Neoprene is a synthetic rubber produced artificially by free radical polymerization of chloroprene. It was first developed in the 1930s, as an oil-resistant substitute for natural latex rubber with DuPont being the first to market the compound in 1931. Neoprene offers various advantages over natural rubber latex and other synthetic compounds. Neoprene provides a strong level of protection from oxidizing agents such as alcohols, oils, and acids and offers resistant to all acetonic solvents. It also provides high resistance to physical failures like cuts and is resistant to damage caused by abrasion, flexing and twisting. Neoprene also does not degrade in the presence of sun, ozone or weather and provides excellent adhesion to fabrics and metals. Moreover, Neoprene exhibits good chemical stability and maintains flexibility over a wide temperature range. Compared to natural rubber, neoprene is more gas permeation resistant and can tolerate higher temperatures: up to 200 degrees Fahrenheit (F). Even at such elevated temperatures, neoprene maintains its integrity, making it better suited to long-term use in high temperature applications compared to natural rubber. Neoprene’s polymer structure also allows it to be modified to create a material compound with a diverse range of chemical and physical properties, based on the product needs.

The global demand of neoprene has been increasing continuously over the last few years catalyzed by its superior physical and chemical properties. The automotive sector represents one of the biggest end users of neoprene. In the automotive industry neoprene is used in the manufacturing of tires, oil seals, power transmission belts, breaking and steering system components, hose covers, etc. Apart from the automotive industry, the growth in the construction sector is also catalyzing the demand of neoprene where it is used to provide electrical insulation; seals for windows, doors, and facades; elevator astragals; deviator pads; Highway and bridge seals, etc.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the global neoprene market report, along with forecasts at the global and regional level from 2025-2033. Our report has categorized the market based on manufacturing route, grade, application and end-user.Breakup by Manufacturing Route:

- Butadiene Route

- Acetylene Route

Breakup by Grade:

- General-Purpose Grade Neoprene

- Pre-Crosslinked Grade Neoprene

- Sulfur-Modified Grade Neoprene

- Slow Crystallizing Grade Neoprene

Breakup by Application:

- Technical Rubber

- Adhesives Industry

- Latex Industry

Breakup by End-User:

- Automotive

- Manufacturing

- Consumer Goods

- Medical

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being Denka Corporation, Lanxess, Showa Denko, Tosoh, Zenith Rubber, GK GmbH Endlosband, Pidilite Industries Ltd., Covestro AG and Asahi Kasei Corporation.Key Questions Answered in This Report:

- How has the global neoprene market performed so far and how will it perform in the coming years?

- What are the key regional markets in the global neoprene industry?

- What has been the impact of COVID-19 on the global neoprene market?

- What is the breakup of the global neoprene market on the basis of manufacturing route?

- What is the breakup of the global neoprene market on the basis of grade?

- What is the breakup of the global neoprene market on the basis of application?

- What is the breakup of the global neoprene market on the basis of end-user?

- What are the various stages in the value chain of the global neoprene market?

- What are the key driving factors and challenges in the global neoprene market?

- What is the structure of the global neoprene market and who are the key players?

- What is the degree of competition in the global neoprene market?

- How is neoprene manufactured?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Properties

4.3 Key Industry Trends

5 Global Neoprene Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Manufacturing Route

5.5 Market Breakup by Grade

5.6 Market Breakup by Application

5.7 Market Breakup by End-User

5.8 Market Breakup by Region

5.9 Market Forecast

6 Market Breakup by Manufacturing Route

6.1 Butadiene Route

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Acetylene Route

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Grade

7.1 General-Purpose Grade Neoprene

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Pre-Crosslinked Grade Neoprene

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Sulfur-Modified Grade Neoprene

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Slow Crystallizing Grade Neoprene

7.4.1 Market Trends

7.4.2 Market Forecast

8 Market Breakup by Application

8.1 Technical Rubber

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Adhesives Industry

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Latex Industry

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by End-User

9.1 Automotive

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Manufacturing

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Consumer Goods

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Medical

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Region

10.1 Asia Pacific

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 North America

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Europe

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Middle East and Africa

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Latin America

10.5.1 Market Trends

10.5.2 Market Forecast

11 Global Neoprene Industry: SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Global Neoprene Industry: Value Chain Analysis

12.1 Overview

12.2 Research and Development

12.3 Raw Material Procurement

12.4 Manufacturing

12.5 Marketing

12.6 Distribution

12.7 End-Use

13 Global Neoprene Industry: Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Global Neoprene Industry: Price Analysis

14.1 Price Indicators

14.2 Price Structure

14.3 Margin Analysis

15 Neoprene Manufacturing Process

15.1 Product Overview

15.2 Raw Material Requirements

15.3 Manufacturing Process

15.4 Key Success and Risk Factors

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 Denka Corporation

16.3.2 Lanxess

16.3.3 Showa Denko

16.3.4 Tosoh

16.3.5 Zenith Rubber

16.3.6 GK GmbH Endlosband

16.3.7 Pidilite Industries Ltd.

16.3.8 Covestro AG

16.3.9 Asahi Kasei Corporation

List of Figures

Figure 1: Global: Neoprene Market: Major Drivers and Challenges

Figure 2: Global: Neoprene Market: Sales Volume (in Kilotons), 2019-2024

Figure 3: Global: Neoprene Market: Breakup by Manufacturing Route (in %), 2024

Figure 4: Global: Neoprene Market: Breakup by Grade (in %), 2024

Figure 5: Global: Neoprene Market: Breakup by Application (in %), 2024

Figure 6: Global: Neoprene Market: Breakup by End-User (in %), 2024

Figure 7: Global: Neoprene Market: Breakup by Region (in %), 2024

Figure 8: Global: Neoprene Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 9: Global: Neoprene Industry: SWOT Analysis

Figure 10: Global: Neoprene Industry: Value Chain Analysis

Figure 11: Global: Neoprene Industry: Porter’s Five Forces Analysis

Figure 12: Global: Neoprene (Butadiene Route) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 13: Global: Neoprene (Butadiene Route) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 14: Global: Neoprene (Acetylene Route) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 15: Global: Neoprene (Acetylene Route) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 16: Global: Neoprene (General-Purpose Grade) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 17: Global: Neoprene (General-Purpose Grade) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 18: Global: Neoprene (Pre-Crosslinked Grade) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 19: Global: Neoprene (Pre-Crosslinked Grade) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 20: Global: Neoprene (Sulfur-Modified Grade) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 21: Global: Neoprene (Sulfur-Modified Grade) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 22: Global: Neoprene (Slow Crystallizing Grade) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 23: Global: Neoprene (Slow Crystallizing Grade) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 24: Global: Neoprene (Technical Rubber) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 25: Global: Neoprene (Technical Rubber) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 26: Global: Neoprene (Adhesives Industry) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 27: Global: Neoprene (Adhesives Industry) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 28: Global: Neoprene (Latex Industry) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 29: Global: Neoprene (Latex Industry) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 30: Global: Neoprene (Automotive) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 31: Global: Neoprene (Automotive) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 32: Global: Neoprene (Manufacturing) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 33: Global: Neoprene (Manufacturing) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 34: Global: Neoprene (Consumer Goods) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 35: Global: Neoprene (Consumer Goods) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 36: Global: Neoprene (Medical) Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 37: Global: Neoprene (Medical) Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 38: Asia Pacific: Neoprene Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 39: Asia Pacific: Neoprene Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 40: North America: Neoprene Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 41: North America: Neoprene Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 42: Europe: Neoprene Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 43: Europe: Neoprene Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 44: Middle East and Africa: Neoprene Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 45: Middle East and Africa: Neoprene Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 46: Latin America: Neoprene Market: Sales Volume (in Kilotons), 2019 & 2024

Figure 47: Latin America: Neoprene Market Forecast: Sales Volume (in Kilotons), 2025-2033

Figure 48: Neoprene Manufacturing: Process Flow

List of Tables

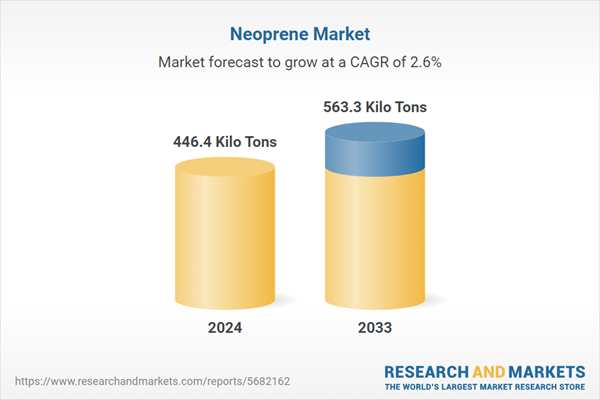

Table 1: Global: Neoprene Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Neoprene Market Forecast: Breakup by Manufacturing Route (in Kilotons), 2025-2033

Table 3: Global: Neoprene Market Forecast: Breakup by Grade (in Kilotons), 2025-2033

Table 4: Global: Neoprene Market Forecast: Breakup by application (in Kilotons), 2025-2033

Table 5: Global: Neoprene Market Forecast: Breakup by End-User (in Kilotons), 2025-2033

Table 6: Global: Neoprene Market Forecast: Breakup by Region (in Kilotons), 2025-2033

Table 7: Neoprene: Raw Material Requirements

Table 8: Global: Neoprene Market Structure

Table 9: Global: Neoprene Market: Key Players

Companies Mentioned

- Denka Corporation

- Lanxess

- Showa Denko

- Tosoh

- Zenith Rubber

- GK GmbH Endlosband

- Pidilite Industries Ltd.

- Covestro AG and Asahi Kasei Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 446.4 Kilo Tons |

| Forecasted Market Value by 2033 | 563.3 Kilo Tons |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |