Molded interconnect devices (MID) are injection molded thermoplastic substrates with conductive circuit patterns which integrate electrical and mechanical functions. These devices integrate housing cables, connectors, and circuit boards, as well as traditional product interfaces, into a fully functional and compact device. These devices are used in a variety of industries, including medicine, automotive, consumer electronics, and telecommunications.

MID reduces circuit density by incorporating fewer auxiliary components, as well as the failure ratio & complexities. These features will increase consumer electronics manufacturers' demand for MID in order to integrate more electronic components into less space. MID is used in mobile devices to improve space utilization by replacing the normal antenna stub with an internal antenna.

When constructing the traces required for a high-performance antenna, LDS processes are capable to fully utilize the 3D structure of a molded plastic body, as opposed to flexible printed circuit board (FPC) antennas & metal sheet stamping antennas. Moreover, because the antenna pattern is defined by a laser beam, the antenna traces can be changed without changing the molding die by simply altering the laser patterning Programme.

COVID-19 Impact Analysis

The COVID-19 pandemic is becoming more serious as a result of its ongoing global spread and the lack of appropriate therapeutic & diagnostic systems. Because the outbreak's epicentre was China, a premium hub of electronic equipment and fabrication technologies, the ongoing disruption has resulted in noticeable changes in the overall demand and supply chain of the molded interconnect device market. Manufacturing is expected to not resume immediately after the lockdown was lifted due to a severe shortage of skilled employees who had already been brought back to their home states.Market Growth Factors

Rising Use of LDS in Manufacturing of 5G Antenna

The demand for better voice & data services has resulted in the deployment of 4G-LTE or 5G services in various parts of the world. Most businesses that use communication are implementing 5G antennas to improve communication speed. The laser direct structuring (LDS) process is ideal for antenna production. Companies are developing antennas for 5G communication systems using the LDS process. The LDS process facilitates the creation of high-frequency antennas on 3D plastic parts of any shape. This procedure eliminates the need for expensive and prone to failure connectors.Increased Use of Mid in the Automotive Industry

Electronic components in vehicles have increased dramatically due to recent advances in traditional automotive technology and the evolution of EVs and HEVs. Sensors and assistive electronics are required in modern vehicles to improve passenger comfort and safety. In order to reduce manufacturing costs, manufacturers are also attempting to decrease the number of electronic devices used in vehicles. This is anticipated to enhance MID demand in the automotive industry. Molded interconnect devices focus on providing value to consumers by integrating superior connection systems, electronics, and software innovation.Market Restraining Factors

High Cost of Raw Material

One of the major factors limiting market expansion is the high cost of raw materials used in molded interconnect device fabrication processes. MID devices are made with raw materials like polycarbonates, high-performance thermoplastics (HPTPs), and resins. These thermoplastics are more expensive than thermosetting & plastic materials, raising overall market production costs. Moreover, precious metals like platinum, aluminum, silver, and gold are required for MID plating applications. Price swings in these high-cost metals reduce market participants' profitability, stifling industry growth.Product Type Outlook

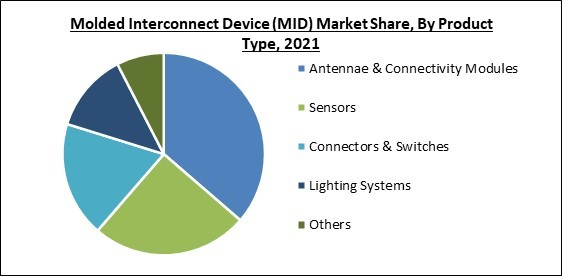

Based on product type, the molded interconnect device market is segmented into antennae & connectivity modules, sensors, connectors & switches, lighting systems and others. In 2021, the antennae & connectivity modules segment dominated the molded interconnect device market by generating the maximum revenue share. With the ability to incorporate mechanical & electrical components into almost any shape of interconnect device, MIDs enable the development of brand-new functions while also enabling the miniaturization of products.Process Outlook

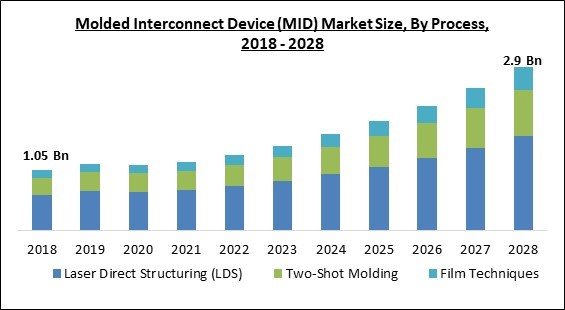

On the basis of process, the molded interconnect device market is fragmented into laser direct structuring (LDS), two-shot molding, and film techniques. The two-shot molding segment covered a significant revenue share in the molded interconnect device market in 2021. The two-shot molding process is a mature and very well method for producing MIDs in a cost-effective and repeatable manner. Two separate molding cycles, different thermostatic polymers, and an electroless plating process are being used to manufacture the component in two-shot molding.Vertical Outlook

By vertical, the molded interconnect device market is classified into telecommunications, consumer electronics, automotive, medical, industrial and military & aerospace. In 2021, the consumer electronics segment led the molded interconnect device market with the highest revenue share. Consumer electronics are electronic devices designed for daily use, typically in communications, entertainment, and office productivity. Almost all electronic devices used for communication, entertainment, and office work are classified as consumer electronics.Regional Outlook

Region wise, the cloud native storage market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region witnessed the largest revenue share in the molded interconnect device market. This is primarily due to several Asian OEMs, and semiconductor device and product manufacturers. The region has excelled in providing the most innovative semiconductor fabrication services and electronic system assembly services, particularly in South Korea, Taiwan, and China. Besides that, semiconductor electronics companies benefit significantly from having their products manufactured in nations like China and Taiwan.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Molex, LLC (Koch Industries, Inc.), TE Connectivity Ltd., Taoglas, KYOCERA AVX Components Corporation (Kyocera Corporation), Amphenol Corporation, LPKF Laser & Electronics AG, HARTING Technology Group, MID Solutions GmbH, and 2E mechatronic GmbH & Co. KG

Scope of the Study

Market Segments Covered in the Report:

By Product Type- Antennae & Connectivity Modules

- Sensors

- Connectors & Switches

- Lighting Systems

- Others

- Laser Direct Structuring (LDS)

- Two-Shot Molding

- Film Techniques

- Consumer Electronics

- Telecommunications

- Automotive

- Medical

- Industrial

- Military & Aerospace

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Molex, LLC (Koch Industries, Inc.)

- TE Connectivity Ltd.

- Taoglas

- KYOCERA AVX Components Corporation (Kyocera Corporation)

- Amphenol Corporation

- LPKF Laser & Electronics AG

- HARTING Technology Group

- MID Solutions GmbH

- 2E mechatronic GmbH & Co. KG

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Molex, LLC (Koch Industries, Inc.)

- TE Connectivity Ltd.

- Taoglas

- KYOCERA AVX Components Corporation (Kyocera Corporation)

- Amphenol Corporation

- LPKF Laser & Electronics AG

- HARTING Technology Group

- MID Solutions GmbH

- 2E mechatronic GmbH & Co. KG