The mining truck is a colossal vehicle designed to transport heavy loads of mined materials from excavation sites. Towering in size, these trucks can carry hundreds of tons of minerals, ores, or coal in a single haul. Engineered for extreme conditions, they boast robust frames, powerful engines, and durable tires, enabling them to navigate rugged terrain and steep inclines easily. Advanced safety features and autonomous technologies have revolutionized the sector, thus enhancing productivity and minimizing human risk. The product contributes significantly to the efficiency of large-scale mining operations, ensuring the steady flow of resources and bolstering the foundations of modern industries worldwide.

The global market is primarily driven by the increasing demand for minerals and metals in various industries, such as construction, automotive, and electronics. In line with this, the rising global population and urbanization are leading to higher infrastructure development and resource needs, significantly contributing to the market. Furthermore, continual advancements in mining technology are positively influencing the market. Apart from this, the growing adoption of renewable energy technologies is catalyzing the market. Moreover, the expansion of mining operations in emerging economies with abundant mineral reserves is offering numerous opportunities for the market. Besides, the government's worldwide initiatives and investments in mining infrastructure and projects are bolstering the market. Additionally, the escalating focus on sustainable mining practices is creating a positive outlook for the market.

Mining Truck Market Trends/Drivers:

Increasing integration of real-time monitoring and data analytics to optimize mining truck performance

The increasing integration of real-time monitoring and data analytics is fostering the market. Mining companies are leveraging advanced sensors and telematics systems to gather real-time critical data from the product. These sensors track fuel consumption, engine health, tire pressure, load capacity, and operating conditions. The data collected is then transmitted to centralized systems where sophisticated data analytics tools process and analyze it. By harnessing the power of data analytics, mining operators can identify inefficiencies, track equipment health, and make informed decisions to enhance overall productivity. Predictive maintenance models can anticipate potential breakdowns and schedule maintenance proactively, minimizing downtime and increasing equipment availability. Furthermore, real-time monitoring aids in optimizing truck routing, enabling better load balancing and fuel efficiency. The integration of real-time monitoring and data analytics streamlines mining operations and enhances safety by providing insights into driver behavior and potential risks. This is revolutionizing the mining industry, driving cost savings, improved resource utilization, and sustainable mining practices.Rising exploration and mining activities in remote and challenging terrains

The rising exploration and mining activities in remote and challenging terrains are strengthening the market. As accessible mineral deposits become scarcer, mining companies must venture into more distant and geographically demanding areas. These remote terrains often present harsh environmental conditions, rugged landscapes, and limited infrastructure, making traditional transportation methods impractical. In response to this challenge, the product has evolved to withstand the rigors of such environments. They have advanced features like all-terrain capabilities, enhanced traction systems, and robust construction to navigate rough terrains and steep inclines. Additionally, the development of autonomous and semi-autonomous mining trucks has further revolutionized operations in these areas, reducing the need for human presence and ensuring safety in hazardous locations. As mining companies continue to explore untapped resources in remote regions, the demand for specialized and reliable product is expected to rise. These versatile machines are pivotal in efficiently transporting extracted materials, contributing to increased productivity and successful mineral extraction in challenging environments.Rapid improvements in the product design

Rapid improvements in product design are offering numerous opportunities for the market. Engineering, materials, and technology advancements have led to the creation of highly efficient and durable products capable of handling heavier loads, navigating challenging terrains, and maximizing productivity. These trucks now have state-of-the-art features like advanced suspension systems, intelligent braking, and improved energy efficiency. One notable trend is the development of electric and hybrid mining trucks, reducing greenhouse gas emissions and minimizing the environmental impact of mining operations. Moreover, the integration of autonomous technologies has revolutionized the sector, enhancing safety and efficiency by enabling unmanned operations and real-time data analysis. Manufacturers also focus on ergonomic designs, providing better driver comfort and reducing operator fatigue during long shifts. Additionally, innovations in telematics and connectivity allow for remote monitoring and predictive maintenance, optimizing truck performance and reducing downtime. With a continual drive for enhanced productivity, cost-effectiveness, and sustainability, the ongoing improvements in product design are crucial in meeting the ever-growing demands of the global mining industry.Mining Truck Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global mining truck market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, application, payload capacity and drive.Breakup by Type:

- Bottom Dump

- Rear Dump

- Lube

- Tow

- Water

- Others

Bottom dump dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes bottom dump, rear dump, lube, tow, water, and others. According to the report, bottom dump represented the largest segment.Bottom dump trucks are designed with a hinged gate at the bottom, allowing them to discharge materials efficiently. They are ideal for spreading materials evenly and are commonly used in construction and earth-moving projects.

On the other hand, rear dump trucks feature a hydraulic lifting mechanism to tip the load at the rear, facilitating quick and controlled unloading. These trucks are suitable for hauling large quantities of materials from mining sites. Moreover, lube trucks are specialized service vehicles equipped with lubrication and maintenance equipment. They are crucial in ensuring mining machinery's continuous operation and upkeep.

Besides, tow trucks transport disabled or faulty mining equipment within the mining site, reducing downtime and enhancing operational efficiency. Additionally, water trucks are employed for dust suppression and road maintenance purposes in dusty mining environments. They help create a safer working environment and prevent excessive wear and tear on the product tires.

Breakup by Application:

- Coal Mining

- Iron Mining

- Copper Mining

- Aluminum Mining

- Others

Coal mining holds the largest share of the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes coal mining, iron mining, copper mining, aluminum mining, and others. According to the report, coal mining accounted for the largest market share.Coal mining trucks are crucial in transporting coal from the extraction point to processing or distribution centers. They are designed to handle the heavy loads and challenging terrains commonly found in coal mines.

On the other hand, iron mining demands robust and high-capacity trucks to haul iron ore from mining sites to processing facilities or transportation hubs. These trucks are equipped to handle the weight and bulk of iron ore efficiently. Moreover, copper mining trucks transport copper ores from mines to smelters or refineries. These trucks must be capable of navigating rocky terrains and busy industrial areas. Besides, aluminum mining requires trucks that can transport bauxite ore or alumina to aluminum processing plants. These trucks are engineered to handle the unique characteristics of bauxite and alumina ores.

Breakup by Payload Capacity:

- < 90 Metric Tons

- 90≤149 Metric Tons

- 150≤290 Metric Tons

- >290 Metric Tons

The trucks falling under the < 90 Metric Tons category are well-suited for smaller mining operations or mines with lower production volumes. They offer nimble maneuverability and cost-effectiveness for handling relatively lighter loads.

Furthermore, 90≤149 Metric Tons comprises trucks with moderate payload capacity, suitable for medium-sized mining projects. These trucks balance efficiency and versatility, making them common choices in various mining applications.

Moreover, product in the 150≤290 Metric Tons category is heavy-duty workhorses capable of transporting substantial loads of minerals or ores. They are typically employed in large-scale mining operations where high productivity and efficiency are essential.

Additionally, representing the highest payload capacity, 290 Metric Tons mega trucks are engineered to tackle the most demanding mining tasks. They are used in colossal mining projects that require maximum material transport capacity, reducing the number of trips needed for large hauls.

Breakup by Drive:

- Mechanical Drive

- Electrical Drive

Mining trucks with mechanical drive systems are traditionally powered by diesel engines, which drive the wheels and axles directly. These trucks are known for their robustness, high torque, and reliability, making them suitable for challenging terrains and heavy loads. They have been the primary choice for many years due to their proven performance and availability of fuel in remote mining areas.

Furthermore, these trucks equipped with electrical drive systems are a more recent development in the industry. They use electric motors to power the wheels, relying on electricity as an energy source. These trucks offer advantages such as reduced emissions, lower maintenance costs, and quieter operation. Electrical drive systems also enable regenerative braking, capturing energy during downhill descents and increasing overall energy efficiency.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest mining truck market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Russia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market.The Asia Pacific region is a significant market due to the rapid industrialization and infrastructure development in countries like China, India, Australia, and Indonesia. These countries are major producers and consumers of various minerals and metals, driving the demand for these trucks for coal, iron, copper, aluminum, and other commodities. The growth of the region’s construction, manufacturing, and automotive industries further boosts the demand for raw materials, necessitating efficient transportation with these trucks. As Asian countries continue to invest in mining projects and modernize their mining operations, the market in this region is expected to grow substantially.

North America, on the other hand, is also a prominent player in the market. The region is home to some of the world's largest mining operations, particularly in countries like the United States and Canada. These mining operations involve the extraction of various minerals, including coal, iron ore, gold, and copper. The demand for efficient and reliable products is high in this region due to the scale of mining activities. Moreover, North America is at the forefront of technological advancements, driving the adoption of autonomous and electric mining trucks to enhance productivity and reduce environmental impact. Additionally, stringent safety regulations and the emphasis on sustainable mining practices fuel this region's demand for advanced mining truck technologies.

Competitive Landscape:

Top mining truck companies are catalyzing the market growth through continuous innovation and strategic partnerships. These companies invest heavily in research and development to enhance their products' performance, efficiency, and safety. By introducing cutting-edge technologies, such as autonomous driving, electrification, and advanced telematics, they attract mining operators looking to optimize productivity and reduce operational costs. Additionally, the top companies collaborate with mining giants to co-develop custom solutions that cater to specific operational needs. Such partnerships ensure the delivery of trucks tailored to handle the demanding requirements of different mining applications, further expanding their market reach. Moreover, these companies focus on sustainability, producing eco-friendly trucks with reduced emissions and improved fuel efficiency. As the mining industry prioritizes environmental responsibility, these sustainable solutions become critical market growth drivers. By consistently delivering high-quality and innovative products, top companies maintain their leadership positions and propel the entire market forward.The report has provided a comprehensive analysis of the competitive landscape in the mining truck market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AB Volvo

- Caterpillar Inc

- ETF HOLDING d.o.o.

- Hitachi Construction Machinery Co., Ltd

- Komatsu America Corp.

- Kress Corporation

- Liebherr Group

- OJSC BELAZ

- Sany Group

- XCMG Group

Key Questions Answered in This Report

1. What will be the global mining truck market outlook during the forecast period (2025-2033)?2. What are the global mining truck market drivers?

3. What are the major trends in the global mining truck market?

4. What is the impact of COVID-19 on the global mining truck market?

5. What is the global mining truck market breakup by type?

6. What is the global mining truck market breakup by application?

7. What is the global mining truck market breakup by payload capacity?

8. What is the global mining truck market breakup by drive?

9. What are the major regions in the global mining truck market?

10. Who are the leading mining truck manufacturers?

Table of Contents

Companies Mentioned

- AB Volvo

- Caterpillar Inc

- ETF HOLDING d.o.o.

- Hitachi Construction Machinery Co. Ltd

- Komatsu America Corp.

- Kress Corporation

- Liebherr Group

- OJSC BELAZ

- Sany Group

- XCMG Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2025 |

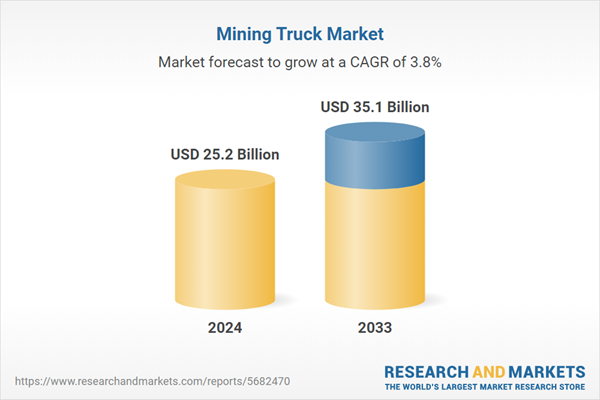

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 25.2 Billion |

| Forecasted Market Value ( USD | $ 35.1 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |