Organic fertilizers improve soil quality by providing necessary macro and micronutrients. Bioorganic matter or biostimulants, known as biofertilizers, improve nutrient intake, promote growth, and increase plant tolerance to environmental stresses. Organic fertilizers contain many minerals, animal sources, sewage sludge, and plants. Biostimulants are associated with organic farming, which is currently witnessing healthy progress in conventional agriculture. These are increasingly being observed as a response to the consumer demand for “easy” agricultural practices. In response to the rising need to meet food adequacy and the importance of certain farming practices, the organic food industry is experiencing a double-digit growth rate. The awareness of health-conscious consumers worldwide is opting for organic food to avoid harmful health effects caused by chemical preservatives or naturally altered ingredients of inorganic food. Organic food and related agriculture products recently account for around 5-10% of the food market, changing from region to region. Organic food products are made without pesticides or fertilizers, so the demand for biostimulants is propelling. Subsequently, the increasing popularity of organic farming is expected to drive the demand for biostimulants in the years to come.

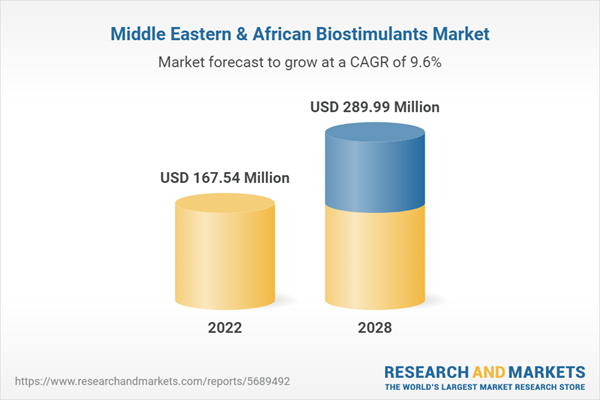

With new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Middle East & Africa biostimulants market at a substantial CAGR during the forecast period.

Middle East & Africa Biostimulants Market Segmentation

The Middle East & Africa biostimulants market is segmented on the basis of product, application, crop type, and country. Based on product, the market is segmented into humic substances, amino acids, microbial stimulants, seaweed extracts, and others. In 2022, the humic substances segment held a larger market share. On the other hand the same segment is expected to register a higher CAGR during the forecast period.Based on application, the Middle East & Africa biostimulants market is segmented into foliar spray, seed treatment, and soil application. The foliar spray segment held the largest market share in 2022 and it is also expected to register the highest CAGR in the market during the forecast period.

Based on application, the Middle East & Africa biostimulants market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, turf and landscape, and others. The cereals and grains segment held the largest market share in 2022 and turf and landscape is expected to register the highest CAGR in the market during the forecast period.

Based on country, the Middle East & Africa biostimulants market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of MEA. In 2022, South Africa held the largest market share. It is also expected to register the highest CAGR during the forecast period.

BASF SE, UPL Ltd, Valagro S.P.A., Gowan Company, FMC Corporation, Haifa Negev Technologies Ltd., ADAMA, and Rallis India Limited are among the leading companies in the Middle East & Africa biostimulants market.

Table of Contents

Companies Mentioned

- BASF SE

- UPL Ltd

- Valagro S.P.A.

- Gowan Company

- FMC Corporation

- Haifa Negev Technologies Ltd.

- ADAMA

- Rallis India Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | October 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 167.54 Million |

| Forecasted Market Value ( USD | $ 289.99 Million |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 8 |