatric population was 703 million people, nationwide. The number of older persons is projected to double to 1.5 billion in 2050. This will fuel the market’s growth during the forecast period. In addition, the increasing number of surgical procedures is spurring the demand for anesthesia devices, which is augmenting the market growth. According to the Agency for Healthcare, Research and Quality, there are more than 11,474,800 surgeries held each year, in the United States.

Furthermore, owing to the rising incidence of chronic illnesses such as cataracts nervous disorders, muscle repair, oral problems and abdominal issues that require surgeries, the use of anesthesia devices has further increased. Technological advancements, owing to increasing investments by major players in research and development, are enhancing the efficiency and reliability of these devices. The advanced anesthesia devices come with advanced ventilators, graphical displays, and other features integrated to ensure the safest possible experience for the patients, which is increasing their adoption among the end-users, thereby augmenting the market growth.

By type, the continuous-flow anaesthesia devices segment is estimated to have a significant market share as it provides an accurate supply of medical gases mixed with a concentration of anesthetic vapor, delivered continuously to the patient at a safe pressure rate. By end-user, the hospital's segment is expected to hold a dominant market share owing to the increasing number of surgeries being performed, worldwide. Geographically, North America holds the largest market share of the overall market owing to the flourishing healthcare industry and the presence of key market players in this region. The Asia Pacific region is expected to witness the highest CAGR over the projected period due to increasing investments in this region by key market players and improving healthcare infrastructure in this region.

Growth Factors.

The increase in the number of patients suffering from chronic and cardiovascular diseases has subsequently increased the number of surgeries being performed, worldwide. The subsequent increase in surgeries has in turn augmented the demand for anesthesia devices in the market, as anaesthesia is a necessity before any surgery. According to an article published by the British Journal of Anesthesia, in 2021, an annual average of 7.9 million procedures (inclusive category), 5.1 million procedures (intermediate category), and 1.5 million procedures (restrictive category) were performed in hospitals in the United Kingdom. Hence, the surge in the number of surgeries being performed globally will drive the market growth of the anaesthesia devices market.

The global population has been on a constant rise, due to which more surgeries are taking place on a day-to-day basis. According to the World Bank, the world population was 7.592 billion which increased to 7.674 billion in 2019. The continuous rise in the population will be favourable for the anaesthesia devices market as the number of patients who require surgeries will increase.

The COVID-19 pandemic moderately impacted the global anesthesia devices market as due to the nationwide lockdown restrictions, many patients deferred their ongoing treatments and postponed their surgeries to avoid public places, which hampered the market’s growth. However, the patients who required surgeries on an urgent basis did go forward, which stabilized the market growth. Also, patients suffering from chronic diseases witnessed a huge spike in numbers due to being affected by the virus, which resulted in an increasing demand for surgeries being performed, subsequently contributing to the growth of the anesthesia devices market.

Competitive Insights.

The market leaders for the Global Anesthesia Devices Market are Koninklijke Philips N.V., Supera Anesthesia Innovations, Drägerwerk AG & Co. KGaA, Dameca A/S, INFINIUM MEDICAL, INC., Smiths Medical, Inc., and Spacelabs Healthcare. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc. to gain a competitive advantage over their competitors. For instance, Koninklijke Philips N.V. keeps updating its product range by launching new technology-driven products to remain the market leader.

The rising geriatric population across the globe will increase the demand for anaesthesia devices as they will require more surgeries and medical treatment for which the devices will be required. According to the United Nations, in 2019, the geriatric population was 703 million people, nationwide. The number of older persons is projected to double to 1.5 billion in 2050. This will fuel the market’s growth during the forecast period. In addition, the increasing number of surgical procedures is spurring the demand for anesthesia devices, which is augmenting the market growth. According to the Agency for Healthcare, Research and Quality, there are more than 11,474,800 surgeries held each year, in the United States.

Furthermore, owing to the rising incidence of chronic illnesses such as cataracts nervous disorders, muscle repair, oral problems and abdominal issues that require surgeries, the use of anesthesia devices has further increased. Technological advancements, owing to increasing investments by major players in research and development, are enhancing the efficiency and reliability of these devices. The advanced anesthesia devices come with advanced ventilators, graphical displays, and other features integrated to ensure the safest possible experience for the patients, which is increasing their adoption among the end-users, thereby augmenting the market growth.

By type, the continuous-flow anaesthesia devices segment is estimated to have a significant market share as it provides an accurate supply of medical gases mixed with a concentration of anesthetic vapor, delivered continuously to the patient at a safe pressure rate. By end-user, the hospital's segment is expected to hold a dominant market share owing to the increasing number of surgeries being performed, worldwide. Geographically, North America holds the largest market share of the overall market owing to the flourishing healthcare industry and the presence of key market players in this region. The Asia Pacific region is expected to witness the highest CAGR over the projected period due to increasing investments in this region by key market players and improving healthcare infrastructure in this region.

Growth Factors.

An increase in the number of surgeries.

The increase in the number of patients suffering from chronic and cardiovascular diseases has subsequently increased the number of surgeries being performed, worldwide. The subsequent increase in surgeries has in turn augmented the demand for anesthesia devices in the market, as anaesthesia is a necessity before any surgery. According to an article published by the British Journal of Anesthesia, in 2021, an annual average of 7.9 million procedures (inclusive category), 5.1 million procedures (intermediate category), and 1.5 million procedures (restrictive category) were performed in hospitals in the United Kingdom. Hence, the surge in the number of surgeries being performed globally will drive the market growth of the anaesthesia devices market.

Spike in global population.

The global population has been on a constant rise, due to which more surgeries are taking place on a day-to-day basis. According to the World Bank, the world population was 7.592 billion which increased to 7.674 billion in 2019. The continuous rise in the population will be favourable for the anaesthesia devices market as the number of patients who require surgeries will increase.

Key Developments

- Medovate has announced the launch of its US Food and Drug Administration-approved product called Safira (Safer Injection for Regional Anesthetics).

- Drager has announced the introduction of its new Altan family of anaesthesia workstations at Arab Health 2020 which is designed to simplify working procedures for clinical staff and biomedical personnel.

The COVID-19 pandemic moderately impacted the global anesthesia devices market as due to the nationwide lockdown restrictions, many patients deferred their ongoing treatments and postponed their surgeries to avoid public places, which hampered the market’s growth. However, the patients who required surgeries on an urgent basis did go forward, which stabilized the market growth. Also, patients suffering from chronic diseases witnessed a huge spike in numbers due to being affected by the virus, which resulted in an increasing demand for surgeries being performed, subsequently contributing to the growth of the anesthesia devices market.

Competitive Insights.

The market leaders for the Global Anesthesia Devices Market are Koninklijke Philips N.V., Supera Anesthesia Innovations, Drägerwerk AG & Co. KGaA, Dameca A/S, INFINIUM MEDICAL, INC., Smiths Medical, Inc., and Spacelabs Healthcare. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc. to gain a competitive advantage over their competitors. For instance, Koninklijke Philips N.V. keeps updating its product range by launching new technology-driven products to remain the market leader.

Segmentation:

By Type

- Intermittent-flow Anesthesia Devices

- Continuous-flow Anesthesia Devices

By End-User

- Hospitals

- Ambulatory Care Centers

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Europe

- UK

- Germany

- France

- Spain

- Middle East and Africa

- Saudi Arabia

- Israel

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Taiwan

- Thailand

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Global Anesthesia Devices Market Analysis, By Type

6. Global Anesthesia Devices Market Analysis, By End-User

7. Global Anesthesia Devices Market Analysis, By Geography

8. Competitive Intelligence

9. Company Profiles

Companies Mentioned

- Koninklijke Philips N.V.

- Supera Anesthesia Innovations

- Drägerwerk AG & Co. KGaA

- INFINIUM MEDICAL, INC.

- ICU Medical

- Teleflex Incorporated

- GE Healthcare

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | August 2022 |

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 7.99 billion |

| Forecasted Market Value ( USD | $ 12.19 billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |