Making data and applications that were separately developed function nicely together is integration. When implementing end-to-end IoT business solutions, IoT integration refers to making the combination of new IoT devices, IoT data, IoT platforms, and IoT applications combined with IT assets such as business applications, legacy data, mobile, and SaaS function well together. The collection of IoT integration that IoT project implementers require to successfully integrate end-to-end IoT business solutions is referred to as the IoT integration market.

With oil analysis, it is expected to be possible to manually check the oil level and condition of equipment every week. However, being aware of the oil condition right now will help avoid equipment failure in between those weekly inspections. There are numerous potentials for efficiency and cost savings due to all the data and reporting. IoT-connected lights are a basic illustration.

To save on electricity, they can be programmed to only turn on when a space is being used or have automated settings to switch lights on or off based on business hours. The in-line oil analysis example resulted in an average cost reduction of 50% as those companies use their oil twice as much. Through this integration, the user can avoid having to enter any data while creating a work order and spend less time checking the oil. Additionally, the company lessens its environmental impact by using less oil.

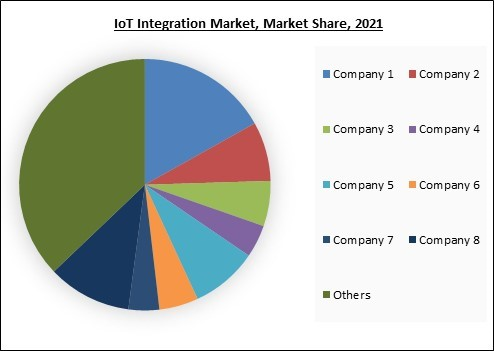

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

COVID-19 Impact Analysis

IoT integration services are among the many businesses that the Covid-19 pandemic has disrupted. Due to Covid-19's low productivity, projects have been disrupted, and businesses are delaying the deployment of IoT integration services. As a result, the market for IoT integration services grew less rapidly in 2020 than it did in 2019. Governments and businesses are using technologies like extended reality, data analytics, the Internet of Things, and artificial intelligence to address the particular problems brought by Covid-19. The healthcare sector has undergone tremendous upheaval as a result of the new coronavirus pandemic.Market Growth Factors

Increasing acceptance of bring your own devices

The popularity of BYOD and remote workplace management solutions has surged in response to the rising demand for IoT devices. Employers are encouraging workers to bring their own devices to work. By allowing workers to work from home and on the device of their choosing, BYOD has helped firms save money by avoiding the purchase of corporate devices. Demand for a universal platform that supports several applications has been generated by this development. A way to connect various devices is through IoT integration services. These services offer real-time, two-way communication between the systems and gadgets.Advancing wireless technology of the IoT integration

Emerging technologies like robots, drones, self-driving cars, and new medical devices all depend heavily on wireless technology. Over the next two years, there will likely be an increase in the need for wireless technologies due to the growing adaptation of Low Power Wide Area Network (LPWAN), Long Range Wide Area Network (LoRaWAN), and wireless sensor networks, 5G, and IPV6. These new technologies provide capabilities like low power consumption and long-range connectivity to create the proper foundations and platforms for IoT landscape advancements.Market Restraining Factors

Lack of cutting-edge communication tools and insufficient operational effectiveness

A standardized interface and communication standards are necessary for IoT-enabled devices to share data or create an intelligent network. The ease of information flow and interoperability amongst linked devices are crucial. To solve the interoperability problems across various connected devices, the existing technical and market situations related to IoT integration services do not offer a promising architectural solution or a standard. The growth and success of the products and services embracing IoT integration depend significantly on interoperability. The IoT interconnection between devices and products is the biggest barrier for all markets and customers since their systems don't adhere to international standards for connectivity and integration.Organization Size Outlook

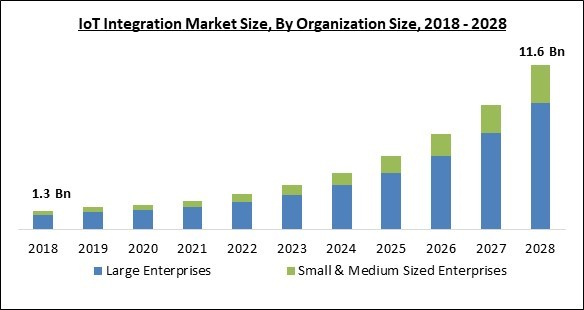

On the basis of Organization Size, the IoT Integration Market is divided into Small & medium-sized enterprises and large enterprises. The small & medium-sized enterprises segment witnessed a substantial revenue share in the IoT integration market in 2021. SMEs may have historically managed their IT systems, and they hardly ever know when their information is in danger. IoT integration services have been difficult to catch on with SMEs in the present market environment.Service Outlook

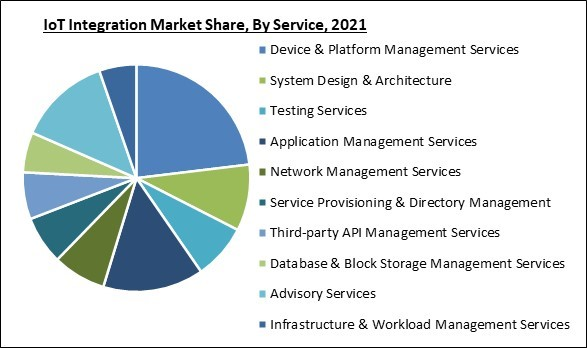

Based on the Service, the IoT Integration Market is segmented into Device and Platform Management Services, Application Management Services, Advisory Services, System Design and Architecture, Testing Services, Service Provisioning and Directory Management, Third-party API Management Services, Database, and Block Storage Management Services, Network Management Services, and Infrastructure and Workload Management Services. The device & platform management services segment acquired the highest revenue share in the IoT integration market in 2021. It is due to the category of device and platform management services because they provide a wide range of services, such as connectivity, remote monitoring, and troubleshooting of heterogeneous devices. Additionally, the platform enables integration, connection, and management of visibility across international IoT chains. Additionally, rising automation use across numerous business verticals to satisfy rising customer demand fuels market expansion.Application Outlook

By Application, the IoT Integration Market is bifurcated into Smart building and home automation, Smart Healthcare, Energy & utilities, Industrial manufacturing and automation, Smart retail, and Smart transportation, logistics, and telematics. The industrial manufacturing and automation segment registered a significant revenue share in the IoT integration market in 2021. Due to the rising demand for improved operational performance and improved production methods. To increase operational efficiency, the manufacturing sectors are implementing IoT technologies, sensors, and wireless connectivity.Regional Outlook

Region wise, the IoT Integration Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region acquired the largest revenue share in the IoT integration market in 2021. It is due to the early users of IoT integration solutions and services including businesses in the region. The area has advanced technologically, and several government programs, including smart cities and IIoT, have been embraced. In North America, which includes the US and Canada, the market for IoT integration is expanding steadily.Cardinal Matrix - IoT Integration Market Competition Analysis

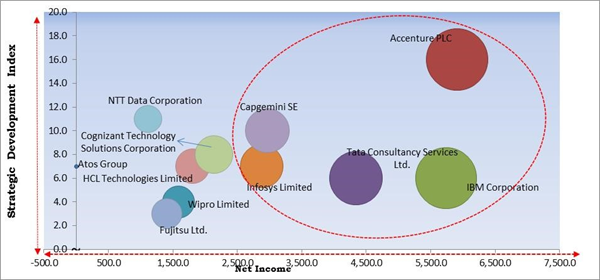

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Tata Consultancy Services Ltd., Infosys Limited, Capgemini SE, Accenture PLC, IBM Corporation are the forerunners in the IOT Integration Market. Companies such as IBM Corporation, NTT Data Corporation, Cognizant Technology Solutions Corporation are some of the key innovators in IOT Integration Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Tata Consultancy Services Ltd., Wipro Limited, Atos Group, Accenture PLC, Fujitsu Limited, Infosys Limited, Capgemini SE, HCL Technologies Ltd. (HCL Enterprises), IBM Corporation, Cognizant Technology Solutions Corporation and NTT Data Corporation.

Strategies deployed in IoT Integration Market

; Partnerships, Collaborations and Agreements:

- Jun-2022: Accenture joined hands with Johnson Controls, the global leader for healthy, smart, and endurable buildings. Together, the companies aimed to provide and operate two new OpenBlue Innovation Centers which is expected to propel Johnson Controls’ rollout of building control system services and products utilizing technologies including digital twins, artificial intelligence (AI), internet of things (IoT), 5G and the cloud. Additionally, the purpose is to drive developed automation in producing operations to attain greater security, safety, sustainability, and consumer experiences.

- May-2022: Atos signed a three-year agreement with Sparkle, the first global service provider in Italy and with the top global operators. Together, the companies aimed to create business possibilities supporting the global existence and the precise expertise area of each enterprise.

- Mar-2022: NTT joined hands with Schneider Electric, a French multinational company that specializes in digital automation. Through this collaboration, the companies aimed to direct the P5G platform at Schneider’s Lexington Smart Factory by early 2022. Additionally, The Lexington Smart Factory is the foremost of Schneider Electric’s US plants to evolve as a Smart Factory showcase area utilizing Edge analytics, IoT connectivity, and predictive analytics to propel energy effectiveness and help achieve environmental goals.

- Jan-2022: Atos formed a partnership with Verizon Business, an American wireless network operator. Through this partnership, the companies aimed to authority intelligent IoT solutions with private 5G multi-access edge computing for companies, governments, and communities across the world. Moreover, by combining the expertise of Verizon and Atos, companies is expected to be capable to develop immersive digital experiences that completely exercise 5G conditions on the edge of their networks, symbolizing the next breakthrough in enterprise value.

- Aug-2021: Wipro Limited came into a partnership with HERE Technologies, the location data, and technology medium. Through this partnership, the companies aimed to deliver location-based services, to consumers from Manufacturing, Energy & Utilities, Transport & Logistics, Telecom, and Automotive sector verticals. Additionally, the Internet of Things (IoT) established smart metering solutions designed by companies that is expected to deliver better information to consumers on energy utilization and asset management.

- Jul-2021: Capgemini teamed up with Qualcomm Technologies, a global leader in 5G, computing, and wireless communications. Through this collaboration, the companies aimed to open the advantages of 5G private networks to sustain their customer's digital shift towards the Intelligent Industry. Additionally, collaboration is expected to enhance compatibility, deliver proven execution, and reduce deployment for consumers glancing to unlock the advantages of 5G private networks.

- Jun-2021: Wipro Lighting formed a partnership with Enlighted, the foremost supplier of Internet of Things (IoT) solutions for retail buildings to provide smarter workplaces. Together, the companies aimed to combine their technologies and solutions to produce smarter buildings across numerous consumer segments. Moreover, Enlighted IoT sensors are combined with Wipro’s smart luminaires, forming the spine for Wipro’s Smart Space Solutions.

- Jun-2021: Infosys joined hands with Archrock, the foremost supplier of natural gas compression services in the U.S. Through this collaboration, Infosys is expected to utilize its pre-configured module for Microsoft Dynamics 365 Field Service Application to reinforce and improve the effectiveness of Archrock’s field operations and services.

- Oct-2020: IBM formed a partnership with ClearBlade, an award-winning edge computing software enterprise. Together, the companies aimed to permit enterprises to quickly process, deploy, store, and research data at the edge, opening their maximum potential to digitally convert.

- Apr-2020: NTT Corporation formed a partnership with Tanium, feature-packed endpoint management. Together, the companies aimed to deliver secure, highly dependable solutions for IT, IoT, and OT conditions, to help Smart World deployments.

; Product Launches and Product Expansions:

- Jun-2022: HCL Technologies introduced Industry NeXT, a transformational framework developed to assist clients in digitally reinvent their companies. The new Industry NeXT builds on the industry 4.0 (I4.0) foundation and allows companies globally to prepare, plan, and seamlessly transform into a collaborative environment. Additionally, it permits promoting affiliated experiences, resilient processes, and the delivery of combined physical and digital products and services supported by intelligent digital interventions.

- May-2022: NTT introduced IoT Services for Sustainability portfolio. the new pile of solutions is expected to permit companies to advance progress against global sustainability industries and make data-driven judgments to decrease their carbon impression through the clever usage of IoT connectivity.

- May-2022-May Atos introduced Atos Business Outcomes-as-a-Service, a 5G, edge, and IoT portfolio designed in collaboration with Dell Technologies. The new Atos Business Outcomes-as-a-Service carries the benefits of cloud architecture to the edge and far edge to provide AI-based enterprise value expanded with end-to-end automated monitoring, deployment, and administration.

- Sep-2021: Infosys launched Equinox. The new platform leverages on raised demand from enormous companies to provide Amazon-like digital commerce and omnichannel experiences to their consumers.

- Jun-2021-Jun Fujitsu Components introduced Endurance Line. The new line-up puffs four new Mesh machines that are developed to elegantly merge into the surroundings, holding great flexibility when it comes to installation, but feature classic Japanese patterns which represent each Endurance Line Smart Building device, carrying quality to the maximum level.

- Mar-2021: Tata Consultancy Services introduced the TCS Connected Consumer Home solution based on RDK, to allow media and communication service providers to deliver reflexive and exciting connected customer experiences. The new TCS Connected Consumer Home Solution normalizes core functions used in broadband, video, and next-generation smart home IoT solutions, allow providing premium consumer experiences and encourages new industry models and innovation in this segment.

- Dec-2020: Tata Consultancy Services unveiled TCS Clever Energy, enterprise-level energy, and emission managing system. The new TCS Clever Energy permits industrial and commercial associations to be more endurable, secure energy and cost effectiveness, reduce carbon emissions, and achieve their carbon impartial purposes.

; Acquisitions and Mergers:

- Jul-2022: HCL Technologies completed the acquisition of Quest Informatics Private Limited, an aftermarket, Industry 4.0, and IoT company. Through this acquisition, Quest is expected to extend HCL Technologies’ Industry 4.0 portfolio into the quick-growing aftermarket space. Additionally, Quest's offering of aftermarket solutions and products is expected to be useful to manufacturing and transport customers globally in their digital conversion journey.

- Mar-2022: NTT DATA completed the acquisition of Vectorform, a digital transformation and creation business. Through this acquisition, Vectorform assembles NTT DATA’s adherence to developing its global digital engineering and creation abilities and enabling to boost consumers’ existing and future digital transformation schedules.

- Nov-2021: Capgemini completed the acquisition of Empired Limited, a national IT Services Provider. Under this acquisition, the integrated scale and wide services offering is expected to position Capgemini as a digital, data, and cloud market head in the region, with vast abilities across the complete Microsoft technology product offering.

- Nov-2020: Cognizant took over Bright Wolf, a privately-held technology services supplier. With this acquisition, Bright Wolf is expected to increase its smart products portfolio and expertise in architecting and executing IIoT solutions.

- Sep-2020: Accenture completed the acquisition of SALT Solutions, a technology consultancy headquartered in Würzburg, Germany. This acquisition is expected to permit Accenture to construct cloud-based industrial internet of things (IoT) platforms that boost up and improve clients’ logistics and production and allow them to lower grade and junk points along the whole supply chain.

- May-2020: Accenture took over Callisto Integration, a Canada-based provider of technology and consulting services. This acquisition is expected to expand Accenture’s abilities to assist clients in North America provide the timely exhibition of orders, growing their yield, and improving the quality of their products.

Scope of the Study

Market Segments Covered in the Report:

By Organization Size

- Large Enterprises

- Small & Medium Sized Enterprises

By Service

- Device & Platform Management Services

- System Design & Architecture

- Testing Services

- Application Management Services

- Network Management Services

- Service Provisioning & Directory Management

- Third-party API Management Services

- Database & Block Storage Management Services

- Advisory Services

- Infrastructure & Workload Management Services

By Application

- Smart Building & Home Automation

- Industrial Manufacturing & Automation

- Smart Healthcare

- Smart Retail

- Smart Transportation, Logistics & Telematics

- Energy & Utilities

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Tata Consultancy Services Ltd.

- Wipro Limited

- Atos Group

- Accenture PLC

- Fujitsu Limited

- Infosys Limited

- Capgemini SE

- HCL Technologies Ltd. (HCL Enterprises)

- IBM Corporation

- Cognizant Technology Solutions Corporation

- NTT Data Corporation

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Tata Consultancy Services Ltd.

- Wipro Limited

- Atos Group

- Accenture PLC

- Fujitsu Limited

- Infosys Limited

- Capgemini SE

- HCL Technologies Ltd. (HCL Enterprises)

- IBM Corporation

- Cognizant Technology Solutions Corporation

- NTT Data Corporation