Excipients may also be employed in specific situations to give powdered or granular product qualities, like high fluidity and resilience to moisture absorption. There are also a few items made from liquid or greasy plant extracts. Plant extracts can be used as and in a variety of applications, including natural sweeteners, natural pigments, functional plant extracts, extracts used in traditional medicine, and plant essential oils utilized in food, additives, specialty foods, health foods, everyday cosmetics, and chemicals, formula particles, and APIs.

Plant roots, stems, leaves, flowers, and fruits serve as the primary raw materials for creating organic matter, which is then processed through drying, refining, and separating steps. Natural pigments derived from plant extracts are a type of organic material. Currently, there are more than 40 primary natural pigments available on the market, including curcumin, gardenia yellow pigment, marigold extract, and capsicum red pigment.

COVID-19 Impact Analysis

The COVID-19 pandemic has slowed down the expansion of numerous international industries, which has resulted in widespread disruption for both buyers and sellers. A number of businesses and production facilities were closed, which has put a stop to the product's production, sale, and marketing. The production of plant extracts was also hauled due to the lockdown caused by the COVID-19 pandemic. However, in the middle period of the pandemic, the demand for plant extracts was expedited due to a number of health benefits of this product. The effectiveness of medicinal plant extracts over coronavirus played a major role in increasing its adoption during the pandemic.Market Growth Factors

Rising demand from the personal care and cosmetic industry

Due to their calming, energizing, antiseptic, antibacterial, decongestant, soothing, antispasmodic, anti-inflammatory, and other beneficial characteristics, essential oils are frequently used in cosmetics, perfumery, cleaning goods, and household fragrances. Essential oils, like lemon and orange, in addition to being utilized as fragrances, also have antibacterial characteristics, drawing interest as potential cosmetic active components. Additionally, essential oils are employed in skincare products that have anti-acne, anti-aging, skin-lightening, and sun-protection properties. This rising demand for such products from the cosmetic industry is significantly driving the growth of the plant extracts market.An increasing number of technological advancements in the process of plant extraction

Technology's involvement throughout the supply chain aids in the growth of the plant extraction industry. High technology is being used in bioactive extraction. Additionally, the use of Green technologies would lead to major sustainable measures. For instance, the polar-nonpolar-sandwiching (PNS) technique was utilized to extract a variety of bioactive from turmeric root extract, including curcuminoid, protein, fiber, polyphenols, and essential oils. A green technology for extracting bioactive materials is ultrasound-assisted extraction. The development of such technical expertise is stimulating the growth of the plant extracts market.Market Restraining Factors

Frequent fluctuations in prices and low availability of raw material

There is a wide variety of plants that are resent all over the world with a significant number of different benefits. However, due to the destruction of forests and extinction of species, several plant species are no longer present. Furthermore, the supply is limited because these therapeutic herbs are only farmed in a selected few nations. In addition, there is an imbalance in supply and demand because there is a limited amount because all these plants only grow once a year. It affects the price of raw materials as well, and the increased cost of storage drives up the price. The market is constrained because demand exceeds supply.Product Type Outlook

Based on Product Type, the Plant Extracts Market is segregated into Oleoresins, Essential oils, Flavonoids, Alkaloids, Carotenoids, and Other types. In 2021, the oleoresin segment procured the largest revenue share of the plant extracts market. The increasing growth of the segment is attributed to the health benefits of oleoresin extracts.The anti-inflammatory and anti-cancer effects of oleoresin. Antioxidants, which prevent free radicals, are abundant in it. It also contains a chemical called sulfur, which is used to treat osteoarthritis and rheumatoid arthritis. Heart problems are also treated with it.Application Outlook

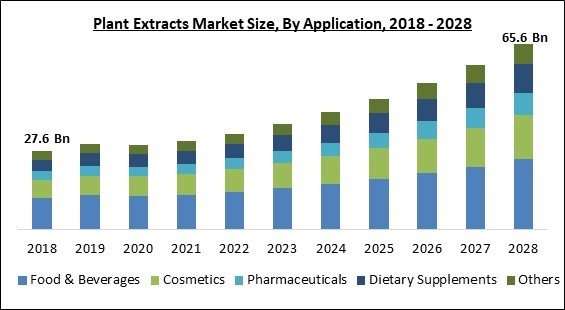

On the basis of Application, the Plant Extracts Market is segmented into Food & beverages, Cosmetics, Pharmaceuticals, Dietary Supplements, and Other applications. In 2021, the pharmaceutical segment witnessed a significant revenue share of the plant extracts market. The pharmaceutical industry heavily relies heavily on the phytochemicals found in medicinal plants. Alkaloids, phenolics, glycosides, terpenoids, and flavonoids are just a few of the many plant metabolites that are separated using traditional extraction techniques and specific solvents.Form Outlook

By Form, the Plant Extracts Market is bifurcated into Dry and Liquid. In 2021, the dry segment acquired the biggest revenue share of the plant extracts market. Drying liquid extracts, such as water extracts and tinctures, frequently under vacuum, produces powdered extracts. The most popular applications for powdered extracts are tablets and capsules. Some powdered extracts are produced using solvents besides ethanol and water because the solvent is removed from the finished product.Source Outlook

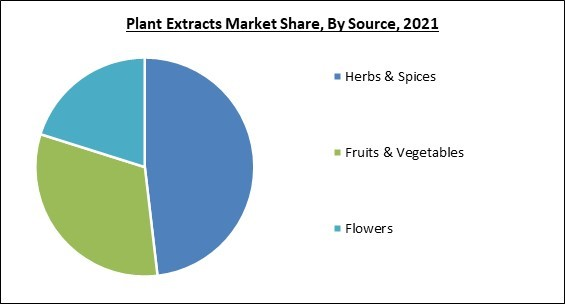

Based on Source, the Plant Extracts Market is classified into Herbs & spices, Fruits & vegetables, and Flowers. In 2021, the herbs & spices segment procured the largest revenue share of the plant extracts market. The growing health consciousness of consumers has led to an increase in the popularity of plant extracts extracted from herbs and spices worldwide. The market growth for the herbs and spices segment is driven by the popular flavors and flavored drinks, as well as the segment's healthfulness and sustainability.Regional Outlook

Region-Wise, the Plant Extracts Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia Pacific accounted for the maximum revenue share of the plant extracts market. Due to significant domestic and international demand, the plant extracts market in the region is booming. Vital Herbs, Alchemy Chemicals, Sydler, and Plantnat are just a few of the small and medium-sized plant extract manufacturers in the region that is aware of the manufacturing of plant extracts and aware of the advantages they bring.Cardinal Matrix-Plant Extracts Market Competition Analysis

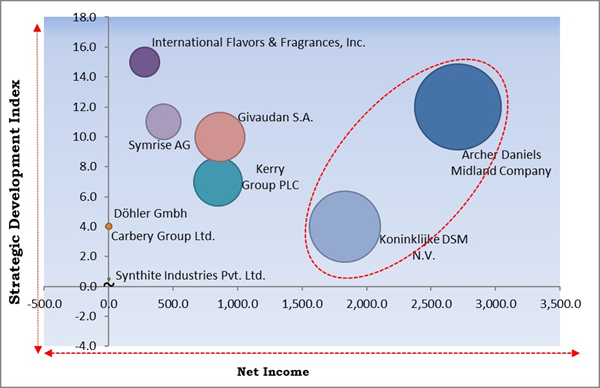

The matrix is designed considering the major strategic developments including Mergers & Acquisitions, product launches, partnership among others and the financial strength of the company in the considered years. Companies such as Kerry Group PLC, Givaudan S.A., Symrise AG are some of the key innovators in Plant Extracts Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include International Flavors & Fragrances, Inc., Kerry Group PLC, Archer Daniels Midland Company, Carbery Group Ltd., Koninklijke DSM N.V., Döhler Gmbh, Symrise AG, Givaudan S.A., Synthite Industries Pvt. Ltd., and Kalsec Inc.

Strategies deployed in Plant Extracts Market

Partnerships, Collaborations and Agreements:

- Feb-2022: Givaudan teamed up with Fiberstar, a US-based company. This collaboration aimed to allow Givaudan to leverage and commercialize Citri-Fi, a natural plant-based texturizing ingredient of Fiberstar, in order to expand its Taste & Well-being offerings. In addition, the collaboration would also allow Fiberstar to expand its geographical footprint and leverage new R&D opportunities.

- Sep-2021: Givaudan collaborated with Biosyntia, a Danish biotech business. Through this collaboration, the companies aimed to explore novel applications of fermentation technology in order to develop natural flavoring ingredients for the food and beverage industry.

Product Launches and Product Expansions:

- Jun-2022: IFF launched GUARDIAN, its new range of plant extract-based synergistic oxidation control and formulations. The new solution aimed to improve the quality and stability of frying oils while also helping customers in maintaining their freshness. In addition, the new GUARDIAN SYNEROX would eliminate frying-oil waste by at least 30%.

- Jun-2022: Givaudan launched BioNootkatone, a breakthrough ingredient, in collaboration with Manus Bio. This product launch aimed to meet the increasing demand for natural, sustainable, and clean-label citrus flavors without the supply and cost volatility of conventional citrus extracts.

- May-2022: Symrise unveiled Aronia juice powder and Aronia extract, a new line of Aronia health actives. This launch aimed to expand the Diana food offerings of health actives of the company.

- Sep-2020: Kerry introduced New! Citrus Extract, an advanced citrus extract technology. This launch aimed to deliver the impact and flavor benefits of conventional natural citrus products with the ability to be labeled as Natural Extract. Moreover, the new technology can be applied to a range of citrus fruit as well as a number of applications.

Acquisition & Mergers:

- Apr-2022: IFF took over Health Wright Products, a leading provider of capsules and formulations. Through this acquisition, the company aimed to leverage HWP's capabilities and expertise in order to fulfil the rising and evolving demands of customers.

- Mar-2022: Symrise completed its acquisition of Groupe Neroli and fragrance houses, France-based businesses. Following this acquisition, the company aimed to gain greater access to natural ingredients and also strengthen its fine fragrance prevalence within southern France.

- Dec-2021: ADM completed its acquisition of Flavor Infusion International, a provider of flavor and specialty ingredient solutions In Latin America. With this acquisition, the company aimed to leverage new regional prospects offered by Flavor Infusion.

- Dec-2021: Royal DSM completed its acquisition of Vestkorn Milling, a leading European producer of ingredients. Through this acquisition, the company aimed to mark a milestone in its strategy to develop a substitute protein business and offer innovative CanolaPRO of rapeseed protein isolate DSM to synergy.

- Jul-2021: Kerry acquired Biosearch, a leader in biotechnology. With this acquisition, the company aimed to use the skills and expertise of Biosearch in order to expand its science-backed branded ingredients offerings.

- May-2021: Carbery Group took over Innova Flavors, a business of Griffith Foods. With this acquisition, the company aimed to offer a wide variety of savory solutions to customers. Furthermore, this acquisition would also expand the service portfolio of Synergy.

- Feb-2021: IFF formed a merger with the Nutrition & Biosciences business of DuPont. Through this merger, the companies aimed to manufacture high-value solutions as well as ingredients for the Food & Beverage industry, Health & Wellness market, and Home & Personal Care sector. Moreover, this merger would also accelerate the company's position in Texture, Taste, Nutrition, Enzymes, and Scent.

- Nov-2020: Symrisetook over fragrance and aroma chemicals activities of Sensient Technologies, a vendor of manufacturer and marketer of colors, flavors, essential oils, and extracts. Under this acquisition, the company aimed to leverage the broad line of fragrances and aroma molecules of Sensient in order to expand its portfolio of fragrance ingredients and bolster its position in the manufacture of fragrance compositions.

- Jan-2020: ADM took over Yerbalatina Phytoactives, a natural plant-based ingredients and extracts manufacturer. Through this acquisition, the company aimed to significantly expand its business throughout Brazil.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Dietary Supplements

- Others

By Source

- Herbs & Spices

- Fruits & Vegetables

- Flowers

By Form

- Dry

- Liquid

By Product Type

- Oleoresins

- Essential Oils

- Flavonoids

- Alkaloids

- Carotenoids

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- International Flavors & Fragrances, Inc.

- Kerry Group PLC

- Archer Daniels Midland Company

- Carbery Group Ltd.

- Koninklijke DSM N.V.

- Döhler Gmbh

- Symrise AG

- Givaudan S.A.

- Synthite Industries Pvt. Ltd.

- Kalsec Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- International Flavors & Fragrances, Inc.

- Kerry Group PLC

- Archer Daniels Midland Company

- Carbery Group Ltd.

- Koninklijke DSM N.V.

- Döhler Gmbh

- Symrise AG

- Givaudan S.A.

- Synthite Industries Pvt. Ltd.

- Kalsec Inc.