The rising number of consumers of different types of coffee, specifically instant coffee, has led the beverage to gain popularity in the country and pulled the Russian instant coffee market to a significant position in Europe

Russia is considered to be one of the largest instant coffee consumers in the European region. The popularity of coffee has grown and has slowly ingrained itself into the lives of individuals. One of the leading players, Strauss Coffee Russia, has acquired the Chernaya Karta brand in the Russian coffee market landscape to cater to the different demands of the consumers and the rising popularity of coffee in the country. In addition, healthier variants are also being made available, such as coffee with added chicory or green coffee extract.Moreover, the consumption of tea has fallen slightly as some of the tea consumers in the country have shifted to drinking instant coffee due to its greater health benefits, better and richer taste, and the convenience associated with the preparation of coffee. This can also be attributed to the influence of the culture of other European countries, which has spread into the country by the younger population. Thus, these factors are driving the rising demand for instant coffee and are augmenting the market's growth.

Product Offerings by the market players in the Russian instant coffee market

The offering of better and more advanced varieties of instant coffee with enhanced flavours and aromas, among others, by existing and new players in different markets is estimated to lead to increased adoption and propel the market growth further over the forecast period.Some of the product offerings have been mentioned below

- HORS’, which is a coffee-producing company, offers different varieties of coffee, including instant coffee, under its product portfolio under its different brands such as EGOSITE CAFÉ and Moskofe. Under its EGOSITE CAFÉ brand, it offers 4 types of instant coffee, called the “Egoiste Special 100”, “Egosite Special 50”, “Egoiste VS 100”, and Egosite X.O. 100”. Egoiste Special 100 is a product that has a full-bodied flavour and is a type of whole bean instant coffee. It is made up of 20% ground and 80% instant coffee with premium Arabica beans. The Egoiste X.0 100 is a unique and rare coffee product that has been made using GRAND CRU Arabica beans and is a composition of 30% ground and 70% instant coffee.

- SOBRANIE is a manufacturer of different brands of coffee such as SOBRANIE, BUCHERON, SWISS ORIGINAL, SPORTMAX, and CAFÉ CRÈME among others. Under its CAFÉ CRÈME BRAND, it sells differ pes of instant coffee, such as “COFFEE CAFÉ CRÈME INSTANT AROMA GOLD”, which is a type of free dried instant coffee that is offered in a pouch of 100g as well as a jar of 100g. Some of its other products include “CAFÉ CRÈME GRANDE RESERVA”, which is a type of freeze-dried instant coffee, that has a creamy smooth, and thick flavour and is offered in a jar of 100g as well as 45g.

COVID-19 Insights

COVID-19 had a negative Russian instant coffee market. The rise in infected cases and enforcement of lockdown led to the closure of the coffee houses, food houses, institutions, and corporations, among many other public places, causing the sales to decline in these segments. The volatile prices of coffee also had a significant impact on the market. However, owing to the rapid development of the e-commerce industry, the market experienced a boost in online sales. Nonetheless, this led to boosted sales in the domestic segment.Russian-Ukraine War Impact:

The war between Russia and Ukraine had a negative impact on the coffee market. The plunge in share prices during the period caused many brands to quit or reduce investments in the region. In May 2022, for instance, Starbucks announced its exit from Russia. Consequently, Starbucks' 130 franchises and stores were shut down. At the same time, companies like Nestles had announced their plans to halt investments in Russia in the near future.Segmentation

By Type

- Freeze-Dried Instant Coffee

- Spray-Dried Instant Coffee

By Distribution Channel

- Offline

- Foodservices

- Retail

- Supermarket/Hypermarket

- Convenience Stores

- Online

By Province

- Moscow

- Saint Petersburg

- Yekaterinburg

Table of Contents

Companies Mentioned

- Nestlé

- KRAFT Foods

- HORS’

- Strauss Russia LLC

- MacCoffee

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 78 |

| Published | September 2022 |

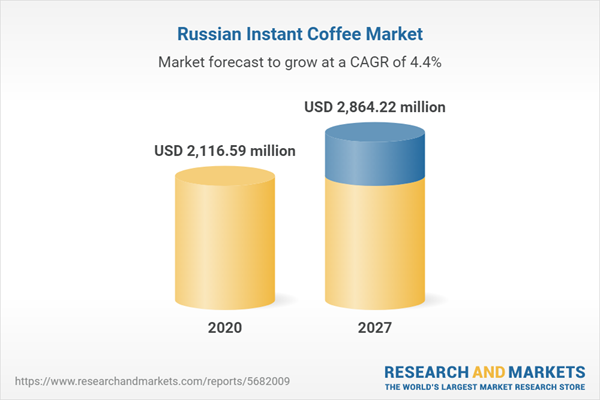

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 2116.59 million |

| Forecasted Market Value ( USD | $ 2864.22 million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Russia |

| No. of Companies Mentioned | 5 |