Mobile biometric authentication uses biometrics to recognize and confirm a person's identity when they attempt to access any mobile application. Authentication can be carried out using these mobile biometric devices in a number of different ways, including face recognition, fingerprint readers, voice recognition, and others. Mobile biometrics solutions straddle the line between identity and connectivity.

They make use of smartphones, tablets, other forms of handheld devices, wearable technologies, and Internet of Things devices for their flexible deployment capabilities. Controlling access to information, locations, and systems have become more and more necessary over time. Many businesses currently use cards, PINs, or passwords to verify users' identities before granting access. However, there are significant problems with this conventional method.

In recent years, biometric technology has gained popularity on mobile devices. The technology improved in terms of user-friendliness and consumer affordability. This biometric solution is a method used to authenticate a person who is in possession of a mobile device and uses it as a distinctive biometric identifier. Single-factor authentication (SFA) and multi-factor authentication (MFA) are the two different authentication mechanisms used by mobile biometric systems.

These systems operate using a variety of techniques, including Deep Neural Networks and Keystroke Dynamics. Together, these procedures form a mobile biometrics system that provides coordinated security for mobile devices. The demand for this effective security solution typically increases significantly. In order to determine similarity, biometric authentication compares data for a person's features to that person's biometric "template".

COVID-19 Impact Analysis

The pandemic had a positive impact on the mobile biometrics market. This was due to a significant shift toward the rise of digital stores and e-commerce platforms, which has led to an increase in the use of online payments. The potential for an increase in cyberattacks in the form of fraud and identity theft also guided the market. Secure authentication services for different banking and financial applications, like client KYC and money transfer, are required in such a situation, and the usage of top-notch security tools is crucial.Market Growth Factors

Increase In Platforms Using Biometric Authentication

The demand for biometric solutions has increased over the past few years as digital media and internet content delivery have grown. Traditional methods of authentication, like signatures and text-based credentials, have been shown to be more difficult for users to use because they are so vulnerable to contemporary cyberattacks. Furthermore, customers really need to develop faster methods of authentication due to the growing quantity of digital services.Assurance Of Higher Security With Biometrics Usage

One of the key factors propelling the growth of mobile biometrics is the increasing demand for intelligence security devices in mobile devices to secure the data saved in the devices, such as bank account information, photos, recordings, contacts, and other personalized data. By confirming a physical, real-world characteristic that is (typically) specific to that person, such as fingerprints, facial features, voice articulation, and others, biometric solutions can give providers a higher level of assurance that the person is real.Market Restraining Factors

Wrong And Inaccurate Results Through Biometrics

False positives and inaccuracy are two of the most significant challenges. Biometric authentication procedures rely on insufficient data to confirm a user's identity. For instance, during the enrollment step, a mobile biometric device will scan a whole fingerprint and turn it into data. Future fingerprint biometric authentication, however, will only require a portion of the print to confirm identity, making the process speedier overall.Component Outlook

Based on the component, the mobile biometrics market is segmented into hardware, software and service. The hardware segment garnered the highest revenue share in the mobile biometrics market in 2021. This is caused by the fact that the majority of mobile devices include voice, fingerprint, or facial recognition technologies. Most mobiles in the mediocre range now come with a fingerprint recognition feature at the very least. During the coming years, this segment is likely to have a significant impact on the growth of the mobile biometrics market.Authentication Mode Outlook

On the basis of authentication mode, the mobile biometrics market is bifurcated into single factor authentication and multi factor authentication. The multi-factor authentication segment witnessed a substantial revenue share in the mobile biometrics market in 2021. Multi-factor authentication requires the user to provide more than two verification factors. It allows them access to resources including applications, online accounts, and VPNs. MFA is a key component of a solid identity and access management (IAM) policy.Technology Outlook

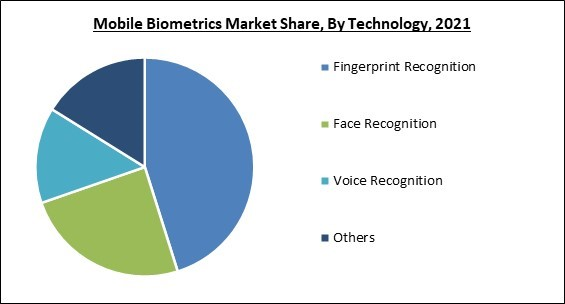

Based on technology, the mobile biometrics market is divided into fingerprint recognition, voice recognition, face recognition, and others. The fingerprint recognition segment garnered the maximum revenue share in the mobile biometrics market in 2021. The most used biometric identification method up until recently was fingerprinting. Because there are low-cost mobile devices with fingerprint biometrics available, most consumers worldwide can afford them.Industry Outlook

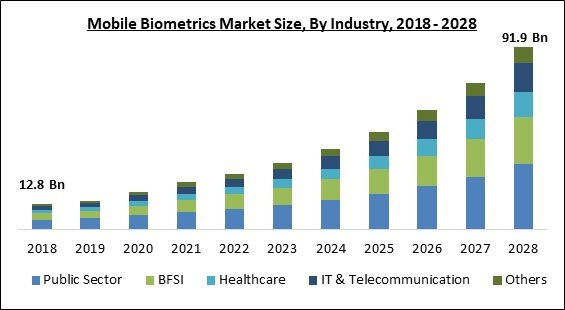

On the basis of industry, the mobile biometrics market is categorized into public sector, BFSI, healthcare, IT & telecommunication, and others. The BFSI segment witnessed a substantial revenue share in the mobile biometrics market in 2021. With the development of technology, one of the key biometric developments in online banking is the usage of mobile biometric data. As more people use banking and financial services via online portals, there is a growing need for sophisticated authentication to safeguard the sensitive information of customers connected to the banking institution.Regional Outlook

Based on region, the mobile biometrics market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired the largest revenue share in the mobile biometrics market in 2021. This is due to the region's high concentration of companies offering mobile biometric solutions, which is projected to propel the market for this technology.Cardinal Matrix - Mobile Biometrics Market Competition Analysis

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Apple, Inc. is the forerunner in the Mobile Biometrics Market. Companies such as 3M Company, BIO-key International, Inc., Aware, Inc. are some of the key innovators in Mobile Biometrics Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3M Company, Apple Inc., NEC Corporation, BIO-key International, Inc., Fujitsu Limited, HID Global Corporation, Precise Biometrics AB, M2SYS Technology, Inc., and Aware, Inc.

Strategies deployed in Mobile Biometrics Market

; Partnerships, Collaborations and Agreements:

- Apr-2022: BIO-key International formed a partnership with 3Eye Technologies, a value-added distributor of mobile, security, and identity solutions. Under this partnership, BIO-key aimed at utilizing 3Eye Technologies' network of VARs and MSPs to expand the scope of its channel sales and marketing and increase market education for organizations about the benefits of IBB-based solutions. Through this partnership, BIO-key is expected to grow its Channel Alliance Partner (CAP) program, expand the use of IBB and continue to be a thought leader in the cybersecurity space.

- Sep-2021: Apple collaborated with the University of California, Los Angeles (UCLA) and Biogen, an American multinational biotechnology company. Through this collaboration, the companies focused on developing new biometric capabilities for iPhones that is expected to detect depression and signs of cognitive decline via expression recognition and behavioral biometrics.

- Jul-2020: NEC Corporation came into collaboration with SITA, a multinational information technology company providing IT and telecommunication services to the air transport industry. Under this acquisition, the companies planned to roll out a walk-through, contactless digital identity solution for airports. The collaboration is expected to leverage NEC’s biometric identity management platform and SITA's Smart Path and SITA Flex solutions. The collaboration resulted in NEC I: Delight which utilized NEC’s cutting-edge digital identity solutions that capitalize on biometrics technologies to deliver a unified customer experience across a wide range of services.

; Product Launches and Product Expansions:

- Jun-2022: Aware launched Knomi, a highly secure authentication alternative to the password. This authentication platform allows organizations to take advantage of the biometric sensors that come built in with modern smartphones. The technology is designed to mitigate the threat of identity theft and eliminate the risk of data breaches that goes along with passwords.

- Aug-2021: BIO-key unveiled a new, Android-based point of sale (POS) solution featuring FBI-certified capacitive fingerprint biometrics. This fingerprint biometric can also be deployed in other scenarios, including microfinance, SIM registration, and inventory management. The solution supports BIO-key fingerprint and contactless PalmPositive biometric technologies and comes with some interesting specs and features.

; Acquisition and Mergers:

- Jul-2022: Apple took over AuthenTec, a semiconductor, computer security, mobile security, identity management, biometrics, and touch control solutions company. From this acquisition, Apple aimed at powering future authentication and securing payment initiatives. This acquisition gave Apple the right to use AuthenTec hardware, software, and patents.

- Apr-2022: 3M acquired technology assets of LeanTec, a provider of digital inventory management solutions for the automotive aftermarket segment in the United States and Canada. This acquisition added new levels of data integration and insights that is expected to allow body shops greater visibility of their business operations, operational efficiency, and a better customer experience.

- Feb-2022: BIO-key acquired Swivel Secure Europe, a Madrid-based digital identity and access management (IAM) and multi-factor authentication provider. From this acquisition, BIO-key aimed at expanding the reach of its identity-bound biometrics throughout the European, Middle East, and African markets.

- Dec-2021: Aware took over Fortress Identity, an intelligent biometrics platform that replaces passwords with secure multimodal and multi-factor identification. Through this acquisition, Aware added technical capabilities around biometric onboarding, know your customer (KYC) checks and authentication to its offerings, and expanded its presence in the financial services market. The acquisition strengthened Aware's position in core markets in Latin America and Europe.

- Nov-2021: Precise Biometrics took over EastCoast, a visitor management system provider. This acquisition boosted Precise’ digital identity software-as-a-service (SaaS) business area and strengthened the company’s positioning in the physical access control market.

- Oct-2020: NEC Corporation acquired Avaloq Group, a Swiss company that develops and provides software for core banking. From this acquisition, NEC acquired digital finance software and domain knowledge as it entered into the field globally and strengthened its business in the digital government field.

- Jul-2020: BIO-key International took over PistolStar, an established provider of large-scale on-premise and Identity-as-a-Service (IDaaS) identity and access management (IAM) solutions. This acquisition strengthened BIO-key’s multi-factor authentication capabilities to offer a complete suite of Identity Access Management and Identity-as-a-Service solutions to a broader universe of enterprise customers.

Scope of the Study

Market Segments Covered in the Report:

By Industry

- Public Sector

- BFSI

- Healthcare

- IT & Telecommunication

- Others

By Technology

- Fingerprint Recognition

- Face Recognition

- Voice Recognition

- Others

By Authentication Mode

- Single Factor

- Multi Factor

By Component

- Hardware

- Software

- Service

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- 3M Company

- Apple Inc.

- NEC Corporation

- BIO-key International, Inc.

- Fujitsu Limited

- HID Global Corporation

- Precise Biometrics AB

- M2SYS Technology, Inc.

- Aware, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- 3M Company

- Apple Inc.

- NEC Corporation

- BIO-key International, Inc.

- Fujitsu Limited

- HID Global Corporation

- Precise Biometrics AB

- M2SYS Technology, Inc.

- Aware, Inc.