Global Military Lighting Market - Key Trends & Drivers Summarized

How Is Lighting Technology Enhancing Military Operations?

Military lighting plays a crucial role in operational safety and effectiveness, encompassing a wide range of applications from vehicle lighting to base illumination and portable solutions. The shift towards LED technology has been a significant trend, offering benefits such as lower power consumption, longer life spans, and improved durability under harsh conditions. Specialized lighting systems, such as infrared and blackout lights, enhance night-time operations without compromising stealth. Lighting solutions in military contexts are designed to meet stringent standards for ruggedness, reliability, and environmental resistance, ensuring they function optimally in diverse and challenging scenarios.What Technological Advancements Impact Military Lighting?

The integration of smart lighting technologies that can be remotely controlled and adjusted to different environments is a key development in military lighting. These systems contribute to energy efficiency and can be integrated into the broader command and control infrastructure, allowing for dynamic adjustments based on operational needs. The use of advanced materials and manufacturing processes has also led to more resilient lighting solutions capable of withstanding extreme temperatures, vibrations, and impacts, which are common in military environments.Customization and Flexibility in Military Lighting Solutions

Customization is essential in military lighting to address the specific needs of different service branches and missions. Flexible lighting solutions that can be adapted for use in multiple environments, whether onboard ships, aircraft, ground vehicles, or in field camps, are particularly valuable. Manufacturers are focusing on developing modular lighting systems that can be easily integrated into existing military platforms or reconfigured as needed, enhancing operational flexibility and reducing logistical burdens.What Drives the Growth in the Military Lighting Market?

The growth in the military lighting market is driven by several factors, including the ongoing modernization of military platforms and infrastructure, which necessitates upgraded lighting systems that meet current operational standards. Increasing focus on energy efficiency and reduced maintenance costs also propel the adoption of advanced lighting solutions. Additionally, the expansion of military operations worldwide necessitates robust and reliable lighting that can perform in a variety of environmental conditions and tactical situations. As militaries strive to improve the safety and effectiveness of their operations, the demand for innovative, durable, and cost-effective lighting solutions continues to grow.Report Scope

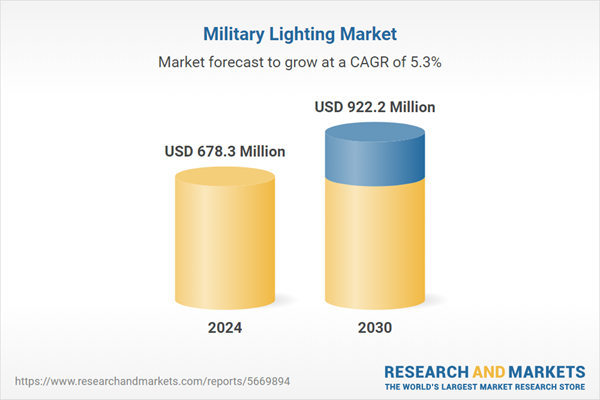

The report analyzes the Military Lighting market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Technology (LED, Non-LED); Offering (Hardware, Services, Software).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LED Technology segment, which is expected to reach US$721.1 Million by 2030 with a CAGR of 5.6%. The Non-LED Technology segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $176.2 Million in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $210.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military Lighting Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military Lighting Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military Lighting Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acuity Brands Lighting Inc., ADB Safegate BVBA, Astronics Corporation, atg airports limited, Avlite Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 14 companies featured in this Military Lighting market report include:

- Acuity Brands Lighting Inc.

- ADB Safegate BVBA

- Astronics Corporation

- atg airports limited

- Avlite Systems

- Carmanah Technologies Corporation

- Cobham PLC

- Glamox AS

- Honeywell International, Inc.

- L. C. Doane Company

- Luminator Technology Group

- Orion Energy Systems, Inc.

- Osram Licht AG

- Oxley Developments Co., Ltd.

- Revolution Lighting Technologies, Inc.

- Rockwell Collins, Inc.

- Soderberg Manufacturing Company, Inc.

- STG Aerospace

- United Technologies Corporation (UTC)

- Zodiac Aerospace SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acuity Brands Lighting Inc.

- ADB Safegate BVBA

- Astronics Corporation

- atg airports limited

- Avlite Systems

- Carmanah Technologies Corporation

- Cobham PLC

- Glamox AS

- Honeywell International, Inc.

- L. C. Doane Company

- Luminator Technology Group

- Orion Energy Systems, Inc.

- Osram Licht AG

- Oxley Developments Co., Ltd.

- Revolution Lighting Technologies, Inc.

- Rockwell Collins, Inc.

- Soderberg Manufacturing Company, Inc.

- STG Aerospace

- United Technologies Corporation (UTC)

- Zodiac Aerospace SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 678.3 Million |

| Forecasted Market Value ( USD | $ 922.2 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |