Infectious respiratory disorders like tuberculosis and pneumonia are becoming more common, diagnostic technology is improving, and significant companies, the government, and charitable groups are investing more in R&D for diagnostic testing. Additionally, increased number of product launches along with increased demand for tests and consumables during the pandemic. These are the main reasons that will drive the market.

Rapid technology improvements are anticipated to have a significant impact on this market by enabling accurate findings, portability, and cost-effectiveness. Due to the comparable symptoms of RSV, COVID-19, and influenza, major players are investing in the R&D and commercialization of multiplex tests for their use in the simultaneous diagnosis of these illnesses. Multiplex testing makes it possible to target numerous genes at once, cutting down on the time and expense associated with performing traditional PCR. Self-testing and point-of-care solutions are becoming more widely used, which might help the market develop even more.

COVID-19 Impact Analysis

The need for infectious disease diagnostics products has increased due to the rising burden of infectious illnesses and hospital-acquired infections worldwide. Many people dealt with respiratory issues due to the COVID-19 effect. Although many committed healthcare workers are working tirelessly on the front lines to combat this disaster, it's equally crucial to prevent the spread of disease by getting a diagnosis as soon as possible. This is projected to have an impact on the demand for quick diagnostics testing and grow the respiratory infectious diagnostics market throughout the projection period.Market Growth Factors

Increase in Aged Population

The proportion of elderly people in the population is rising in almost every nation on earth. Around 703 million people around the world were 65 or older in 2019. By 2050, there would be 1.5 billion older people in the world, a more than double increase. One of the main drivers of the growth of the market for respiratory disease testing and diagnostics is the increase in the world's geriatric population. A large number of old age people are suffering from diseases such as TB. Also, the pulmonary disease is now one of the most common causes of death worldwide.An Increase in Healthcare Facility Investment

Rising investment in research & development, particularly in developed and developing economies, will further open up lucrative market expansion opportunities for medical instruments and devices. One another significant factor promoting the growth of the market is the increased focus on improving the state of healthcare facilities and the infrastructure for healthcare as a whole. The public-private partnerships and strategic collaborations for the purpose of funding and implementing new and improved technology has been increased over the past few years.Market Restraining Factors

Cross-Contamination Dangers and a Lack of Qualified Medical Personnel

Due to the concentration of patients with lung diseases, the potential for coughing, and the formation of droplets around pulmonary function test procedures, pulmonary function testing could be a route for the transmission of infection. These systems include laboratory-grade tubing, rebreathing valves, and mouthpieces. The most frequent source of cross-infection during testing is mouthpieces. The risk of developing tuberculosis increases due to factors such as exposed surface areas, upholstery quality, air conditioning, general clutter, ideal temperature, and humidity levels.Product Type Outlook

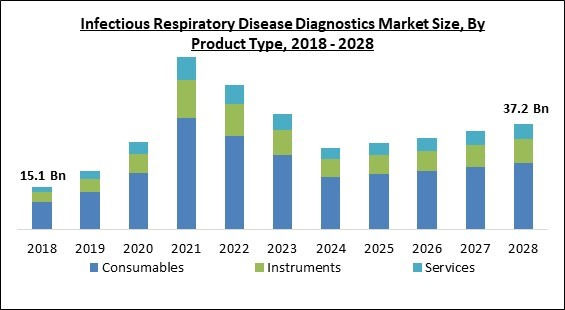

Based on product type, the infectious respiratory disease diagnostics market is segmented into instruments, consumables and services. The instrument segment acquired a substantial revenue share in the infectious respiratory disease diagnostics market in 2021. This is because of the development of products that are cutting-edge and help doctors diagnose COVID-19 patients. Furthermore, the demand for respiratory disease diagnostics instruments is rising as the patients are now more aware of consequences of such diseases and thus are more concerned for fitness.Instrument Type Outlook

Under instruments type, the infectious respiratory disease market is divided into imaging tests, respiratory measurement devices and other instruments. The imaging test segment garnered maximum revenue share in the infectious respiratory disease diagnostics market in 2021. A high-resolution CT scan could provide more information on lung problems. Images in three dimensions are possible with helical CT. Typically, a big breath is taken before a CT scan (inhales).Application Outlook

By application, the infectious respiratory disease diagnostics market is divided into SARS/COVID-19, influenza, RSV (Respiratory Syncytial Virus), tuberculosis, streptococcus testing and other respiratory disease testing. In 2021, the SARS/COVID-19 segment witnessed the largest revenue share in the infectious respiratory disease diagnostics market. The dominance is the result of the high incidence of COVID-19, more product approvals, and greater R&D. Nevertheless, during the predicted period, rising immunization rates are anticipated to lessen the disease's severity and declining testing rates.Sample Type Outlook

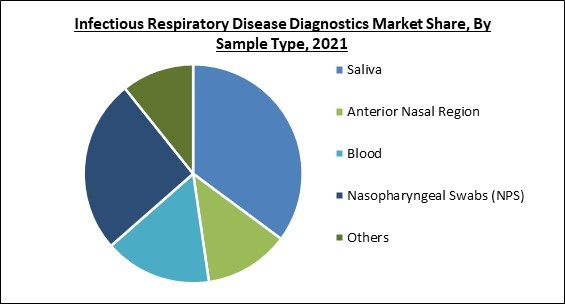

On the basis of sample type, the infectious respiratory disease diagnostics market is fragmented into saliva, nasopharyngeal swabs (NPS), anterior nasal region, blood and others. In 2021, the nasopharyngeal swabs segment recorded a substantial revenue share in the infectious respiratory disease diagnostics market. This growth is the result of the increase in demand for NPS accompanied by a wide range of applications for conducting various tests, such as rapid antigen detection tests, direct fluorescent antibodies, and Polymerase Chain Reaction (PCR). Many businesses have dramatically increased their swab manufacturing capacities in response to the COVID-19 pandemic.Technology Outlook

Based on technology, the infectious respiratory disease diagnostics market is classified into immunoassay, molecular diagnostics, micro-biology and other technologies. In 2021, the molecular diagnostics segment accounted the maximum revenue share in the infectious respiratory disease diagnostics market. The rising demand for RT-PCR testing for the diagnosis of COVID-19, RSV, influenza, and other diseases might be blamed for the high share. The most well-known and dependable gold standard technology for amplifying DNA to undertake molecular diagnostics is a polymerase chain reaction.End Use Outlook

On the basis of end-use, the infectious respiratory disease diagnostics market is segmented into hospitals, diagnostic laboratories, physician offices, and other end users. The physician offices segment generated a significant revenue share in the infectious respiratory disease diagnostics market in 2021. This is due to growing patient preference and manufacturers' increased attention on the development of point-of-care diagnostics, the physician offices end-use sector is anticipated to see a high growth rate over the course of the forecast period. It is anticipated that the advent of innovative assays that deliver speedy PoC findings would accelerate segment expansion.Regional Outlook

Region wise, the infectious respiratory disease diagnostics market is analysed across the North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region led the infectious respiratory disease diagnostics market by generating the highest revenue share. The market in this region is being propelled due to the rising number of the ageing population. Furthermore, the government of nations in the region such as India and China is taking various initiatives in order to enhance the healthcare facilities in the region. As a result of this, the infectious respiratory disease diagnostics market would grow in the region.Cardinal Matrix-Infectious Respiratory Disease Diagnostics Market Competition Analysis

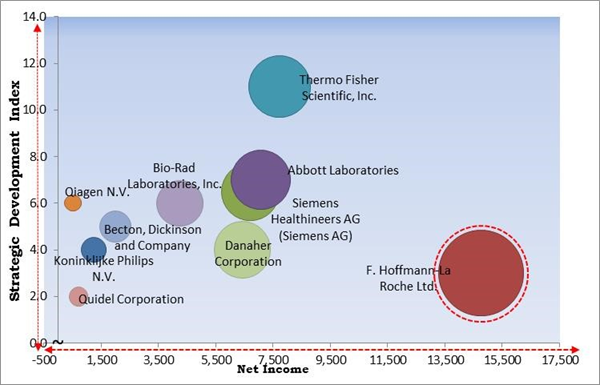

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd. is the forerunners in the Infectious Respiratory Disease Diagnostics Market. Companies such as Thermo Fisher Scientific, Inc., Abbott Laboratories and Siemens Healthineers AG are some of the key innovators in Infectious Respiratory Disease Diagnostics Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Becton, Dickinson and Company, Siemens Healthineers AG (Siemens AG), Thermo Fisher Scientific, Inc., Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd., Qiagen N.V., Bio-Rad Laboratories, Inc., Danaher Corporation, Quidel Corporation

Strategies deployed in Infectious Respiratory Disease Diagnostics Market

Partnerships, Collaborations and Agreements:

- Apr-2022: Royal Philips signed an agreement with Prisma Health, South Carolina's largest non-profit healthcare system. This agreement aimed at innovating healthcare across the enterprise and unlocking the power of patient data. Philips’ solutions portfolio includes real-time patient monitoring, telehealth, image management, therapeutic devices, and informatics solutions including radiology and cardiology PACS, advanced visualization, vendor-neutral archive (VNA), and Philips Enterprise Viewer.

- Oct-2021: BD collaborated with U.S. Government. Under this collaboration, BD would get clearance for five new combination tests that include BD Veritor Plus System Respiratory Panel, BD MAX System Respiratory Panel, BD MAX System Respiratory Panel plus Pan-Coronavirus, BD COR System Respiratory Panel, and BD COR System Respiratory Panel plus Pan-Coronavirus. These diagnostic tests aimed at providing the ability to screen for multiple pathogens in a single sample taken from a person with the signs & symptoms of a respiratory illness.

- Sep-2021: Thermo Fisher Scientific teamed up with AstraZeneca, a global, science-led biopharmaceutical business. Under this collaboration, the companies would together develop next-generation sequencing (NGS) based companion diagnostics (CDx) to support AstraZeneca's expanding portfolio of targeted therapies. Furthermore, more than 90 percent of AstraZeneca's clinical pipeline, across all main areas from cardiovascular, oncology, and renal to metabolic and respiratory disease, is targeted precision medicine therapies.

- May-2021: Siemens Healthineers entered into a partnership with Genetron Health, a leading precision oncology platform. This partnership focused on promoting precision oncology for lung cancer. Further, this partnership aimed to promote large-scale application of Genetron’s S5 platform and lung cancer 8-gene IVD assay in Chinese hospitals, in order to provide non-small cell lung cancer (NSCLC) patients with efficient & accurate personalized diagnosis and treatment guidance.

Product Launches and Product Expansions:

- Jul-2022: Thermo Fisher Scientific released Applied Biosystems TaqPath Respiratory Viral Select Panel; a CE-IVD-marked molecular assay panel. This launch would detect the five common viruses, including those that may cause the common cold, bronchiolitis, croup, influenza-like illnesses, and pneumonia.

- Jul-2022: Hologic released molecular tests. These latest test panels would detect various common viruses at once such as COVID-19, the flu, the common cold, respiratory syncytial virus, pneumonia, and more. The test panels would be initially launched with CE mark approval in the European Union.

- Jun-2022: BD introduced BD MAX Respiratory Viral Panel (RVP), a new molecular diagnostic combination test for SARS-CoV-2, Influenza A + B, and Respiratory Syncytial Virus (RSV). This launch would help eliminate the requirement for multiple tests or doctor visits and could help clinicians to implement the right treatment plan rapidly.

- May-2022: QIAGEN released therascreen EGFR Plus RGQ PCR Kit, a new in-vitro diagnostic test. This launch would help guide non-small cell lung cancer (NSCLC) treatment. The real-time qPCR test builds on the established therascreen EGFR RGQ PCR Kit and provides enhanced limits of detection, quicker turnaround times, automated sample extraction options as well as automated results analysis.

- Nov-2021: QIAGEN expanded its existing QIAstat-Dx testing menu by adding with a respiratory four-plex panel that differentiates between flu, RSV, and SARS-CoV-2. The launch would be marketed soon as this easy-to-use cartridge receives CE-marking in Europe.

- Sep-2021: Roche released three molecular PCR diagnostic test panels. This launch focused on simultaneously detecting and differentiating common respiratory pathogens. As respiratory viruses circulating within a community could vary depending on seasonality and geography, a flexible testing option based on a syndromic-style panel allows personalized healthcare & helps reduce unnecessary testing.

- Jul-2021: Bio-Rad introduced COVID & Flu PCR kit; a single molecular test designed for clinical diagnostic labs. The assay kit contains Bio-Rad’s standard & negative molecular controls as well as assay reagents.

- Oct-2020: Bio-Rad Laboratories unveiled VIROTROL SARS-CoV-2 and VIROCLEAR SARS-CoV-2, positive and negative quality controls. The product has got CE mark requirements for in vitro diagnostics in markets outside the United States.

- Aug-2020: Thermo Fisher Scientific launched a highly automated, real-time PCR solution. This solution would allow laboratories to double or even triple their testing capacity to support global efforts to return communities to work and school. The launch aimed at analyzing up to 6,000 samples in a single day to meet the rising global demand for covid-19 testing.

- Mar-2020: ABBOTT introduced the molecular point-of-care test. This launch aimed at providing a solution that can detect novel coronavirus within a few minutes. This test would run on Abbott's ID NOW platform, providing rapid results in a broad range of healthcare settings like physicians' offices, urgent care clinics, and hospital emergency departments.

Mergers & Acquisition:

- Sep-2021: Abbott took over Walk Vascular, a commercial-stage medical device company. This acquisition would fit into Abbott's leading vascular device offerings and further drives Abbott's ability to provide one-of-a-kind endovascular therapy solutions to enhance patient care.

- Jun-2021: Danaher took over Precision NanoSystems (PNI), a company that develops technologies and solutions for genetic medicines. Under this acquisition, the Vancouver, Canada-based company would join Danaher’s life sciences platform, complementing the portfolios of both Cytiva and Pall, according to Emmanuel Ligner, Danaher group executive.

Geographical Expansion:

- Apr-2022: Siemens Healthineers expanded its geographical footprint in India by opening a new manufacturing facility in the region. This expansion focused on accelerating the growth of the medical devices space in the region, the company has introduced its new production line (plant) for computed tomography scanners at its Bengaluru facility.

Approvals & Trails :

- Jan-2021: QUIDEL got emergency use approval for QUICKVUE. This approval would enable the company to market its new QuickVue At-Home COVID-19 Test for the qualitative detection of the nucleocapsid protein antigen from SARS-CoV-2. This test would be authorized for prescription home use with self-collected (unobserved) anterior nares (NS) swab specimens directly from individuals aged 14 years & older who are suspected of COVID-19 by their healthcare provider within the first six days of the onset of symptoms.

Scope of the Study

Market Segments Covered in the Report:

By Product Type

- Consumables

- Instruments

- Imaging Tests

- Respiratory Measurement Devices

- Others

- Services

By Application

- SARS/COVID 19

- Influenza

- RSV (Respiratory Syncytial Virus)

- Tuberculosis

- Streptococcus Testing

- Others

By Sample Type

- Saliva

- Anterior Nasal Region

- Blood

- Nasopharyngeal Swabs (NPS)

- Others

By Technology

- Molecular Diagnostics

- Microbiology

- Immunoassay

- Others

By End Use

- Diagnostic Laboratories

- Hospitals

- Physician Offices & Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Abbott Laboratories

- Becton, Dickinson and Company

- Siemens Healthineers AG (Siemens AG)

- Thermo Fisher Scientific, Inc.

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Quidel Corporation

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company

- Siemens Healthineers AG (Siemens AG)

- Thermo Fisher Scientific, Inc.

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Quidel Corporation