Residential Air Purifiers Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth owing to the increasing awareness about health-related issues associated with poor air quality.

- Key Market Trends: The rise of smart air purifiers, which include internet of things (IoT) connectivity and can be operated remotely using smartphones is bolstering the residential air purifiers market growth. Automated adjustment and real-time air quality monitoring are common features of these systems.

- Geographical Trends: Asia Pacific dominates the market because of high pollution levels in major cities and a growing middle class with increasing disposable income.

- Competitive Landscape: Some of the major market players in the residential air purifiers industry include AllerAir Industries Inc., Daikin Industries Ltd., Dyson Ltd., Honeywell International Inc., IQAir, Koninklijke Philips N.V., LG Electronics Inc., Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, Unilever plc, Whirlpool Corporation, Xiaomi Inc., among many others.

- Challenges and Opportunities: Challenges consist of the increasing prices of air purifiers. Nevertheless, manufacturers are designing affordable models that maintain air purification effectiveness, possibly increasing their customer reach.

Residential Air Purifiers Market Industry Trends:

Rising Urbanization and Deteriorating Indoor Air Quality:

According to GlobalData, India's urbanization rate stood at 1.34% in 2021. Urbanization is resulting in more crowded living areas and increasing indoor air pollution from sources such as traffic, industrial operations, and building projects. Additionally, pollutants generated by common household tasks like cooking and cleaning, as well as emissions from furniture and construction materials, are responsible for the low quality of air indoors. The rising awareness among urban residents regarding these issues are driving the demand for residential air purifiers.The desire to establish a cleaner, healthier living space is especially notable in households with children or older individuals, who are more vulnerable to the negative consequences of air pollution. As per the United Nations (UN) report, the population of individuals who are 80 years or older is increasing at a rapid rate. Around 10% of the global population were 65 or older in 2021 and this proportion is expected to increase to 1 in 6 by 2050. Moreover, the worldwide population of individuals aged 65 and above is projected to reach 1.6 billion by 2050.

Growing Occurrence of Respiratory Diseases

The increasing occurrence of respiratory illnesses and allergies among the masses is a key factor driving the residential air purifiers demand. Health issues like asthma, bronchitis, and allergic rhinitis worsen due to pollutants like dust, pollen, pet dander, and particulate matter often present in indoor spaces. According to information from the Center for Disease Control and Prevention (CDC), 4.6% of adult patients in 2022 had a background of chronic obstructive pulmonary disease (COPD), emphysema, or chronic bronchitis.Air purifiers with advanced filtration systems like high-efficiency particulate absorbing (HEPA) filters effectively eliminate irritants from the air, resulting in a healthier living environment that can reduce allergy and asthma symptoms and attacks. Health professionals and individuals are both acknowledging the importance of this proactive strategy, making air purifiers a crucial addition to the homes of individuals with these conditions.

Technological Advancements in Air Purification:

Continuous technological advancements that improve product effectiveness and customer convenience are offering a favorable residential air purifiers market outlook. Contemporary air purifiers come with advanced filters such as HEPA filters, which can capture particles as tiny as 0.3 microns. New technologies include sensors that adjust settings based on air quality data, and connected devices that allow users to monitor and control their appliances via smartphone apps. These advancements in technology enhance both the efficiency of air purifiers in removing airborne contaminants and enhance user satisfaction, appealing to users who are tech-savvy.Daikin unveiled an air purifier in January 2024 that integrates ultraviolet (UV) technology with Streamer technology, featuring a unique UV filter for over 99% virus suppression within 30 minutes. Stringent safety protocols and innovative layout designs guarantee efficient UV radiation without leaks, addressing concerns about confirming invisible UV light and safety.

Residential Air Purifiers Market Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, filtration technology, and distribution channel.Breakup by Type:

- Stand-alone/Portable

- In-Duc.

Stand-alone/portable exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes stand-alone/portable and in-duct. According to the report, stand-alone/portable accounted for the largest market share.The stand-alone/portable segment is the most popular in the market because of its versatility, ease of installation, and affordability when compared to in-duct systems. These easily transportable devices attract a wide variety of users as they can be conveniently placed in any room and relocated as required, offering versatility that is especially useful in rental spaces or homes where permanent setups are not possible. Stand-alone air purifiers commonly include advanced filtration methods such as HEPA filters, activated carbon, and occasionally UV lights or ionizers, which increase their attractiveness by providing effective pollutant removal.

Manufacturers are constantly finding new ways to improve the look, lower noise, and add smart features to air purifiers to meet the growing need for efficient and convenient solutions. Nirvana Being introduced India's initial portable MESP air purifier in November 2023, employing cutting-edge technology for efficient air cleaning, energy conservation, and a reusable filter, with the ability to eliminate multiple pollutants like PM2.5, dust, pollen, smoke, viruses, and bacteria. Perfect for enhancing the air quality indoors, this product includes advanced features and sustainability, which helps minimize the need for expensive filter changes.

Breakup by Filtration Technology:

- High-efficiency Particulate Absorbing (HEPA)

- Activated Carbon

- Ionic Filters

- Other.

High-efficiency particulate absorbing (HEPA) dominates the market

The report has provided a detailed breakup and analysis of the market based on the filtration technology. This includes high-efficiency particulate absorbing (HEPA), activated carbon, ionic filters, and others. According to the report, high-efficiency particulate absorbing (HEPA) represented the largest segment.High-efficiency particulate absorbing (HEPA) segment holds the biggest share in the market, primarily due to its proven effectiveness in capturing a wide range of airborne particles, including pollen, dust mites, and other allergens, with a high efficiency rate. HEPA filters are highly favored in residential settings because they notably improve indoor air quality, making them essential for households with allergy sufferers, asthmatics, and those concerned about exposure to airborne pollutants.

Their reliability and performance are making HEPA-equipped air purifiers the go-to choose for people seeking dependable air purification solutions, prompting manufacturers to continually innovate and improve these filters to meet rising user expectations and regulatory standards. For instance, in January 2024, Coway introduced the Airmega 100, a cylindrical air purifier, featuring a 3-stage HEPA filtration system, ideal for smaller spaces up to 810 square feet, with real-time air quality indicator and whisper-quiet sleep mode. It efficiently filters harmful pollutants, capturing 99.999% of nano-sized particles down to 0.01 microns, including allergens, bacteria, mold, and viruses, promoting healthier living environments.

Breakup by Distribution Channel:

- Online

- Offline

Online distribution channel is mainly driven by the convenience of e-commerce platforms and the expansive reach they offer. This segment allows individuals to easily compare different models, read customer reviews, and access detailed product information and specifications, all from the comfort of their home. Moreover, the global e-commerce sector was valued at US$ 21.1 trillion in 2023 according to The research.

Additionally, online channels often provide competitive pricing, promotional deals, and more diverse product selections than traditional retail outlets. The rise of online shopping is accelerated by digital marketing strategies and the proliferation of mobile shopping apps, making it a crucial avenue for manufacturers to target tech-savvy users and expand their customer base globally.

Offline remains a vital part of the market, with people often preferring to purchase these devices from physical retail stores like home improvement stores, specialty stores, and department stores. This preference is driven by the opportunity to physically inspect products, assess their size and design, and receive immediate, expert advice from sales personnel. Offline channels also benefit from the trust and reliability perceived in purchasing from established retail brands and the immediate product availability without the wait or cost of shipping. Many buyers still value the tactile experience and personalized service that offline stores offer, maintaining their relevance in the market landscape.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Asia Pacific leads the market, accounting for the largest residential air purifiers market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for residential air purifiers.The Asia Pacific region is the largest segment in the market, primarily driven by high pollution levels in populous countries like China and India. Rapid urbanization, industrial growth, and increasing awareness about the health implications of poor air quality are significant factors contributing to the robust demand for air purifiers in this region. Based on the data provided by the World Bank, global urban population is projected to rise to 6 billion people by 2045, a 1.5-fold increase.

Additionally, the rising middle-class population with growing disposable incomes is increasingly investing in health and wellness products, including air purifiers. Governments across the region are also implementing stricter air quality regulations, which further boosts the sales of residential air purifiers. These factors combined make Asia Pacific a dynamic and rapidly expanding market for air purification technologies.

Competitive Landscape:

- The residential air purifiers market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the residential air purifiers industry include AllerAir Industries Inc., Daikin Industries Ltd., Dyson Ltd., Honeywell International Inc., IQAir, Koninklijke Philips N.V., LG Electronics Inc., Panasonic Holdings Corporation, Samsung Electronics Co. Ltd., Sharp Corporation, Unilever plc, Whirlpool Corporation and Xiaomi Inc.

- Key players in the market are intensively focusing on innovation and technology integration to enhance the efficiency and functionality of their products. They are incorporating advanced filtration technologies, such as HEPA and activated carbon, and integrating smart features like IoT connectivity for remote monitoring and control. For instance, in November 2022, IQAir introduced the PerfectPro® Whole House Air Purifier Series, offering homeowners a high-performance air cleaning solution. The series features compact designs and high-efficiency particle filtration, addressing the need for clean indoor air amid increasing concerns about airborne pollutants. Additionally, companies are actively expanding their market presence through strategic mergers and acquisitions (M&A), and by forming partnerships with technology firms to leverage cutting-edge technologies. This competitive landscape is marked by a continual effort to improve product offerings, increase user trust, and expand into emerging markets, all while emphasizing sustainability and energy efficiency.

Key Questions Answered in This Report

- What was the size of the global residential air purifiers market in 2024?

- What is the expected growth rate of the global residential air purifiers market during 2025-2033?

- What are the key factors driving the global residential air purifiers market?

- What has been the impact of COVID-19 on the global residential air purifiers market?

- What is the breakup of the global residential air purifiers market based on the type?

- What is the breakup of the global residential air purifiers market based on the filtration technology?

- What are the key regions in the global residential air purifiers market?

- Who are the key players/companies in the global residential air purifiers market?

Table of Contents

Companies Mentioned

- AllerAir Industries Inc.

- Daikin Industries Ltd.

- Dyson Ltd.

- Honeywell International Inc.

- IQAir

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Panasonic Holdings Corporation

- Samsung Electronics Co. Ltd.

- Sharp Corporation

- Unilever plc

- Whirlpool Corporation

- Xiaomi Inc

Table Information

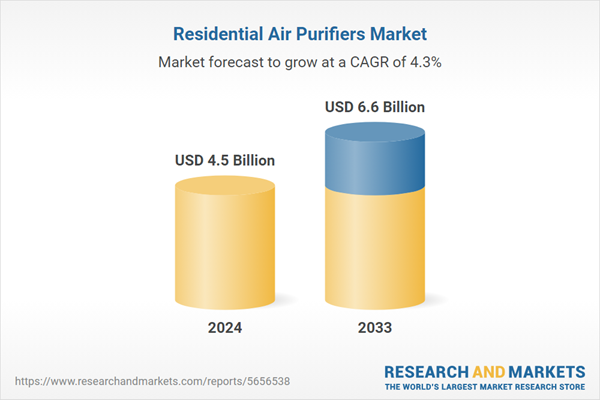

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 6.6 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |