Growth of E-Commerce and Q-Commerce Markets

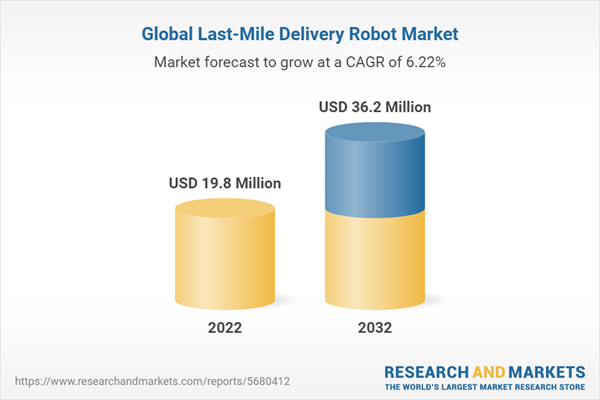

The global last-mile delivery robot market was valued at $18.1 million in 2021, and it is estimated to reach $36.2 million by 2032 at a compound annual growth rate (CAGR) of 6.22% during the forecast period 2022-2032. The major factor driving the market growth is the rise of e-commerce markets, online shopping, food and retail delivery platforms, and demand for faster and cost-effective last-mile deliveries. During the COVID-19 pandemic, the adoption of last-mile delivery robots saw significant traction for applications such as healthcare and pharmaceutical delivery, food and beverage delivery, and retail delivery.

Market Lifecycle Stage

International organizations like the United Nations Economic Commission for Europe (UNECE) and the International Organization for Standardization (ISO) define robots as multifunctional and programmable machines capable of moving objects, tools, or devices through programmed motions to execute a wide range of tasks along with sensing the environment, acquiring information, and responding intelligently.

Over the years, robotic technology has evolved significantly, leading to the integration of robots in various aspects of human life. Owing to their wide range of applications, robots are classified into two categories, i.e., industrial robots and service robots. Robots used for cleaning and dusting homes, assisting health professionals during surgeries, and helping elderlies fall under the category of service robots, while the robots used for picking and moving heavy industrial goods along with inspecting and monitoring storage facilities are classified as industrial robots. The last-mile delivery robots fall under the category of service robots.

At present, utilizing last-mile delivery robots to enable faster and cheaper deliveries of various goods is gaining traction as automation, artificial intelligence (AI), and edge computing technologies have become more advanced. Moreover, last-mile delivery robots are expected to reduce the carbon emission caused by using traditional delivery methods as well as overcome the challenge of labor shortage in the logistics and delivery industry over the forecast period 2022-2032.

Impact

At present, companies operating in the logistics, e-commerce, and retail markets continue to face financial challenges emerging from the expensive last-mile deliveries due to failed deliveries, traffic congestion, road accidents, and misplaced parcels. To overcome these challenges, these companies, as well as robotics manufacturers globally, are increasing their focus on developing efficient last-mile delivery robots to enable cost-effective, faster, and safer delivery solutions.

The last-mile delivery robot market is witnessing a rise in the manufacturing of autonomous wheeled robot types for various last-mile delivery applications such as healthcare and pharmaceuticals, food and beverage, retail, postal, and parcel delivery. These robots have been designed to carry a minimum payload of 2kg to 50kg and a maximum payload of 100kg and above, with the capability to operate in a range of 50kms and above at an average speed of 15km/hour. In the last three years, wheeled robots for autonomous last-mile deliveries have become operational on sidewalks and curbs in many parts of countries such as the U.S., China, Russia, France, and Germany. Moreover, newer technologies such as level 3 and level 4 automation capabilities and artificial intelligence (AI) are expected to support the growth of the global last-mile delivery robot market over the forecast period 2022-2032.

Market Segmentation

Segmentation 1: by Application

- Healthcare and Pharmaceuticals

- Food and Beverage

- Retail

- Postal and Parcel

Based on application, the last-mile delivery robot market is expected to be dominated by retail delivery applications owing to the increasing number of e-commerce and q-commerce platforms globally. Last-mile delivery robots are expected to reduce the challenges of last-mile deliveries for the retail sector, including reducing the costs incurred for last-mile deliveries and reducing the number of lost or undelivered parcels due to GPS errors, along with reducing the carbon emission caused by using conventional vehicles for last-mile delivery applications.

Segmentation 2: by Robot Type

- Wheeled

- Legged

Based on robot type, the last-mile delivery robot market is expected to be dominated by the wheeled robot type. The robot manufacturers in the last-mile delivery robot market are highly focused on developing robots with four or six wheels for last-mile delivery applications. This design has been proven efficient for operations on sidewalks, curbs, and roads leading to a higher adoption rate of wheeled last-mile delivery robots.

Segmentation 3: by Payload Capacity

- 2Kg to 50Kg

- 51Kg to 100Kg

- 101Kg and Above

The last-mile delivery robots are being designed with different payload capacities to carry out operations as per their use cases. Over the forecast period 2022-2032, the last-mile delivery robots with payload capacities between 2Kg-50Kg are expected to lead the market as they are being adopted by a large number of e-commerce, retail, and food and beverage industries to enable faster deliveries of their products in small-scale neighborhoods.

Segmentation 4: by Range

- 1Km to 25Km

- 25Km and Above

The last mile-delivery robots with a distance range from 1km to 25km are useful for operating in small geographical locations with less population density. At the same time, the last-mile delivery robots with a distance range of 25km and above are useful for geographical locations with higher population density as the robot would be able to carry out multiple deliveries in a single trip. Over the forecast period 2022-2032, robots with a distance range of 1km to 25km are expected to gain traction as they can be deployed in college and university campuses, airports, and residential localities to enable faster last-mile deliveries.

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

During the forecast period 2022-2032, the North America region is expected to dominate the last-mile delivery robot market. The presence of key robotic companies engaged in manufacturing last-mile delivery robots, related cameras, and sensors and developing automation software is a key factor attributing to the region's growth. A higher number of collaborations between robot manufacturers, sensor manufacturers, software providers, and retail and e-commerce companies is another factor driving the growth.

Recent Developments in Last-Mile Delivery Robot Market

- On 9 September 2022, Amazon.com, Inc. acquired a Belgium-based mechatronics company D. Cloostermans -Huwaert N.V, to amplify its last-mile delivery robot operations and research and development.

- On 7 September 2022, Cartken Inc. and Magna International Inc. entered an agreement under which Magna International Inc. agreed to manufacture Cartken Inc.’s autonomous delivery robot fleet to address the increasing demand for last-mile delivery robots. The production has begun in the Magna International Inc. facility in Michigan, U.S. This agreement will enable Cartken Inc. to increase its robot fleet to thousands in the coming years.

- On 28 April 2022, Agility Robotics, Inc. secured $150 million in Series B funding from DCVC, Playground Global LLC, and Amazon Industrial Innovation Fund. This funding would help the company to scale its robot production capacity and research and development activities.

- On 25 April 2022, Domino's Pizza Enterprises Ltd. partnered with TERAKI GmbH to deliver pizzas via last-mile delivery robots in Berlin, Germany. At present, TERAKI GmbH is the only company with a government permit to operate delivery robots on sidewalks in Berlin, Germany.

- On 1 March 2022, Starship Technologies Inc. announced that the company had raised $100 million in 30 days to triple its fleet of last-mile delivery robots and expand its operations worldwide.

- On 2 March 2022, TwinswHeel announced the launch of its last-mile delivery robots at the University of Toulouse in France. The delivery robots will be used to deliver on-demand snacks at the university campus.

- On 25 October 2021, North Carolina Agricultural and Technical State University and Sodexo, Inc partnered with Starship Technologies Inc. to enable last-mile delivery robot services in North Carolina, U.S.

- On 6 July 2021, Yandex SDG partnered with the online food ordering platform Grubhub Holdings Inc. This partnership would enable last-mile delivery robots for food and beverage delivery across 250 colleges in the U.S.

- On 22 January 2021, Amazon.com, Inc. acquired Finland-based 3-D modeling and specialization company Umbra Software Oy. This acquisition helped Amazon.com, Inc. to develop 3-D software to enhance its last-mile delivery robot Scout’s safe navigation through sidewalk obstacles.

- On 19 April 2019, ANYbotics AG partnered with Continental AG to develop and demonstrate a last-mile delivery robot by combining Continental AG’s self-driving vehicle with the legged robot ANYmal.

Demand - Drivers and Limitations

Following are the drivers for the last-mile delivery robot market:

- Growth of E-Commerce and Q-Commerce Markets

Following are the challenges for the last-mile delivery robot market:

- High Manufacturing Costs

- Evaluation of Business Model Sustainability

- Scalability of the Delivery Solution

- Financial Risks in Events of Robotics Malfunction

- Infrastructure Challenges

- Regulatory Challenges

- Operational Parameters of Delivery Robot

Following are the opportunities for the last-mile delivery robot market:

- Greater Last-Mile Delivery Capacity

- Potential to Fill the Labor Shortage Gap

- Entry of Automation Services Start-ups

How can this report add value to an organization?

Product/Innovation Strategy: The product section will help the reader understand the various ongoing and upcoming developments in the last-mile delivery robot market. It will also help the readers understand the global potential of different solution markets. The players operating in this market are developing innovative robotics technology and are deeply engaged in long-term partnerships and collaborations with commercial and government agencies. Moreover, the study also examines the investment scenario in the research and development of the last-mile delivery robot market.

Growth/Marketing Strategy: The players operating in the last-mile delivery robot market are engaged in several strategies, including product developments, strategic partnerships, acquisitions, collaborations, and business expansions. The marketing strategies will help the readers understand the revenue-generating strategies adopted by robot manufacturing players operating in the last-mile delivery robot market.

For instance, on 12 April 2022, Starship Technologies, Inc. partnered with Finnish retail operator HOK-Elanto Group for last-mile delivery robot applications. Additionally, On 13 June 2022, Catken Inc. partnered with Grubhub Holdings Inc. to enable food deliveries using last-mile delivery robots in the U.S.

In January 2022, ANYbotics AG demonstrated hiking and advanced locomotion technology in its four-legged robot ANYmal. This development would help the robot to operate in rough terrain. Moreover, on 15 February 2022, Kiwi Campus Inc. and Sodexo entered into a contract to expand Kiwibot’s last-mile delivery robot fleet to 1,200 robots to enable food deliveries in 50 U.S. college campuses by the end of 2022.

Competitive Strategy: The study has analyzed and profiled the key robot manufacturers, start-ups, and emerging players in robot manufacturing in the global last-mile delivery robot market. These companies capture the maximum share in the global last-mile delivery robot market. Moreover, a detailed competitive benchmarking of the companies and organizations operating in the last-mile delivery robot market has been carried out, which will help the reader to understand how players are performing, exhibiting a clear market landscape. In addition to this, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies profiled in the study have been selected based on inputs gathered from primary experts and analysis of the company's product portfolio, key developments, and market penetration.

In 2021, the top segment players leading the market comprised robot manufacturers providing last-mile delivery robots and related hardware and constitute 65.6% presence in the market. Emerging market participants, including start-up entities, constitute approximately 34.4% of the presence in the market.

Some prominent established names in this market are:

- Agility Robotics, Inc.

- Amazon.com, Inc.

- ANYbotics AG

- Cyan Robotics, Inc.

- FedEx Corporation

- Kiwi Campus Inc.

- Meituan Inc.

- Nuro, Inc.

- Rakuten Group, Inc.

- Segway Robotics

- Serve Robotics Inc

- Starship Technologies Inc.

- TERAKI GmbH

- TwinswHeel

- Yandex LLC

Table of Contents

Companies Mentioned

- Agility Robotics, Inc.

- Amazon.com, Inc.

- ANYbotics AG

- Cyan Robotics, Inc.

- FedEx Corporation

- Kiwi Campus Inc.

- Meituan Inc.

- Nuro, Inc.

- Rakuten Group, Inc.

- Segway Robotics

- Serve Robotics Inc

- Starship Technologies Inc.

- TERAKI GmbH

- TwinswHeel

- Yandex LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 169 |

| Published | October 2022 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 19.8 Million |

| Forecasted Market Value ( USD | $ 36.2 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |