Without the energy sector, no industry would exist. It also accounts for the largest number of projects and installations with high financial worth. As emerging nations continue to increase their manufacturing facilities to meet expanding demand, the number of energy projects worldwide is continuously rising. Energy logistics uses labor, infrastructure, and equipment effectively to drive energy product logistics within the energy sector. Energy companies are attempting things like changing the energy mix and boosting the influence of renewable power on the market. Energy corporations offer high-quality, safe solutions that help energy companies boost production and cut expenses.

Presently, growing Internet of things (IoT) adoption in the industry allows freight businesses to gain direct internet access to the company network. The use of technologically sophisticated systems for logistics improvement and increased expenditure by several energy logistics organizations throughout the globe are additional factors that are anticipated to fuel the market's expansion over the forecast period.

COVID-19 Impact Analysis

The majority of the COVID-19-affected nations, including the United States, India, Germany, Italy, and the UK, are serviced by China's extensive supply chain network. In addition, all of these nations aside from China engage in trade activities with one another to exchange a variety of goods, both essential and non-essential, such as energy-based goods, automobiles, and their ancillary parts, mobile phones, industrial equipment, and even active pharmaceutical ingredients (APIs). Considering all these factors, the energy logistics market is negatively affected due to the widespread COVID-19 pandemic.Market Growth Factors

The rise in agreements relating to trade

Globalization is primarily driven by the expansion of the economy and the dynamism of the market. A surge in numerous trade-related activities can be attributed to the acceleration of globalization. As a result, it is getting more challenging for retailers or manufacturers to effectively monitor these actions. Energy logistics services are essential for consumers who are price conscious and need a greater selection of high-quality products delivered on time. For major companies, this factor is anticipated to drive the energy logistics market.The rise in last-mile deliveries and the automation of logistics

The term 'last mile logistics'describes the last stage of the delivery from a facility or distribution center to the end customer. A larger emphasis on last-mile transportation solutions is also being seen in the growing pharmaceuticals, chemical, wind, and food and beverage industries. Another possibility that is anticipated to fuel the expansion of the logistics industry in the near future is the ongoing effort made by energy logistics businesses to provide effective last-mile deliveries. The market for energy logistics is anticipated to benefit greatly from the development of last-mile delivery together with logistics automation.Market Restraining Factors

Inefficient infrastructure and more expensive logistics

Good supply chains, infrastructure, and trade facilitation are necessary for energy logistics. Without these, businesses must accumulate more working capital and stock reserves, which can have a significant impact on regional and national competitiveness due to high financial expenses. The energy logistics business is further hampered by a lack of infrastructure, which drives up costs and decreases supply chain dependability. These include considerable transportation inefficiencies, shoddy storage facilities, a complicated tax system, a low rate of technology adoption, and inadequate energy logistics professionals. The necessity for huge stocks to cover contingencies as a result of inadequate transportation infrastructure might raise total logistics costs.Application Outlook

Based on application, the energy logistics market is segmented into oil & gas, renewable energy, power generation, and energy mining. In 2021, the oil & gas segment dominated the energy logistics market by generating maximum revenue share. This is due to growing efforts to refine oil & gas from natural reservoirs. Additionally, the logistic service providers have been providing effective energy logistical services, which has fueled the segment's expansion in the market. The explosion in offshore oil & gas exploration, as well as production activities, has increased.End-users Outlook

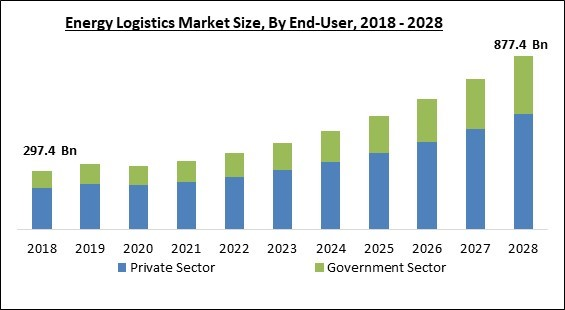

On the basis of end-users, the energy logistics market is fragmented into government sector and private sector. The private sector segment held the largest revenue share in the energy logistics market in 2021. The growth in this segment is the result of the increased contract allocation to private companies for the extraction of raw materials from mines & ores and transportation of them to private locations like power stations or private refineries to be used for energy generation. Thus, the market for energy logistics would grow in this segment.Mode of Transportation Outlook

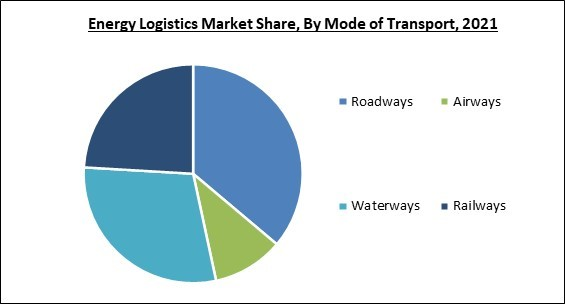

By mode of transportation, the energy logistics market is divided into railways, airways, roadways, and waterways. The railway's segment procured a significant revenue share in the energy logistics market in 2021. This is because of the expanding e-commerce sector and rising door-to-door delivery. The objective is to maintain affordable multi-modal transportation options, which is a crucial strategy for the logistics industry as it grows regionally.Regional Outlook

Region wise, the energy logistics market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region led the energy logistics market with the largest revenue share. This is due to the ease with which outsourced logistics services are adopted and the substantial government support given to the growth of the logistics infrastructure in the region. The market is expanding in the region as a result of the rising import & export business locally as well as internationally which is anticipated to be continued in near future.Cardinal Matrix-Energy Logistics Market Competition Analysis

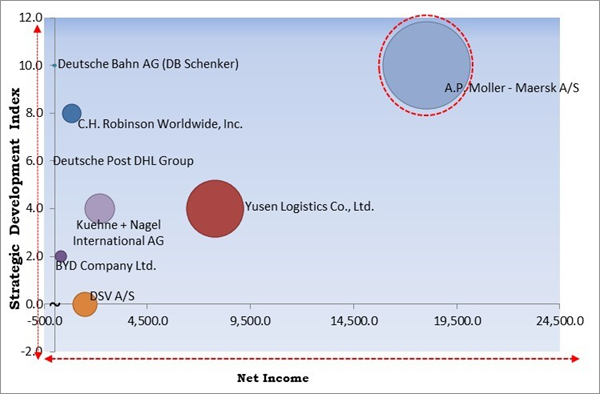

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; A.P. Moller-Maersk A/S is the forerunner in the Energy Logistics Market. Companies such as Yusen Logistics Co., Ltd., Kuehne + Nagel International AG, C.H. Robinson Worldwide, Inc. are some of the key innovators in Energy Logistics Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BYD Company Ltd., Deutsche Bahn AG (DB Schenker), C.H. Robinson Worldwide, Inc., Yusen Logistics Co., Ltd. (Nippon Yusen Kabushiki Kaisha), A.P. Moller-Maersk A/S, DSV A/S, Kuehne + Nagel International AG, Deutsche Post DHL Group, and Hellmann Worldwide Logistics SE & Co. KG.

Strategies deployed in Energy Logistics Market

Partnerships, Collaborations and Agreements:

- Nov-2021: DB Schenker partnered with Volta Trucks, a company that manufactures and provides services. This partnership would accelerate the transition to an all-electric urban vehicle fleet. This partnership would enable DB to significantly rise the pace of electrification of its fleet and invest in greener transport solutions and support the company's goal of carbon neutral logistics.

- Nov-2021: Maersk partnered with Vestas, a Danish manufacturer, seller, installer, and servicer of wind turbines. This partnership includes door-to-door transport from the company´s suppliers to their factories and service warehouses as well as containerized site parts and transport equipment as well as airfreight shipments.

- Oct-2021: BYD partnered with Levo Mobility, a joint venture of Nuvve Holding, affiliates of Stonepeak Partners LP, and Evolve Transition Infrastructure LP. This partnership focused on integrating Nuvve’s leading vehicle-to-grid (“V2G”) technology with a mix of BYD battery electric vehicles and plans for the joint deployment of up to 5,000 BEVs. The partnership would further provide a much-needed financing solution & the world’s leading V2G platform to catalyze the electrification initiative.

Acquisition and Merger:

- Sep-2022: DB Schenker completed the acquisition of USA Truck, a leading capacity solutions provider. This acquisition focused on the company's aim to grow in North America in terms of both market share as well as geographical footprint.

- Sep-2022: A.P. Moller - Maersk took over LF logistics, a privately-owned company by Li & Fung. Through this acquisition, Maersk would add 223 warehouses* to the existing portfolio, bringing the total number of facilities to 549 globally. This acquisition would enable Maersk’s aim to support customers’ supply chain needs end-to-end as a trusted partner in control of the assets.

- Aug-2022: A.P. Moller-Maersk signed an agreement to acquire Martin Bencher Group, a Denmark-based project logistics company. This Martin Bencher will be an excellent fit for Maersk and our integrator strategy, strengthening our ability to provide project logistics services to our global clients.

- Jun-2022: DB Schenker acquired Bitergo, a logistics software provider. The acquisition focused on integrating into the DB's vision of managing the supply chain digitally and end-to-end in the future.

- Aug-2021: Deutsche Post DHL Group acquired JF Hillebrand Group, an ocean freight forwarding expert. With the growing maturity of our freight forwarding business, this bolt-on acquisition of Hillebrand is highly complementary to our existing portfolio. In line with our Group Strategy, we strengthen our core logistics business and deliver profitable long-term growth.

- May-2021: Kuehne+Nagel acquired Apex, a free-to-play battle royale-hero shooter. This acquisition would complement Kuehne+Nagel's successful organic growth strategy and substantiates its strong position as one of the world’s biggest logistics providers. Further, this acquisition would enable the expansion of the Group’s service offering, networks, and growth potential.

- May-2021: C.H. Robinson acquired Combinex Holding B.V., a company that operates in the Transportation/Trucking/Railroad industry. This acquisition would strengthen C.H. Robinson's existing footprint in Europe, particularly in Western Europe, Combinex would also offer additional haul capabilities with a dedicated fleet, expanding its reach in the short-medium haul market.

Scope of the Study

Market Segments Covered in the Report:

By End-User

- Private Sector

- Government Sector

By Mode of Transport

- Roadways

- Airways

- Waterways

- Railways

By Application

- Oil & Gas

- Renewable Energy

- Power Generation

- Energy Mining

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- BYD Company Ltd.

- Deutsche Bahn AG (DB Schenker)

- C.H. Robinson Worldwide, Inc.

- Yusen Logistics Co., Ltd. (Nippon Yusen Kabushiki Kaisha)

- A.P. Moller-Maersk A/S

- DSV A/S

- Kuehne + Nagel International AG

- Deutsche Post DHL Group

- Hellmann Worldwide Logistics SE & Co. KG

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- BYD Company Ltd.

- Deutsche Bahn AG (DB Schenker)

- C.H. Robinson Worldwide, Inc.

- Yusen Logistics Co., Ltd. (Nippon Yusen Kabushiki Kaisha)

- A.P. Moller - Maersk A/S

- DSV A/S

- Kuehne + Nagel International AG

- Deutsche Post DHL Group

- Hellmann Worldwide Logistics SE & Co. KG