Increasing disposable income among individuals has led to a rise in the consumption of premium quality red meat and poultry products, driving a surge in demand for skin packaging, which effectively extends product shelf life. The consumption patterns of various types of meat are closely linked to lifestyle choices, living standards, and purchasing power, as well as product pricing. In recent years, the increase in average income and disposable income has enhanced the spending capacity of low- and middle-income populations, prompting them to spend more on meat. Meanwhile, higher-income consumers are increasingly willing to invest in premium meat options. The Dietary Guidelines for Americans (2020-2025) categorize poultry to include all types of chicken, turkey, duck, geese, guineas, and game birds such as quail and pheasant. Chicken accounts for 13.9% of animal protein consumption in the United States and 7.2% of total protein intake. Other poultry types contribute a mere 0.2% of animal protein and 0.1% of total protein consumption. Chicken is the most consumed meat per capita in the U.S., with its consumption steadily increasing - more than tripling since 1960 - making poultry the most consumed type of animal meat globally.

Key Drivers of the Global Skin Packaging Market

- Growing Demand for Longer Shelf-Life Products: The need for products with extended shelf life is expected to drive growth in the skin packaging market. Skin packaging involves sealing a product onto a substrate using a thin, heat-formed plastic film and is widely utilized across food, medical, and consumer goods sectors. The primary advantage of skin packaging is its ability to better protect products, preserve freshness, and extend shelf life. This has become increasingly appealing to manufacturers aiming to meet consumer demands for fresh and safe products, particularly in the food industry.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The global skin packaging market is segmented and analyzed as follows:

- By Material Type

- Polyethylene

- PVC

- Ionomer

- PET

- By End-User

- Fast-Moving Consumer Goods (FMCG)

- Food & Beverage

- Retail

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America

Table of Contents

Companies Mentioned

- PLASTOPIL

- MULTIVAC

- WestRock Company

- G.Mondini Spa

- Amcor plc

- Berry Global Inc.

- Sealed Air

- Dow

- Wentus

- Durapak

Table Information

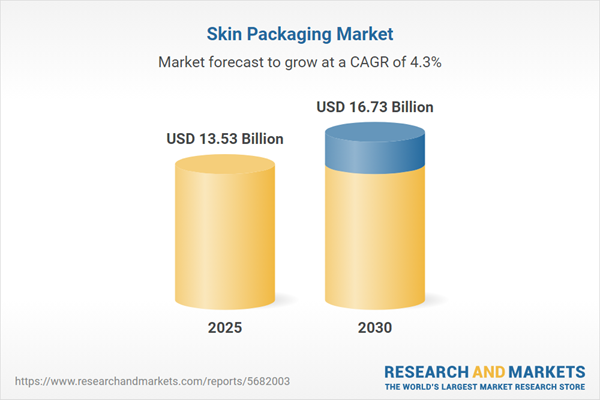

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | January 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 13.53 Billion |

| Forecasted Market Value ( USD | $ 16.73 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |