Speak directly to the analyst to clarify any post sales queries you may have.

Recent Developments in the Singapore Elevator and Escalator Market

- In August 2024, Otis unveiled its Gen3™ connected elevator platform at its ‘Platform for Possibility’ launch event in Southeast Asia.

- Furthermore, in 2024, Mitsubishi Electric Building Solutions Corporation announced its new elevator type, NEXIEZ-Fit’, which is an elevator that combines superior cost performance with carefully selected specifications.

- Moreover, in December 2024, KONE announced the launch of its High-Rise MiniSpaceTM DX elevator in the Southeast Asia market. The elevator comes with KONE UltraRope®, which is 80% lighter than traditional steel rope and three times more durable.

SEGMENTATION INSIGHTS

- The Singapore elevators market by the installed base is expected to reach 77.2 thousand units by 2030.

- Elevators used in the residential sector accounted for the largest share, despite low purchasing power due to high interest rates. The market is set to recover in 2025 pertaining to high government expenditure on construction projects.

- The machine room-less traction segment accounted for the largest market share due to its high popularity.

- The Singapore-installed base escalators market is expected to reach 8.2 thousand units by 2030.

- Escalators used in public transits accounted for the largest share in 2024 due to increasing public transit projects in the pipeline.

- The parallel escalators segment accounted for the largest industry share in 2024 due to the high construction of commercial buildings.

- The modernization market in Singapore is expected to reach USD 146.07 million by 2030.

- Singapore’s tourism sector is propelling foreign direct investment in the country’s hospitality sector. The government’s focus on boosting tourism through programs such as the four-year Tourism Development Fund (TDF), and other long-term economic strategies will lead to a significant increase in investments in the hospitality industry in 2025 and beyond.

Elevator Market Segmentation by

Machine Type

- Hydraulic and Pneumatic

- Machine Room Traction

- Machine Room Less Traction

- Others

- Climbing

- Elevators

- Industrial Elevators

Carriage Type

- Passenger

- Freight

Capacity

- 2-15 Persons

- 16-24 Persons

- 25-33 Persons

- 34 Persons and Above

End-User

- Commercial

- Residential

- Industrial

- Others

- Public Transit

- Institutional

- Infrastructural

Escalator Market Segmentation by

Product Type

- Parallel

- Multi Parallel

- Walkway

- Crisscross

End-User

- Public Transit

- Commercial

- Others

- Institutional Sector

- Infrastructure

- Industrial

MARKET OPPORTUNITIES & DRIVERS

Integration of Artificial Intelligence (AI) Is Expected to Create Future Opportunities in the Singapore Elevator and Escalator Market

- The integration of AI in the Singapore elevator and escalator market reflects a growing trend in the modernization of urban infrastructure. AI-driven solutions enhance safety, efficiency, and user experience in public and private transportation systems.

- AI monitors real-time data from sensors installed in elevators and escalators to predict and prevent potential malfunctions. This reduces downtime and improves the reliability of equipment. Companies like KONE and Otis have already implemented AI-based predictive maintenance globally, including in Asia-Pacific countries like Singapore.

- Singapore’s government developed its Smart Nation concept to solve the growing problems of an aging population, urban density, and energy sustainability.

Sustainable Construction Practices to Drive Demand

- According to the Singapore Residential Property Market Analysis 2024, published in May 2024, residential property prices in Singapore continue to rise. Modular construction emerges as a key solution in this regard.

- The Housing & Development Board has initiated the use of prefabrication technology in public housing, achieving significant productivity improvements and maintaining housing affordability through innovative building designs and construction methods.

- The private sector in Singapore is also adopting modular construction, with projects such as Avenue South Residence showcasing how modular technologies can efficiently deliver high-rise, sustainable residential buildings.

Booming Manufacturing Sector Supporting the Singapore Elevator and Escalator Market Growth

- Through its Manufacturing 2030 plan, Singapore aims to increase manufacturing output by 50% by 2030 end, emphasizing both physical and digital transformation. This includes prompting innovation in advanced electronics and adopting Industry 4.0 technologies like AI and robotics.

- In November 2024, Singapore’s manufacturing output expanded for the fifth straight month, as production surged in the electronics industry (which accounts for nearly half of the country’s manufacturing output). Total factory output rose by 8.5% in November 2024.

Rising Construction Expenditure Is Driving The Demand

- The rising growth of the Singapore elevator and escalator market aligns with the projected growth in construction activity. The Building and Construction Authority (BCA) recently estimated the total construction demand for 2025 to range between USD 35 billion and USD 39 billion in real terms, reflecting an increase of 0.3% to 11.7% compared to pre-COVID levels in 2019.

- This surge is driven by major developments like Changi Airport Terminal 5, the Marina Bay Sands expansion, public housing projects, and upgrading works. In 2024, construction demand reached USD 44.2 billion in nominal terms, surpassing earlier forecasts of USD 35 billion to USD 41 billion.

INDUSTRY RESTRAINTS

Skilled Labor Shortage in The Country To Hamper The Demand

In recent years, Singapore has grappled with a rising skilled labor shortage, impacting various industries, including construction, manufacturing, and technology sectors. Adding to this challenge is the country’s aging population. As of mid-2022, 17.6% of Singapore’s residents were aged 65 and above, a proportion that is expected to rise to 25% by 2030. Furthermore, the construction industry, which is the backbone of new elevator and escalator installations, has been severely impacted by the labor crunch. Delays in construction projects, higher labor costs, and potential compromises in installation quality are becoming common in Singapore.Singapore’s Land Scarcity Issue Is Hampering Construction of Data Centers

Singapore’s position as one of the leading hubs for data centers in Southeast Asia has historically driven demand for infrastructure, consequently driving demand for vertical transportation solutions. Data centers often require large physical space and multi-story configurations, which are significant drivers of the Singapore elevator and escalator market to ensure efficient internal operations. However, the government’s suspension announcement of new data center construction in 2020 (aimed at addressing energy consumption concerns), has curtailed the pace of new developments.VENDOR LANDSCAPE

- Mitsubishi Electric, Otis Elevator, TK Elevator, Schindler Group, and Kone Corporation are the top manufacturers in the Singapore elevator and escalator market.

- Other prominent players in the Singapore elevator and escalator market are Hitachi Ltd., Fujitec Co., Ltd, Hyundai Elevator Co., Ltd., Toshiba Elevator and Building Systems Corporation (TELC), Sigma Elevator, Stannah Lifts Holdings Ltd, and others. These leading players continuously innovate to provide state-of-the-art technology, ensuring safety, efficiency, and sustainability.

Key Vendors

- Otis

- KONE

- TK Elevator

- Schindler

- Mitsubishi Electric

- Hitachi

- Hyundai Elevator

- Fujitec

Other Prominent Vendors

- Toshiba Elevator and Building Systems Corporation

- Sigma Elevator

- Stannah Lifts Holdings Ltd

- CA M&E Elevator

- Gylet

- IFE ELEVATORS CO., LTD.

KEY QUESTIONS ANSWERED

1. How big is the Singapore elevator and escalator market?2. What will be the growth rate of the Singapore elevator and escalator market?

3. What are the key opportunities in the Singapore elevator and escalator market?

4. What is the number of installed bases in the Singapore elevator and escalator market in 2024?

5. What are the key Singapore elevator and escalator market players?

Table of Contents

Companies Mentioned

- Otis

- KONE

- TK Elevator

- Schindler

- Mitsubishi Electric

- Hitachi

- Hyundai Elevator

- Fujitec

- Toshiba Elevator and Building Systems Corporation

- Sigma Elevator

- Stannah Lifts Holdings Ltd

- CA M&E Elevator

- Gylet

- IFE ELEVATORS CO., LTD.

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 116 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

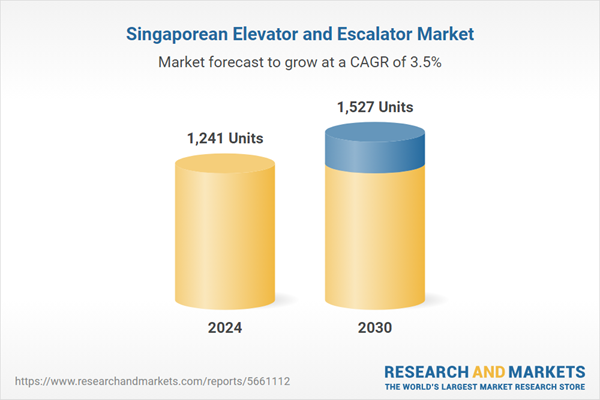

| Estimated Market Value in 2024 | 1241 Units |

| Forecasted Market Value by 2030 | 1527 Units |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Singapore |

| No. of Companies Mentioned | 14 |