The increasing consumption of frozen seafood owing to its ease of availability and cooking process has significantly boosted the growth of the frozen seafood market in South & Central America. The increased demand for frozen seafood products in remote areas across the region has propelled the production of frozen seafood. Further, robust cold chain infrastructure in the region is deemed profitable for the distribution of frozen seafood since buying it is much more convenient and cost-effective, and frozen seafood tends to maintain its freshness, flavor, and nutritional value.

The changing dietary preferences and lifestyle patterns of the population of South & Central American countries are an impetus to the growth of the frozen seafood market. The innovative marketing strategies adopted by leading players, the high disposable income of individuals, and the easy availability of frozen seafood via online and offline distribution channels are likely to boost the market growth of frozen seafood in South & Central America.

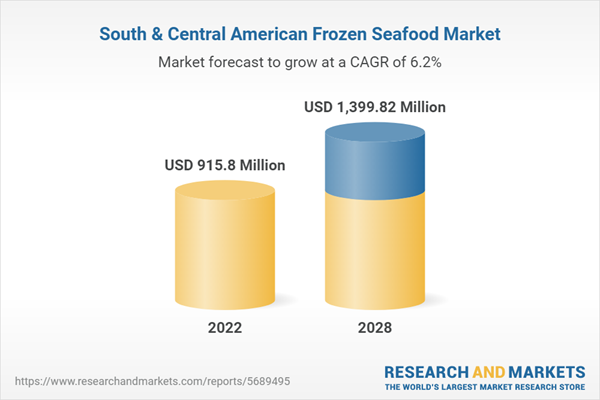

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the South & Central America Frozen seafood market at a substantial CAGR during the forecast period.

South & Central America Frozen Seafood Market Segmentation

The South & Central America Frozen seafood market is segmented into type, distribution channel, and country.- Based on type, the South & Central America frozen seafood market is segmented into frozen fish, frozen crustaceans, frozen mollusks, and others. In 2022, the frozen fish segment accounted for the largest revenue share.

- Based on the distribution channel, the South & Central America frozen seafood market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Supermarkets and hypermarkets held the largest market share by revenue in 2022.

- Based on country, the South & Central America Frozen seafood market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil held the largest market share in 2022.

Table of Contents

Companies Mentioned

- Castlerock Inc.

- Clifton Seafood Company

- Marine Foods

- Sterling Seafood

- The Sirena Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | October 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 915.8 Million |

| Forecasted Market Value ( USD | $ 1399.82 Million |

| Compound Annual Growth Rate | 6.2% |

| No. of Companies Mentioned | 5 |