Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Government Policies and Incentives

The Indian government offers significant subsidies on fertilizers, which reduces costs for farmers. Since ammonia is a crucial raw material for nitrogenous fertilizers, these subsidies directly increase ammonia demand by making fertilizers more affordable. Programs such as the Pradhan Mantri Krishi Sinchai Yojana and the National Food Security Mission enhance agricultural productivity and fertilizer usage, thus further driving ammonia demand. The fertilizer sector received subsidies of USD 16 Billion, USD 17 Billion, and USD 18 Billion in the three most recent budgets, beginning with the 2020-21 fiscal year.The government's commitment to reducing carbon emissions and fostering sustainable practices impacts the ammonia market by encouraging the development and adoption of greener technologies. In 2024, the government introduced a new incentive scheme for green hydrogen and green ammonia production, aimed at demand aggregation. This is the first incentive program specifically for green ammonia under the National Green Hydrogen Mission. There is growing interest in green ammonia, which is produced using renewable energy or more sustainable methods. Government incentives and funding for research and development in green ammonia technology are expected to drive market growth and innovation. In April 2024, the Indian Farmers Fertilizer Cooperative Limited (IFFCO) and ACME Cleantech Solutions Private Limited signed a Memorandum of Understanding (MoU), with ACME supplying IFFCO with 200,000 metric tons of ammonia produced from renewable energy. This represents a significant milestone in India’s transition to cleaner energy and lower carbon emissions.

Initiatives promoting environmentally friendly and sustainable agricultural practices include the development of fertilizers that reduce environmental impact, driving demand for green ammonia as part of advanced fertilizer formulations. Increased public awareness of environmental issues and sustainability pressures companies to adopt greener practices, influencing the ammonia market by promoting more sustainable production methods and products. In July 2024, KBR announced that OCIOR Energy has selected its green ammonia technology, K-GreeN, for a facility in Gopalpur, Odisha. This marks KBR’s 10th globally licensed green ammonia plant and the first in India. Under this agreement, KBR will provide OCIOR with technology licensing, engineering design, equipment, and catalysts for a facility capable of producing 600 metric tons per day of green ammonia, while also assisting in optimizing production costs.

Government policies and sustainability factors are pivotal drivers of the ammonia market in India. Subsidies and development programs that support fertilizer use, combined with initiatives that promote environmental sustainability and green technology, shape the market dynamics. As India focuses on boosting agricultural productivity and addressing environmental challenges, these policies will further propel the growth of the ammonia market.

Growing Usage as a Refrigerant

India's food processing industry is experiencing rapid expansion, fueled by rising domestic consumption and increased export opportunities. Ammonia plays a critical role in industrial refrigeration systems for chilling and freezing food products, essential for maintaining supply chain efficiency and product quality. The escalating demand for cold storage, especially in the dairy, meat, and pharmaceutical sectors, is driving the need for ammonia-based refrigeration solutions. The Pradhan Mantri Kisan Sampada Yojana has been extended until March 2026 with a funding allocation of INR 4,600 crore. Under this scheme, projects such as Integrated Cold Chain and Value Addition Infrastructure will be implemented. Ammonia refrigeration systems are highly efficient compared to other refrigerants, leading to reduced energy consumption and operational costs, making them the preferred choice for large-scale industrial use. Their superior heat transfer efficiency lowers overall cooling costs for businesses.The study titled “Retaining Natural Refrigerants in Seafood Processing Industries in India,” conducted by a team including Arun B. Sa, Sumit Kumar, and Kristina Norne, was supported by the Indo-Norwegian Future Refrigeration India (INDEE+) project. Funded by the Norwegian Ministry of Foreign Affairs, INDEE+ aims to facilitate the transition to more eco-friendly refrigeration technologies in India. The study found that an ammonia (NH3/R717)/CO2 (R744) cascade refrigeration system has an annual coefficient of performance (COP) 35% higher than an R404A system in 2024.

Ammonia's low global warming potential (GWP) and lack of ozone depletion align with global and national environmental goals, making it an attractive option as industries and governments work to reduce carbon footprints. In line with this, India ratified the Kigali Amendment in 2021 and introduced the India Cooling Action Plan (ICAP) in 2019. This plan sets national targets for improving cooling efficiency and shifting to alternative refrigerants, aiming to cut greenhouse gas emissions using natural refrigerants and noble gases for ultra-low-temperature applications.

NAS Fisheries, part of the Kochi project, began utilizing an ammonia (R717)/CO2 cascade refrigeration system in December 2023 to freeze-dry shrimp and cuttlefish at temperatures as low as -40°C (-40°F). Despite higher initial setup costs, ammonia systems typically offer long-term savings due to their energy efficiency and lower operational costs, which promotes their adoption in industrial applications. As India's industrial sector grows and evolves, the demand for ammonia-based refrigeration systems is expected to rise, supporting market expansion.

Key Market Challenges

High Production Costs

Ammonia production is heavily dependent on natural gas, which serves both as a feedstock and an energy source. Variations in natural gas prices can result in increased production costs. Energy prices in India are influenced by global market trends and domestic supply issues, impacting ammonia production expenses. Establishing ammonia production facilities requires a significant capital investment in infrastructure, including reactors, storage tanks, and safety systems. These substantial initial costs can be a barrier for new entrants or those expanding their operations.Investing in advanced production technologies that improve efficiency and reduce emissions also entails high costs. Although these technologies can offer long-term savings, the initial financial outlay is considerable. Adhering to stringent environmental regulations and standards adds further expenses. Investments in pollution control measures and waste management are costly. Ammonia production requires meeting strict safety standards, including advanced safety systems and regular inspections, which further increases costs. The hazardous nature of ammonia necessitates specialized transportation and handling, leading to higher logistics expenses. Safe transportation and storage infrastructure, while essential, are also costly. Proper storage facilities for ammonia, equipped with necessary safety measures, contribute to elevated production and operational costs. Many ammonia producers, especially in the fertilizer sector, depend on government subsidies to mitigate production costs. Any changes in subsidy policies or reductions in government support can significantly impact production costs and market viability.

Supply Chain Disruptions

Ammonia necessitates secure and specialized storage facilities due to its volatile nature. Inadequate storage infrastructure can result in supply interruptions and increased costs. Proper handling and storage of ammonia requires stringent safety protocols; any lapses in these protocols can lead to operational disruptions and heightened regulatory scrutiny. For example, during a gas leak incident at the Coromandel Fertilizer Plant in Ennore in December 2024, around 67.63 tonnes of ammonia were released over 15 minutes, and none of the 19 ammonia sensors at the facility detected the leak. Insufficient infrastructure for handling and distributing ammonia including pipelines, storage facilities, and transportation networks can cause inefficiencies and bottlenecks in the supply chain. Additionally, fluctuations in trade policies, tariffs, and international agreements can impact the import and export of raw materials and finished ammonia products, with trade disputes or sanctions potentially worsening supply chain disruptions.Supply chain issues can lead to production delays due to shortages of raw materials or interruptions in the delivery of essential components and equipment. Delays in receiving spare parts or maintenance supplies can result in extended downtime or decreased operational efficiency. These disruptions often lead to higher costs for raw materials and transportation, which are typically passed on to consumers, affecting the overall pricing and competitiveness of ammonia products. Ammonia production heavily relies on natural gas, both as a feedstock and an energy source. Disruptions in the supply of natural gas, whether due to geopolitical tensions like the Russia-Ukraine war, extraction problems, or domestic supply constraints, can directly affect ammonia production. Additionally, supply chain problems can impede the timely implementation of safety and environmental regulations, leading to compliance challenges and potential penalties.

Key Market Trends

Shift Towards Sustainable Practices

There is a growing focus on producing ammonia using renewable energy sources. Green ammonia production involves generating hydrogen from renewable sources, such as wind or solar power, instead of natural gas, which represents a more sustainable approach. The Indian government is actively fostering this transition through policies that support cleaner technologies and environmental stewardship. In March 2024, the state of Odisha in eastern India approved two investment proposals for green ammonia projects totaling USD 2.27 billion. Greenko Group is developing one of the world’s largest green ammonia production facilities, starting with an annual production capacity of one million tonnes, and expanding to five million tonnes per year by 2030. Additionally, state-run SJVN’s green energy division, SGEL, has agreed to provide 4.5 GW of renewable energy to Greenko Group’s AM Green Ammonia Holdings for its new production facilities, as per an agreement signed in July 2024.Many companies are setting ambitious goals to achieve carbon neutrality or significantly cut their carbon emissions. This includes transitioning to more sustainable production methods and employing carbon offset strategies. For instance, Adani Power Ltd (APL) announced plans to use green ammonia alongside conventional coal to fuel the 330 MW boiler at its Mundra plant in Gujarat in 2023, with green ammonia comprising up to 20% of the total fuel mix. Businesses are increasingly integrating sustainability into their operations by optimizing resource use, reducing energy consumption, and improving overall operational efficiency. Industry associations and organizations are promoting best practices for sustainability, offering guidance, and encouraging collaboration to drive sector-wide changes.

In April 2024, Reliance Industries Ltd (RIL), Larsen & Toubro (L&T), Greenko Group, and Welspun New Energy announced plans to establish green hydrogen and ammonia production facilities at Deendayal Port Authority (DPA) in Kandla, Gujarat. This joint venture is expected to attract an investment of up to INR1 lakh crore. Significant investments are also being made in R&D to advance technologies that enhance the sustainability of ammonia production. For example, Malaysian energy giant Petronas and Singapore’s sovereign wealth fund GIC are investing in a project being developed by AM Green to produce five million tonnes of green ammonia annually in India by 2030. Efforts to develop more sustainable supply chains are underway, including the adoption of energy-efficient transportation methods and the creation of infrastructure to support environmentally friendly logistics. The shift towards sustainable practices in the Indian ammonia market underscores a growing commitment to environmental responsibility and efficiency, driven by government policies, technological advancements, and market demand. This trend is influencing all facets of ammonia production and use, from production methods to supply chain management.

Segmental Insights

Form Insights

Based on Form, the Anhydrous Ammonia emerged as the dominating segment in the Indian market for Ammonia in 2024. Anhydrous ammonia is a vital raw material in the manufacturing of nitrogen fertilizers such as urea, ammonium nitrate, and ammonium sulfate. These fertilizers are essential for improving soil fertility and increasing crop yields, making anhydrous ammonia crucial for the agricultural sector, which significantly drives ammonia demand in India. It also serves as a feedstock for various chemical processes, including the production of industrial chemicals, explosives, and other specialty products. The logistics for anhydrous ammonia are well-optimized due to its extensive use and the established network of storage and transportation facilities, reinforcing its market dominance. Economically, anhydrous ammonia is more cost-effective compared to other ammonia forms because of its higher nitrogen content and reduced handling costs in bulk applications. Its concentrated nature allows for a high nitrogen yield per unit volume, making it particularly advantageous for large-scale uses. Beyond fertilizers, anhydrous ammonia is utilized in diverse applications such as water treatment, industrial cleaning, and as a raw material in various chemical manufacturing processes. This versatility further strengthens its position in the market.Application Insights

Based on Application, Fertilizers emerged as the fastest growing segment in the Indian market for Ammonia during the forecast period. India’s agriculture sector plays a vital role in its economy, with ongoing efforts to improve crop yields and soil fertility. Ammonia is a crucial component of nitrogen fertilizers like urea, which significantly enhance agricultural productivity. Government initiatives and subsidies boost fertilizer usage, thereby increasing ammonia demand. There is substantial investment in expanding and upgrading fertilizer production facilities to meet rising food demand and improve agricultural efficiency. The shift towards green ammonia production, which utilizes renewable energy sources, aims to address fertilizer needs sustainably. In June 2024, the Ministry of New and Renewable Energy (MNRE) updated the Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme to increase the bidding capacity for green ammonia production to 750,000 MT annually. Additionally, in April 2024, Japan’s JERA and India-based ReNew Energy Global agreed to develop a green ammonia production project in India. Investment in the fertilizer sector is expected to rise due to domestic demand and government policies focused on food security. Technological advancements are further enhancing the efficiency and sustainability of fertilizer production, driving the growth of ammonia use in this sector.Regional Insights

Based on Region, West India emerged as the dominant region in the Indian market for Ammonia in 2024. This is driven by its advanced industrial infrastructure, high concentration of fertilizer production, strategic port locations, supportive policies, and substantial agricultural demand. Regions like Gujarat and Maharashtra in West India have significant agricultural activities that require large quantities of fertilizers, thus driving the demand for ammonia, a key ingredient in these fertilizers. Gujarat, in particular, hosts some of India's largest fertilizer plants, which are major consumers of ammonia for producing urea and other nitrogen-based fertilizers. In May 2024, Aegis Logistics announced plans to expand its ammonia storage capacity in Gujarat by adding approximately 36,000 metric tons to its specialized terminal. The region has also seen substantial investments in technology and innovation, improving efficiency and production capabilities in the chemical and fertilizer sectors. Inox Air Products signed a memorandum of understanding with the Maharashtra government in January 2024 to establish the state's first green ammonia plant, with a capacity of 500,000 MTPA and a planned investment of USD 3 billion, set to be operational within 3-5 years. West India’s strategic advantages are further supported by its well-developed port infrastructure, including the Kandla and Mundra ports in Gujarat, which facilitate the import and export of ammonia and other chemicals, reinforcing its prominent position in the ammonia market.Key Market Players

- Indian Farmers Fertiliser Cooperative Limited

- Gujarat State Fertilizer & Chemicals Limited

- Madras Fertilizers Limited

- Trilok Chemicals Pvt Ltd

- Deepak Fertilisers And Petrochemicals Corporation Limited

- Yara Fertilisers India Pvt. Ltd.

- Tata Chemicals Limited

- Brahmaputra Valley Fertlizers Corporation Limited

- Mysore Ammonia Pvt. Ltd.

- Fertilisers and Chemicals Travancore Limited

Report Scope:

In this report, the India Ammonia Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Ammonia Market, By Form:

- Anhydrous Ammonia

- Aqueous Ammonia

India Ammonia Market, By Sales Channel:

- Direct Sales Channel

- Indirect Sales Channel

India Ammonia Market, By Application:

- Fertilizers

- Explosives

- Others

India Ammonia Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Ammonia Market.Available Customizations:

India Ammonia Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Indian Farmers Fertiliser Cooperative Limited

- Gujarat State Fertilizer & Chemicals Limited

- Madras Fertilizers Limited

- Trilok Chemicals Pvt Ltd

- Deepak Fertilisers And Petrochemicals Corporation Limited

- Yara Fertilisers India Pvt. Ltd.

- Tata Chemicals Limited

- Brahmaputra Valley Fertlizers Corporation Limited

- Mysore Ammonia Pvt. Ltd.

- Fertilisers and Chemicals Travancore Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2024 |

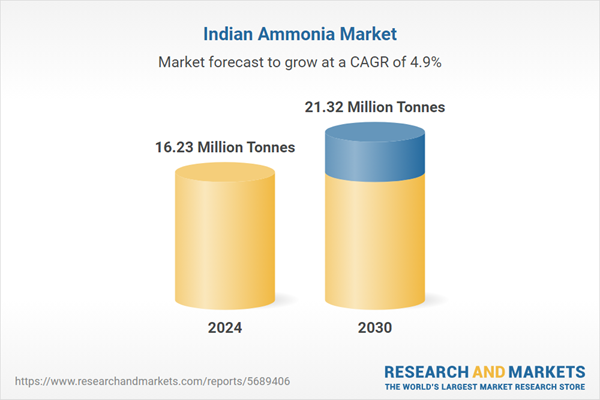

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 16.23 Million Tonnes |

| Forecasted Market Value by 2030 | 21.32 Million Tonnes |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |