Speak directly to the analyst to clarify any post sales queries you may have.

The personal finance software market is undergoing substantial change, driven by evolving regulatory frameworks, increasing operational demands, and a strategic shift toward digital platforms. Senior decision-makers now focus on integrating robust, compliant technologies to maintain agility and security in diverse finance environments.

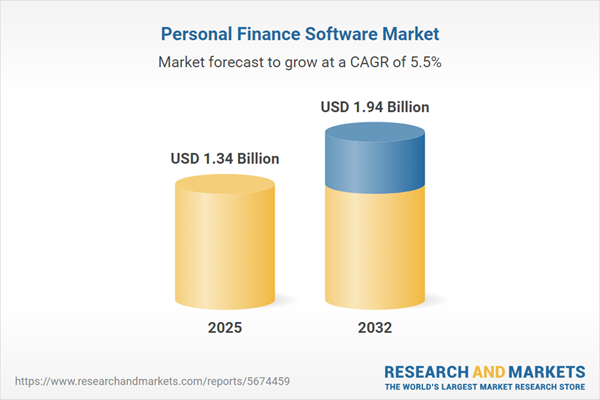

Market Snapshot: Growth and Outlook for the Personal Finance Software Market

By 2024, the global personal finance software market reached USD 1.26 billion, with forecasts indicating continued expansion to USD 1.34 billion in 2025 and a compound annual growth rate of 5.50%. Market growth is attributed to swift enterprise adoption of digital finance management tools, the rise of advanced analytics applications, and stronger integration of automation. Organizations now prioritize solutions that deliver comprehensive data security and digital resilience. The need for increased real-time insight and rapid adaptability shapes platform requirements, particularly as regulatory complexity intensifies. Demand for adaptable, compliant finance platforms continues as companies emphasize operational control and efficiency.

Scope & Segmentation: Key Dimensions of the Personal Finance Software Market

- Solution Types: Budgeting tools, portfolio management, retirement and tax planning, and integrated wealth management provide organizations with control, accurate forecasting, and actionable risk analytics across finance functions.

- Deployment Modes: Cloud-based, on-premise, and hosted solutions, available in public, private, and hybrid models, allow for compliant finance operations and responsive scaling to support business evolution.

- Platform Variety: Desktop systems, browser-based platforms, and mobile applications enable accessibility, support distributed finance teams, and ensure workflow collaboration regardless of location or device.

- End User Segments: Families, young professionals, microbusinesses, and small enterprises benefit from tailored automation, proactive financial planning, and adaptive reporting aligned with varying operational scales.

- Geographical Coverage: Americas, Europe, Middle East, Africa, and Asia-Pacific exhibit distinct adoption patterns, impacted by local digital maturity and the region-specific regulatory environment, prompting organizations to localize strategies accordingly.

- Technology Drivers: Artificial intelligence, blockchain, open banking APIs, biometric authentication, advanced encryption, and hybrid cloud infrastructure enhance analytics capability, reinforce data protection, and safeguard the futureproofing of financial procedures.

- Competitive Landscape: Major vendors, including Oracle Corporation, Mastercard, Fiserv, Fidelity National Information Services, Intuit, Robinhood Markets, Temenos Group, SoFi Technologies, Envestnet, and Q2 Holdings, advance product innovation and industry evolution through continuous enhancement and key alliances.

Key Takeaways for Senior Decision-Makers

- Digital finance solutions now support greater transparency and flexible adaptation, meeting complexity and compliance needs in multifaceted organizational environments.

- The adoption of artificial intelligence and machine learning increases the speed and accuracy of analytics, enabling finance leaders to make informed, real-time decisions across teams and markets.

- Hybrid and multi-cloud approaches support enterprise resilience, offering scalable options to address changing regional requirements and shifting market conditions.

- Customization of finance platforms allows organizations to respond quickly to local regulatory standards, minimizing operational and compliance risks during expansion or restructuring.

- Collaboration with established vendors and finance technology partners streamlines the adoption of new systems and facilitates seamless transitions in times of policy or organizational change.

- Implementing advanced encryption and authentication solutions remains vital to securing sensitive finance data and ensuring alignment with emerging standards and security expectations.

Tariff Impact: Cost Management and IT Strategy Adjustments

In 2025, changes to U.S. tariffs are prompting business leaders to adjust technology procurement strategies and reevaluate financial management priorities. The preference for cloud-based deployments is growing as organizations seek predictable costs and the ability to scale rapidly, supporting both operational changes and evolving compliance requirements. Strategic partnerships with regional providers are enabling organizations to maintain agility, facilitate contract adjustments, and ensure ongoing regulatory alignment as local directives shift.

Methodology & Data Sources

This report integrates direct insights from finance executives, technology leaders, and end users, alongside comprehensive industry research and regulatory review. Corporate disclosures are also analyzed to ensure a complete understanding of how digital transformation is influencing the personal finance software market.

Why This Report Matters for Senior Decision-Makers

- Supports strategic investment in digital and risk-aware operational models that evolve alongside changing compliance requirements.

- Clarifies deployment options that advance data security and sustain operational agility within modern finance environments.

- Supplies actionable evaluation benchmarks for software solutions, guiding senior leaders through modernization decisions in line with organizational goals.

Conclusion

These insights give senior leaders the information needed to evolve finance strategies, meet regulatory demands, and ensure adaptability throughout industry changes.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Personal Finance Software market report include:- Oracle Corporation

- Mastercard Incorporated

- Fiserv, Inc.

- Fidelity National Information Services, Inc.

- Intuit Inc.

- Robinhood Markets, Inc.

- Temenos Group AG

- SoFi Technologies, Inc.

- Envestnet, Inc.

- Q2 Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.34 Billion |

| Forecasted Market Value ( USD | $ 1.94 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |