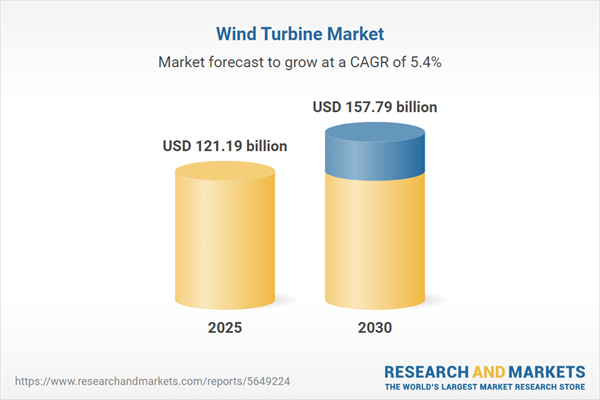

The wind turbine market is poised for significant growth during the forecast period, driven by the increasing demand for renewable energy, efforts to reduce reliance on fossil fuels, and stringent energy efficiency regulations. The shift toward sustainable energy sources, particularly wind power, is fueled by environmental concerns, technological advancements, and supportive government initiatives.

Market Drivers

Environmental and Economic Benefits

Wind turbines offer substantial environmental and economic advantages, driving their adoption globally. By reducing emissions of carbon dioxide, nitrogen oxides, and sulfur dioxide, wind energy contributes to improved public health and climate outcomes. These benefits align with global sustainability goals, encouraging the deployment of wind turbines to replace fossil fuel-based power generation. The declining costs of wind power technology, coupled with its scalability, make it an economically viable option for meeting rising energy demands while minimizing environmental impact.Rising Wind Power Installations

The global push for clean energy has led to a surge in wind power plant installations. Both onshore and offshore wind projects are expanding, supported by advancements in turbine technology that enhance efficiency and output. The increasing size and capacity of wind turbines further bolster their appeal, enabling higher energy generation with fewer units. This trend is expected to continue as countries prioritize renewable energy to meet sustainability targets and address growing energy needs.Growing Demand for Offshore Wind

Offshore wind energy is gaining traction as a critical component of the renewable energy mix, driven by its ability to deliver clean, reliable power. Innovations in offshore turbine technology, such as larger and more efficient designs, are facilitating rapid deployment. The scalability of offshore wind projects makes them attractive for meeting large-scale energy demands, particularly in coastal regions. Government incentives and policies further accelerate the growth of offshore wind, positioning it as a cornerstone of the global energy transition.Supportive Government Initiatives

Government policies and incentives are pivotal in driving the wind turbine market. In 2023, significant initiatives included the U.S. federal approval of a major offshore wind project in New Jersey, expected to power hundreds of thousands of homes and create over 3,000 jobs in construction and development. In Japan, the Ministries of Economy, Trade, and Industry (METI) and Land, Infrastructure, Transport, and Tourism (MLIT) completed a second round of offshore wind tenders in June 2023, targeting 1.8 gigawatts of capacity across four areas. These initiatives underscore the global commitment to expanding wind energy infrastructure.Geographical Outlook

Asia-Pacific as a Growth Leader

The Asia-Pacific region is expected to experience substantial growth in the wind turbine market, driven by abundant wind resources and a focus on sustainable development. Countries like China, India, and Japan are prioritizing wind energy to reduce greenhouse gas emissions and meet rising energy demands. Offshore wind, in particular, is emerging as a major energy source due to technological advancements and government support. For instance, India’s focus on expanding wind power capacity highlights the region’s potential to lead global wind energy growth.Key Developments

In April 2023, Vestas secured a 238 MW order from Hibiki Wind Energy for the Kitakyushu-Hibikinada Offshore Wind Farm Project off the coast of Kitakyushu city, Japan, reinforcing the region’s commitment to offshore wind. In January 2023, Braun Windturbinen GmbH announced plans to install 7.5 KW small wind turbines in Germany, featuring the Smart Wind SW7.5 with a 6.0 kW heating rod for grid-parallel operation. These developments highlight ongoing innovation and investment in both large-scale and small-scale wind turbine solutions.The wind turbine market is on a robust growth trajectory, propelled by the demand for renewable energy, environmental imperatives, and supportive government policies. The Asia-Pacific region is emerging as a key growth hub, with offshore wind gaining prominence due to technological advancements. Recent developments, such as major offshore projects in the U.S. and Japan, underscore the market’s dynamic evolution. As wind energy continues to offer environmental and economic benefits, the market is well-positioned to play a pivotal role in the global transition to sustainable energy.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use these reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others.

Wind Turbine Market Segmentation:

By Type

- Horizontal-axis Wind Turbine

- Vertical-axis Wind Turbine

By Size

- Small

- Medium

- Large

By Location

- Onshore

- Offshore

By Application

- Utility

- Non-utility

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- General Electric

- Siemens Gamesa Renewable Energy, S.A.

- Vestas

- Nordex SE

- Suzlon Energy Limited

- Goldwind

- Envision Group

- Renewables First

- Bergey Windpower Co.

- Enessere S.r.l.

- VENSYS Energy AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 151 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 121.19 billion |

| Forecasted Market Value ( USD | $ 157.79 billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |