The Internet of Everything offers superior standards of security as well as other social and financial advantages. Businesses are implementing IoE to boost productivity and reduce costs, such as capital expenditures, energy, and labor. Mobile device use has made traveling easier and led to an increase in app creation. This enables IoT companies to create apps that act as an interface between embedded systems and other smart devices, enabling the interchange of data and analytics. Additionally, municipalities are increasingly using smart meters for electricity and water monitoring within commercial and residential properties to measure use and explore new ways to reduce costs. In the coming years, these aspects are anticipated to offer the industry profitable growth prospects.

IoE is characterized by four main components, including people, objects, data, and processes. In an IoE environment, users can access the internet via PCs, cellphones, tablets, and fitness trackers. User's interactions with various tools, websites, social networks, and applications produce data. Additionally, smart tattoos, skin sensors, and smart clothing also produce data that offer vitally important personal insights into the users. People thus serve as a node on the IoE-enabled network that aids enterprises in solving pressing problems or making decisions by having an awareness of human issues.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly affected the economy across the world. A number of businesses were majorly demolished as a result of the outbreak. The COVID-19 pandemic had an extremely significant effect on society and the economy. The COVID-19 pandemic also had a major impact on the IoE system supply chain. Professional services saw a delay, and many IoE projects had their implementation paused. In the initial period of the outbreak, operations within a number of companies were hauled, due to which, the utilization of connected devices declined. However, the pandemic also had a positive impact on the market in the second half of the year. The outbreak accelerated the adoption of numerous technologies since individuals are becoming more tech-savvy and adopting technology while working from home. Examples of these technologies include IoT, IoE, Artificial Intelligence, Machine Learning, and others.Market Growth Factors

Increasing consumption of the internet by people across the world

A variety of significant services and materials that are necessary for daily life are available on the internet. People can advance in almost all aspects of their life by leveraging the internet. Because it is a universal computer network structure, it can connect people from all over the world and build communities. It is an excellent way to share and obtain knowledge, and it is accessible practically anywhere. It is a phenomenal way to exchange information around the world and save time because it's quick, accessible, and affordable. The world has become smaller because people no longer need to waste time looking for information as it is now readily available on computer displays through the Internet. Therefore, the adoption of the Internet of Everything is also rising. This factor is propelling the growth of the marketAn upsurge in the adoption of cloud-based solutions in companies

Small and medium-sized businesses and major corporations are among the user groups that have contributed to the expansion of the cloud industry by increasing the need for affordable data storage, backup, as well as protection. Utilizing the mobile workforce with convenient data collection, archiving, access, and recovery facilities improves corporate operations. The adoption of cloud-based IoT software and platforms all over the world rises as end-user enterprises switch to cloud computing technologies. For example, Sam's West, Inc., a subsidiary of Wal-Mart Stores, Inc., granted a contract to Salesforce.com in 2016 for the deployment of a customer success platform to transform its current business membership purchase and engagement process into a digital process to enhance membership experience across SAM's 650 clubs. Thus, this factor is augmenting the growth of the Internet of Everything market.Market Restraining Factors

Prevalence of malware, including Distributed DoS Attacks, Botnets, and ThingBots

One of the major risks to connected devices is the threat of malware. When Mirai infected a significant number of IoT devices all over the world, including printers, routers, and real-time cameras, security vulnerabilities for IoTs were initially identified as an alarming concern. In order to overwhelm the servers and prevent users from accessing the website, the attackers connected and targeted a website using every device that was infected with the Mirai malware at once. The worst effect of a Mirai attack is that it can completely destroy any IoT device that has been improperly set up. As the IoE is an upgrade to IoT technology, it is also vulnerable to these threats. This factor is impeding the growth of the Internet of Everything market.Component Outlook

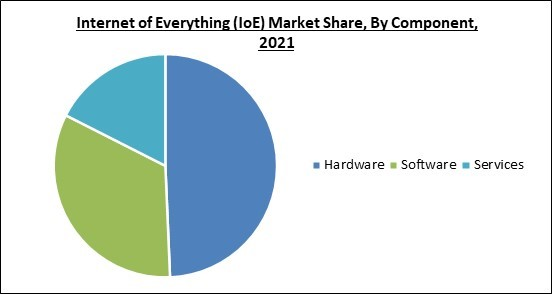

On the basis of Component, the Internet of Everything (IoE) Market is segmented into Hardware, Software, and Services. In 2021, the hardware segment acquired the highest revenue share of the Internet of Things market. The market is growing as a result of a surge in smartphone adoption and the use of 3G and 4G networks. To meet the rising customer demand, major manufacturers are increasingly creating inexpensive sensors and other components. Moreover, a number of compact devices with a bulk of features are rapidly being introduced within the market. Therefore, this factor is estimated to majorly propel the growth of this segment of the market.Vertical Outlook

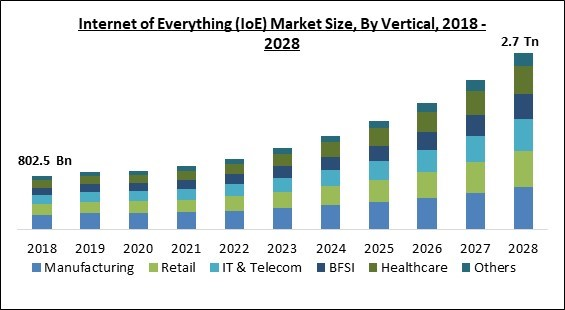

By Vertical, the Internet of Everything (IoE) Market is segregated into Healthcare, Manufacturing, Retail, BFSI, IT and Telecom, and Others. In 2021, the healthcare segment witnessed a substantial revenue share of the Internet of Everything market. The growth of the segment is significantly increasing due to improvements in medical technology, widespread use of healthcare-linked devices, and the requirement to track the whereabouts of medical equipment, patients, and staff. Moreover, healthcare wearable is a new trend in the modern era. These gadgets allow the user to monitor their health statistics through a wearable, such as a smartwatch or a smart ring. These factors are accelerating the growth of this segment of the market.Regional Outlook

Region-Wise, the Internet of Everything (IoE) Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America recorded the biggest revenue share of the market. The regional IoE market is anticipated to grow during the forecast period due to an increase in government sector spending and technical developments in the telecom sector. Moreover, IoE is also anticipated to be used to support growth in the manufacturing sector, which includes asset monitoring, supply chain connectivity, workplace safety administration, and energy management.Cardinal Matrix-Internet of Everything (IoE) Market Competition Analysis

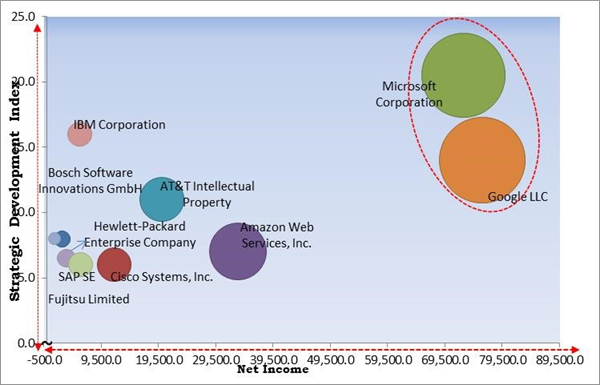

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the Internet of Everything (IoE) Market. Companies such as Amazon Web Services, Inc. (Amazon.com, Inc.), AT&T Intellectual Property and IBM Corporation are some of the key innovators in Internet of Everything (IoE) Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), AT&T Intellectual Property, Bosch.IO GmbH (Robert Bosch GmbH), Cisco Systems, Inc., Fujitsu Limited, Google LLC, Hewlett-Packard Enterprise Company, IBM Corporation, Microsoft Corporation, and SAP SE.

Strategies deployed in Internet of Everything (IoE) Market

Partnerships, Collaborations and Agreements:

- Aug-2022: Microsoft entered into a partnership with Larsen & Toubro, an Infotech. Under this partnership, the companies would focus on introducing high-value cloud solutions for enterprises. Moreover, LTI would also launch a dedicated Microsoft business unit to develop and distribute end-to-end digital transformation solutions.

- Jun-2022: SAP partnered with Unilever, a British multinational consumer goods company. With this partnership, the companies aimed to pilot SAP's GreenToken in order to expand their transparency as well as traceability within the global palm oil supply chain of Unilever.

- Jun-2022: Cisco collaborated with Telefonica, a Spanish multinational telecommunications company. Following this collaboration, the companies aimed to introduce new managed services across the globe, including integrated security and connectivity offers for both SMBs and large companies.

- May-2022: Fujitsu Limited teamed up with Amazon Web Services, a subsidiary of Amazon. This collaboration aimed to expedite the digital transformation of customers within the retail and financial industries. Moreover, the companies would also bring new services built on AWS, which would be deployed by Fujitsu In Japan as well as all over the world.

- May-2022: SAP came into a partnership with Google Cloud, a suite of cloud computing services by Google. With this partnership, the companies aimed to enable their customers to link crucial SAP software designed for operating all mission-critical processes over the cloud.

- May-2022: SAP joined hands with HCL, a leader in global technology. Under this collaboration, HCL would package relevant SAP software along with hardware and services that can expedite and streamline the complex and fragmented solution stack being encountered by businesses while driving Industry 4.0 transformations.

- May-2022: Microsoft joined hands with STMicroelectronics, a global semiconductor leader. Through this collaboration, the companies aimed to strengthen the security and safety of emerging IoT applications.

- May-2022: Google came into a partnership with Asus IoT, a sub-brand of Asus. Through this partnership, the companies aimed to leverage Asus IoT's capabilities in order to expand the reach of its inferencing and AI capabilities to hardware. Moreover, this partnership would also allow Google to scale the manufacturing, distribution, as well as support for Coral.

- May-2022: AT&T signed an agreement with DISH, an American television services provider. Following this collaboration, DISH would integrate AT&T Internet services within its offerings for existing as well as new DISH customers.

- Mar-2022: Google came into a partnership with TELUS and NXN Digital. With this partnership, the company aimed to provide the next generation of efficient, secure, sustainable, and innovative IoT technologies that would strengthen communities, businesses, as well as residents via a broad ecosystem of people-first solutions.

- Mar-2022: Google collaborated with IoTeX, a platform that connects IoT devices. Under this partnership, IoTeX would become the primary cloud provider of Google Cloud in order to expedite its global expansion strategy.

- Feb-2022: HPE teamed up with Qualcomm Technologies, an American multinational corporation. Following this collaboration, the companies would provide advanced Qualcomm Technologies-powered 5G distributed units inline accelerator cards, namely the Qualcomm X100 5G RAN.

- Feb-2022: IBM joined hands with SAP, a German multinational software company. With collaboration, the companies aimed to offer consulting and technology expertise in order to streamline customers to adopt a hybrid cloud approach to migrate their mission-critical workloads from SAP solutions to the cloud for non-regulated as well as regulated industries.

- Jan-2022: AWS teamed up with Stellantis, a Dutch multinational automotive manufacturing corporation. Following this collaboration, the companies aimed to implement Amazon’s software and technology expertise throughout Stellantis’ organization, including building connected in-vehicle experiences, vehicle development, as well as training advanced automotive software engineers. Furthermore, the companies would also develop a range of software-based services and products.

- Dec-2021: Microsoft partnered with Wärtsilä Voyage, a leader in maritime end-to-end onboard solutions. With this partnership, the companies aimed to reinforce its synergies throughout its end-to-end digital services offerings while also bringing its current and future products over a common platform.

- Nov-2021: IBM collaborated with Infosys Finacle, a part of Infosys's EdgeVerve Systems. Following this collaboration, the companies aimed to introduce the Finacle Digital Banking Solution Suite over the Red Hat OpenShift as well as IBM Cloud for financial services

- Sep-2021: Fujitsu teamed up with KDDI, a Japanese telecommunications operator. Under this collaboration, the companies aimed to develop new services that would accelerate the customer experience while also contributing to the resolution of social challenges by leveraging KDDI's au 5G technologies in integration with Fujitsu's private 5G.

- Aug-2021: AT&T entered into a partnership with Cisco, an American-based multinational technology conglomerate. With this partnership, the companies aimed to launch 5G network capabilities in order to bolster performance for IoT applications throughout the United States.

- Jun-2021: Amazon Web Services partnered with Salesforce, an American cloud-based software company. This partnership aimed to streamline customers to leverage the full range of AWS as well as Salesforce capabilities in order to rapidly develop and deploy powerful new business applications intending to expedite digital transformation.

- May-2021: Google partnered with SpaceX, an American spacecraft manufacturer. This partnership aimed to offer cloud services to aid in delivering internet via the latter's Starlink satellites.

- Feb-2021: Bosch joined hands with Microsoft, an American multinational technology corporation. With this collaboration, the companies aimed to develop a software platform with the aim of seamlessly connecting cars to the cloud. Moreover, it would also streamline and expedite the development and installation of vehicle software over the car’s lifetime according to automotive quality standards.

- Feb-2021: Microsoft collaborated with Intel, an American multinational corporation. Under this collaboration, the companies aimed to offer IoT services and products in order to help in lowering the complexity of solution development by integrating their software, hardware, processing edge, and cloud capabilities.

- Oct-2020: AT&T teamed up with Cisco, an American-based multinational technology conglomerate. Under this collaboration, the companies aimed to manage IoT devices for enterprises with the launch of the Cisco-powered AT&T Control Center. Moreover, the new solution would offer near real-time visibility to businesses for all the devices over their network.

- Aug-2020: Google came into a partnership with Best Buy, an American multinational consumer electronics retailer. Following this partnership, Google would offer its cloud services to Best Buy's Enterprise Data Platform to empower a data-driven retail strategy. Moreover, it would deliver new and more customized shopping experiences for customers.

- Jul-2020: Microsoft teamed up with Verizon, the Telecom giant. This collaboration aimed to aid developers along with service providers in creating and providing IoT solutions faster.

Product Launches and Product Expansions:

- May-2022: AT&T unveiled a new managed wireless wide area network. The new solutions aimed to offer businesses untether assets, locations, and people with a solution monitored and managed by network experts.

- Nov-2021: AWS rolled out the AWS IoT RoboRunner, a novel robotics service. The new solution would facilitate enterprises to develop and deploy applications with the capacity to aid fleets of robots to work unparalleled. In addition, the new solution would also enable users to connect work management systems and robots to allow them to orchestrate work across the operation through a single system view.

Acquisitions and Mergers:

- Jul-2022: Fujitsu acquired Enable Professional Services, the largest independent ServiceNow specialist in Asia-Pacific. Through this acquisition, the company aimed to gain the market-leading capabilities and expertise of Enable in order to offer ServiceNow advisory, delivery services, and consulting to customers throughout the region.

- Jul-2022: IBM took over Databand, a leader in data observability software. With this acquisition, the company aimed to strengthen its software portfolio through automation, data, and AI in order to address the full spectrum of observability.

- Feb-2022: IBM completed its acquisition of Sentaca, a leading telco consulting services and solutions provider. This acquisition aimed to expedite the hybrid cloud consulting business of IBM with the addition of critical skills to aid CSPs and media giants in modernizing multiple cloud platforms.

- Dec-2021: Bosch took over Climatec, a privately owned environmental engineering company. Through this acquisition, the company aimed to expand its presence throughout the world and strengthen its offerings.

- Sep-2021: HPE took over Zerto, a leader in cloud data management and protection. Following this acquisition, the company aimed to expand its HPE GreenLake cloud data services by leveraging Zerto’s market-leading cloud data management and protection software.

- Jun-2021: Microsoft acquired ReFirm Labs, an IoT security provider. Through this acquisition, the company aimed to strengthen its firmware security and analysis capabilities throughout devices that form the intelligent edge spanning from servers to IoT.

- Aug-2020: Cisco acquired ThousandEyes, a network intelligence company. With this acquisition, the company aimed to leverage the internet and cloud intelligence platform of ThousandEyes in order to experience expanded insights and visibility into the digital delivery of services and applications throughout the cloud and the internet.

Geographical Expansions:

- Jun-2020: HPE expanded its geographical footprint with the launch of an IoT experience center in Bengaluru. Through this geographical expansion, the company aimed to offer IoT solutions and service portfolios to its enterprise customers as well as partners across industries.

Scope of the Study

Market Segments Covered in the Report:

By Vertical

- Manufacturing

- Retail

- IT & Telecom

- BFSI

- Healthcare

- Others

By Component

- Hardware

- Software

- Services

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- AT&T Intellectual Property

- Bosch.IO GmbH (Robert Bosch GmbH)

- Cisco Systems, Inc.

- Fujitsu Limited

- Google LLC

- Hewlett-Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- SAP SE

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- AT&T Intellectual Property

- Bosch.IO GmbH (Robert Bosch GmbH)

- Cisco Systems, Inc.

- Fujitsu Limited

- Google LLC

- Hewlett-Packard Enterprise Company

- IBM Corporation

- Microsoft Corporation

- SAP SE