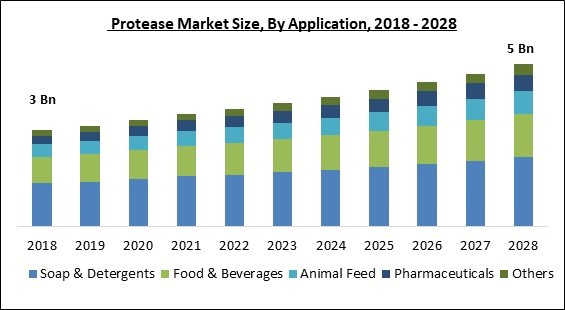

The Global Protease Market size is expected to reach $5 billion by 2028, rising at a market growth of 5.5% CAGR during the forecast period.

Protein digestion after ingestion, protein catabolism (the breakdown of aged proteins), and cell signaling are a few of the biological processes that proteases involved. Proteolysis would occur very slowly, requiring hundreds of years if there were no functional accelerants. All living forms and viruses have proteases. Distinct classes of protease can carry out the same reaction by entirely different catalytic processes as a result of their own numerous independent evolutionary cycles.

The hydrolysis of peptide bonds is a typical chemical reaction that is effectively carried out by proteases. There are several proteases that carry out slightly different reactions from the majority of proteolytic enzymes, which break down -peptide bonds between naturally existing amino acids. Thus, a large class of enzymes called DUBs can hydrolyze isopeptide bonds in ubiquitin and ubiquitin-such as protein conjugates; glutamyl hydrolase and glutamate carboxypeptidase target -glutamyl bonds; glutamyl transferase transfer and cleave peptide bonds; and intramolecular autoproteases such as notably, and under some circumstances, proteases are also capable of producing peptide bonds.

The pharmaceutical industry's increasing use of proteases for their therapeutic advantages, like anticancer, antibacterial, and anti-inflammation, is likely to result in a large increase in demand for them over the forecast period, which will favor the market for proteases globally. Drugs for the treatment of chronic pain, cardiovascular illnesses, and digestive issues are made using proteases.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Advanced Enzyme Technologies Limited, Amano Enzyme, Inc., Associated British Foods PLC, BASF SE, Dupont De Nemours, Inc., Koninklijke DSM N.V., Novozymes A/S, Chr. Hansen Holding A/S, Biocatalysts Limited (Brain AG), and Dyadic International, Inc.

Protein digestion after ingestion, protein catabolism (the breakdown of aged proteins), and cell signaling are a few of the biological processes that proteases involved. Proteolysis would occur very slowly, requiring hundreds of years if there were no functional accelerants. All living forms and viruses have proteases. Distinct classes of protease can carry out the same reaction by entirely different catalytic processes as a result of their own numerous independent evolutionary cycles.

The hydrolysis of peptide bonds is a typical chemical reaction that is effectively carried out by proteases. There are several proteases that carry out slightly different reactions from the majority of proteolytic enzymes, which break down -peptide bonds between naturally existing amino acids. Thus, a large class of enzymes called DUBs can hydrolyze isopeptide bonds in ubiquitin and ubiquitin-such as protein conjugates; glutamyl hydrolase and glutamate carboxypeptidase target -glutamyl bonds; glutamyl transferase transfer and cleave peptide bonds; and intramolecular autoproteases such as notably, and under some circumstances, proteases are also capable of producing peptide bonds.

The pharmaceutical industry's increasing use of proteases for their therapeutic advantages, like anticancer, antibacterial, and anti-inflammation, is likely to result in a large increase in demand for them over the forecast period, which will favor the market for proteases globally. Drugs for the treatment of chronic pain, cardiovascular illnesses, and digestive issues are made using proteases.

COVID-19 Impact Analysis

To reduce COVID-19 transmission through food, the World Health Organization (WHO) has published guidelines for ensuring food hygiene and food safety practices. The demand for protease products with clean labels will rise as a result of these developments. The market will grow over the projected period as a result of the worldwide economy's recovery, which will also result in an increase in per capita income and the adoption of healthier lifestyles.Market Growth Factors

Increasing Drug And Therapeutic Applications

Because of the many advantages proteases offer, like boosting the immune system, preventing inflammatory bowel diseases, and treating burns, and stomach ulcers, the rise of the healthcare sector will have a beneficial impact on the protease market. However, a large component of the protease market is made up of other sectors, like animal feed, where protease is employed to enhance the nutritional or digestive qualities of fodder and preserve the health of animal guts.Rising Consumer Awareness Regarding What They Are Consuming

Consumer demand for goods with clean labels as well as natural ingredients is rising. The popularity of protease among those who are concerned about their health has increased as people become more conscious of the necessity to live a healthy lifestyle. The prevalence of chronic illnesses and pandemic situations are encouraging people to adopt healthy eating practices in order to protect themselves against a number of deadly ailments.Market Restraining Factors

Risks And Possible Side Effects Of Protease

Proteolytic enzymes are generally regarded as harmless. However, some people may experience negative effects. It's conceivable, especially if someone takes very large quantities, that may develop digestive problems like nausea, diarrhea, and vomiting. Large amounts of fruits rich in proteolytic enzymes could also irritate the stomach, though supplements are much more likely to do so. Symptoms of allergies can also appear.Source Outlook

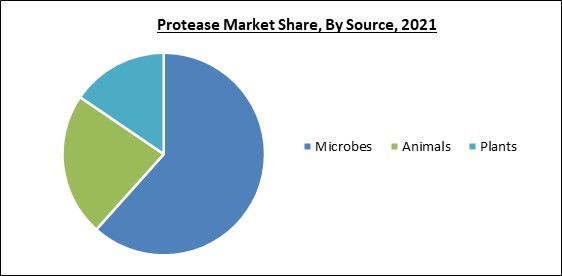

Based on source, the protease market is segmented into plants, animals, and microbes. The plant segment acquired a substantial revenue share in the protease market in 2021. Papain and bromelain are two examples of the category of proteases that are derived from plants. Also, factors such as climatic, viability, culture, circumstances, and drawn-out extraction procedures have a significant impact on the usage of plants as a source of proteases. Thus, the protease market would grow in this segment over the forecast period.Application Outlook

On the basis of application, the protease market is fragmented into food & beverage, pharmaceuticals, animal feed, soap & detergent and others. The soap & detergent segment held the largest revenue share in the protease market in 2021. Protease's ability to remove stains has made it possible to use it in detergent manufacturing. Consumer awareness of hygiene and cleanliness is predicted to increase, which will increase the demand for soaps and detergents.Regional Outlook

Region wise, the protease market is analyzed across the North America, Europe, Asia Pacific and LAMEA. The North America region led the protease market with maximum revenue share in 2021. The rising demand for both plant- and animal-based proteases is responsible for the expansion of the regional protease market. The demand for protease is further derived from a variety of food functionalities, the growing importance of washing goods, the rising need for infant formula, and expanding consumption as well as production of meat products.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Advanced Enzyme Technologies Limited, Amano Enzyme, Inc., Associated British Foods PLC, BASF SE, Dupont De Nemours, Inc., Koninklijke DSM N.V., Novozymes A/S, Chr. Hansen Holding A/S, Biocatalysts Limited (Brain AG), and Dyadic International, Inc.

Strategies deployed in Protease Market

- Nov-2021: Biocatalysts introduced Promod 324L, a new enzyme added to their range of enzymes for the pet food industry. The Promod 324L offers a broad substrate specificity and high effectiveness in the hydrolysis of both animal & fish protein. Promod 324 would be developed specifically with an exceptional blend of endopeptidase activities for the hydrolysis of animal waste protein.

- Jun-2021: Novozymes Feed Enzymes Alliance launched ProAct 360, the company's breakthrough second-generation protease. ProAct 360 would deliver more consistent enhancements in growth performance, along with advanced matrix values for key amino acids & faster action.

- Mar-2021: Amano Enzyme released Umamizyme Pulse; a non-GMO enzyme designed for use in a variety of plant protein products. Umamizyme Pulse would work well in an acidic environment, enabling the customers to prevent contamination with less salt.

- Feb-2021: Novozymes came into partnership with FMC, an American chemical manufacturing company. This partnership would support Novozymes’ existing BioAg base in microbes. Under this partnership, both companies would co-develop enzyme solutions for two segments, leveraging Novozymes’ multi-partner setup in BioAg. In addition, this would leverage Novozymes’ enzyme biocontrol technology development to date, and the companies would work together to grab growth opportunities and seek the necessary approvals to commercialize the technology in the relevant markets.

- Dec-2020: DuPont Nutrition & Biosciences released Versilk, the latest in its range of enzymes. This launch would help yogurt & beverage producers achieve optimal texture & taste in yogurts, drinkable dairy products, and other drinkable fermented products.

- Oct-2020: BASF expanded its existing protease portfolio by adding Lavergy Pro 106 LS, and Lavergy Pro 114 LS. This expansion enhances BASF’s enzyme portfolio with a novel stabilizing protease making formulation development even more sustainable. Further, this expansion aimed at strengthening the emerging market for enzymes with BASF's excellent innovation pipeline & high-quality standards to improve the development of effective and sustainable solutions together with the consumers.

- Jul-2020: Royal DSM formed a joint venture, Olatein, with Avril, France's fourth-largest agro-industrial group. Through this joint venture, the DSM and Avril would together develop CanolaPRO, a high-quality and nutritious protein that supports the DSM's consumers to provide them with better tasting, more enjoyable meat and dairy alternatives in line with the market trends.

- Mar-2019: DuPont Nutrition & Biosciences released OPTIMASE, the latest portfolio of biobased enzymes for medical instrument cleaning applications. OPTIMASE offers a better, more efficient & cleaner biobased alternative for detergent manufacturers that serve the medical instrument cleaning industry.

- Mar-2019: BASF unveiled Natuphos E, a new generation phytase. Natuphos E would enable poultry to better use nutrients like phosphorous, amino acids, calcium, and energy. The new enzyme would promote healthy growth in animals as well as reduces phosphorus emissions from livestock.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Soap & Detergents

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Others

By Source

- Microbes

- Animals

- Plants

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Australia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Advanced Enzyme Technologies Limited

- Amano Enzyme, Inc.

- Associated British Foods PLC

- BASF SE

- Dupont De Nemours, Inc.

- Koninklijke DSM N.V.

- Novozymes A/S

- Chr. Hansen Holding A/S

- Biocatalysts Limited (Brain AG)

- Dyadic International, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 4. Global Protease Market by Application

Chapter 5. Global Protease Market by Source

Chapter 6. Global Protease Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- Advanced Enzyme Technologies Limited

- Amano Enzyme, Inc.

- Associated British Foods PLC

- BASF SE

- Dupont De Nemours, Inc.

- Koninklijke DSM N.V.

- Novozymes A/S

- Chr. Hansen Holding A/S

- Biocatalysts Limited (Brain AG)

- Dyadic International, Inc.

Methodology

LOADING...