Additionally, satellite antennae and frequency converters are required for the establishment of a satellite link. Data to be communicated are transmitted to modems from data terminal equipment. The intermediate frequency (IF) output of the modem is typically 50-200 MHz; however, the signal is occasionally modulated straight to the L band.

In the majority of instances, the frequency must be transformed with an upconverter before amplification and transmission. Depending on the modulation technique employed, a modulated signal is a sequence of symbols, or forms of data conveyed by a corresponding signal state, such as a bit or a few bits.

Recovering a symbol clock (synchronizing a local symbol clock generator with a distant one) is one of the most essential responsibilities of a demodulator. Similarly, a signal received from a satellite is initially down-converted, followed by demodulation by a modem, and finally handled by data terminal equipment. The LNB is typically supplied with 13 or 18 V DC through the solution providers by the modem.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a substantial influence on the expansion of this sector. During the pandemic, the demand for this market was greatly bolstered by the increase in demand for satellite communication solutions across several industries. In addition, the worldwide telecommunications industry has begun deploying satellite modem solutions, which is anticipated to boost the expansion of the satellite modem market study post-pandemic.Market Growth Factors

Data Connectivity at High Speeds Is Becoming More Important

Numerous end-user sectors, including those in the maritime, oil and gas, transport, communications, and education, among others, have increased their need for real-time and high-speed communication, which has led to an increase in the demand for sophisticated high-speed satellite modems. Users are now able to send massive quantities of data effectively due to the satellite modem industry's ongoing advancements. The speed and data connectivity rates that are also available onshore are not available to offshore teams.Increasing Leo Satellite and Constellation Launches

A lot of businesses in this industry have suggested or are putting into practice plans to create satellite constellations, while CubeSats and other tiny spacecraft are also gaining popularity. The rising popularity of GPS is a key factor in the expansion of LEO and MEO satellites. It is now a crucial component of the satellite communications system. To supply GPS, a large number of MEO satellites are deployed into orbit. More MEO satellites will be required as the demand for GPS connection rises. For effective signal transmission, this will lead to a necessity for several satellite modems to be placed throughout base stations. The massive launches of the satellites surge the growth of the satellite modem market.Market Restraining Factors

Satcom Equipment's Susceptibility to Cyberattacks

For the majority of enterprises installing IoT systems and, more recently, 5G networks, which include numerous connected devices across networks, platforms, and devices, security is the most important technical challenge. IoT growth implies a bad actor might potentially control a vast network of linked devices if just one unencrypted device or the communication between them isn't safeguarded. Every step of the data transmission process must be secured, not only the devices themselves. The satellite-space industry is now under threat from network hacking and cyberattacks, which is creating an increasing challenge to satellite operators.Channel Type Outlook

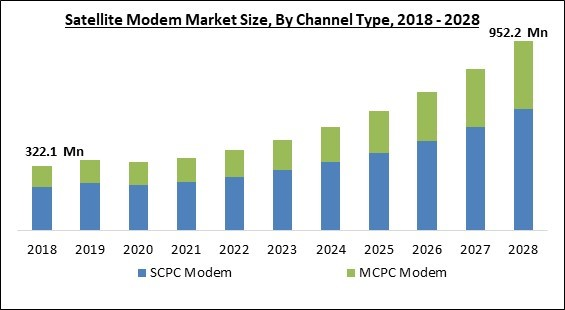

Based on the Channel Type, the Satellite Modem Market is segmented into SCPC Modem and MCPC Modem. The MCPC modem segment witnessed a significant revenue share in the satellite modem market in 2021. It is due to the unmatched channel efficiency provided by these modems, which is a fundamental necessity for high-data-traffic applications such as mobile communication, the Internet, and wireless broadband.Application Outlook

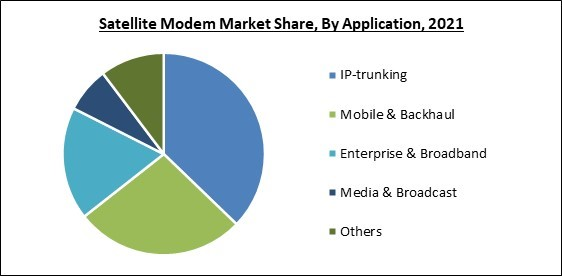

By Application, the Satellite Modem Market is classified into Mobile & Backhaul, IP-trunking, Enterprise & Broadband, Media & Broadcast, and Others. The IP-trucking segment garnered the highest revenue share in the satellite modem market in 2021. It is because IP-trunking offers a huge array of advantages, including unlimited employee mobility, dependable phone service, and a robust end-to-end unified communications network that improves data security while also enhancing communication system quality.Technology Outlook

On the basis of Technology, the Satellite Modem Market is divided into VSAT, Satcom-on-the-move, Satcom-on-the-pause, and Others. The VSAT segment recorded a substantial revenue share in the satellite modem market in 2021. It is because VSATs are used to transmit either narrowband or broadband data. VSATs are also utilized for mobile, transportable (using phased array antennas), or mobile marine communications.End User Outlook

Based on the End User, the Satellite Modem Market is bifurcated into Telecommunications, Marine, Military & Defense, Transportation & Logistics, Oil & Gas, and Others. The military & defense segment acquired the largest revenue share in the satellite modem market in 2021. It is due to the information collection, situational awareness, and border patrol are just a few of the numerous military and defense applications for satellite communication. In recent years, the volume of data, voice, and video exchanged between headquarters and remote locations has expanded significantly.Regional Outlook

Region-wise, the Satellite Modem Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured a promising revenue share in the satellite modem market in 2021. This market will be driven by the increasing demand for complicated industrial applications using metals such as steel. China continues to be the largest market for satellite modems and is expected to maintain its dominating position during the projection period. Investments in the growth of glass production and government backing for steel production are anticipated to create enormous prospects for the market.Cardinal Matrix-Satellite Modem Market Competition Analysis

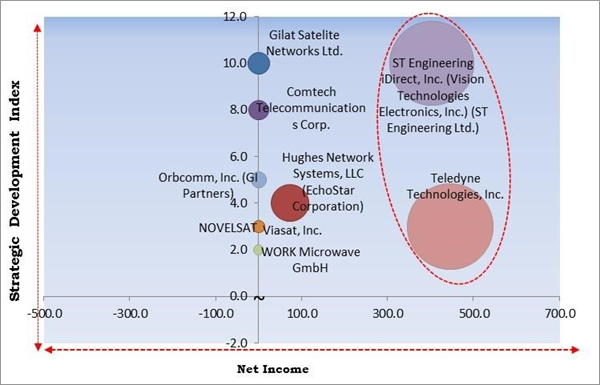

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.) (ST Engineering Ltd.) and Teledyne Technologies, Inc. are the forerunners in the Satellite Modem Market. Companies such as Gilat Satelite Networks Ltd., Comtech Telecommunications Corp., Orbcomm, Inc. (GI Partners) are some of the key innovators in Satellite Modem Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Comtech Telecommunications Corp., Datum System, Gilat Satelite Networks Ltd., Hughes Network Systems, LLC (EchoStar Corporation), Orbcomm, Inc. (GI Partners), NOVELSAT, ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.), Teledyne Technologies, Inc., Viasat, Inc. and WORK Microwave GmbH.

Strategies deployed in Satellite Modem Market

Partnerships, Collaborations and Agreements:

- Sep-2022: Hughes Communications teamed up with the Indian Space Research Organization, the national space agency of India. Under this collaboration, Hughes Communication would launch its first high throughput satellite (HTS) broadband internet service in the country.

- Jul-2022: Gilat Satellite Networks partnered Intelsat, a multinational satellite services provider. This partnership would aid Intelsat’s successful efforts to deliver reliable in-flight connectivity in Japan and other regions.

- Mar-2022: Gilat Satellite Networks entered into a partnership with SES, a Luxembourgish-French satellite telecommunications network provider. Under this partnership, Gilat’s SkyEdge IV platform would operate with its SES-17 satellite.

- Apr-2021: Comtech Telecommunications came into a partnership with Kymeta, the communications company making mobile global. This partnership would allow new and existing Department of Defense (DoD) and commercial consumers to operate the state-of-the-art Kymeta u8 for cost-effective and seamless communication solutions through its VSAT router technology.

- Nov-2020: WORK Microwave collaborated with IQ Spacecom, a leading provider of satellite radio solutions. Under this collaboration, WORK Microwave’s AX-60 IP modem would be combined with IQ Spacecom’s XLink advanced transceiver system, a brand of IQ wireless GmbH, operators have an affordable, one-stop-shop solution for new space applications, that includes low Earth orbit (LEO) satellite missions for Earth observation.

- Oct-2020: ORBCOMM extends its existing agreement with Inmarsat, the world leader in global mobile satellite communications. Through this agreement, both companies would collaborate on joint product development & distribution of next-generation IoT satellite services, telematics devices, and end-to-end solutions which offer the best-in-class combination of high bandwidth data packets with low-cost terminals.

- Mar-2020: Hughes Network Systems came into a partnership with OneWeb, the global communications company. Under this partnership, Hughes would market OneWeb services across the globe for applications like enterprise & government networking, cellular backhaul, and community Wi-Fi hotspots.

Product Launches and Product Expansions:

- Sep-2022: ST Engineering released MCX8000, a high density, high availability, and fully redundant modular system. The MCX8000 allows broadcasters to cater to every type of broadcast scenario, that includes high IP encapsulation rates for Over the Top (OTT) applications.

- Aug-2022: Viasat introduced the ViaSat-3 satellite, a global constellation of three geostationary Ka-band communications satellites. This launch focused on providing the best bandwidth economics in the industry with incredible flexibility to move & concentrate that capacity virtually anywhere there is demand whether it is over land, the ocean or in the air.

- Jul-2022: ST Engineering MEASAT is significantly expanding its iDirect Evolution-based satellite network. This expansion focused on delivering a “plethora of services to organizations and communities located in rural and ultra-rural regions. In addition, the expansion would enable users to enjoy high-speed broadband regardless of their location in Malaysia.

- Mar-2022: Teledyne Paradise Datacom launched AXIOM-R, AXIOM-C, and AXIOM-N, Satcom modems suitable for P2P and P2MP networks. This launch would increase the number of situations where satellite communications can be utilized and are compatible with the existing modem product lines.

- Mar-2022: Comtech introduced a high-speed CDM-780 Gateway modem. The latest modem would be capable of managing an unprecedented volume of data delivered over new ultra-powerful & complex wideband GEO, MEO, and LEO satellites & constellations. This launch focused on providing users with high-speed trunking services to gateways & support massive VSAT networks of hundreds of thousands of sites.

- Feb-2022: Gilat Satellite Networks launched SkyEdge IV, a next-generation satellite communication ground system. This launch aimed at capturing a leading position in the multibillion-dollar emerging VHTS market opportunity.

- Apr-2021: Comtech EF Data, a subsidiary of Comtech Telecommunications launched CDM-650 Satellite Modem. The CDM-650 would leverage the heritage and feature set of Comtech’s SLM-5650B/C, CDM-625A, and CDM-425 modems, that have been adopted & employed worldwide to support government & commercial applications.

- Feb-2021: Gilat Satellite Networks introduced the next generation family of VSATs, Aquarius. These ultra-high-performance, multi-orbit VSATs would provide over 2 Gigabits per second of concurrent speeds & support seamless satellite handover.

- Dec-2020: ORBCOMM unveiled a new satellite as an accessory offering. This satellite would create a dual-mode capability for ORBCOMM's transportation solutions. Further, the launch aimed at serving with expanded, reliable, and cost-effective coverage for transportation solutions.

Scope of the Study

Market Segments Covered in the Report:

By Channel Type

- SCPC Modem

- MCPC Modem

By Application

- IP-trunking

- Mobile & Backhaul

- Enterprise & Broadband

- Media & Broadcast

- Others

By Technology

- Satcom-on-the-move

- Satcom-on-the-pause

- VSAT

- Others

By End User

- Military & Defense

- Telecommunications

- Marine

- Oil & Gas

- Transportation & Logistics

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Comtech Telecommunications Corp.

- Datum System

- Gilat Satelite Networks Ltd.

- Hughes Network Systems, LLC (EchoStar Corporation)

- Orbcomm, Inc. (GI Partners)

- NOVELSAT

- ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.)

- Teledyne Technologies, Inc.

- Viasat, Inc.

- WORK Microwave GmbH

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Comtech Telecommunications Corp.

- Datum System

- Gilat Satelite Networks Ltd.

- Hughes Network Systems, LLC (EchoStar Corporation)

- Orbcomm, Inc. (GI Partners)

- NOVELSAT

- ST Engineering iDirect, Inc. (Vision Technologies Electronics, Inc.)

- Teledyne Technologies, Inc.

- Viasat, Inc.

- WORK Microwave GmbH