Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is characterized by a diverse range of products, including single-door, double-door, and side-by-side refrigerators, catering to different consumer needs. Energy efficiency and environmental concerns have also become key considerations for consumers, prompting manufacturers to introduce more energy-efficient models. Prominent international brands like Samsung, LG, and Panasonic have established a strong presence in the Vietnamese market, alongside local players like Electrolux and Sanyo.

Additionally, government initiatives to promote energy efficiency and technological advancements are driving innovation and competition in the market. The e-commerce sector has played a pivotal role in the distribution and sales of refrigerators, making it convenient for consumers to browse and purchase products online. The ongoing urbanization and the modernization of retail infrastructure further contribute to the growth of the refrigerator market in Vietnam. Overall, the Vietnam refrigerator market is expected to continue its upward trajectory, reflecting the changing lifestyle and economic landscape of the country.

Key Market Drivers

Rising Disposable Incomes and Middle-Class Expansion

One of the primary drivers of the refrigerator market in Vietnam is the increasing disposable income of the population. As Vietnam's economy continues to grow, there has been a significant rise in the income levels of the people. This has led to an improved standard of living, which includes the ability to afford modern appliances like refrigerators.As more households move into the middle-class bracket, there is a growing demand for higher-end refrigerators with advanced features and greater storage capacity. The expanding middle class is also characterized by changing lifestyle preferences. People are now more inclined to dine out less and cook at home, which necessitates the need for a refrigerator to store fresh food and groceries. As a result, this demographic shift contributes significantly to the increasing sales of refrigerators in Vietnam.

Urbanization and Smaller Living Spaces

Urbanization is a prominent trend in Vietnam, with more people moving to cities in search of better job opportunities and improved living conditions. In urban areas, living spaces tend to be smaller and compact, making it necessary for consumers to optimize their storage solutions. This trend has boosted the demand for compact and space-efficient refrigerators, such as single-door and bottom-freezer models, which are suitable for smaller apartments and homes. Furthermore, the fast-paced urban lifestyle requires convenience and quick access to food. Refrigerators with features like quick-cooling technology, smart storage solutions, and flexible shelving options are in high demand to meet the needs of urban consumers. Manufacturers have responded to this demand by introducing innovative and compact refrigerator designs, making them an ideal choice for urban dwellers.Focus on Food Preservation and Storage

With the growing awareness of health and hygiene, consumers in Vietnam are placing a greater emphasis on the preservation and storage of food. Refrigerators play a crucial role in maintaining the freshness and quality of groceries and cooked meals. This focus on food safety and quality has driven the demand for refrigeration appliances. In addition to basic cooling functions, consumers are seeking refrigerators with features such as humidity control, air filtration, and specialized compartments for storing fruits, vegetables, and meat. The desire to reduce food waste and save money by extending the shelf life of perishable items has led to a surge in the adoption of refrigerators equipped with advanced technology to ensure better food preservation.Energy Efficiency and Environmental Concerns

Energy efficiency and environmental sustainability have become important considerations for consumers and policymakers in Vietnam. The government has implemented regulations and initiatives to promote energy-efficient appliances, including refrigerators. As a result, consumers are increasingly opting for energy-efficient refrigerator models that not only reduce electricity bills but also have a lower environmental impact. Manufacturers have responded by developing refrigerators that meet these energy efficiency standards and incorporate environmentally friendly features, such as R600a refrigerants and LED lighting.Energy labels and certifications like the Vietnam Energy Efficiency Label (VEEL) help consumers make informed choices by providing information on a refrigerator's energy consumption and environmental impact. Additionally, global concerns about climate change and greenhouse gas emissions have heightened environmental awareness among consumers, encouraging them to make sustainable choices. This has led to an increasing demand for refrigerators that have a reduced carbon footprint and contribute to the overall sustainability goals of the country.

The Vietnam refrigerator market is being driven by a combination of factors, including rising incomes, urbanization, the need for efficient food storage, and environmental considerations. These drivers are shaping the market's dynamics and propelling it towards continued growth. As consumer preferences and economic conditions evolve, the refrigerator market in Vietnam is expected to see further innovation and expansion to meet the changing demands of the population. Manufacturers and retailers in the industry will need to remain responsive to these drivers to maintain their competitive edge in this dynamic market.

Key Market Challenges

Intense Competition and Market Saturation

As the refrigerator market in Vietnam continues to expand, competition among both international and domestic manufacturers has intensified. A plethora of brands and models are available in the market, leading to market saturation. While this gives consumers more options, it poses challenges for manufacturers to differentiate their products and maintain profitability. The highly competitive landscape puts pressure on pricing and profit margins.Manufacturers must continually innovate to offer unique features and advanced technology while keeping costs in check. In some cases, companies may resort to price wars, which can be detrimental to the long-term sustainability of the industry. Additionally, due to market saturation, manufacturers are investing heavily in marketing and promotions to capture market share, further increasing operating costs. As a result, companies must find ways to balance competition and profitability to thrive in this environment.

Consumer Price Sensitivity

Price sensitivity remains a key challenge in the Vietnam refrigerator market. While there is growing demand for advanced and feature-rich refrigerators, many consumers are highly price-conscious. A significant portion of the population still prefers more budget-friendly options, especially in a price-sensitive market like Vietnam. Manufacturers must strike a balance between offering cost-effective models and premium, high-end refrigerators.To cater to a broad consumer base, companies often introduce multiple product lines with varying price points and features. This can be challenging as it requires effective supply chain management, marketing strategies, and product positioning to meet diverse consumer demands. Price sensitivity is also influenced by the economic conditions of the country. Fluctuations in currency exchange rates and inflation can impact consumer purchasing power, making it difficult for manufacturers to set stable prices and maintain profit margins.

Technological Adoption and Consumer Education

The rapid technological advancements in refrigeration appliances, including smart features, energy efficiency, and eco-friendly innovations, present a challenge related to consumer education and adoption. While some consumers are eager to embrace the latest technologies, many may not fully understand or appreciate the benefits of these innovations. Manufacturers face the challenge of effectively educating consumers about the advantages of features like inverter compressors, smart connectivity, and energy-efficient systems. This often requires substantial marketing efforts and after-sales support to address consumer queries and concerns. The adoption of new technologies can also vary across different regions of Vietnam. Rural areas may not have the same level of awareness or access to advanced appliances compared to urban centers. Companies need to tailor their marketing and distribution strategies to accommodate these disparities in technological adoption.Infrastructure and Distribution Challenges

The distribution and retail infrastructure in Vietnam can be a significant hurdle for refrigerator manufacturers. The country's geography, which includes urban centers, rural areas, and remote regions, presents logistical challenges for the efficient distribution of refrigeration appliances. Inadequate transportation and warehousing facilities in some areas can lead to delays and increased costs associated with the supply chain. Manufacturers need to develop a robust distribution network that reaches all corners of the country while ensuring the safe and timely delivery of products.Additionally, the expansion of e-commerce has disrupted traditional brick-and-mortar retail models, forcing manufacturers to adapt to changing consumer preferences. Companies must invest in e-commerce capabilities, digital marketing, and online sales channels to stay competitive. However, this transition can be challenging for some manufacturers that are not well-equipped for e-commerce operations. The need for reliable after-sales service and customer support is crucial in the refrigerator market. Ensuring that customers have access to maintenance, repairs, and spare parts can be challenging, especially in remote areas.

Manufacturers must develop a robust after-sales service network to provide timely assistance to customers across the country. The Vietnam refrigerator market offers substantial growth opportunities, it also faces several challenges, including intense competition, consumer price sensitivity, technological adoption hurdles, and infrastructure and distribution issues. Successfully navigating these challenges requires manufacturers to remain agile, innovative, and customer-focused, adapting their strategies to the unique characteristics and evolving dynamics of the Vietnamese market. Overcoming these challenges can lead to long-term success in a market that continues to evolve and expand.

Key Market Trends

Shift Towards Energy Efficiency and Eco-friendliness

One prominent trend in the Vietnam refrigerator market is the growing emphasis on energy efficiency and eco-friendliness. As consumers become more environmentally conscious and seek to reduce their carbon footprint, the demand for energy-efficient refrigerators has surged. Manufacturers are responding by introducing refrigerators with inverter technology, which adjusts compressor speed according to cooling demands, resulting in lower energy consumption.These models often come with energy labels and certifications to inform consumers about their efficiency. Additionally, eco-friendly refrigerants such as R600a and R290 are being increasingly used to minimize the environmental impact of refrigeration systems. The Vietnamese government has also played a role in promoting energy-efficient appliances through initiatives and regulations. As a result, energy-efficient and eco-friendly refrigerators are becoming a standard choice for many consumers in Vietnam.

Rise of Smart and Connected Appliances

The adoption of smart and connected appliances is gaining momentum in the Vietnamese refrigerator market. Consumers are showing a growing interest in refrigerators with advanced features like Wi-Fi connectivity, mobile app control, and integration with other smart home devices. These features offer convenience and customization, allowing users to adjust settings, receive alerts, and monitor the refrigerator's contents remotely. Smart refrigerators often include touch screens or displays on the door, which enable users to access recipes, check the weather, or play music. Some models even incorporate voice-activated virtual assistants, enhancing the overall user experience. This trend aligns with the global movement toward the Internet of Things (IoT) and smart homes. Manufacturers are working to meet the demands of tech-savvy consumers by developing innovative, connected refrigeration appliances that cater to modern lifestyles.\Customization and Flexible Storage Solutions

Vietnamese consumers are increasingly looking for refrigerators that offer flexibility and customization in terms of storage solutions. This trend is driven by changing dietary preferences, an emphasis on food storage, and the need to optimize limited kitchen space, especially in urban areas. Refrigerators are now designed with adjustable shelves, moveable dividers, and versatile compartments, allowing users to configure the interior to accommodate various types of food items. This flexibility enables better organization and the ability to store bulkier or irregularly shaped items with ease. Specialized storage features, such as humidity-controlled drawers for fruits and vegetables, and separate compartments for different types of meat, have gained popularity. These options help maintain food freshness and quality, which aligns with the growing emphasis on food preservation.Compact and Space-Efficient Models

As urbanization continues in Vietnam, many consumers are residing in smaller living spaces, such as apartments and condominiums. This has led to a trend in the demand for compact and space-efficient refrigerators. Single-door and bottom-freezer models are becoming more popular because of their smaller footprint and ability to fit into tight kitchen spaces. Manufacturers have responded to this trend by designing sleek and compact refrigerators with modern aesthetics that match the interior décor of smaller homes.Additionally, counter-depth and slim-profile models are gaining traction, providing a seamless, built-in look that saves space without compromising on storage capacity.While compact refrigerators are a common choice for urban dwellers, they are not limited to this demographic. Even in larger households, consumers often opt for smaller secondary refrigerators for convenience and to segregate specific types of food.

The Vietnam refrigerator market is experiencing several notable trends, including a shift towards energy efficiency and eco-friendliness, the rise of smart and connected appliances, an emphasis on customization and flexible storage solutions, and the popularity of compact and space-efficient models. These trends reflect the evolving needs and preferences of Vietnamese consumers, as well as the influence of global technological and environmental movements. Manufacturers in the industry are adapting to these trends by introducing innovative and feature-rich refrigeration appliances that cater to the diverse and dynamic Vietnamese market.

Segmental Insights

Type Insights

The bottom freezer segment was experiencing remarkable growth in the Vietnam refrigerator market. This trend is primarily driven by changing consumer preferences and lifestyle needs. Vietnamese consumers are increasingly looking for modern and efficient refrigeration solutions that offer both convenience and practicality. The bottom freezer design, with the refrigerator compartment at eye level and the freezer section at the bottom, aligns well with the preferences of many households.The advantages of the bottom freezer configuration include easy access to frequently used items in the refrigerator, reduced bending and stooping, and improved organization of food items. This design is particularly appealing to urban dwellers and smaller households where space optimization is crucial. It not only offers a contemporary and streamlined look to kitchens but also provides efficient storage options for fresh foods. Manufacturers in the Vietnam refrigerator market are recognizing the growing popularity of bottom freezers and are introducing a range of models with innovative features to cater to this segment, further propelling its growth.

Sales Channel Insights

Online sales have emerged as a rapidly growing segment in the Vietnam refrigerator market, reflecting the changing consumer behavior and retail landscape. The convenience, wide product selection, and competitive pricing offered by e-commerce platforms have made online sales an increasingly popular choice for consumers seeking refrigeration appliances in Vietnam. The rapid expansion of internet access and smartphone penetration in the country has facilitated the shift towards online purchases. Consumers can now research, compare, and purchase refrigerators from the comfort of their homes, saving time and effort.Additionally, various promotional campaigns, discounts, and customer reviews on e-commerce websites contribute to the online sales growth. Manufacturers and retailers have recognized the potential of online sales and are investing in robust e-commerce strategies, including user-friendly websites, secure payment gateways, and efficient delivery systems. This trend is further accelerated by the COVID-19 pandemic, which has reinforced the importance of online shopping and contactless delivery. As the digital landscape continues to evolve, online sales are expected to remain a prominent and growing segment in the Vietnam refrigerator market.

Regional Insights

Northern Vietnam stand out as the dominant region in the Vietnam refrigerator market due to a combination of factors that have contributed to its leading position. The region, comprising major cities like Hanoi and Hai Phong, as well as numerous urban centers and a significant portion of the country's population, has been a key driver of market growth. The northern region has a higher population density and greater urbanization compared to other parts of Vietnam. This demographic concentration has led to a higher demand for refrigerators, especially in urban households where modern appliances are increasingly essential.The northern region is the country's economic and administrative center, with higher income levels and increased purchasing power. As a result, consumers in this region are more likely to invest in higher-end refrigerators with advanced features. The northern region has a well-established distribution network, including a strong presence of retail stores, electronics chains, and e-commerce platforms. This infrastructure makes it easier for consumers to access a wide range of refrigerator options. The northern region dominates the market, other parts of Vietnam, such as the central and southern regions, are also experiencing growth, driven by rising incomes, urbanization, and changing consumer preferences. However, the northern region remains at the forefront of the Vietnam refrigerator market.

Key Market Players

- Samsung Electronics Vietnam Co., Ltd.

- Panasonic Vietnam Co.,Ltd

- Haier ElectricalAppliances Vietnam Co., Ltd

- Sharp Electronics (Vietnam) Company Limited

- Toshiba Vietnam consumer Products Co., Ltd

- LG Electronics Vietnam Hai Phong Co., Ltd,

- Arcelik Hitachi Home Appliances Sales Vietnam Co,Ltd

- Mitsubishi Electric Corporation

- Vietbeko Co., Ltd

- Electrolux Vietnam Co. Ltd

Report Scope:

In this report, the Vietnam Refrigerator market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Refrigerator Market, By Type:

- Top Freezer

- Bottom Freezer

- Side-by-Side

- Single Door

- French Door

Vietnam Refrigerator Market, By End User:

- Residential

- Commercial

Vietnam Refrigerator Market, By Technology:

- Non-Smart

- Smart

Vietnam Refrigerator Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Multi Branded Stores

- Online

- Others

Vietnam Refrigerator Market, By Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Refrigerator market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Samsung Electronics Vietnam Co., Ltd.

- Panasonic Vietnam Co.,Ltd

- Haier ElectricalAppliances Vietnam Co., Ltd

- Sharp Electronics (Vietnam) Company Limited

- Toshiba Vietnam consumer Products Co., Ltd

- LG Electronics Vietnam Hai Phong Co., Ltd,

- Arcelik Hitachi Home Appliances Sales Vietnam Co ,Ltd

- Mitsubishi Electric Corporation

- Vietbeko Co., Ltd

- Electrolux Vietnam Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

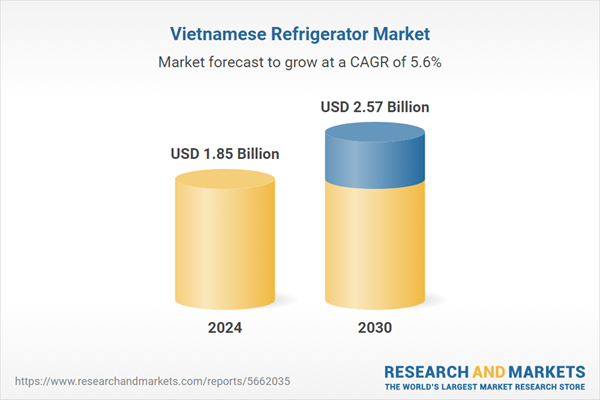

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.85 Billion |

| Forecasted Market Value ( USD | $ 2.57 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |