Portugal's rich coffee culture is contributing to instant coffee market growth during the forecast period. Drinking coffee is deeply rooted in every part of the life, culture and history of the Portuguese, further contributing to the expansion of the coffee industry in the region, further fueling the market growth in the country. Also, it has been observed that drinking coffee out of home is comparatively cheaper. The country is known for its least expensive coffee in Europe, and thus, coffee consumption is considered a democratic right for the citizens of Portugal. The rich café culture in the country is further providing an impetus to propagate the market growth during the forecast period. Even though at-home consumption is growing, however, Portuguese prefer to consume coffee in restaurants or in a café. Individuals prefer to drink coffee to socialize. The most popular coffee drink consumed is an expresso. High out-of-home consumption is further contributing to the surging sales of instant coffee products during the forecast period. The popular coffee brands consumed in the region include Delta, Buondi, Nicola, Bicafe, Chave d’ Ouro, Sical, and Camelo. On average, the per capita consumption of coffee is around 4 kg in a year. Hence, this will provide an opportunity for the market to thrive in the forecast period.

However, keeping in view the present COVID-19 scenario, the market is projected to experience a slight decline due to the closure of cafes and restaurants that serve as end-users for soluble coffee.

The retail sector in Portugal is considered among the most concentrated and competitive in the European region. Hence, this will contribute to providing convenience for individuals in purchasing instant coffee products from a nearby store. Also, the growing trend of the comeback of small retail shops has been observed in recent years. These neighbourhood grocery stores would further provide convenience and ease in purchasing essential household products required for day-to-day consumption. As coffee drinking is quite dominant among the Portuguese, instant coffee products hold strong market growth potential in the forecast period. Furthermore, the rising consumer interest in omnichannel retailing, combining internet shopping and shopping through a brick mortar store, will further continue to drive the market's growth over the next five years.

It is estimated that during the forecast period, modern grocery retailers are projected to hold a significant market share in the total retail sector in comparison to traditional grocery stores. It is also expected that supermarkets, convenience stores, and hypermarkets in the region will generate significant revenues, further fueling market growth during the forecast period. Furthermore, the high internet penetration, with more than 60% of the population using the internet, is providing an opportunity for the market to flourish with the rise in internet shopping, further contributing to the driving force of the e-commerce market growth in the region. Online shoppers in the country use prepaid cards, bank transfers, credit cards, and select eWallets for payment.

COVID-19 SCENARIO

Due to the closure of cafés and restaurants that act as end-users for soluble coffee as a result of the COVID-19 outbreak, the Portugal instant coffee market is expected to undergo a minor dip but the consumption grew rapidly for the domestic purpose. On the other side, the present trend of internet purchases for at-home consumption is pressuring retailers, coffees, and consumers to adjust to this new reality. As a result, Portugal's instant coffee consumption is predicted to rise and coffee sales were particularly brisk during the pandemic, as people stocked up on essentials.Key Development

April 2022- Nestlé is expanding its coffee and vegan food offerings in Portugal.Feb 2021- Delta Cafés brings the slow coffee experience to market.

Segmentation:

By Type

- Freeze-Dried Instant Coffee

- Spray-Dried Instant Coffee

By Distribution Channel

- Offline

- Retail

- Food Services

- Online

By Cities

- Faro

- Lagos

Table of Contents

Companies Mentioned

- Nestle

- Nabeiro Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 71 |

| Published | October 2022 |

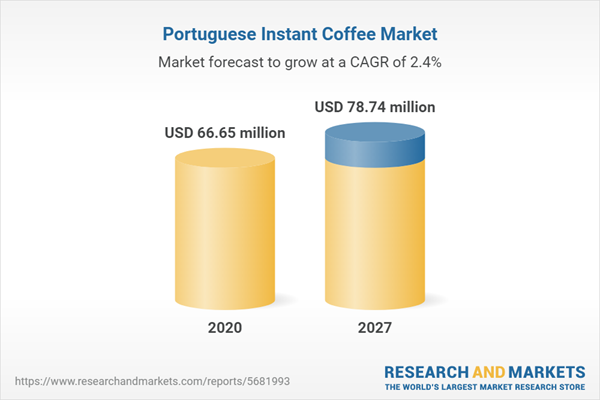

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 66.65 million |

| Forecasted Market Value ( USD | $ 78.74 million |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Portugal |

| No. of Companies Mentioned | 2 |