The viability of any invention can be intuitively understood by designers from the very beginning thanks to a ready-made tool. Several countries are interested in 3D printing because of its potential. This move by the governments is expected to have a significant impact on the demand for 3D printing technology. The favorable environment is contributing to the demand for 3D printing technology.

Additionally, the thought of applying 3D printing to the aerospace industry is particularly attractive because this technology can produce lightweight structures. Additionally, 3D printing technology has the capacity to produce parts that are robust enough to support flight. The requirement for heavy bolts and nuts can be avoided by manufacturing light material structures with the aid of 3D printing technology.

COVID-19 Impact Analysis

Players in the 3D technology business have been severely harmed by the breakout and propagation of COVID-19. One of the major factors driving the growth of the 3D technology industry is the rising demand for automobiles on a global scale. Nevertheless, lockdowns implemented by many governments to stem the spread of the COVID-19 have dramatically reduced automobile sales globally, which has had an adverse effect on the market for 3D technology. Furthermore, the GDP of nations and the per capita income of people all around the world have both been damaged by these lockdowns.Market Growth Factors

Growing Demand for 3D Technology in Entertainment Sector All Over the World

Realistic films with 3D and 4D motion images and interactive effects are increasingly popular in the entertainment field. A result of recent advancements in 3D animation and a rise in computer-based visuals, 3D is now the norm for special effects. In past years, 3D animation in films has surpassed both hand-drawn and practical effects in terms of popularity. To create a more realistic setting, visual effects (VFX) are frequently utilized in films. The utilization of 3D digital technology in films to create a comprehensive, multi-sensory cinematic experience is growing.Rising Growth Opportunities by Military and Defense Sector

3D cameras, printers, sensors, scanners, and displays are utilized in the military and defense industry for accurate measurement and inspection. In comparison to more conventional measurement techniques, 3D scanners are employed to swiftly and accurately measure new or reused parts of vehicles, tanks, and helicopters. The sensors, 3D cameras, and scanners are also utilized to locate, plan routes for unmanned ground vehicles (UGVs), and map terrains.Market Restraining Factors

Huge Cost of Maintenance of 3D Imaging Devices

The sensors and cameras used for 3D imaging are susceptible to dust, microparticles, contaminants, and trauma. An image's quality could be greatly impacted by a small disruption. Thus, such devices need to be handled carefully and are needed to be maintained after a regular interval of time. The dimension and complexity of the scanned 3D image, in addition to the total size and geometry of the devices be purchased, all affect how much 3D imaging costs.Product Outlook

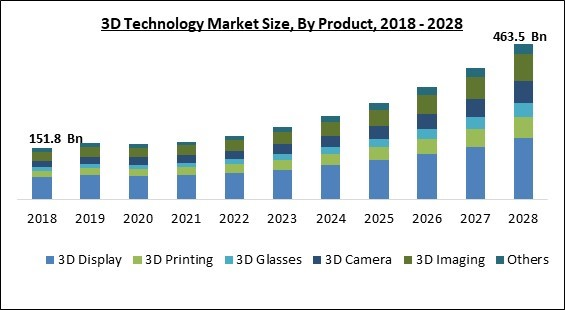

Based on product, the 3D technology market is segmented into 3D Printing, 3D Glasses, 3D Glasses, 3D Display, 3D Imaging and 3D Camera. 3D Imaging segment recorded a significant revenue share in the 3D technology market in 2021. Gesture recognition, 3D modelling, 3D rendering, and other applications all make utilization 3D imaging technologies. There are several uses for 3D technology in the fields of medicine, security & surveillance,defense, entertainment, industrial automation, construction, and others. 3D medical imaging is among the most well-known uses.Application Outlook

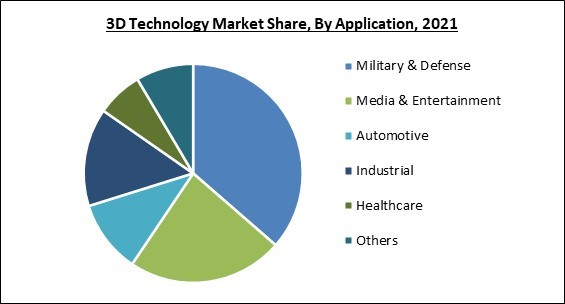

By application, the 3D technology market is divided into Media & Entertainment, Automotive, Industrial, Healthcare, Military and Defense, and Others. The Military and Defense segment garnered the maximum revenue share in the 3D technology market in 2021. This is a result of flexible materials utilized in war being utilized to print incredibly accurate prototypes. The rise in the investments by various nations on strengthening their military and defense sector would create more demand for a wide range of 3D technologies and systems over the forecast period.Regional Outlook

Region-wise, the 3D technology market is analyzed across North America, Europe, Asia Pacific and LAMEA. North America emerged as the leading region in the 3D technology market with the largest revenue share in 2021. The main reason behind the adoption of 3D technology into numerous application sectors in the region is the rising need for advanced technology-based solutions that assist to shorten processing times. The U.S. and Canada are two examples of North American nations that were among the leading and early users of such technologies in a variety of manufacturing procedures.Cardinal Matrix-3D Technology Market Competition Analysis

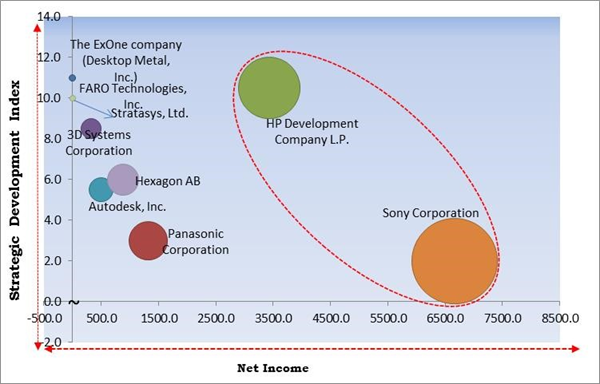

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Sony Corporation and HP Development Company L.P. are the forerunners in the 3D Technology Market. Companies such as Panasonic Corporation, Hexagon AB and Autodesk, Inc. are some of the key innovators in 3D Technology Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include 3D Systems Corporation, Autodesk, Inc., Panasonic Corporation, Sony Corporation, FARO Technologies, Inc., Hewlett-Packard enterprise company (HP Development Company L.P.), The ExOne company (Desktop Metal, Inc.), Hexagon AB, Stratasys, Ltd., Vicon Motion System, Ltd.

Strategies deployed in 3D Technology Market

Partnerships, Collaborations and Agreements:

- May-2022: Sony Group Corporation entered into a partnership with Theta Labs, a leading decentralized video streaming platform. This partnership aimed to introduce 3D non-fungible token (NFT) assets. The NFTs would be crafted for the Sony Spatial Reality Display and would be developed for three-dimensional viewing.

- Dec-2021: Autodesk entered into a collaboration with Capgemini, a business and technology transformation leader. This collaboration aimed to provide end-to-end Building Information Modeling (BIM) platforms and transformation programs.

- Nov-2021: Stratasys entered into a partnership with ECCO, a Danish shoe manufacturer and retailer. This partnership aimed to innovate footwear manufacturing using 3D printing technology, which would boost automation and a more simplified development process.

- Oct-2021: Hexagon came into a partnership with Stratasys, an American-Israeli manufacturer of 3D printers, software, and materials. Under this partnership, customers of Stratasys' ULTEM 9085 filaments would utilize Hexagon's Digimat material modeling software to predict the way printed parts would perform.

- Jul-2021: Stratasys formed a partnership with Tata Technologies, a provider of services in engineering and design. This partnership aimed to integrate comprehensive capabilities & offerings of Stratasys in the polymer space with deep manufacturing domain knowledge and a strong presence of Tata Technologies in the manufacturing industry, providing end-to-end solutions from concept to prototyping to manufacturing organizations based out of India.

Product Launches and Product Expansions:

- Sep-2022: HP unveiled a new metal 3D printer. This printer would assist industries to shore up their supply chain along with scalable mass production component printing. This printer would be commercially available for mass production of high-quality 3D printed metal parts for users in medical, consumer goods, industrial, and automotive industries.

- Apr-2022: FARO released End-To-End 3D Digital Reality Capture & Collaboration Platform. This platform would allow simple, fast & precise 3D Model Creation. Through FARO Sphere as its backbone, the new end-to-end 3D capture platform would deliver customers with leading ease of use, precise and speed. In addition, real-time data would capture validation, and remote collaboration would transform the way customers access, generate, and use 3D data models.

- Oct-2021: Autodesk unveiled the latest version of its Netfabb 3D printing, design, and simulation platform. This platform is developed to offer customers a more refined experience, and update its tool pathing and simulation tools.

- Jun-2021: Stratasys released two new PolyJet 3D printers, the Stratasys J35 Pro and the Stratasys J55 Prime, with the latest software solutions for research and packaging prototyping. The latest versatile J35 Pro 3D printer would accommodate everything from concept modeling to high-fidelity, fully functioning, and realistic models.

- May-2021: Stratasys introduced three new 3D printers. These printers together would address a huge portion of the multi-billion-dollar market growth prospect in additive manufacturing of end-use parts. These systems would enhance the shift from conventional to additive manufacturing for low-to-mid-volume production applications underserved by conventional manufacturing ways.

- Nov-2020: FARO launched a new Vantage Laser Tracker 6DoF Probe. The platform would deliver complete, large-volume 3D measurements up to 80 meters, substantially simplifying the procedure and decreasing inspection cycle times along with ensuring complete confidence in the results.

- Jul-2020: ExOne released New Sand 3D Printing Network. This product is used in automotive, aerospace, agricultural, and other manufacturers, who can deploy it to tap the advantages of 3D printed sand molds & cores for high-value metal casting projects.

- May-2020: Panasonic Corporation launched a new hybrid manufacturing method for mold cooling water channels. This method contains 3D printing, milling, and generative design. In addition, the company developed a conformal cooling system, which would minimize cooling time by 20% in comparison to the traditional drilled channels.

Acquisitions and Mergers:

- Feb-2022: 3D Systems took over Titan Additive and Kumovis, polymer extrusion 3D printing companies. This acquisition aimed to expand its play in the industrial and medical markets. Through the acquisition of Titan, 3D Systems would have a larger play in sand casting, tooling, jigs and fixtures, and end-use parts applications such as air ducts, brackets, and structural components.

- Feb-2022: HP acquired Choose Packaging, a plastic-free packaging development company. Through this acquisition, HP launched its Molded Fiber Advanced Tooling technology.

- Oct-2021: 3D Systems acquired Volumetric Biotechnologies, a Houston-based biotech company. This acquisition aimed to use the Volumetric team’s expertise to expand the applications of the ‘Print to Perfusion’ technology it would develop with United Therapeutics.

- Aug-2021: Hexagon took over Wuhan Zhongguan Company. This acquisition aimed to enhance its offerings in the field of 3D data acquisition and would expand Hexagon’s solution portfolio in the field of intelligent manufacturing.

- Apr-2021: The ExOne Company took over Freshmade 3D, an Ohio-based startup. This acquisition aimed to strengthen ExOne’s position as a provider of large-format 3D printed tooling for various industrial applications.

Geographical Expansion

- Sep-2022: Autodesk expanded its geographical footprint by opening its UK Technology Centre in Birmingham. This center would assist people to solve the world's most innovative high-value manufacturing challenges. This center would house a variety of tools from subtractive to additive manufacturing (AM) and robotics and would benefit customers such as BMW and GKN Aerospace.

- Feb-2021: 3D Systems expanded its geographical footprints in South Carolina headquarters through the addition of 100,000 square feet in space. The expansion is established as a vehicle that would bring to market his Stereolithography 3D printing technology.

Scope of the Study

Market Segments Covered in the Report:

By Product

- 3D Display

- 3D Printing

- 3D Glasses

- 3D Camera

- 3D Imaging

- Others

By Application

- Military & Defense

- Media & Entertainment

- Automotive

- Industrial

- Healthcare

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- 3D Systems Corporation

- Autodesk, Inc.

- Panasonic Corporation

- Sony Corporation

- FARO Technologies, Inc.

- Hewlett-Packard enterprise company (HP Development Company L.P.)

- The ExOne Company (Desktop Metal, Inc.)

- Hexagon AB

- Stratasys, Ltd.

- Vicon Motion System, Ltd.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- 3D Systems Corporation

- Autodesk, Inc.

- Panasonic Corporation

- Sony Corporation

- FARO Technologies, Inc.

- Hewlett-Packard enterprise company (HP Development Company L.P.)

- The ExOne Company (Desktop Metal, Inc.)

- Hexagon AB

- Stratasys, Ltd.

- Vicon Motion System, Ltd.