The global market is majorly driven by the prevalence of chronic and infectious diseases requiring faster and accurate diagnostic solutions for effective management. In addition to this, increasing demand for rapid testing kits in emergency and remote settings is augmenting the adoption of point-of-care diagnostics, thereby promoting the accessibility of healthcare services. Furthermore, the integration of sophisticated technologies, including biosensors and microfluidics, into the processes for streamlining diagnosis, resulting in increased efficiency and reliability, is propelling the market. Moreover, continual improvements the healthcare infrastructure, along with an increasing focus on early detection of diseases for timely intervention, are creating a positive market outlook. Besides this, research and development (R&D) expenditures for innovative diagnostic solutions are encouraging the growth in point-of-care technologies. The increasing demand for digital platforms and connectivity in diagnostics is also making it easier to manage data and consequently improving overall outcomes for the patient. Furthermore, the increased applications of point-of-care diagnostics in such areas as oncology, cardiology, and infectious disease management have strengthened the growth of this market.

The United States stands out as a key regional market, driven by the increasing prevalence of chronic and infectious diseases among the masses. Besides, the accelerating demand for home-based and portable testing devices is also propelling the point-of-care diagnostics market by facilitating greater patient convenience. Also, the increasing usage of advanced technologies such as AI and biosensors in diagnostics has streamlined the process and helped in better accuracy and efficiency, which is creating lucrative opportunities in the market. In addition, positive regulatory policies driving innovation and increasing the availability of products in all healthcare settings is impelling the market. As of February 22, 2024, the FDA's Diagnostic Data Program launched an initiative that aimed to support the development of innovative methods for collecting, harmonizing, transmitting, and analyzing diagnostic data from tests performed outside traditional laboratories. This will help integrate non-laboratory-based data streams with lab-based ones to improve public health decision-making. Also, strategic collaborations with federal agencies, such as NIH's ITAP and RADx programs, are facilitating the authorization of at-home tests by developing standardized evaluation protocols and data reporting mechanisms. Furthermore, increased investments in healthcare infrastructure is significantly expanding access to sophisticated diagnostic solutions, which is driving market growth.

Point-of-Care Diagnostics Market Trends:

The Growing Prevalence of Chronic Diseases

According to the World Health Organization (WHO), non-communicable diseases, also called chronic diseases, kills 41 million people each year, which is equivalent to 74% of all deaths globally. Similarly, infectious diseases such as HIV remain a major health challenge, with an estimated 39.0 million people living with HIV in 2022 and approximately 1.3 million acquiring the infection globally that year, according to WHO. The global rise in chronic diseases is driving the demand for POC diagnostic services. Chronic conditions, such as diabetes, cardiovascular diseases, and respiratory disorders, are becoming increasingly prevalent among the masses, posing substantial challenges to healthcare systems worldwide. POC diagnostics offer a valuable tool for spontaneous detection and continuous monitoring of these health complications, facilitating timely interventions and effective disease management. The convenience and easy availability of POC testing further contributes to the management of chronic diseases, especially in remote or rural areas where access to traditional laboratory facilities is limited or not available.Various Technological Advancements

Technological innovations and integration play a crucial role in supporting the point-of-care diagnostics market growth. Initiatives and research in miniaturization, biosensors, and connectivity are leading to the creation of various smart and portable diagnostic devices and systems. These POC devices can perform a wide range of tests with high accuracy, which traditional laboratory-based methods often fail to deliver. They are also often integrated with expanded test menus to eliminate the need for multiple devices and reduce turnaround time for getting the test results. For instance, in February 2023, Huwel Lifesciences developed a portable RT-PCR device that can test multiple viruses. The company stated the test takes about 30 minutes and can identify respiratory and other infections using blood and gastrointestinal samples. Similarly, Abbott launched ID NOW in 2020, which is the world's fastest molecular POC test. It delivers COVID-19 results in just 13 minutes. This device is widely used in dispersed healthcare settings such as doctor's offices and urgent care clinics. In May 2023, Danaher Corporation introduced the Dxl 9000 Access Immunoassay Analyzer, capable of running up to 215 tests per hour, significantly expanding the company's POC diagnostics offerings. Companies are also planning to produce POC diagnostics systems which are compact in size and offer comprehensive testing facilities. Key market players are also collaborating with other firms to offer unique and reliable diagnostic solutions to revolutionize healthcare delivery. Molbio Diagnostics declared its partnership with SigTuple in 2023 to develop next-generation AI-enabled portable devices for many routine and diagnostic tests.The Growing Emphasis on Personalized Medicine

The increasing need for personalized medicine among the masses is propelling the growth of the market. The National Cancer Institute (NCI) has launched a large precision medicine cancer initiative to examine the effectiveness of treating children and adults with various novel drug combinations. Moreover, as the healthcare sector is transitioning towards a more patient-centric approach, the acceptance of personalized medicine is facilitating the creation of treatment plans according to the needs of patients. The World Health Organization (WHO) reported that sharp increases in government spending on health at all income levels in 2020 underpinned a rise in global health expenditure to a new high of USD 9 Trillion, accounting for approximately 11% of global GDP. This increase in investment reflects the growing focus on advanced healthcare solutions, including precision medicine. POC diagnostics play a pivotal part in this procedure as it offers rapid and targeted diagnostic solutions that aid in precise disease identification and monitoring. They provide a sense of assurance to patients regarding their treatment and overall wellbeing, which is also responsible for their high acceptance among patients. Moreover, according to research done by Coriell Life Sciences, it is confirmed that precision medicine has reached a global tipping position for adoption.Point-of-Care Diagnostics Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global point-of-care diagnostics market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product type, platform, prescription mode, and end-user.Analysis by Product Type:

- Blood-Glucose Monitoring Kit

- Cardio-Metabolic Monitoring Kit

- Pregnancy and Fertility Testing Kit

- Infectious Disease Testing Kit

- Cholesterol Test Strip

- Hematology Testing Kit

- Others

Analysis by Platform:

- Lateral Flow Assays

- Dipsticks

- Microfluidics

- Molecular Diagnostics

- Immunoassays

Analysis by Prescription Mode:

- Prescription-Based Testing

- OTC Testing

Analysis by End-User:

- Professional Diagnostic Centers

- Home Care

- Research Laboratories

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Point-of-Care Diagnostics Market Analysis

The increasing cancer incidence in the United States is a strong growth factor for the point-of-care diagnostics market in the country. Early detection of cancer improves patient outcomes and the demand for advanced diagnostic solutions is on the rise. According to Cancer.org 2021 data, approximately 1.9 million new cancer cases were diagnosed in the U.S., with 608,570 deaths reported. These alarming statistics call for some innovative diagnostic technologies that should enable timely and accurate disease detection. Moreover, the market leaders have been bringing innovative products due to growing demand for this emerging need. For instance, last October 2022, F. Hoffmann-La Roche Ltd. received its first companion diagnostic, which allows the identification of patients suffering from HER2-low metastatic breast cancer, eligible to receive ENHERTU. This diagnostic breakthrough would mark an important step ahead in cancer care, and it is the role of point-of-care diagnostics that becomes vital in providing patient-specific and targeted solutions. Such innovation will most likely propel the U.S. POC diagnostics market since they respond to the growing need for customized and accurate health care.Europe Point-of-Care Diagnostics Market Analysis

The increasing prevalence of chronic diseases in Europe is a key growth driver for this region's point-of-care diagnostics market. The International Diabetes Federation (IDF) reports that the prevalence of diabetes in the European region is going to increase by 13%. The number of people afflicted with this disease will reach 61 million by 2045. This growing diabetes burden increases the demand for POC diagnostic solutions to monitor glucose levels and manage the disease effectively. Also, cardiovascular diseases (CVD), which are the cause of death in Europe, also drive the POC diagnostics market. The National Institutes of Health reported that CVD accounts for 45% of all deaths in the region, with over 4 million deaths annually, primarily from coronary heart disease and stroke. With a rising incidence of these conditions, there is a need for prompt, on-site diagnostic solutions to detect early, manage, and monitor. POC diagnostics offer an efficient way to address these healthcare challenges, contributing to the market’s growth.Asia Pacific Point-of-Care Diagnostics Market Analysis

One major driving force for the POC diagnostics market in Asia Pacific is the accelerating patients with chronic diseases. Notably, the OECD 2021 states that, out of 227 million people living with type 2 diabetes in the Asia-Pacific region, close to half remain undiagnosed or without realizing their long-term complications. This increase in trend is leading to an escalating demand for early detection and monitoring and thereby propelling the utilization of POC diagnostics. Additionally, the miniaturized diagnostic models and the measures undertaken in hospitals and clinics to reduce the duration of hospital and clinic stay will further propel the demand for POC devices. Moreover, improving health outcomes require accessible and efficient solutions for diagnostics, especially in rural and underserved areas. Also, the market is also being driven by rapid technological advancements, high prevalence of both chronic and infectious diseases, and continuous efforts by local companies and organizations to improve healthcare access. For instance, in January 2023, Cipla Limited launched Cippoint, a POC device capable of testing a wide range of parameters, including diabetes, cardiac markers, fertility, and infectious diseases. This innovation reflects the growing trend of comprehensive, multi-disease diagnostics in the region, further boosting the adoption of POC technologies.Latin America Point-of-Care Diagnostics Market Analysis

This market is gaining momentum in Latin America, primarily due to the increase in prevalence of chronic diseases, along with the growth need for early disease diagnosis. The World Cancer Research Fund International reported that nearly 101,703 cancer cases were diagnosed in Mexico in 2022, which points out the growing demand for appropriate and easily accessible diagnostic devices. POC diagnostics are highly important as early detection of a condition, such as cancer or any other dangerous disease, can lead to positive health outcomes and lessen further health burdens. The rising chronic diseases, including diabetes and cardiovascular diseases, have been stimulating the demand for POC devices as it can offer an immediate and cost-effective diagnosis that results in proper and efficient care of these patients. Also, increasing healthcare technologies and an increase in the awareness levels for preventive health are also significant growth-inducing factors for the market across this region.Middle East and Africa Point-of-Care Diagnostics Market Analysis

The World Heart Federation says that CVD is the leading cause of death in the MENA region, accounting for more than one-third of all deaths or approximately 1.4 million fatalities annually. In 2024, the percentage of CVD deaths varies from country to country in the region, which ranges from 40 percent of total deaths in Oman to 10 percent in Somalia. High prevalence rates of cardiovascular diseases will fuel point-of-care diagnostics growth in Middle East and Africa. POC diagnostics in the management of cardiovascular disease ensure early detection, monitoring, and management of this type of disease, making a timely intervention possible. Growing cardiovascular diseases weigh much on the region. Adoption of POC technologies across the region is likely to gain momentum because of an increasing demand for accessible, rapid, and cost-effective diagnostic solutions. MENA region healthcare systems that have prioritized efficient and preventive care are also going to create an even greater need for POC diagnostics, hence accelerating market growth.Competitive Landscape:

The competitive landscape of the market comprises a wide variety of players, which comprises established companies, emerging startups, and specialized firms. Major players are focusing significant investment on R&D innovation and development of the latest POC diagnostic solutions. Also, they are placing their emphasis on accuracy, sensitivity, and speed of the tests. Top companies expand the range of analytes and diseases detectable by POC devices. R&D activities also encompass the design of innovative technologies, such as biosensors, microfluidics, and systems that are lab-on-a-chip, in pursuit of improving the performance capabilities of POC diagnostics. In addition, they adjust the designs of their products to meet specific health needs and regulatory requirements in various countries. For instance, the company Cipla expanded its product portfolio with the launch of a point-of-care testing device for different forms of non-communicable diseases and other diseases/health conditions. The point-of-care diagnostics market statistics clearly show a very strong growth trajectory, led by higher demands for rapid testing, new technologies, and increasing attention to decentralized healthcare.The report provides a comprehensive analysis of the competitive landscape in the point-of-care diagnostics market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche AG

- Instrumentation Laboratory

- Johnson & Johnson

- Nova Biomedical Corporation

- Pts Diagnostics

- Qiagen

- Siemens

- Trinity Biotech

Key Questions Answered in This Report

1. What is point-of-care diagnostics?2. How big is the global point-of-care diagnostics market?

3. What is the expected growth rate of the global point-of-care diagnostics market during 2025-2033?

4. What are the key factors driving the global point-of-care diagnostics market?

5. What is the leading segment of the global point-of-care diagnostics market based on the product type?

6. What is the leading segment of the global point-of-care diagnostics market based on platform?

7. What is the leading segment of the global point-of-care diagnostics market based on prescription mode?

8. What is the leading segment of the global point-of-care diagnostics market based on end-user?

9. What are the key regions in the global point-of-care diagnostics market?

10. Who are the key players/companies in the global point-of-care diagnostics market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Beckman Coulter Inc.

- Becton

- Dickinson and Company

- F. Hoffmann-La Roche AG

- Instrumentation Laboratory

- Johnson & Johnson

- Nova Biomedical Corporation

- Pts Diagnostics

- Qiagen

- Siemens

- Trinity Biotech etc.

Table Information

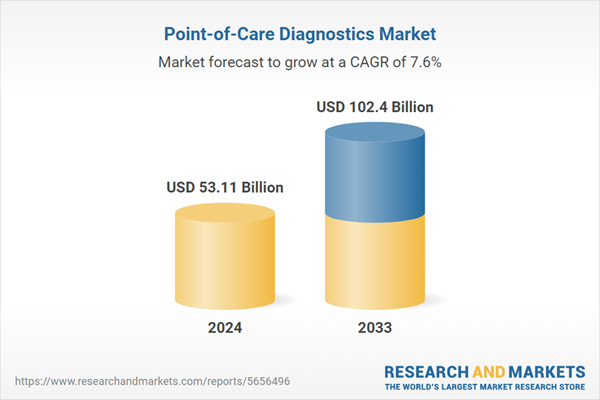

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 53.11 Billion |

| Forecasted Market Value ( USD | $ 102.4 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |