Security robots are robotic devices that are created to carry out numerous duties, earlier done by humans. These are autonomous devices that do not need much human assistance. These are autonomous guards that monitor and carry out security duties using streaming video, artificial intelligence (AI), and other linked technology. They have modern, large-capacity batteries, electric motors, and high-definition (HD) cameras.

They assist with reporting, observing, looking for intrusions, and patrolling of monitoring zones. Security personnel can use security robots to detect potential threats, acquire a close-up first look from a safe distance, as well as provide accurate information about the hazard so that preemptive measures can be done. Shopping centers, workplaces, and public spaces are all increasingly using security robots.

The fact that these robots collect significantly more data than people suggests that they are more analogous to security mobile robots than typical security guards. Despite this, they are frequently portrayed as friendly patrol bots that will potentially replace human security guards. Security robots are widely used in many establishments throughout the world, including malls, parking lots, and universities because they are dependable, incorruptible, and more affordable than security staff.

The paradigm of security and facility management is evolving across various industries as a result of the introduction of machine learning, computer vision, and robotics. More than just a collection of sensors and computations make up robots. They are essential computers that can reach out and touch the entire globe, offering both innovation and adaptability. They are made to travel across human places safely and without appearing menacing or frightening, which facilitates cultural acceptability.

COVID-19 Impact Analysis

As the infection spread, it necessitated the hiring of new staff members or lowering of safety and service standards. This led private security firms to use security robots. The pandemic pushed for the development of robots that can sanitize the whole premises. These later evolved to replace infected security personnel at various places doing security checks as well as temperature checks where needed. Most countries saw a surge in automated robot sales during the pandemic. Therefore, it is evident that the pandemic had an overall positive impact on the security robots market.Market Growth Factors

Increasing Defense Budget is expected to Escalate The Demand For Security Robots

To protect the borders against undersea dangers, nations all over the world are utilizing cutting-edge technology. In the current global environment, dangers from pirates, terrorists, and sailors causing problems across maritime and land borders have increased. This results in the country's revenue trafficking concerns. Arms and ammunition, light weapons, drugs, and people trafficking become recurring. Such concerns have legitimized the increase of defense expenditure worldwide in efforts to bring these crimes under control.Innovation And Implementation Of Cutting-Edge Technology In Robotics

Security robots are widely used in a variety of applications because of advancements in automation and sensor technologies. These robots may learn over time and expand their usefulness due to advancements in neural network technology. Robots can analyze their environment and offer more accurate information with the aid of these sensors. The distant sensing capabilities of these robots can be employed to protect the area and find potential dangers.Marketing Restraining Factor:

Security Robots' Unreliability In Military Operations And Functionality

In a variety of defense applications, security robot dependability is crucial. These robots' malfunctions can be broken down into design, technological, manufacturing, environmental, and operating categories. In the event of a failure, effective preventative measures and backup plans are needed. Transporting the malfunctioning security robots back to the main station must be planned in advance. Security robots' functional unreliability limits their usage in a variety of military and covert activities since it might lead to the transfer and loss of sensitive data and expose it to enemy forces' exploitation.Type Outlook

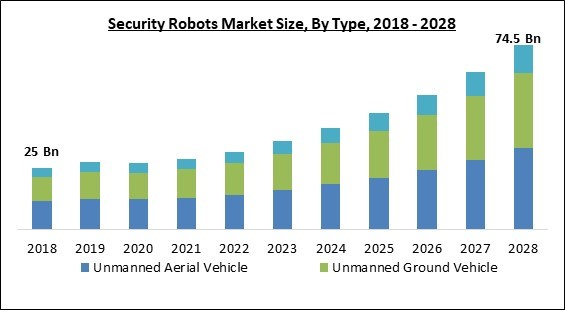

Based on type, the security robots market is divided into UAV (Unmanned Aerial Vehicle), UUV (Unmanned Underwater Vehicle), and UGV (Unmanned Ground Vehicle). The Unmanned Underwater Vehicles (UUV) segment acquired a promising revenue share in the security robots market in 2021. UUVs are submersible vehicles that can function underwater without a human occupant. These are also referred to as underwater drones. Remotely operated underwater vehicles (ROUVs) and autonomous underwater vehicles are two subcategories of UUVs.End User Outlook

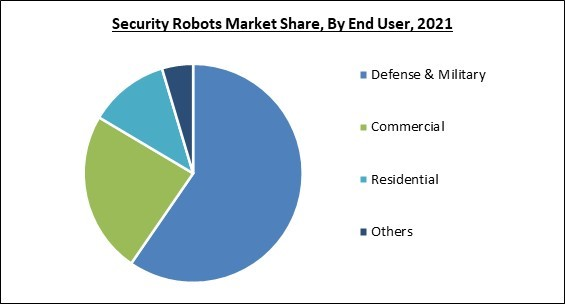

Based on end user, the security robots market is categorized into defense & military, residential, commercial, and Calibration. The commercial segment recorded a substantial revenue share in the security robots market in 2021. These are robots that are primarily employed for outside security. It is mostly utilized to secure sizable spaces like workplaces, schools, and other places. These robots have a camera installed inside of them that may be able to rotate 360 degrees and provide the control center with all the data.Regional Outlook

On the basis of region, the security robots market is analyzed across North America, Europe, Asia Pacific, and LAMEA. North America garnered the largest revenue share in the security robots market in 2021. The market is growing with the expansive application of robots in this region. Given their dependability and quality, unmanned solutions are widely used by US security and surveillance services. There have been more terrorist attacks and ongoing armed confrontations in public venues like schools.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thales Group S.A., Northrop Grumman Corporation, Leonardo SpA, Lockheed Martin Corporation, Cobham Limited (Eaton Corporation PLC), Kongsberg Group, Saab AB, BAE Systems PLC, Elbit Sytems Ltd., and QinetiQ Group PLC (The Carlyle Group).

Strategies deployed in Security Robots Market

- Aug-2022: QinetiQ US took over the acquisition of Avantus Federal, a mission-focused data, cyber, and space services and solutions company. Through this acquisition, QinetiQ integrated business, core capabilities, and customer relationships to complement its distinctive offerings. This acquisition allowed the companies to grow the services and solutions that is expected to benefit their combined global customers.

- Jun-2022: Elbit Systems unveiled COPAS-L, a new Electro-Optical (EO) payload for Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR). COPAS-L is a miniaturized configuration of the company’s Commander Open Architecture Panoramic Sight (COAPS). This EO payload has small dimensions and weighs only 40kg. COPAS-L provides light platforms such as light tactical vehicles, UGVs, and surface vessels with AFV-level ISTAR capabilities.

- Mar-2022: BAE Systems took over Bohemia Interactive Simulations (BISim), a US-based software company. This acquisition added BISim’s software development capabilities, and advanced military simulation and training solutions to BAE Systems digital transformation portfolio. With this acquisition, the companies is expected to be better positioned to meet customers’ evolving needs in the rapidly growing market for global military training and deliver next-generation virtual systems to assist the US military and its allies effectively.

- Jan-2022: Leonardo acquired HENSOLDT AG, a leading German player in the field of sensors for defense and security applications, with an expanding portfolio in sensors, data management, and robotics. This acquisition is expected to also allow Leonardo to establish a long-term strategic presence in the fast-growing German defense market.

- Nov-2021: Elbit Systems introduced ROOK, a multi-payload military 6X6 Unmanned Ground Vehicle (UGV) together with Roboteam. ROOK has a unique design and built-in autonomy suite which offers a combination of greater capacity, improved maneuverability, and field agility that is key for greater mission effectiveness. The product is expected to assist in delivering supplies, evacuating casualties, performing intelligence gathering missions, and operating as a remote weapon system.

- Aug-2021: QinetiQ collaborated with Adarga, one of the UK’s leading artificial intelligence (AI) software developers. Under this acquisition, QinetiQ aimed at using AI to harness the power of data for the defense and security markets. The collaboration combined Adarga’s leading enterprise AI analytics platform with QinetiQ’s experience in helping defense and security customers.

- Aug-2020: BAE Systems acquired Techmodal, a UK-based data consultancy, and digital services firm. From this acquisition, the company focused on strengthening its technology and data portfolio.

- Jun-2019: BAE Systems took over Riptide Autonomous Solutions (Riptide), a Plymouth, Massachusetts-based provider of innovative, affordable unmanned underwater vehicle (UUV) technology and solutions. Through this acquisition, the company aimed at providing customers unmatched flexibility by offering a family of UUVs and integrated payload solutions capable of supporting a variety of critical missions.

- Jun-2019: BAE Systems partnered with UiPath, a robotic process automation (RPA) leader. Under this partnership, the companies aimed at developing suites of software robots that their customers is expected to be able to use to automate high-volume, repetitive business processes. As part of this partnership, BAE Systems is expected to also work with UiPath to develop and embed new automation capabilities within its Advanced Analytics Lab.

- Nov-2018: Elbit Systems acquired IMI Systems, a defense systems house specializing in the development, manufacturing, marketing, and implementation of end-to-end combat-proven solutions. This acquisition synergized the capabilities of both companies enabling them to offer an enhanced portfolio.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Unmanned Aerial Vehicle

- Unmanned Ground Vehicle

- Unmanned Underwater Vehicle

By End User

- Defense & Military

- Commercial

- Residential

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Thales Group S.A.

- Northrop Grumman Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Cobham Limited (Eaton Corporation PLC)

- Kongsberg Group

- Saab AB

- BAE Systems PLC

- Elbit Sytems Ltd.

- QinetiQ Group PLC (The Carlyle Group)

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Thales Group S.A.

- Northrop Grumman Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Cobham Limited (Eaton Corporation PLC)

- Kongsberg Group

- Saab AB

- BAE Systems PLC

- Elbit Sytems Ltd.

- QinetiQ Group PLC (The Carlyle Group)