LED downlights are defined as recessed light fixtures which are mounted into a hollow opening in a ceiling. These lights are extensively used across residential and commercial spaces. LED downlights are energy efficient as well as eco-friendly lighting solutions, which emit light in the downward direction with a narrow beam. These lights have a relatively longer lifespan with minimum heat radiation. They currently find wide applications in shopping malls, offices, living rooms, kitchens, bathrooms, etc.

LED downlights are proficient of enduring tough conditions such as external shocks and vibrations, extreme weather conditions, and traffic-related public exposure, etc. This has resulted in LED downlights turning into one of the most favoured choices for outdoor lighting systems. In addition, the sales of these lights are also proliferating since they consume a significant lower amount of electricity and emit lesser amount of ultraviolet (UV) rays and heat. Apart from this, on account of the rising prices of electricity in several developing economies, the governments are taking initiatives to encourage the widespread incorporation of LED lights across various sectors.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the US LED downlight market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on product type and application.Breakup by Product Type:

- Luminaire

- Lamp and Retrofits

Breakup by Application:

- Retrofit

- Retail & Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Manufacturing

- Others

Breakup by Region:

- South

- West

- Northeast

- Midwest

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being Acuity Brands Inc., Bridgelux Inc., Cree Inc., Eaton Corporation, Everlight Electronics, Feit Electric Company Inc., General Electric Company, Hubbell Incorporated, Lsi Industries, Osram Licht Ag, Phillips Electronics and Samsung Electronics Co. Ltd.Key Questions Answered in This Report

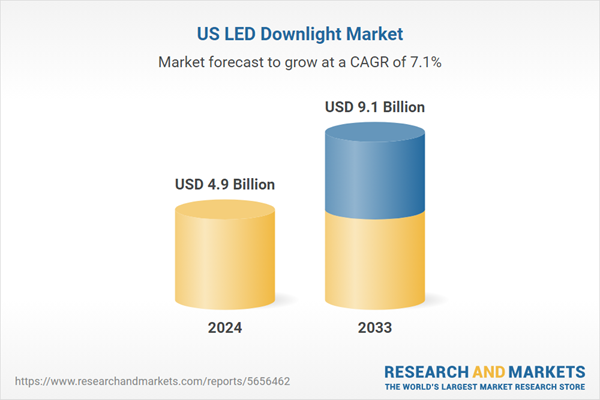

1. What was the size of the US LED downlight market in 2024?2. What is the expected growth rate of the US LED downlight market during 2025-2033?

3. What are the key factors driving the US LED downlight market?

4. What has been the impact of COVID-19 on the US LED downlight market?

5. What is the breakup of the US LED downlight market based on the product type?

6. What is the breakup of the US LED downlight market based on the application?

7. What are the key regions in the US LED downlight market?

8. Who are the key players/companies in the US LED downlight market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 United States LED Downlight Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 United States LED Downlight Market: Breakup by Region

6.1 South

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 West

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Northeast

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Midwest

6.4.1 Market Trends

6.4.2 Market Forecast

7 United States LED Downlight Market: Breakup by Application

7.1 Retrofit

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Retail & Hospitality

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Outdoor

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Offices

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Architectural

7.5.1 Market Trends

7.5.2 Market Forecast

7.6 Residential

7.6.1 Market Trends

7.6.2 Market Forecast

7.7 Manufacturing

7.7.1 Market Trends

7.7.2 Market Forecast

7.8 Others

7.8.1 Market Trends

7.8.2 Market Forecast

8 United States LED Downlight Market: Breakup by Product Type

8.1 Luminaire

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Lamp and Retrofits

8.2.1 Market Trends

8.2.2 Market Forecast

9 SWOT Analysis

9.1 Overview

9.2 Strengths

9.3 Weaknesses

9.4 Opportunities

9.5 Threats

10 Value Chain Analysis

10.1 Primary Raw Materials Suppliers

10.2 LED Chip Manufacturers

10.3 LED Package and Module Manufacturers

10.4 Lighting Products, Electronic Products and Automotive Part Manufacturers

10.5 Product Distribution

10.6 End Users

11 Porters Five Forces Analysis

11.1 Overview

11.2 Bargaining Power of Buyers

11.3 Bargaining Power of Suppliers

11.4 Degree of Competition

11.5 Threat of New Entrants

11.6 Threat of Substitutes

12 Key Success and Risk Factors for LED Downlight Manufacturers

13 Comparative Analysis of CFL and LED

14 Price Analysis

14.1 Key Price Indicators

14.2 Price Structure

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Acuity Brands Inc.

15.3.2 Cree Inc.

15.3.3 General Electric Company

15.3.4 Eaton Corporation

15.3.5 Osram Licht Ag

15.3.6 Samsung Electronics Co. Ltd

15.3.7 Everlight Electronics

15.3.8 Hubbell Incorporated

15.3.9 Feit Electric Company Inc.

15.3.10 Phillips Electronics

15.3.11 Bridgelux, Inc.

15.3.12 LSI Industries Inc.

List of Figures

Figure 1: United States: LED Downlight Market: Major Drivers and Challenges

Figure 2: United States: LED Downlight Market: Value Trends (in Billion USD), 2019-2024

Figure 3: United States: LED Downlight Market: Breakup by Region (in %), 2024

Figure 4: United States: LED Downlight Market: Breakup by Application (in %), 2024

Figure 5: United States: LED Downlight Market: Breakup by Product Type (in %), 2024

Figure 6: United States: LED Downlight Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 7: South: LED Downlight Market: Value Trends (in Million USD), 2019 & 2024

Figure 8: South: LED Downlight Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 9: West: LED Downlight Market: Value Trends (in Million USD), 2019 & 2024

Figure 10: West: LED Downlight Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 11: Northeast: LED Downlight Market: Value Trends (in Million USD), 2019 & 2024

Figure 12: Northeast: LED Downlight Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 13: Midwest: LED Downlight Market: Value Trends (in Million USD), 2019 & 2024

Figure 14: Midwest: LED Downlight Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 15: United States: LED Downlight (Retrofit) Market: Value Trends (in Million USD), 2019 & 2024

Figure 16: United States: LED Downlight (Retrofit) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 17: United States: LED Downlight (Retail & Hospitality) Market: Value Trends (in Million USD), 2019 & 2024

Figure 18: United States: LED Downlight (Retail & Hospitality) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 19: United States: LED Downlight (Outdoor) Market: Value Trends (in Million USD), 2019 & 2024

Figure 20: United States: LED Downlight (Outdoor) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 21: United States: LED Downlight (Offices) Market: Value Trends (in Million USD), 2019 & 2024

Figure 22: United States: LED Downlight (Offices) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 23: United States: LED Downlight (Architectural) Market: Value Trends (in Million USD), 2019 & 2024

Figure 24: United States: LED Downlight (Architectural) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 25: United States: LED Downlight (Residential) Market: Value Trends (in Million USD), 2019 & 2024

Figure 26: United States: LED Downlight (Residential) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 27: United States: LED Downlight (Manufacturing) Market: Value Trends (in Million USD), 2019 & 2024

Figure 28: United States: LED Downlight (Manufacturing) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 29: United States: LED Downlight (Others) Market: Value Trends (in Million USD), 2019 & 2024

Figure 30: United States: LED Downlight (Others) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 31: United States: LED Downlight (Luminaire) Market: Value Trends (in Million USD), 2019 & 2024

Figure 32: United States: LED Downlight (Luminaire) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 33: United States: LED Downlight (Lamp and Retrofits) Market: Value Trends (in Million USD), 2019 & 2024

Figure 34: United States: LED Downlight (Lamp and Retrofits) Market Forecast: Value Trends (in Million USD), 2025-2033

Figure 35: United States: LED Downlight Industry: SWOT Analysis

Figure 36: United States: LED Downlight Industry: Value Chain Analysis

Figure 37: United States: LED Downlight Industry: Porter’s Five Forces Analysis

Figure 38: United States: LED Downlight Production Cost Breakup

List of Tables

Table 1: United States: LED Downlight Market: Key Industry Highlights, 2024 and 2033

Table 2: United States: LED Downlight Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 3: United States: LED Downlight Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: United States: LED Downlight Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 5: Comparison of LED with Compact Fluorescent Lamps (CFL) (Based on Energy Efficiency and Environmental Impact)

Table 6: Comparison of LED and Compact Fluorescent Lamps (CFL) (Based on Luminous Flux)

Table 7: United States: LED Downlight Industry: Price Indicator

Table 8: United States: LED Downlight Market: Competitive Structure

Table 9: United States: LED Downlight Market: Key Players

Companies Mentioned

- Acuity Brands Inc.

- Bridgelux Inc.

- Cree Inc.

- Eaton Corporation

- Everlight Electronics

- Feit Electric Company Inc.

- General Electric Company

- Hubbell Incorporated

- Lsi Industries

- Osram Licht Ag

- Phillips Electronics and Samsung Electronics Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.9 Billion |

| Forecasted Market Value ( USD | $ 9.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |